Marine, Aviation and Transit Insurance Market Size and Trends Analysis by Region, Business Lines, Top Markets, Regulatory Overview and Competitive Landscape, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

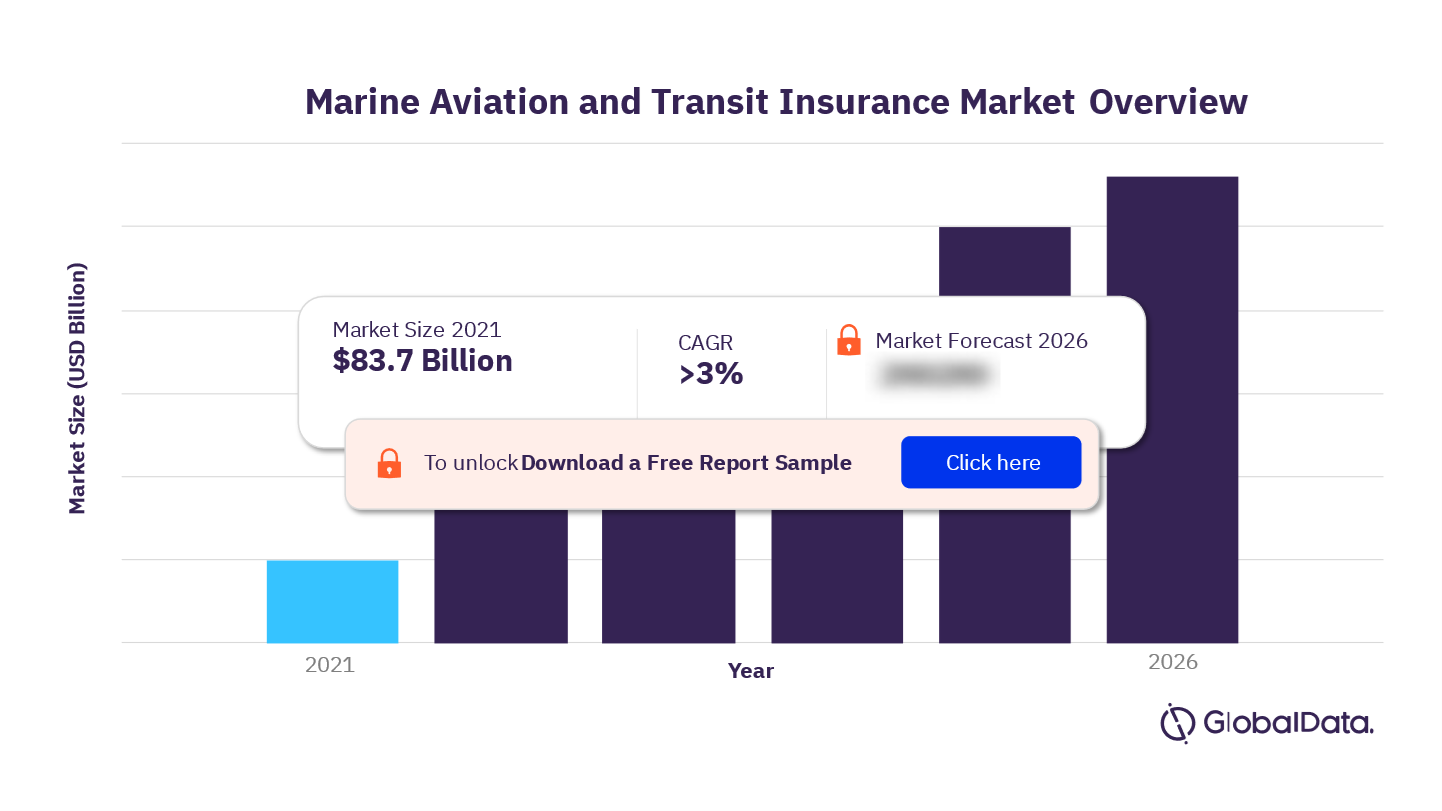

Marine Aviation and Transit Insurance Market Overview

The written premium of the MAT insurance market was $83.7 billion in 2021 and is expected to achieve a CAGR of more than 3% during 2021-2026. The industry is likely to witness a sluggish growth due to soaring inflation and recession fears from the ongoing war in Ukraine, and global disruption in the supply chain caused by China’s strict zero-COVID-19 policy. The MAT insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for the MAT insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the economy and demographics, and provides detailed information on the competitive landscape in the main markets. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the market. The report includes details of insurance regulations and recent changes in the regulatory structure.

MAT Insurance Market Outlook, 2021 ($ Billion)

To gain more information about MAT insurance market forecast, download a free report sample

MAT Insurance Market Trends

Advanced marine analytics solutions, deployment of drones, implementation of green supply chain management (GSCM) and electric vehicles, increasing risks due to rising geo-political tensions, and growing climate change and renewable energy developments are some of the trends impacting the MAT insurance market.

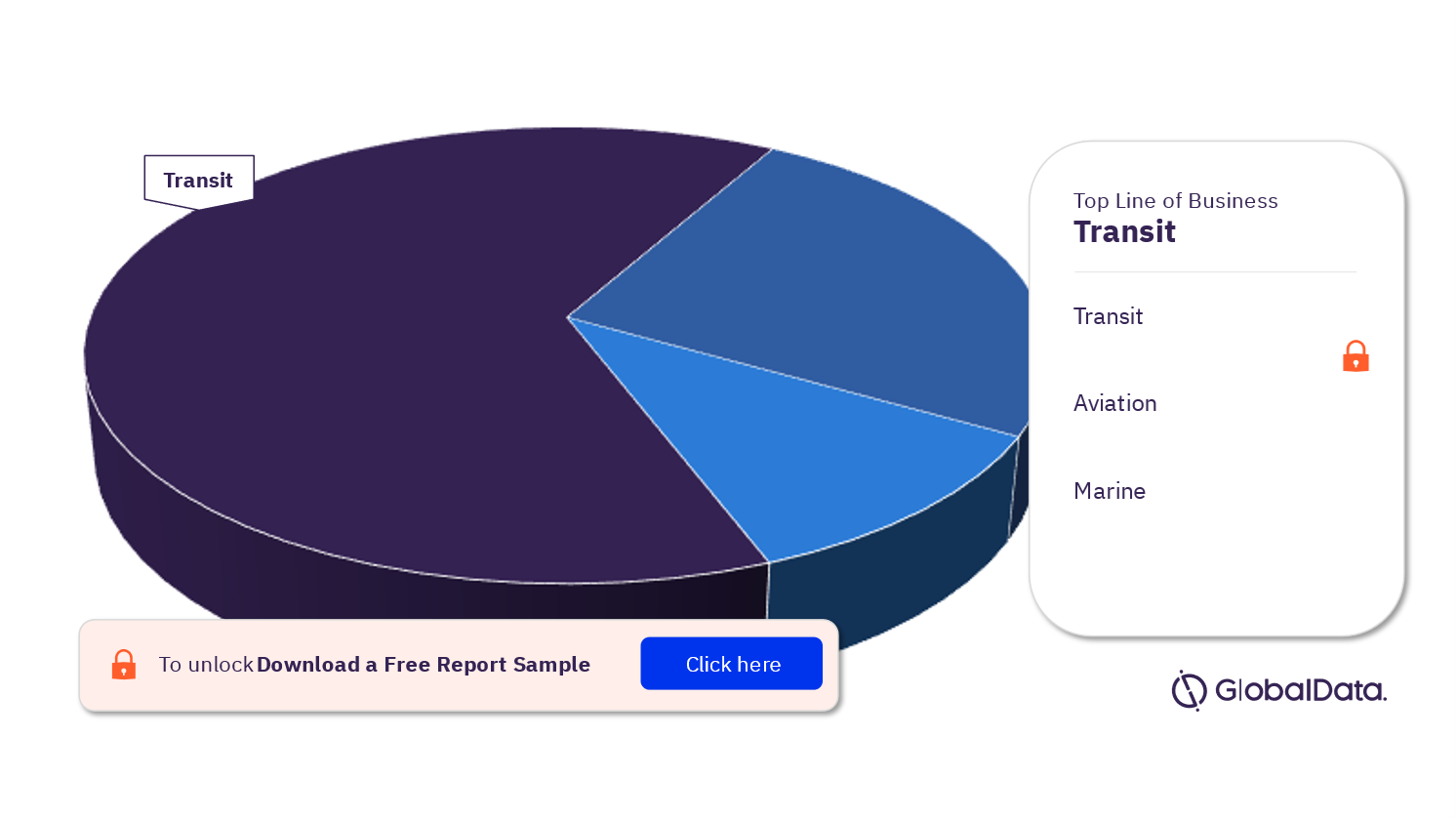

MAT Insurance Market Segmentation by Lines of Business

The key lines of business in the MAT insurance industry are aviation, marine, and transit. Among the MAT insurance lines, transit held the largest share in 2021. Revival in international and domestic travel, coupled with strong growth in e-commerce and compulsory transit insurance in several markets, supported its growth.

MAT Insurance Industry Analysis, by Lines of Business, 2021 (%)

For more lines of business insights into the MAT insurance market, download a free report sample

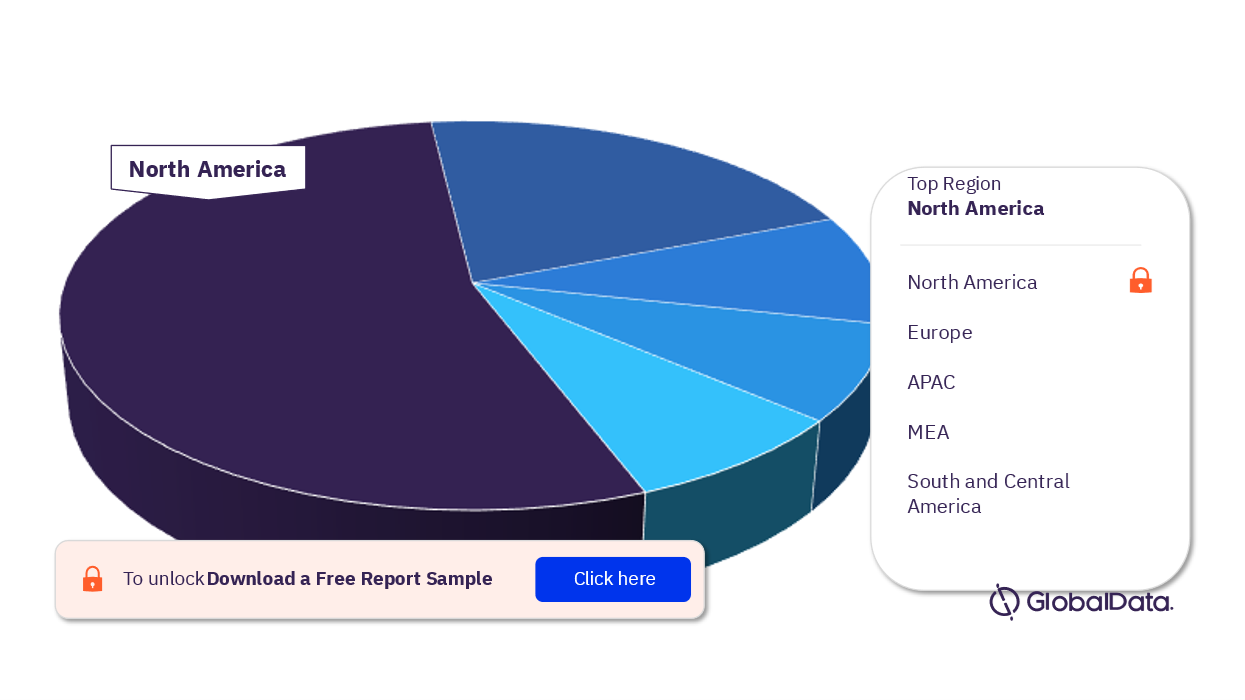

MAT Insurance Market Segmentation by Regions

The key regions in the MAT insurance industry are North America, Europe, APAC, MEA, and South and Central America. North America held the largest share of the MAT insurance business in 2021, followed by Europe and Asia-Pacific. The US was the largest MAT insurance market in the region in 2021 and is expected to continue its dominance during the forecast period.

MAT Insurance Industry Analysis, by Regions, 2021 (%)

For more regional insights into the MAT insurance market, download a free report sample

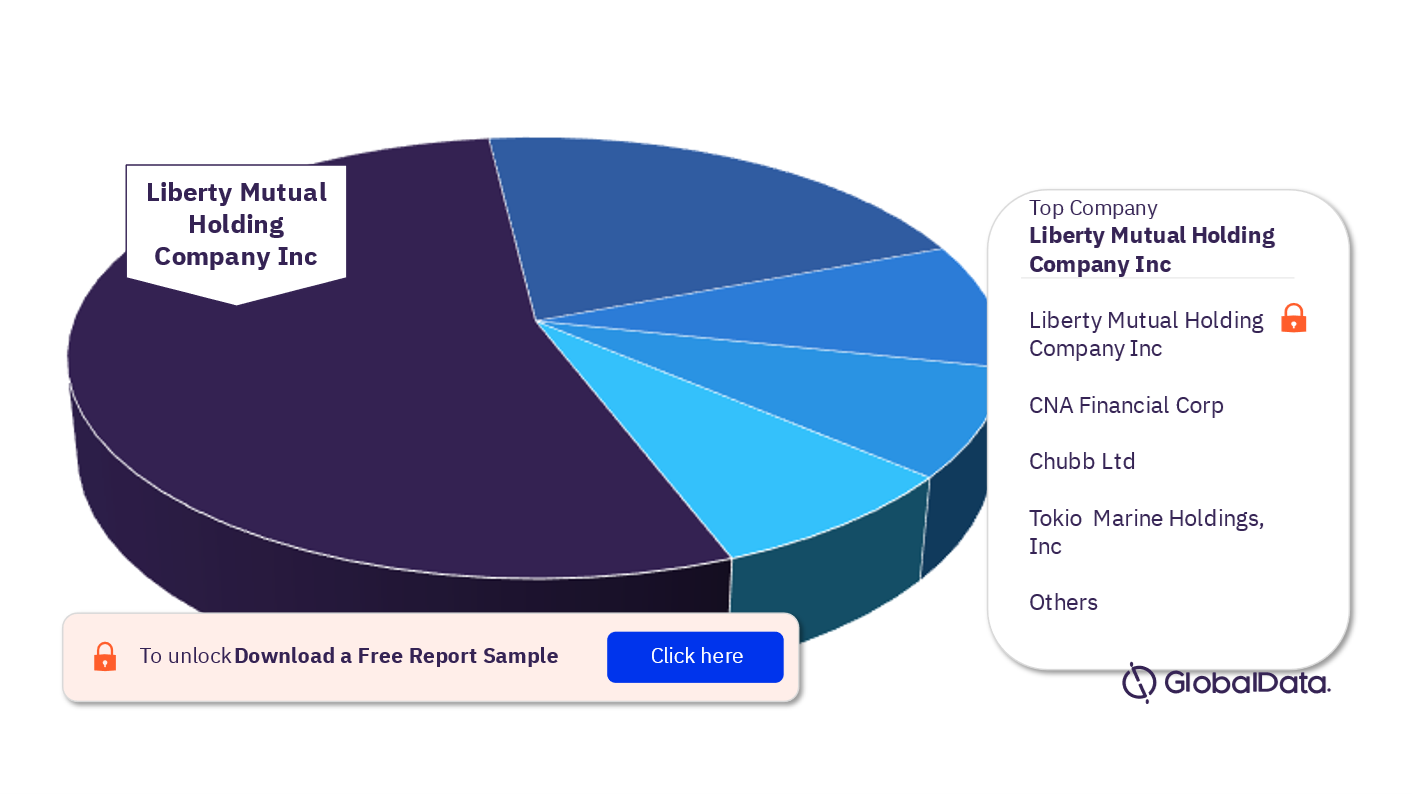

MAT Insurance Market - Competitive Landscape

Some of the leading MAT insurance companies are Liberty Mutual Holding Company Inc., CNA Financial Corp, AIG, Chubb Ltd, Allianz SE, Tokio Marine Holdings, Inc, Zurich Insurance Group AG, Nationwide Mutual Insurance Company, Assurant Inc., and The Travelers Companies, Inc. Liberty Mutual Holding Company Inc has the highest market share in 2021 in the MAT insurance market.

MAT Insurance Industry Analysis, by Companies, 2021 (%)

To know more about the leading players in the MAT insurance market, download a free report sample

MAT Insurance Market Report Overview

| Market Size (2021) | $83.7 billion |

| CAGR (2021-2026) | >3% |

| Forecast period | 2022-2026 |

| Key Lines of Business | Aviation, Marine, and Transit |

| Key Regions | North America, Europe, APAC, MEA, and South and Central America |

| Leading Companies | Liberty Mutual Holding Company Inc., CNA Financial Corp, AIG, Chubb Ltd, Allianz SE, Tokio Marine Holdings, Inc, Zurich Insurance Group AG, Nationwide Mutual Insurance Company, Assurant Inc., and The Travelers Companies, Inc |

MAT Insurance Market LoB Outlook ( Value, $ Billion, 2021-2026)

- Aviation

- Marine

- Transit

MAT Insurance Market Regional Outlook ( Value, $ Billion, 2021-2026)

- North America

- Europe

- APAC

- MEA

- South and Central America

Scope

This report provides a comprehensive analysis of the global marine, aviation, and transit insurance industry –

- It provides historical values for the global and regional marine, aviation, and transit insurance industry for the report’s review period, and projected figures for the forecast period.

- It offers a detailed analysis of the regional marine, aviation, and transit insurance industry and market forecasts to 2026.

- It provides key market trends in the global marine, aviation, and transit insurance industry.

- It provides rankings, premiums, and market share of top global and regional marine, aviation, and transit insurers and analyzes the competitive landscape.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the global and regional marine, aviation, and transit insurance industry.

- In-depth market analysis, information, and insights into the global marine, aviation, and transit insurance industry.

- In-depth analysis of the competitive landscape and top 20 regional markets.

- Understand the key dynamics, trends, and growth opportunities in the global and regional marine, aviation, and transit insurance industry.

- Identify key regulatory developments impacting the market growth.

- Identify growth opportunities in key regional markets.

CNA Financial

AIG

Chubb

Allianz

Tokio Marine Holdings

Zurich Insurance

Nationwide Mutual Insurance

Assurant Inc.

The Travelers Companies

Starr Group

Sompo Holdings

HDI

Factory Mutual Global

MS&AD Insurance

Berkshire Hathaway

Equitable Holdings

State Farm

Progressive Corp.

The People's Insurance Company (PICC)

Table of Contents

Frequently asked questions

-

What was the MAT insurance market written premium in 2021?

The written premium of the MAT insurance market was $83.7 billion in 2021.

-

What is the MAT insurance market growth rate?

The MAT insurance market in is expected to achieve a CAGR of more than 3% during 2021-2026.

-

What are the key lines of business in the MAT insurance market?

The key lines of business in the MAT insurance industry are aviation, marine, and transit.

-

What are the key regions in the MAT insurance market?

The key regions in the MAT insurance industry are North America, Europe, APAC, MEA, and South and Central America.

-

What are the leading companies in the MAT insurance industry?

Some of the leading insurance companies in the MAT insurance industry are Liberty Mutual Holding Company Inc., CNA Financial Corp, AIG, Chubb Ltd, Allianz SE, Tokio Marine Holdings, Inc, Zurich Insurance Group AG, Nationwide Mutual Insurance Company, Assurant Inc., and The Travelers Companies, Inc.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports