Malaysia Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Malaysia Cards and Payments Market Report Overview

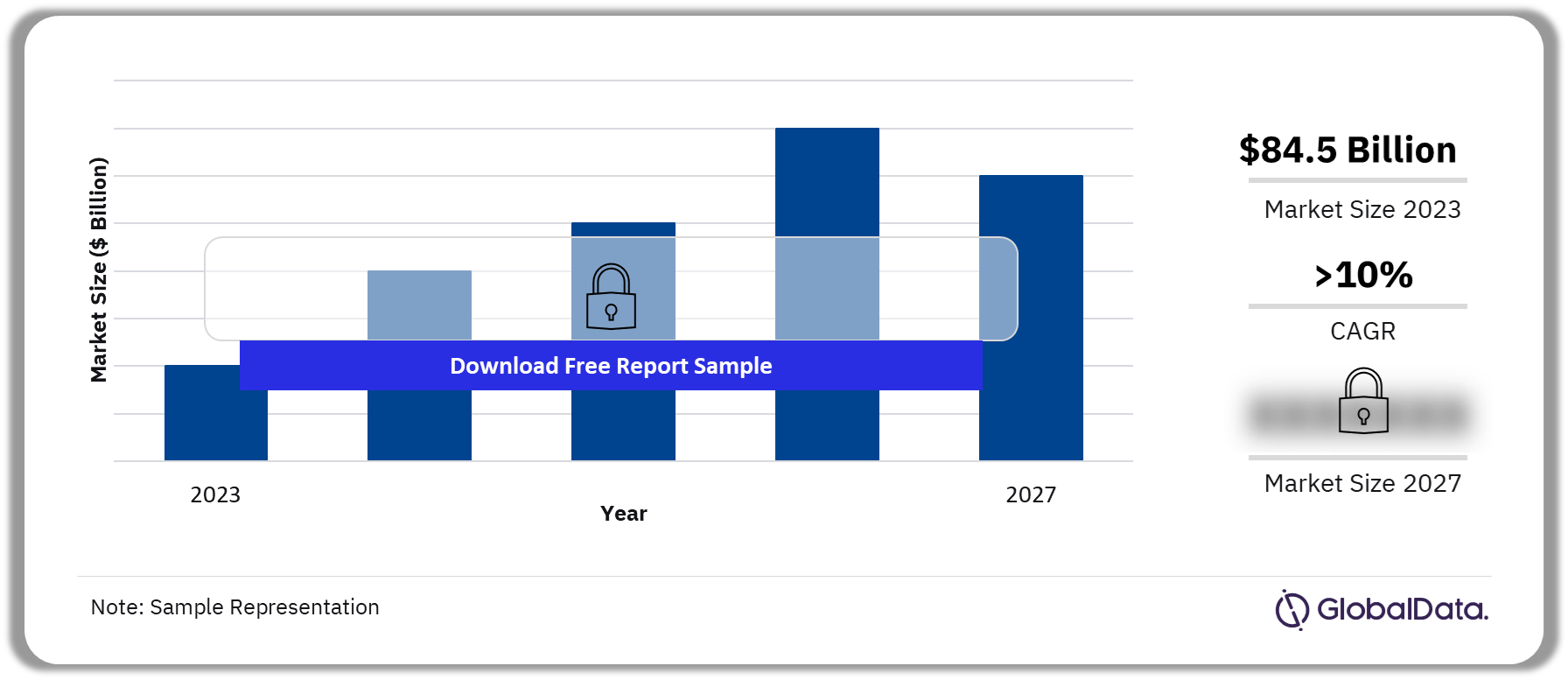

The annual value of card transactions in the Malaysia cards and payments market is estimated to be $84.5 billion in 2023 and is expected to grow at a CAGR of more than 10% during 2023-2027. The Malaysian payments market remains cash-reliant but has high growth potential as it shifts towards digital payments. Government initiatives including the introduction of an interchange fee cap, the migration of payment cards to support contactless payments, charges on ATM transactions, and the expansion of payment infrastructure have all contributed to the ongoing digital transformation of the market.

Malaysia Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Malaysia Cards and Payments Market Forecast, Download a Free Sample Report

The Malaysia cards and payments market research report provides a detailed analysis of market trends in the Malaysian cards and payments industry. It provides values and volumes for several key performance indicators in the industry, including cards, credit transfers, direct debits, and cheques during the review period. The report also analyzes various payment card markets operating in the industry. It provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also covers regulatory policy details and recent regulatory structure changes. It includes information on the payment instruments that are in use in the Malaysian market, the key segments within the market, as well as the companies associated with the Malaysia cards and payments market.

| Annual Value of Card Transactions (2023) | $84.5 billion |

| CAGR (2023-2027) | >10% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cash

· Credit transfers · Cards · Mobile Wallets · Direct debits · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments · P2P Payments · Bill Payments · Alternative Payments |

| Leading Players | · PayPal

· Samsung Pay · Apple Pay · Click to Pay · WeChat Pay |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Malaysia Cards and Payments Market Dynamics

In Malaysia, each individual holds an average of more than one debit card, driving the debit card penetration in the country. Banks offer various services to promote debit card adoption and usage including online bank account opening facilities and contactless cards. Additionally, Malaysia is among the fastest-growing e-commerce markets in Southeast Asia. The rapid adoption of smartphones, growing internet penetration, the availability of secure online payment systems, and the increasing number of online shoppers all supported this growth. As a result, digital payment solutions such as GrabPay, ShopeePay, and Touch ‘n Go eWallet have benefitted from this trend.

Buy the Full Report to Get Additional Malaysia Cards and Payments Market Dynamics

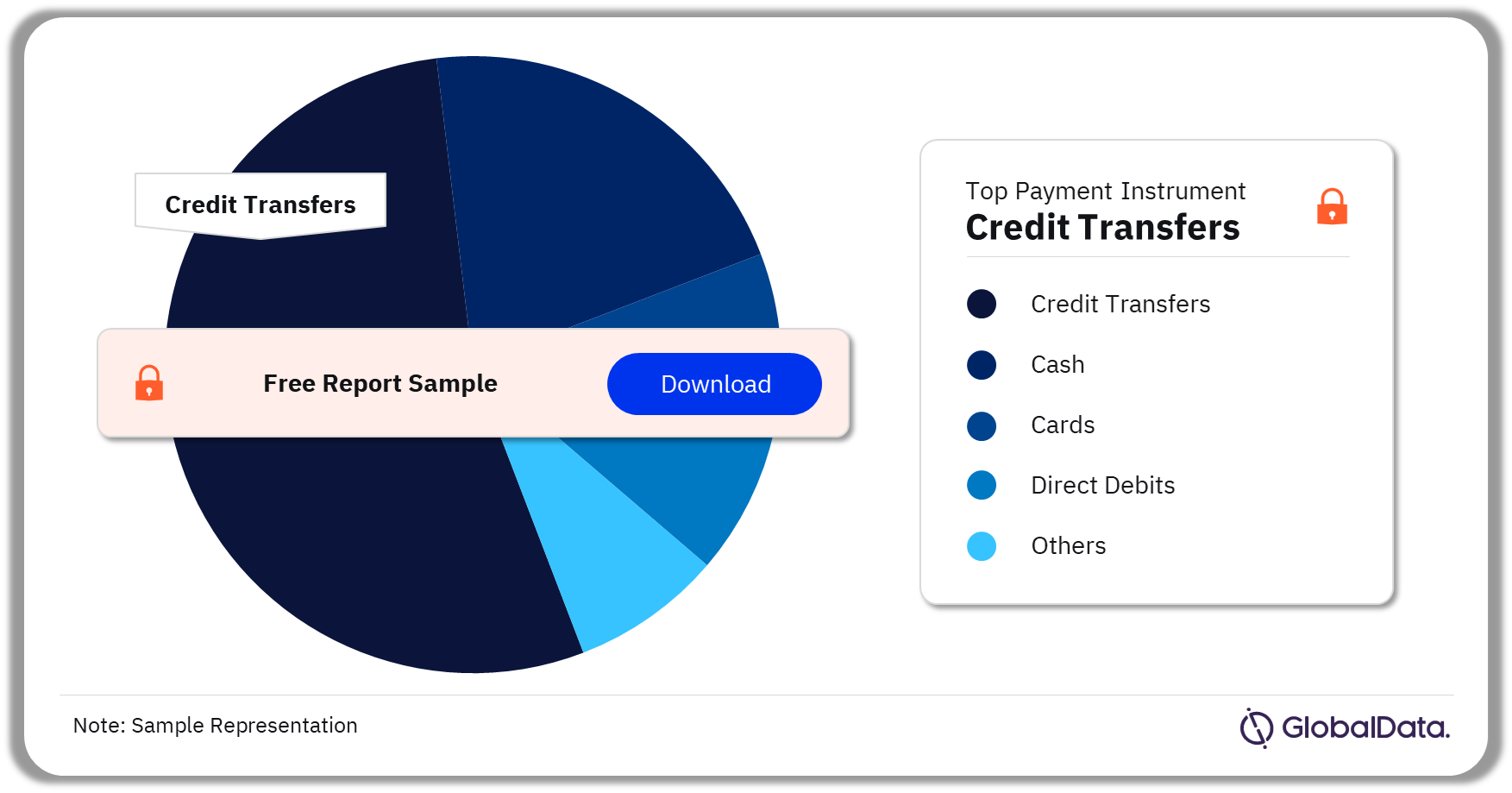

Malaysia Cards and Payments Market Segmentation by Payment Instruments

Cash has the highest share in the market in volume terms in 2023.

The key payment instruments in the Malaysia cards and payments market are cash, credit transfers, cards, mobile wallets, direct debits, and cheques. Credit transfers lead the market in 2023 in terms of value and are settled via the Interbank GIRO and Instant Interbank Fund Transfer systems. The growing consumer preference for electronic payments poses a challenge to the cash-driven economy of Malaysia.

Malaysia Cards and Payments Market Analysis by Payment Instruments, 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Malaysia Cards and Payments Market

Malaysia Cards and Payments Market Segments

The Malaysian debit card market is dominated by Visa and Mastercard.

The key segments in the Malaysia cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

Card-Based Payments: Even though cash is the preferred mode of payment in Malaysia for daily spending, card-based payments are gradually taking over. This is supported by various government initiatives including reduced interchange fees, the migration of payment cards to EMV standards to support PIN and contactless payments, rising POS terminal installations, and increased fees for cash withdrawals. Meanwhile, COVID-19 has further boosted digital payments in the country as consumers opt to avoid cash-based payments.

Buy the Full Report for More Market Segment Insights into the Malaysia Cards and Payments Market

Malaysia Cards and Payments Market - Competitive Landscape

Some of the leading players in the Malaysia cards and payments market are:

- PayPal

- Samsung Pay

- Apple Pay

- Click to Pay

- WeChat Pay

PayPal: It is a money transfer and e-commerce payment provider that allows customers to transfer money from their bank account to their PayPal account to make online payments without using bank cards. PayPal offers automatic payments that allow customers to pay recurring bills, subscriptions, and installments from one platform.

Leading Malaysia Cards and Payments Players, 2023

Buy the Full Report to Know More about the Leading Malaysia Cards and Payments Companies

Segments Covered in the Report

Malaysia Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cash

- Credit transfers

- Cards

- Mobile Wallets

- Direct debits

- Cheques

Malaysia Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

This report provides top-level market analysis, information, and insights into the Malaysia cards and payments industry, including –

- Current and forecast values for each market in the Malaysian cards and payments industry including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, credit transfer, cards, mobile wallets, cheques, and direct debits. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Malaysian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Malaysian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Malaysian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Malaysian cards and payments industry.

- Assess the competitive dynamics in the Malaysian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Malaysia.

- Gain insights into key regulations governing the Malaysian cards and payments industry.

BSN

CIMB

Hong Leong Bank

Maybank

Public Bank

United Overseas Bank

AmBank

HSBC

RHB Bank

Bank Islam Malaysia

Aeon Credit Service

Citibank

MyDebit

American Express

Mastercard

Visa

Table of Contents

Frequently asked questions

-

What is the annual value of card transactions in the Malaysia cards and payments market in 2023?

The annual value of card transactions in the Malaysia cards and payments market is estimated to be $84.5 billion in 2023.

-

What is the growth rate of the annual card transactions in the Malaysia cards and payments market?

The annual value of card transactions in the Malaysia cards and payments market is expected to grow at a CAGR of more than 10% during 2023-2027.

-

Which is the leading payment instrument in the Malaysia cards and payments market in 2023?

Credit transfers is the leading payment instrument in value terms in the Malaysia cards and payments market in 2023.

-

Which are the leading players in the Malaysia cards and payments market?

Some of the leading players in the Malaysia cards and payments market are PayPal, Samsung Pay, Apple Pay, Click to Pay, and WeChat Pay, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports