Morocco General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Morocco General Insurance Market Report Overview

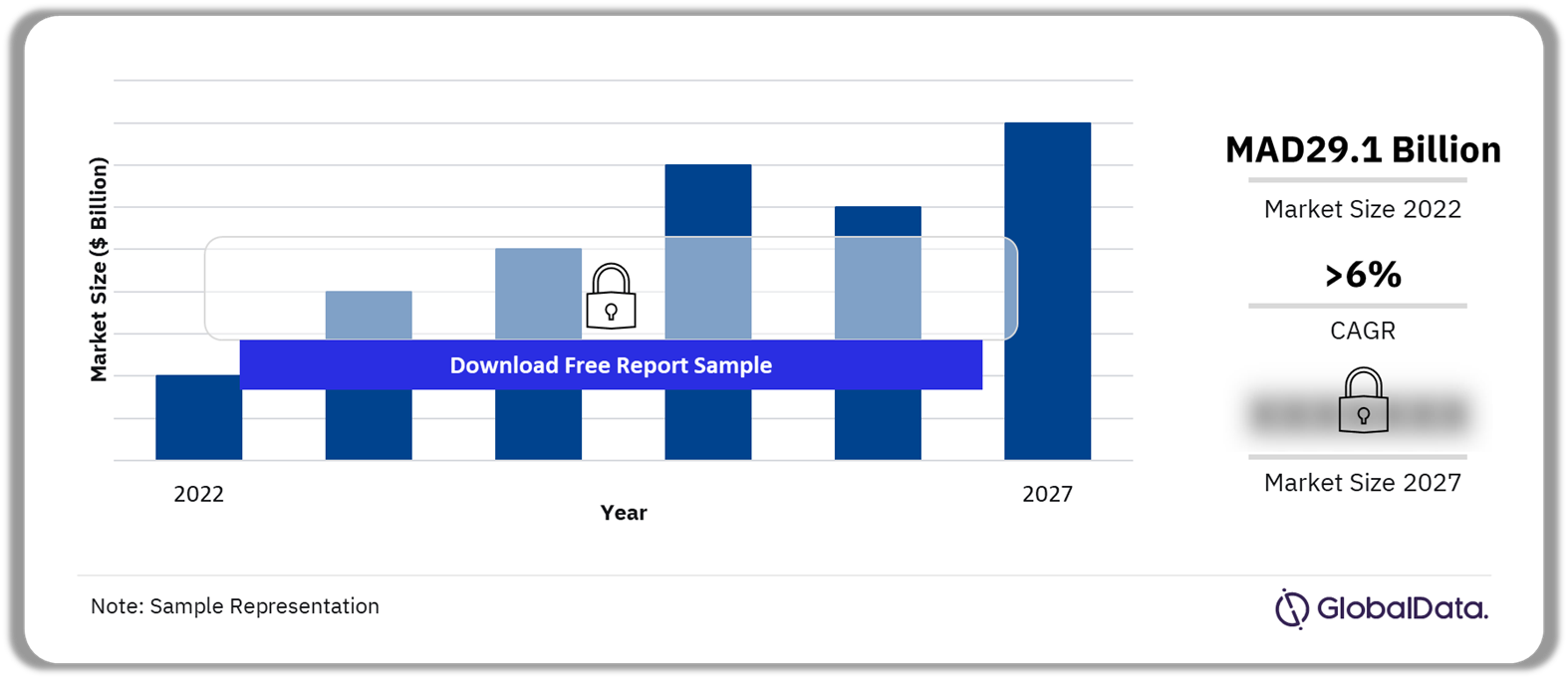

The gross written premium of the Morocco general insurance market was MAD29.1 billion ($2.8 billion) in 2022. The market is expected to achieve a CAGR of more than 6% during 2023-2027. The Morocco General Insurance market research report provides an in-depth analysis of various product categories in the Moroccan GI market. The report gives an overview of the country’s economic outlook and the general insurance regulatory and compliance framework. In addition, the report covers the emerging trends in the market segments, key performance indicators, and growth prospects for the Taiwan GI industry for the forecast period.

Morocco General Insurance Market Outlook, 2022-2027 (MAD Billion)

Buy the Full Report to Gain More Information about Morocco’s General Insurance Market Forecast Download a Free Report Sample

The report also gives an insight into the distribution channels, the key players, and the competitive landscape in the Morocco GI market.

| Market Size (2022) | MAD29.1 billion ($2.8 billion) |

| CAGR (2023-2027) | >6% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Trends | • NatCat insurance

• Microinsurance • Cyber insurance • Digital initiatives • Electric vehicles (EVs) |

| Key Lines of Business | • Property

• Motor • Liability • Financial Lines • MAT • Non-Life PA&H • Miscellaneous |

| Key Distribution Channels | • Insurance Agents

• Insurance Brokers • Direct Management Offices |

| Leading Companies | • Sanlam

• Wafa Assurance • AtlantaSanad • AXA Assurance • Royale Marocaine D’Assurance |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Morocco General Insurance Market Trends

The rising popularity of electric vehicles (EVs), digital initiatives, and the growing awareness of cyber insurance, microinsurance, and NatCat insurance will also impact the Moroccan general insurance market growth in the next few years. For instance, Morocco suffered the most cyber-attacks on banks in the whole of Africa in 2022, with phishing being one of the most common cybercrimes, accounting for 23% of total attacks on financial institutions. For this purpose, in September 2023, Cypherleak, a cyber risk monitoring and scoring startup, obtained a $750,000 seed funding to expand in the Middle East and Africa region, including Morocco. Cypherleak specializes in providing risk monitoring for SMEs without the need for deep cybersecurity technical expertise.

Furthermore, Morocco is at the forefront of EV production due to its pioneering ultra-fast charging electric car batteries. In May 2023, global Anglo-Moroccan technology company, ATLAS E-Mobility, announced its plans to launch the ‘first African-designed and engineered Battery Electric Vehicle (BEV)’ and develop its manufacturing facilities in Morocco.

Buy the Full Report for More Insights on the Key Morocco General Insurance Market Trends, Download a Free Sample Report

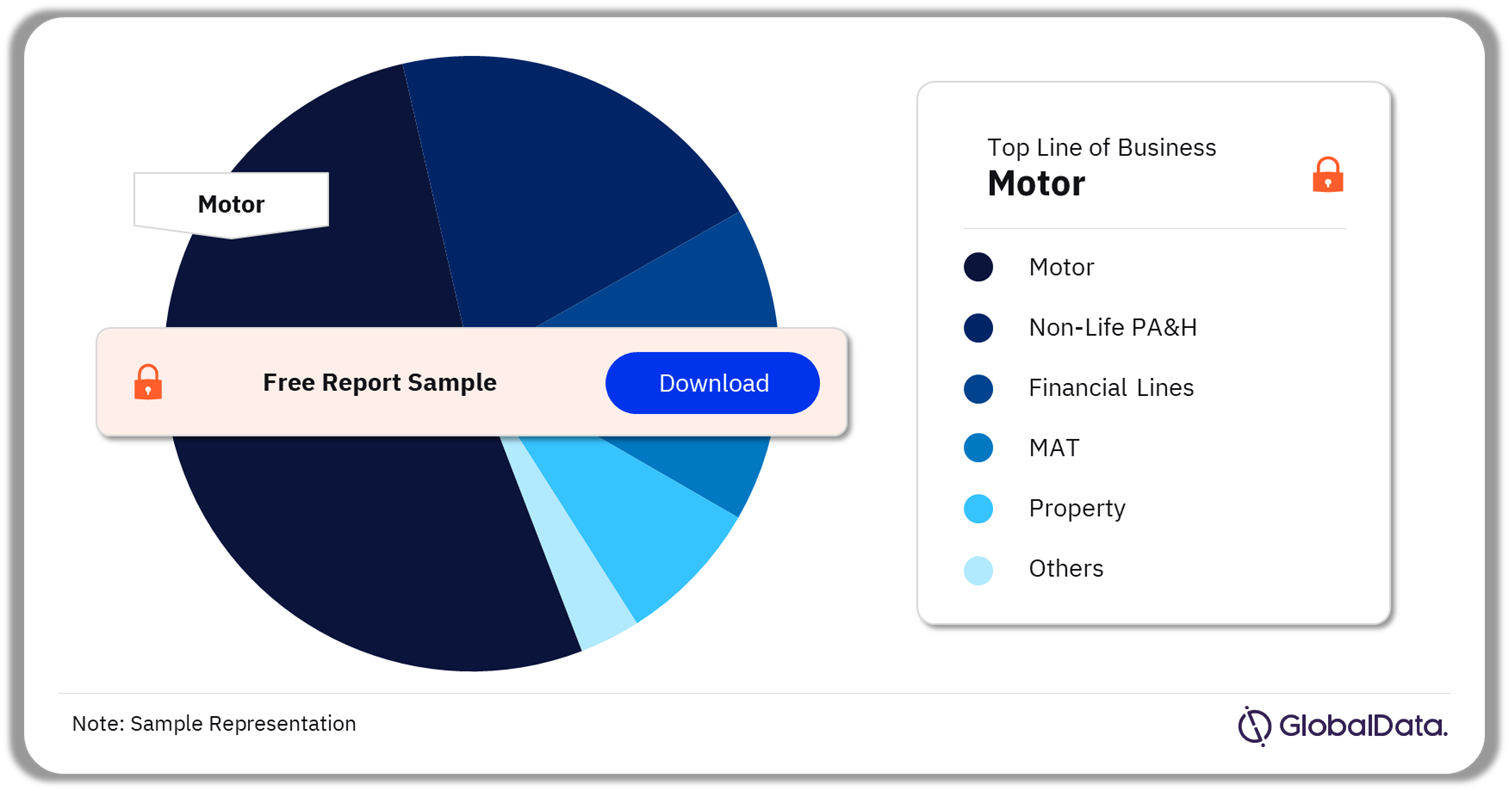

Morocco General Insurance Market Segmentation by Lines of Business

The key lines of business in the Morocco general insurance market are property, motor, liability, financial lines, MAT, non-life PA&H, and miscellaneous among others. The motor line of business was the leading general insurance line, followed by general PA&H.

Motor insurance premiums experienced a decline in 2022 and 2023. However, car sales in Morocco are expected to revive in 2024 due to an improved supply of semiconductors, increased consumer spending, and the revival of the global economy. Moreover, Morocco is at the forefront of EV production due to its pioneering ultra-fast charging electric car batteries.

Morocco General Insurance Market Analysis by Lines of Business, 2022 (%)

Buy the Full Report for More Lines of Business Insights into Morocco’s General Insurance Market Download a Free Report Sample

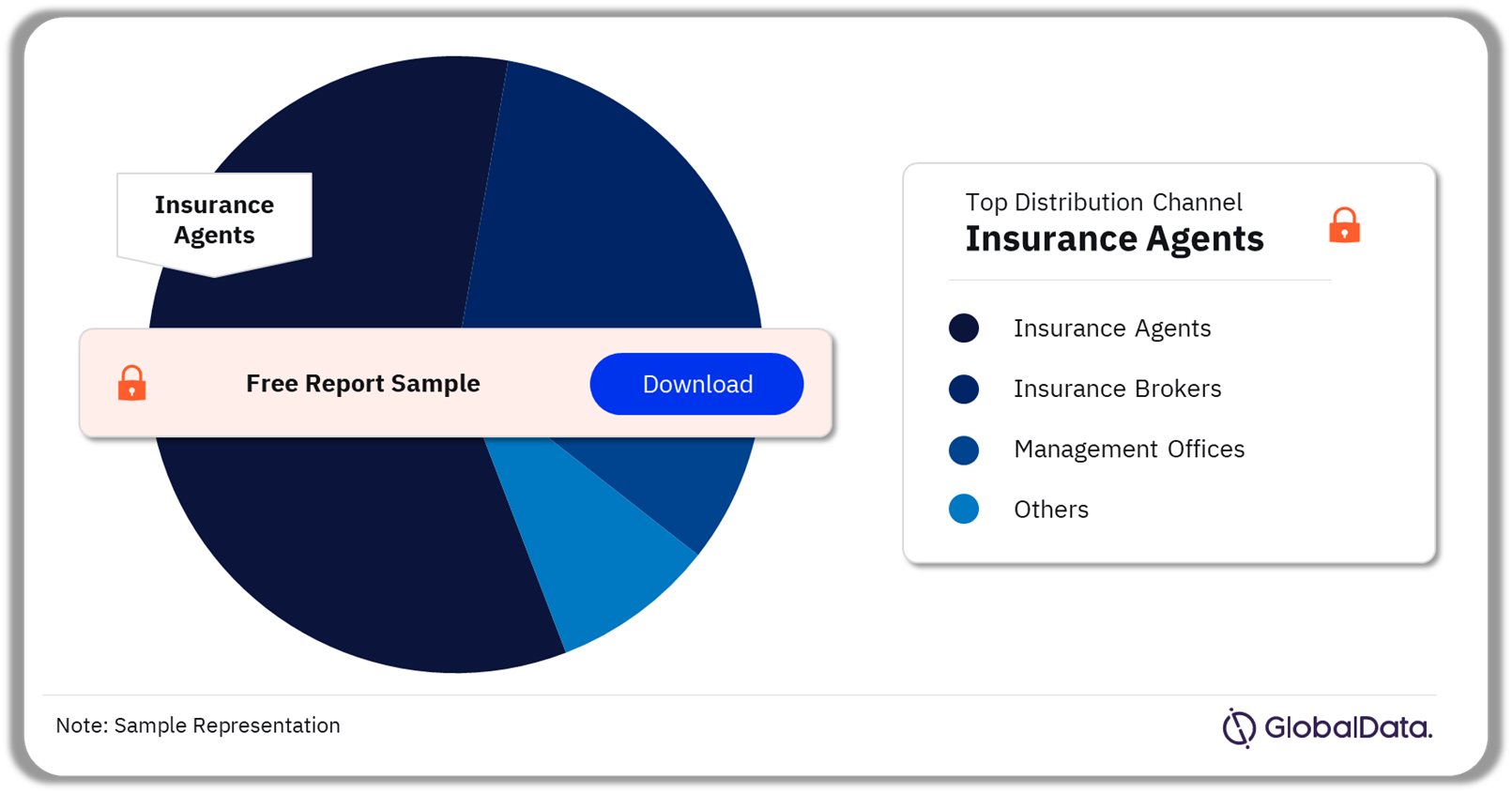

Morocco General Insurance Market Segmentation by Distribution Channels

The key distribution channels in the Morocco general insurance market are insurance agents, insurance brokers, and management offices. Insurance brokers were the leading distribution channel according to ACAPS. In 2023, most individuals preferred insurance agents or brokers as a source of information about insurance products.

Morocco Motor General Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy Full Report for More Distribution Channel Insights into Morocco’s General Insurance Market

Download a Free Report Sample

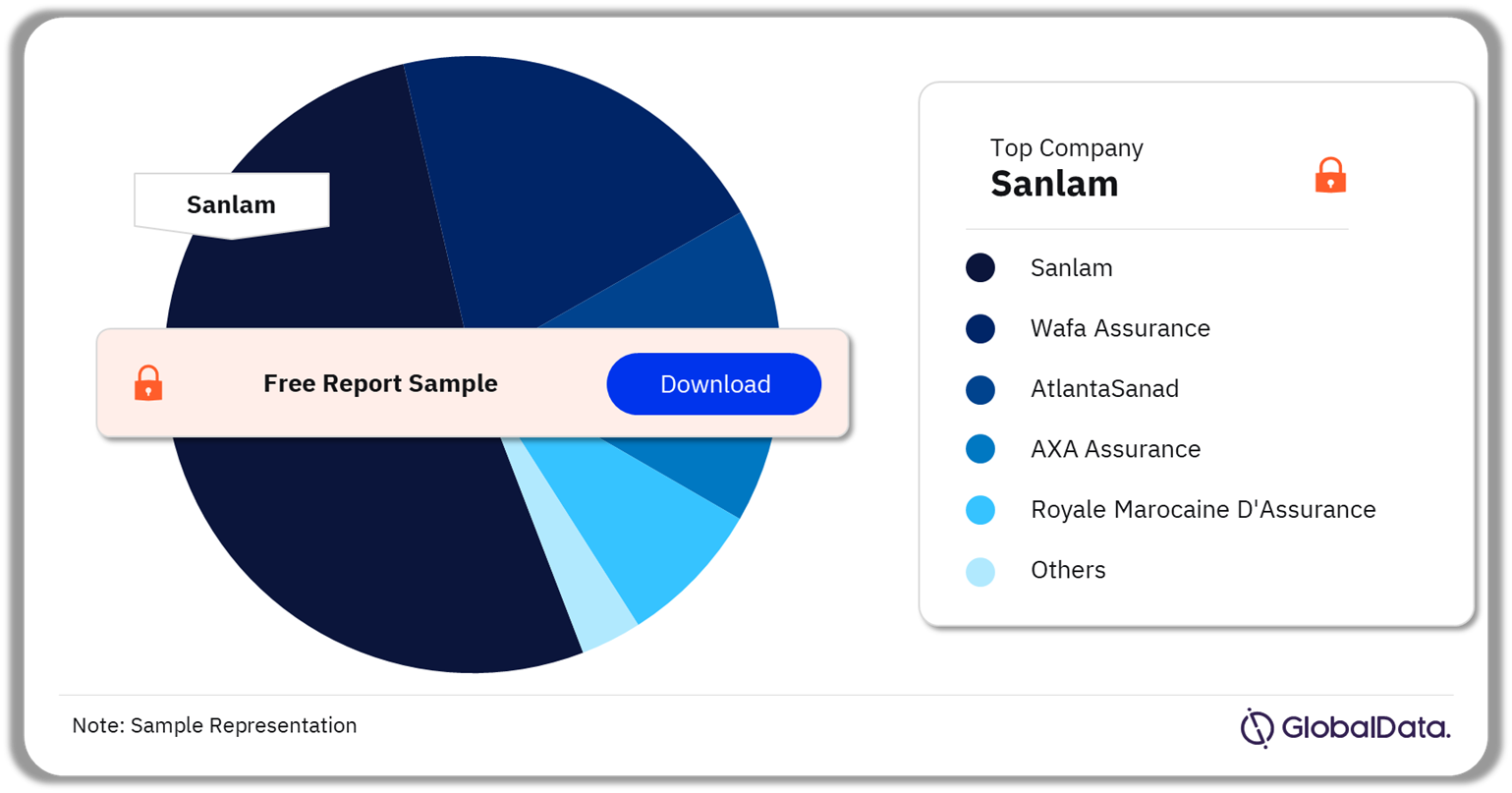

Morocco General Insurance Market - Competitive Landscape

The leading insurers in Morocco are Sanlam, Wafa Assurance, AtlantaSanad, AXA Assurance, and Royale Marocaine D’Assurance among others. Sanlam held the largest share in 2022, followed by Wafa Assurance and AtlantaSanad.

Sanlam: In December 2022, Sanlam digitalized its health, automobile, home, and life insurance services so that policyholders can check their accounts, report, and track a claim, and purchase or renew insurance policies online. The insurer also developed “Store Locator”, a solution that allows policyholders to locate the nearest Sanlam intermediary and contact it on WhatsApp, by email, or by phone. The Sanlam Morocco app allows policyholders to access their auto, home, health, and savings insurance contracts, track their claims, follow vehicle repairs in real-time, submit health records, geolocate approved garages, pharmacies, and clinics, and make appointments with doctors instantly.

Morocco General Insurance Market Analysis, by Companies, 2022 (%)

Buy the Full Report to Know More about the Companies in the Morocco General Insurance Market Download a Free Report Sample

Segments Covered in the Report

Morocco General Insurance Market Lines of Business Outlook (Value, MAD Billion, 2018-2027)

- Property

- Motor

- Liability

- Financial Lines

- MAT

- Non-Life PA&H

- Miscellaneous

Morocco General Insurance Distribution Channel Outlook (Value, MAD Billion, 2018-2027)

- Insurance Agents

- Insurance Brokers

- Direct Management Offices

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Morocco.

- Historical values for the Morocco general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Morocco and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Morocco’s general insurance segment.

- A comprehensive overview of Morocco’s economy, government initiatives, and investment opportunities.

- Morocco’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Morocco’s general insurance industry’s market structure gives details of lines of business.

- Morocco’s general reinsurance business market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Morocco’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Key insights and dynamics of Morocco’s general insurance segment.

- A comprehensive overview of Morocco’s economy, government initiatives, and investment opportunities.

- Morocco’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Morocco’s general insurance industry’s market structure gives details of lines of business.

- Morocco’s general reinsurance business market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Morocco’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Wafa Assurance

AtlantaSanad

AXA Assurance

Royale Marocaine D'Assurance

Mutuelle Centrale

Mutuelle Agricole

Allianz

Table of Contents

Frequently asked questions

-

What was the Morocco general insurance market gross written premium in 2022?

The gross written premium of the Morocco general insurance market was MAD29.1 billion ($2.8 billion) in 2022.

-

What is Morocco general insurance market growth rate?

The general insurance market in Morocco is expected to achieve a CAGR of more than 6% during 2023-2027.

-

Which line of business holds the largest share of the Morocco general insurance market?

Motor line of business was the leading general insurance line of business in the Morocco general insurance market in 2022.

-

Which are the key companies operating in the Morocco general insurance market?

Some of the leading insurers in Morocco are Sanlam, Wafa Assurance, AtlantaSanad, AXA Assurance, and Royale Marocaine D’Assurance among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports