Managed Security Services (MSS) Market Trends and Analysis by Enterprise Size Band, Vertical, Region, and Segment Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Managed Security Services (MSS)’ report can help:

- Gain a valuable understanding of the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘Managed Security Services’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for the period 2019-27 for market assessment.

- Detailed segmentation by:

- Vertical – BFSI, Information Technology, Manufacturing, Retail, Government, Healthcare, and Others

- Enterprise Size Band – Micro, Small, Medium, Large, Very large

- Region – North America, Western Europe, Central & Eastern Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market drivers and challenges impacting the MSS market.

- The report covers dashboard analytics for M&A deals, venture financing/private equity deals, job activity, and patent activities.

- The competitive landscape includes competitive positioning of key companies and their strengths and limitations in the market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- The report covers competitive profiling and benchmarking of key companies (based on buying criteria and metrics) in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest MSS trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Managed Security Service Providers/Managed Cybersecurity Providers

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms/Investment Firms

- Telecom Companies

- Infrastructure Security Providers

- Cloud Computing Solution/System Integration Providers

Get a Snapshot of the MSS Market

Managed Security Services Market Report Overview

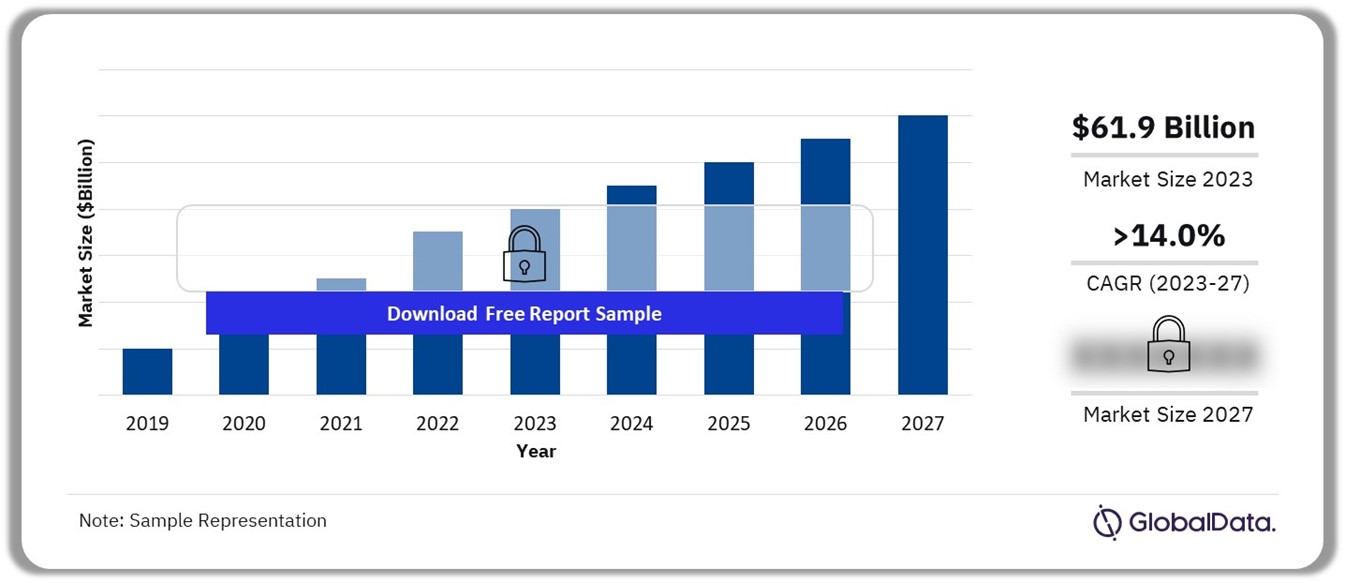

The managed security services (MSS) market size revenue was valued at $61.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 14% over the forecast period. The rapid adoption of cloud services is expected to enhance the requirement for data protection, identity management as well as threat detection. Further, the complexity of IT environments with a mix of cloud, hybrid, and on-premises structures is expected to propel growth over the forecast period.

MSS providers (MSSPs) provide continuous monitoring and real-time threat detection, allowing swift responses to security incidents and mitigating the risk of prolonged breaches and data exfiltration. Advanced security tools and technologies necessary to combat sophisticated cyber threats may be financially burdensome for organizations if managed internally. Therefore, MSSPs offer a more cost-effective solution.

Managed Security Services Market Outlook, 2019-2027 ($Billion)

Buy the Full Report for Additional Insights on the MSS Market Forecast

The adoption of the service is further fueled by regulatory compliance mandates. Regulations such as GDPR, HIPAA, and PCI DSS impose strict standards on data protection and privacy, necessitating expert guidance for compliance. MSS providers offer compliance management services, aiding organizations in understanding regulations, implementing appropriate security measures, and demonstrating compliance through comprehensive reporting and audits.

Enterprises across sectors are engaged in fierce competition to secure cybersecurity talent, intensifying the demand and presenting difficulties for firms in both hiring and retaining skilled professionals. This challenge is further compounded by the continuously shifting landscape of cybersecurity threats, necessitating continual training and skills enhancement. Leveraging MSS providers enables businesses to access specialized knowledge and resources that may be lacking internally.

The growing complexity of IT infrastructures, spurred by the adoption of bring your own device (BYOD) and Internet of Things (IoT), brings an array of endpoints with varying degrees of security risks. This emphasizes the need for enterprises to outsource their security services. By partnering with MSS providers, organizations can access specialized expertise, state-of-the-art technology, and comprehensive security solutions.

The surge in MSS adoption is also driven by mounting cloud security concerns, urging organizations to fortify data protection protocols, maintain visibility and control in cloud infrastructures, and adhere to regulatory mandates. Through the utilization of MSSPs, enterprises can bolster data security measures, safeguarding sensitive data within cloud environments.

| Market Size (2023) | $61.9 billion |

| CAGR (2023-2027) | >14% |

| Forecast Period | 2023-2027 |

| Historic Data | 2019-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Landscape, Growth Trends |

| Enterprise Size Segment | Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), and Very Large (5000+) |

| Vertical Segment | BFSI, Healthcare, Retail, Government, Manufacturing, Information Technology, and Others. |

| Geographies | North America, Western Europe, Asia Pacific, Central & Eastern Europe, South & Central America, Middle East & Africa |

| Countries | US, Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Singapore, Australia, South Korea, Russia, Turkey, Brazil, Argentina, Chile, UAE, Saudi Arabia, South Africa, and Egypt. |

| Key Companies | Verizon Communications Inc., International Business Machines Corp. (IBM), Telefónica S.A., Orange S.A., DXC Technology Company, SecureWorks Corp., BT Group plc, Cisco Systems Inc., Wipro Ltd., and Atos SE. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

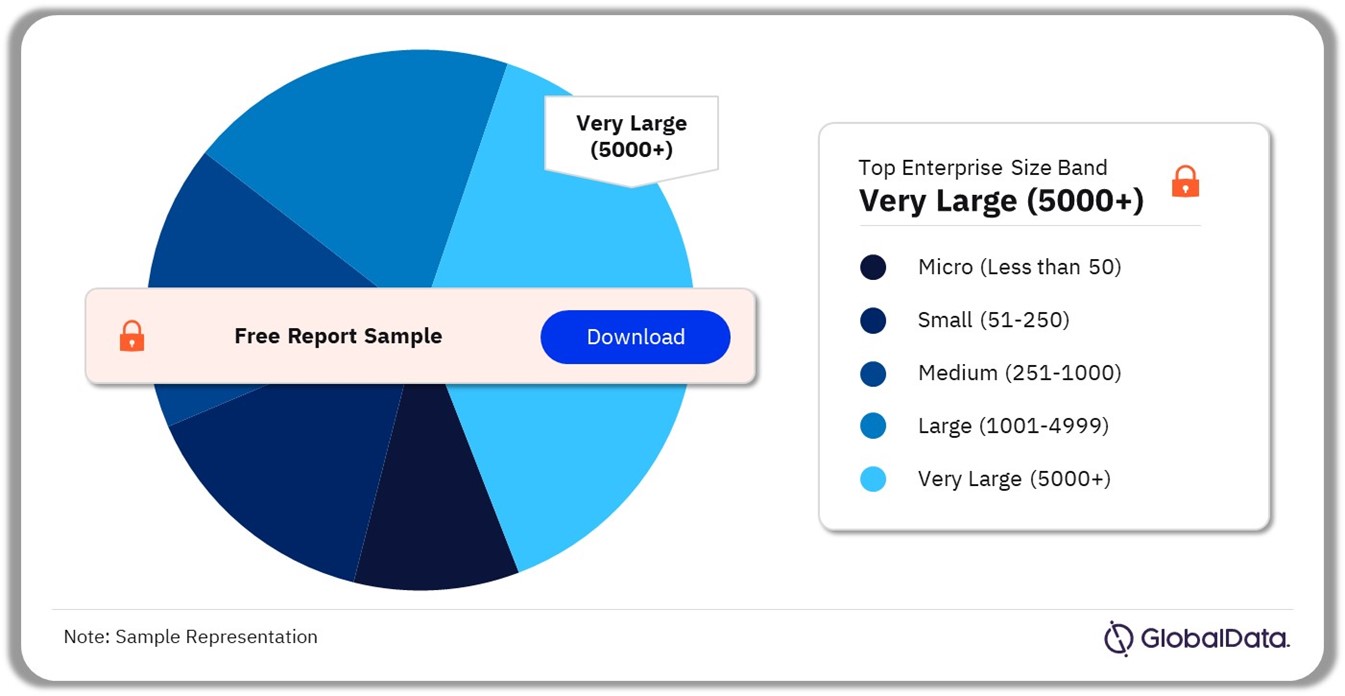

Managed Security Services Market Segmentation by Enterprise Size Band

Based on the enterprise size band, the overall market is categorized into very large (5000+), large (1001-4999), medium (251-1000), small (51-250), and micro (less than 50). In 2023, the very large enterprises market captured a sizeable market share exceeding 35%, and the segment is anticipated to witness strong growth, recording a CAGR surpassing 10% over the forecast period.

Large companies typically have diverse and dynamic IT environments that require scalable security solutions. As a result, they have substantial budgets allocated for cybersecurity, allowing them to invest in specialized security expertise and technologies. MSSPs can provide access to a wide range of security professionals, including threat analysts, incident responders, and security engineers, along with advanced security tools and technologies.

Managed Security Services Market Share by Enterprise Size Band, 2023 (%)

Buy the Full Report for More Information on MSS Market Enterprise Size Bands

In addition, large organizations are more likely to invest in comprehensive MSS solutions due to their larger attack surface and higher value of assets. However, small and medium-sized businesses (SMBs) also benefit significantly from outsourcing their security needs to MSSPs. It allows them to access advanced security technologies and expertise that they may not have in-house while freeing up resources to focus on their core business activities.

Managed Security Services Market Segmentation by Vertical

The MSS vertical segment includes BFSI, healthcare, retail, government, manufacturing, information technology, and others. As of 2023, the MSS market in the BFSI (retail banking, financial markets, and insurance) category captured the highest market size, accounting for over 12% of the overall managed security services market size globally.

Financial institutions deal with highly sensitive data, including the personal and financial information of customers, which makes them a prime target for cybercriminals. Protecting this data against cyber threats, such as unauthorized access or data breaches, is crucial to maintaining trust and compliance with regulations. MSSPs offer proactive threat intelligence, monitoring, and response services to help financial organizations stay ahead of evolving threats and protect against financial losses and reputational damage.

Managed Security Services Market Share by Vertical, 2023 (%)

Buy the Full Report for More Information on MSS Market Verticals

Additionally, verticals such as IT, manufacturing, government, healthcare, and retail captured over 30% of the market size in 2023. Government agencies are prime targets for cyberattacks due to the sensitive nature of the data they hold and their role in national defence. MSSPs help government entities detect and respond to cyber threats effectively, safeguarding critical infrastructure and sensitive information from adversaries. By partnering with MSSPs, various government organizations can enhance their cybersecurity capabilities and improve resilience against cyber threats.

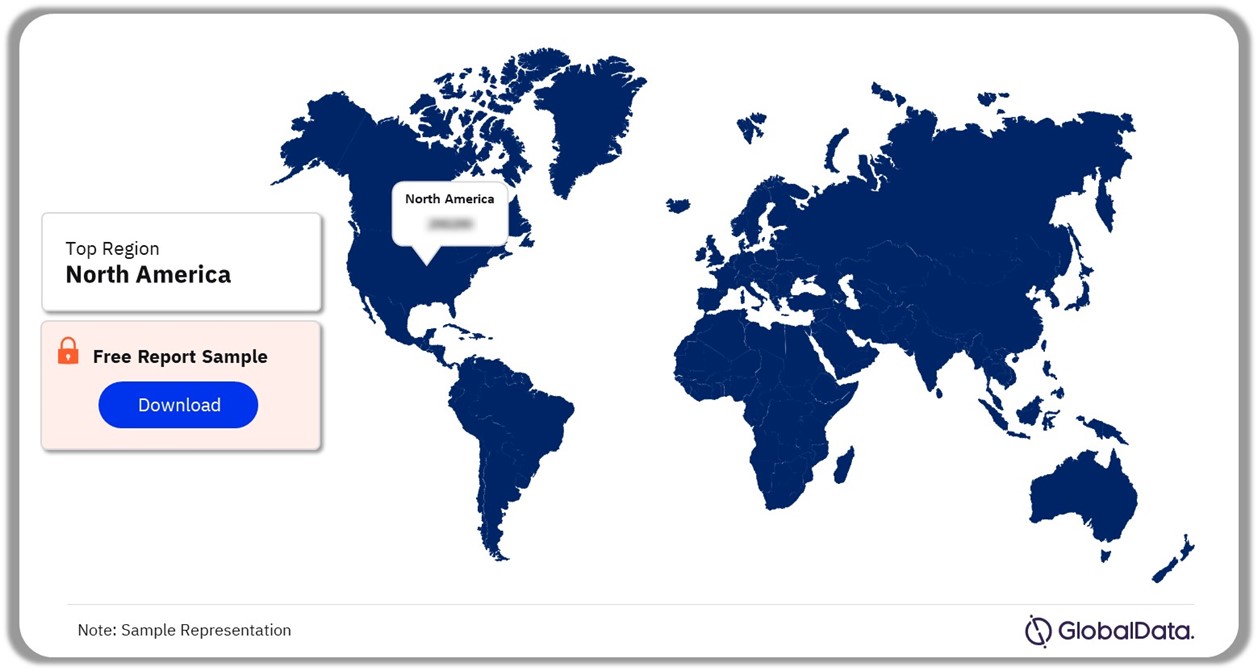

Managed Security Services Market Analysis by Region

North America’s managed security services market value was the highest in 2023, capturing over 30% of the overall market size. The US and China led the global market, collectively accounting for over 35% of the market in 2023. The growth can be credited to various factors, such as the increasing complexity and sophistication of cyber threats, the rising uptake of cloud-based services, and organizations’ necessity to adhere to regulatory standards.

Western Europe is also witnessing growth, with a CAGR exceeding 14% throughout the forecast period. The European Union’s General Data Protection Regulation (GDPR) and other regional data protection laws impose stringent requirements on organizations to safeguard personal data. Compliance with these regulations necessitates robust cybersecurity measures and monitoring, driving the demand for MSS in the region.

Managed Security Services Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the MSS Market

Asia Pacific is projected to retain the largest share by 2027, accounting for over 30% of the MSS market value, with an anticipated growth rate exceeding 15% over the forecast period. Countries in the APAC region are undergoing rapid digital transformation across various sectors, including finance, healthcare, manufacturing, and government. This digitalization trend has expanded the attack surface, making organizations more vulnerable to cyber threats. As a result, there is a growing demand for MSSPs to help manage security risks associated with digital initiatives.

The South and Central America MSS market is expected to witness the highest growth over the near future, registering a CAGR of more than 18% over the forecast period. The region’s economic expansion is driving digital transformation across various sectors. Moreover, amidst global headlines featuring prominent cyber-attacks, organizations in South & Central America are increasingly recognizing the critical significance of cybersecurity. These factors combine to fuel the swift expansion of the MSS market in the region.

Managed Security Services Market – Competitive Landscape

Managed security services (MSS) are growing rapidly, as both public and private sector entities contend with an escalating threat landscape while grappling with limited in-house expertise. The rising expenses associated with breaches have elevated security to a matter of paramount importance at the executive level, underscoring the necessity of prioritizing investments in technologies and services aimed at safeguarding corporate assets.

The cybersecurity landscape is constantly changing, with emerging threats appearing on a regular basis. To address these challenges effectively, MSS providers are partnering with other companies specializing in niche areas such as threat intelligence, endpoint, or cloud security. In March 2024, BT Group and Zscaler Inc. expanded their partnership positioning BT as the premier global service provider to deliver a comprehensive range of MSS services built upon Zscaler’s AI-driven Zero Trust Exchange cloud security platform.

Moreover, MSSPs are constantly striving to innovate and introduce new services in order to secure a higher market share. In alignment with this trend, in March 2024, Telefónica UK&I announced the launch of suite of enterprise cybersecurity tools including its ‘NextDefense’ service in the UK and Ireland, featuring exclusive threat intelligence, state-of-the-art technology, and standardized procedures driven by automation.

Leading Companies in the Managed Security Services Market

- Verizon Communications Inc.

- International Business Machines Corp. (IBM)

- Telefónica S.A.

- Orange S.A.

- DXC Technology Company

- SecureWorks Corp.

- BT Group plc

- Cisco Systems Inc.

- Wipro Ltd.

- Atos SE

Other Managed Security Services Market Vendors Mentioned

T-Systems International GmbH, Accenture Plc, NTT DATA Group Corp, Amazon Web Services Inc., Vodafone Group Plc, and Dell Technologies Inc., among others.

Buy the Full Report to Know More About Leading MSS Companies

Managed Security Services Market Segments

GlobalData Plc has segmented the managed security services (MSS) market report by vertical, enterprise size band, and region:

Managed Security Services Market Vertical Outlook (Revenue, $Million, 2019-2027)

- BFSI

- Information Technology (IT)

- Government

- Manufacturing

- Retail

- Healthcare

- Others

Managed Security Services Market Enterprise Size Band Outlook (Revenue, $Million, 2019-2027)

- Micro (Less than 50)

- Small (51-250)

- Medium (251-1000)

- Large (1001-4999)

- Very Large (5000+)

Managed Security Services Market Regional Outlook (Revenue, $Million, 2019-2027)

- North America

- US

- Canada

- Mexico

- Western Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Western Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- South Korea

- Rest of Asia Pacific

- Central & Eastern Europe

- Russia

- Turkey

- Rest of Central & Eastern Europe

- South & Central America

- Brazil

- Argentina

- Chile

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- Egypt

- South Africa

- Rest of Middle East & Africa

Scope

This report provides overview and service addressable market for managed security services (MSS) market.

It identifies the key trends impacting growth of the managed security services (MSS) market over the next 12 to 24 months.

It includes global market forecasts for the managed security services (MSS) market and analysis of M&A deals, VF/PE deals, patents, and job market trends.

It contains details of M&A deals in the managed security services (MSS) space and a timeline highlighting milestones in the development of MSS market.

The detailed value chain consists of five layers: Security Solutions, Security Vendors, MSS Providers, Types of MSSPs, and End Users.

Key Highlights

The managed security services (MSS) market size revenue was valued at $61.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.7% over the forecast period. Key factors such as sophistication of cyber threats, a shortage of cybersecurity talent, and complexity of IT infrastructures are driving the MSS market.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global managed security services (MSS) market by vertical, enterprise size band, region, and key drivers in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the managed security services (MSS) market.

• The report also covers key insights on buying criteria, vendor/buyer recommendations along with competitive insights on key market players.

• With more than 100 charts and tables, the report is designed for an executive-level audience, enhancing presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in managed security service (MSS) market.

• The broad perspective of the report coupled with comprehensive, actionable detail will help telecom companies, infrastructure security providers, managed security service (MSS) providers, system integration providers, and other intermediaries succeed in growing the managed security service (MSS) market globally.

Key Players

Verizon Communications Inc.International Business Machines Corp. (IBM)

Telefónica S.A.

Orange S.A.

DXC Technology Company

SecureWorks Corp.

BT Group plc

Cisco Systems Inc.

Wipro Ltd.

Atos SE.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the managed security services market size in 2023?

The MSS market size was valued at $61.9 billion in 2023.

-

What is the managed security services market growth rate?

The MSS market is expected to grow at a CAGR of more than 14% during the forecast period.

-

What are the key managed security services market drivers?

The key factors influencing the MSS market comprise the sophistication of cyber threats, a shortage of cybersecurity talent, and the complexity of IT infrastructures. Additionally, regulatory compliance, cost-effectiveness, scalability of MSSPs, and concerns regarding cloud security, play significant roles in driving the MSS market.

-

Which was the leading vertical segment in the managed security services market in 2023?

The BFSI segment accounted for the largest MSS vertical market share in 2023.

-

Which was the leading regional market in the managed security services market in 2023?

North America accounted for the largest MSS regional market share in 2023.

-

Which was the leading enterprise size band in the managed security services market in 2023?

Very Large (5000+) accounted for the largest MSS employee size band market share in 2023.

-

Which are the leading managed security services companies globally?

The leading MSS companies are Verizon Communications Inc., International Business Machines Corp. (IBM), Telefónica S.A., Orange S.A., DXC Technology Company, SecureWorks Corp., BT Group plc, Cisco Systems Inc., Wipro Ltd., and Atos SE.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Managed Security Services reports