Malaysia General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Malaysia General Insurance Market Report Overview

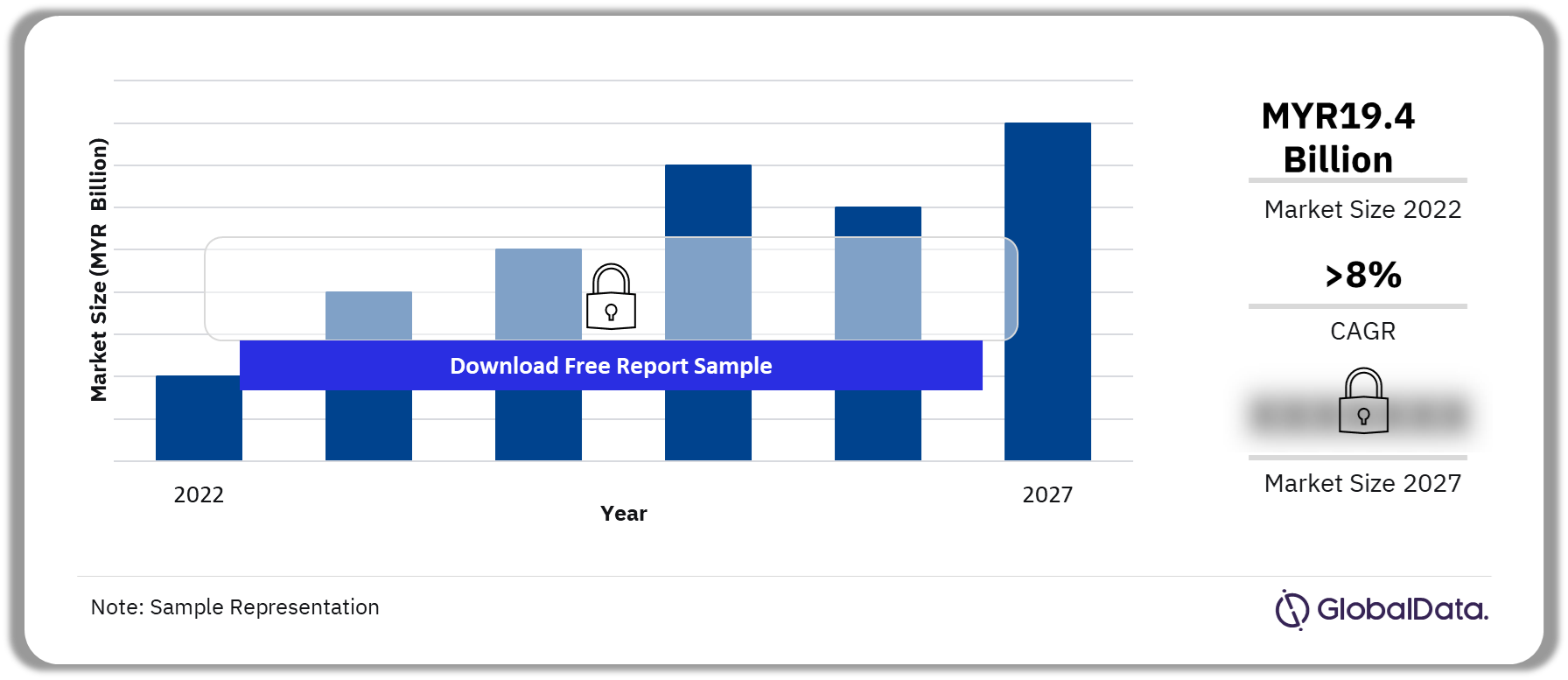

The gross written premium of the Malaysia general insurance market was MYR19.4 billion ($4.4 billion) in 2022. The market is expected to achieve a CAGR of more than 8% during 2023-2027. The Malaysia general insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for the Malaysia general insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

Malaysia General Insurance Market Outlook, 2022-2027 (MYR Billion)

Buy Full Report for More Information about the Malaysia General Insurance Market Forecast

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of Malaysia’s economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | MYR19.4 billion ($4.4 billion) |

| CAGR (2023-2027) | >8% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Trends | • ESG

• Focus on Mental Health • Rise in Sales of AVs |

| Key Lines of Business | • Motor

• Non Life PA&H • Property • Liability • MAT • Miscellaneous |

| Key Distribution Channels | • Agencies

• Direct Marketing • Insurance Brokers • Other Distribution Channels |

| Leading Companies | • Allianz General

• Etiqa General • MSIG Insurance • AmGeneral Insurance • Lonpac Insurance |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Malaysia General Insurance Market Trends

ESG, focus on mental health, and the rise in the sale of AVs are some of the market trends impacting the Malaysian GI industry. For instance, the Malaysian government plans to launch a framework for ESG by the end of 2023. The framework will support funding, transition, and capacity building of SMEs and exporters towards renewable energy. According to the International Renewable Energy Agency, Malaysia must invest a huge sum to achieve its goal of carbon neutrality by 2050. Insurers such as Great Eastern Holdings, Prudential, and Allianz already have net zero emission targets at the group level, and having an ESG framework will enable them to incorporate it into their businesses in Malaysia too.

Furthermore, developments in the autonomous vehicles market will boost the demand for motor insurance in the country and encourage insurers to launch new products specifically for AVs, thus catalyzing product innovation in motor insurance.

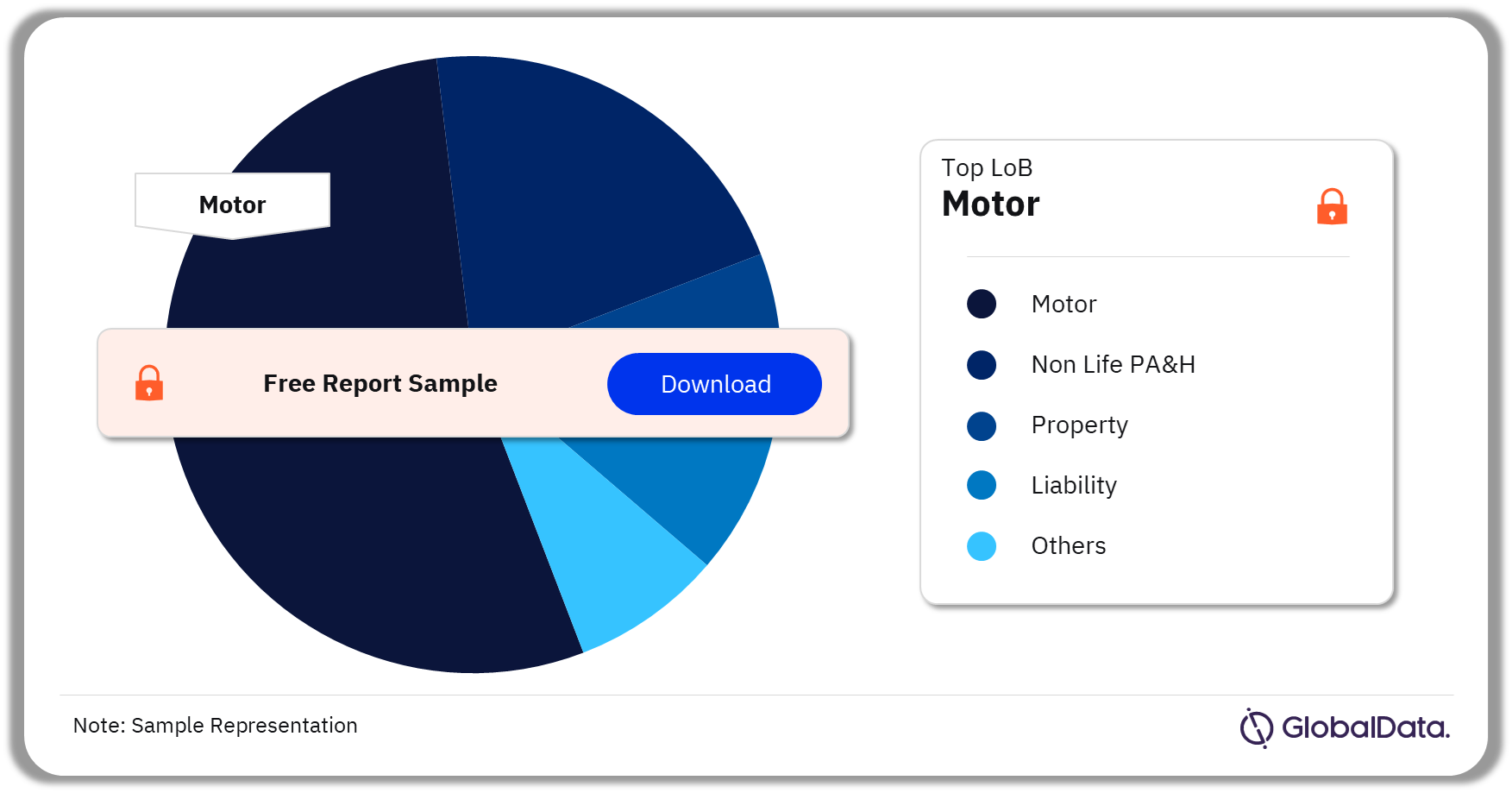

Malaysia General Insurance Market Segmentation by Lines of Business

The key lines of business in the Malaysia general insurance market are property, motor, liability, miscellaneous, MAT, and non life PA&H among others. Motor insurance had the highest market share in Malaysia general insurance market in 2022. It was followed by property insurance.

The market growth in motor insurance was supported by an increase in vehicle sales in 2022. The industry is forecast to record growth in 2023, driven by economic recovery and government initiatives to increase sales of vehicles.

Malaysia General Insurance Market Analysis by Lines of Business, 2022 (%)

Buy the Full Report for More Lines of Business Insights into Malaysia General Insurance Market

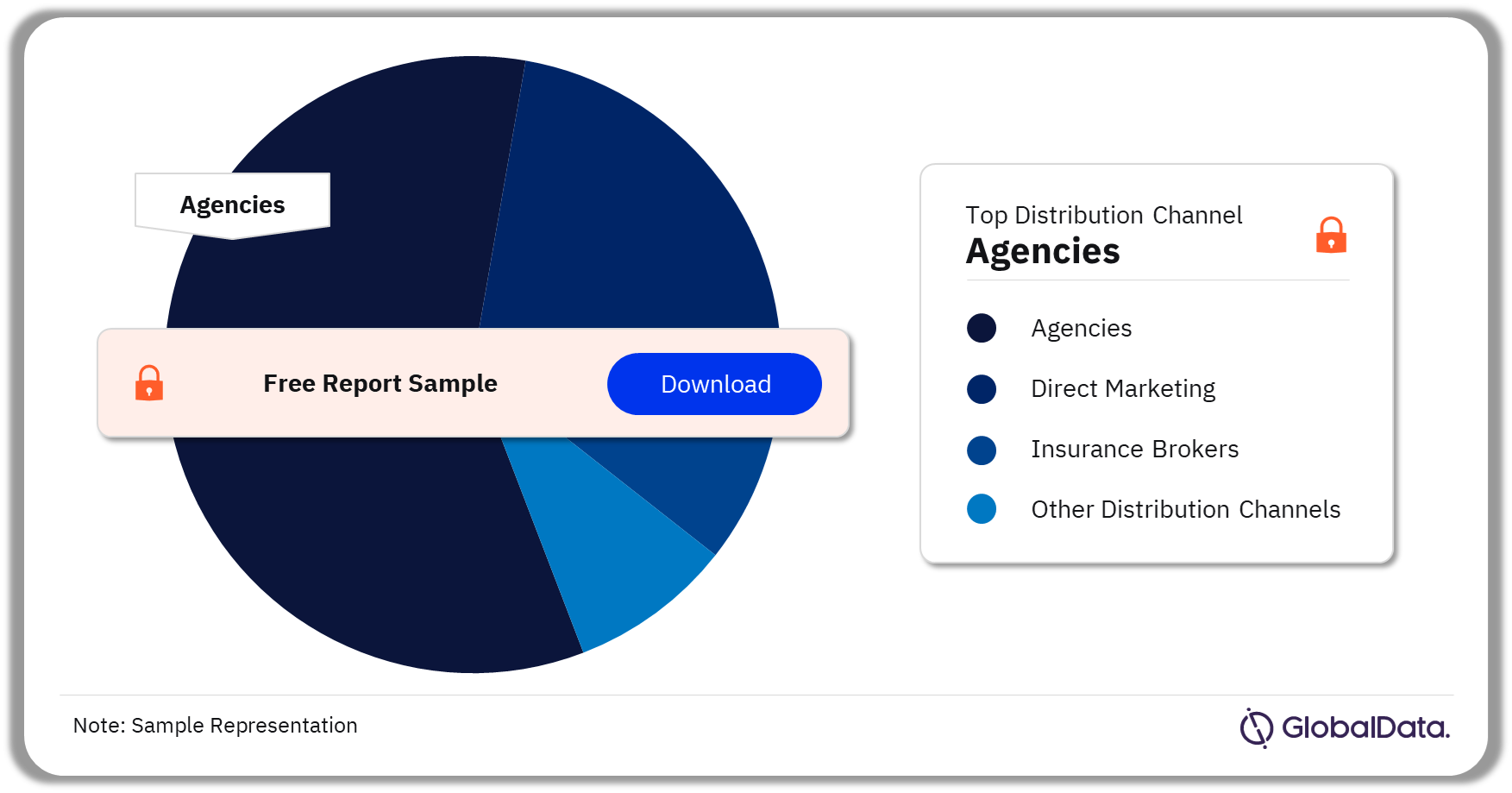

Malaysia General Insurance Market Segmentation by Distribution Channels

The key distribution channels in the Malaysia general insurance market are direct marketing, insurance brokers, agencies, and other distribution channels. Agencies led the distribution channels in DWP in 2022. It was followed by direct marketing.

Malaysia General Insurance Market Analysis by Distribution Channels, 2022 (%)

Buy Full Report for More Distribution Channel Insights into Malaysia General Insurance Market

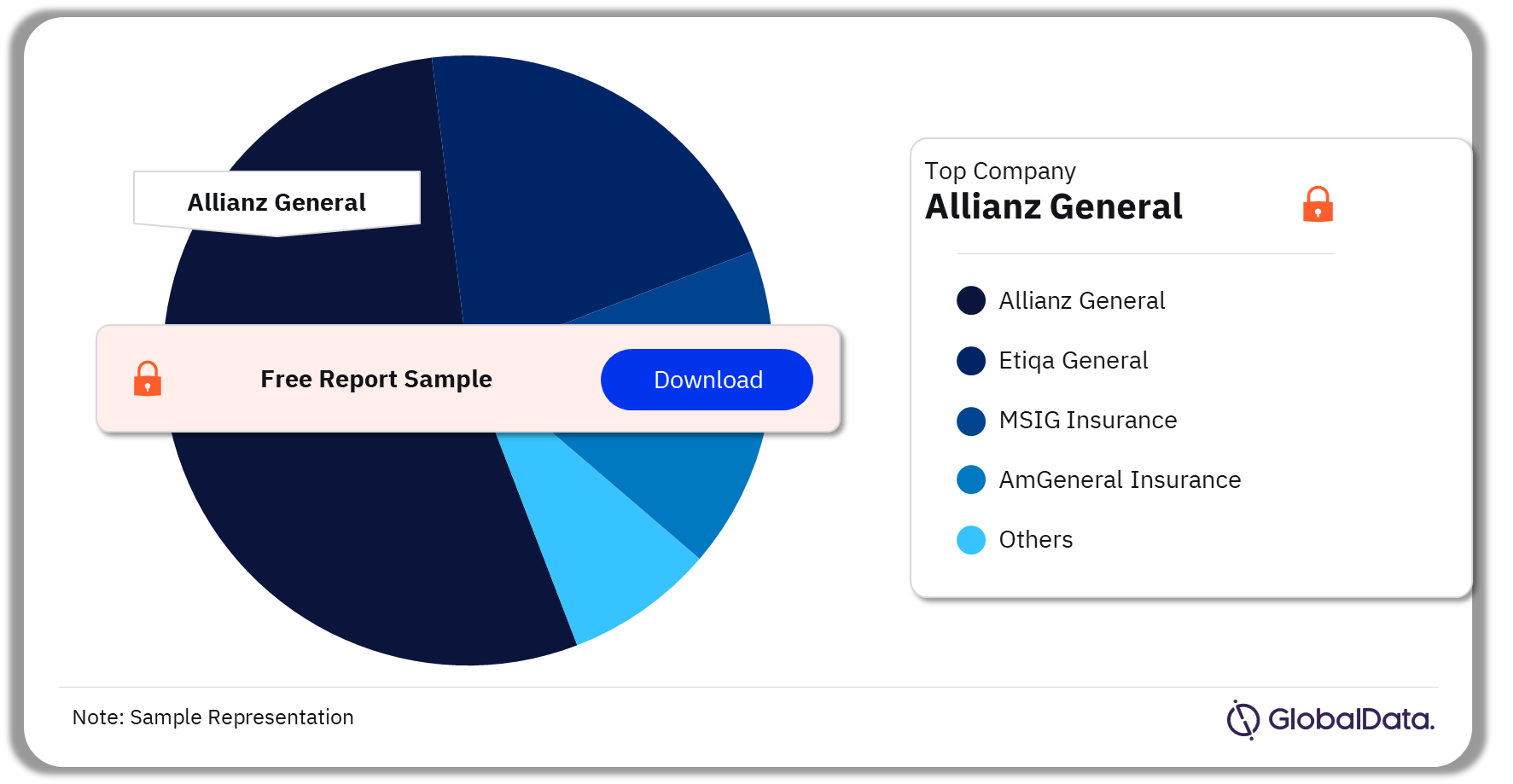

Malaysia General Insurance Market - Competitive Landscape

Some of the leading insurers in Malaysia are Allianz General, Etiqa General, MSIG Insurance, AmGeneral Insurance, and Lonpac Insurance among others. Allianz General was the leading general insurer in 2022. This was followed by Etiqa General.

Malaysia General Insurance Market Analysis, by Companies, 2022 (%)

Buy Full Report to Know More about the Companies in the Malaysia General Insurance Market

Segments Covered in the Report

Malaysia General Insurance Market Lines of Business Outlook (Value, MYR Billion, 2018-2027)

- Property

- Motor

- Liability

- MAT

- Miscellaneous

- Non Life PA&H

Malaysia General Insurance Distribution Channel Outlook (Value, MYR Billion, 2018-2027)

- Direct Marketing

- Insurance Brokers

- Agencies

- Other Distribution Channels

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Malaysia.

- Historical values for the Malaysia general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Malaysia and outlines the key regulations affecting them.

Reasons to Buy

- Key insights and dynamics of Malaysia’s general insurance segment.

- A comprehensive overview of Malaysia’s economy, government initiatives, and investment opportunities.

- Malaysia’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Malaysia’s general insurance industry’s market structure gives details of lines of business.

- Malaysia’s general reinsurance business market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Malaysia’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Allianz

AXA

AmGeneral Insurance

Lonpac Insurance

MSIG Insurance

Tokio Marine

Zurich General

Table of Contents

Frequently asked questions

-

What was the Malaysia general insurance market gross written premium in 2022?

The gross written premium of the Malaysia general insurance market was MYR19.4 billion ($4.4 billion) in 2022.

-

What is Malaysia general insurance market growth rate?

The general insurance market in Malaysia is expected to achieve a CAGR of more than 8% during 2023-2027.

-

Which line of business holds the largest share of the Malaysia general insurance market?

Motor insurance was the leading general insurance line of business in the Malaysia general insurance market in 2022.

-

Which distribution channel holds the highest share in the Malaysia general insurance market?

Agencies was the leading distribution channel in the Malaysia general insurance market in 2022.

-

Which are the key companies operating in the Malaysia general insurance market?

Some of the leading insurers in Malaysia are Allianz General, Etiqa General, MSIG Insurance, AmGeneral Insurance, and Lonpac Insurance among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports