Netherlands Baby Food Market Size and Share by Categories, Distribution and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Netherlands Baby Food Market Report Overview

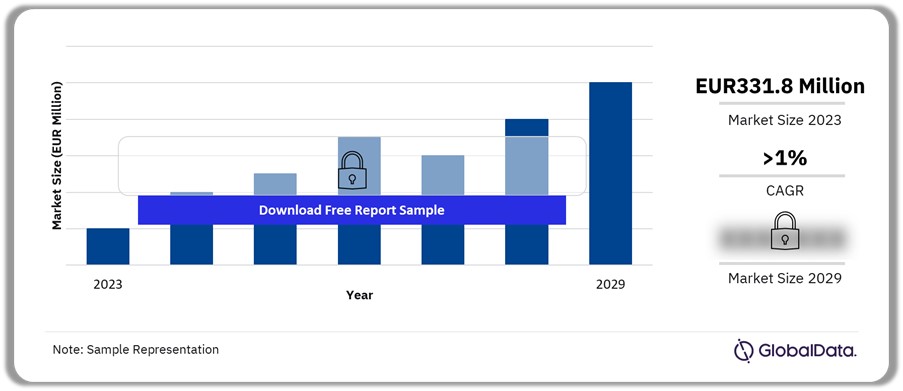

The baby food sales in the Netherlands were EUR331.8 million in 2023. However, the market will record a CAGR of more than 1% during 2023-2029. The Netherlands’ baby food market outlook includes demographic and socio-economic trends to aid clients in effective decision-making.

Netherlands Baby Food Market Outlook, 2023-2029 (EUR Million)

Buy the Full Report for Netherlands Baby Food Market Revenue

Download a Free Report Sample

The Netherlands baby food market insights look at current and future trends that will impact the baby food industry. This report collates multiple data sources to offer a comprehensive baby food sector overview in the Netherlands from 2017 to 2029.

| Market Size (2023) | EUR166 million ($169.6 million) |

| CAGR (2023-2029) | >1% |

| Historical Period | 2017-2023 |

| Forecast Period | 2023-2029 |

| Key Categories | · Baby Milks

· Baby Cereals & Dry Meals · Baby Wet Meals & Other · Baby Finger Food · Baby Drinks |

| Key Distribution Channels | · Hypermarkets & Supermarkets

· Drugstores & Pharmacies · Convenience Stores · E-retailers |

| Leading Manufacturers | · Danone

· Nestlé · Hero · The Hain Celestial Group · The Kraft Heinz Company |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Netherlands Baby Food Market Trends

High inflation affected the purchasing power of many Dutch consumers until 2023. However, convenience will remain a crucial feature with the rise in the purchasing power of women, including new mothers, entering the workforce. Although initially slow to take off, the market for organic and specialist baby foods will gain greater popularity during 2023-2029. Furthermore, increased concern about health issues among adults has already led to the introduction of foods with added vitamins and other health claims in the baby food sector. This will further create an opportunity for baby food manufacturers to launch user-friendly and natural products and drive organic infant food sales in the future.

Buy the Full Report for the Dutch Baby Food Trends Analysis, Download a Free Sample PDF

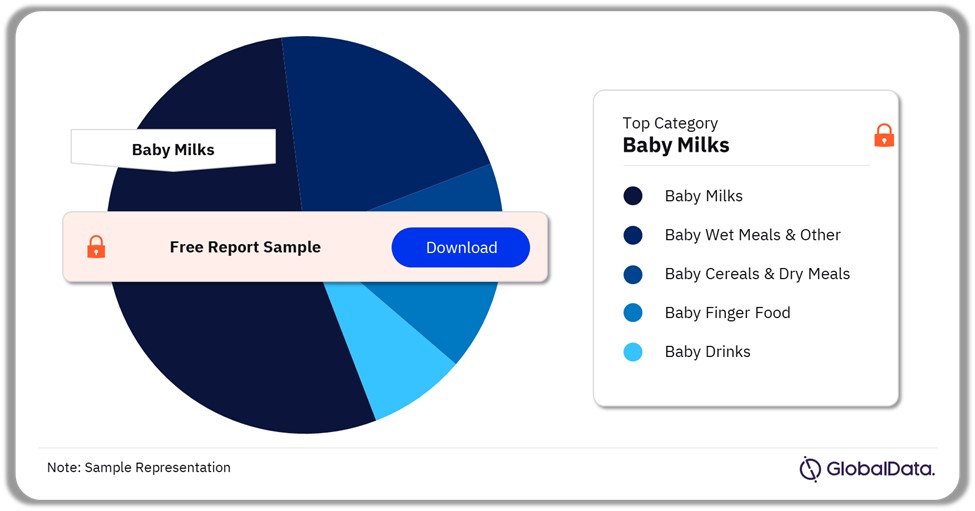

Netherlands Baby Food Market Segmentation by Categories

Baby milks recorded the highest baby food category sales in 2023

The key categories in the Netherlands baby food market are:

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Finger Food

- Baby Drink

The baby milk category will register marginal growth by 2029. Growing-up milk and follow-on milk among others are the key segments in this category. In the Netherlands, most baby milks available were in powdered form. Powdered milks are most prevalent in first-stage milk.

Buy the Full Report for Categorical Netherlands Baby Food Market Outlook

Download a Free Report Sample

Segments Covered in the Report

Netherlands Baby Food Categories Outlook (Value, EUR Million, 2017-2029)

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drinks

Netherlands Baby Food Distribution Channel Outlook (Value, EUR Million, 2017-2029)

- Hypermarkets and Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-Retailers

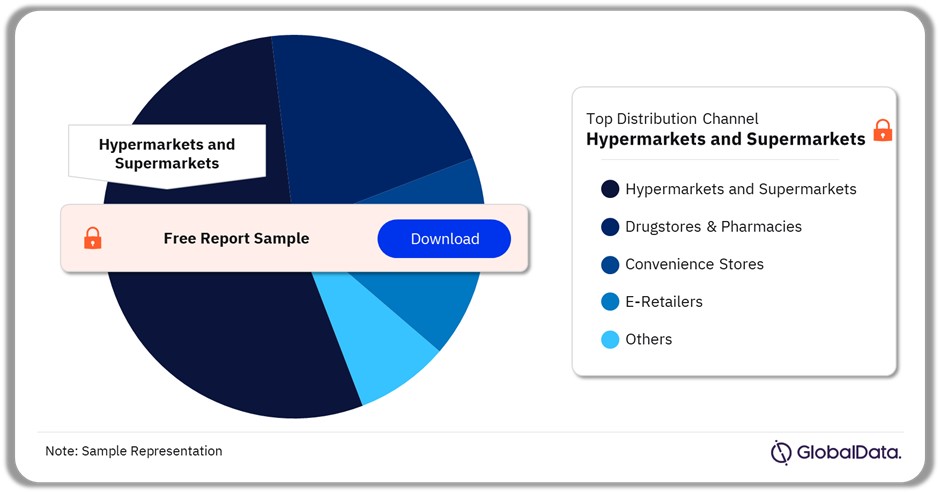

Netherlands Baby Food Market Segmentation by Distribution Channels

Hypermarkets & supermarkets amounted to 70% of overall baby food value sales in 2023

The key distribution channels in the Netherlands baby food market are:

- Hypermarkets & Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-retailers

Hypermarkets & supermarkets was the most preferred distribution channel for baby finger food and baby drinks category in 2023. Drugstores & pharmacies led the second-highest baby food value share in 2023.

Buy the Full Report for More Distribution Channel Insights into the Netherlands Baby Food Market

Download a Free Report Sample

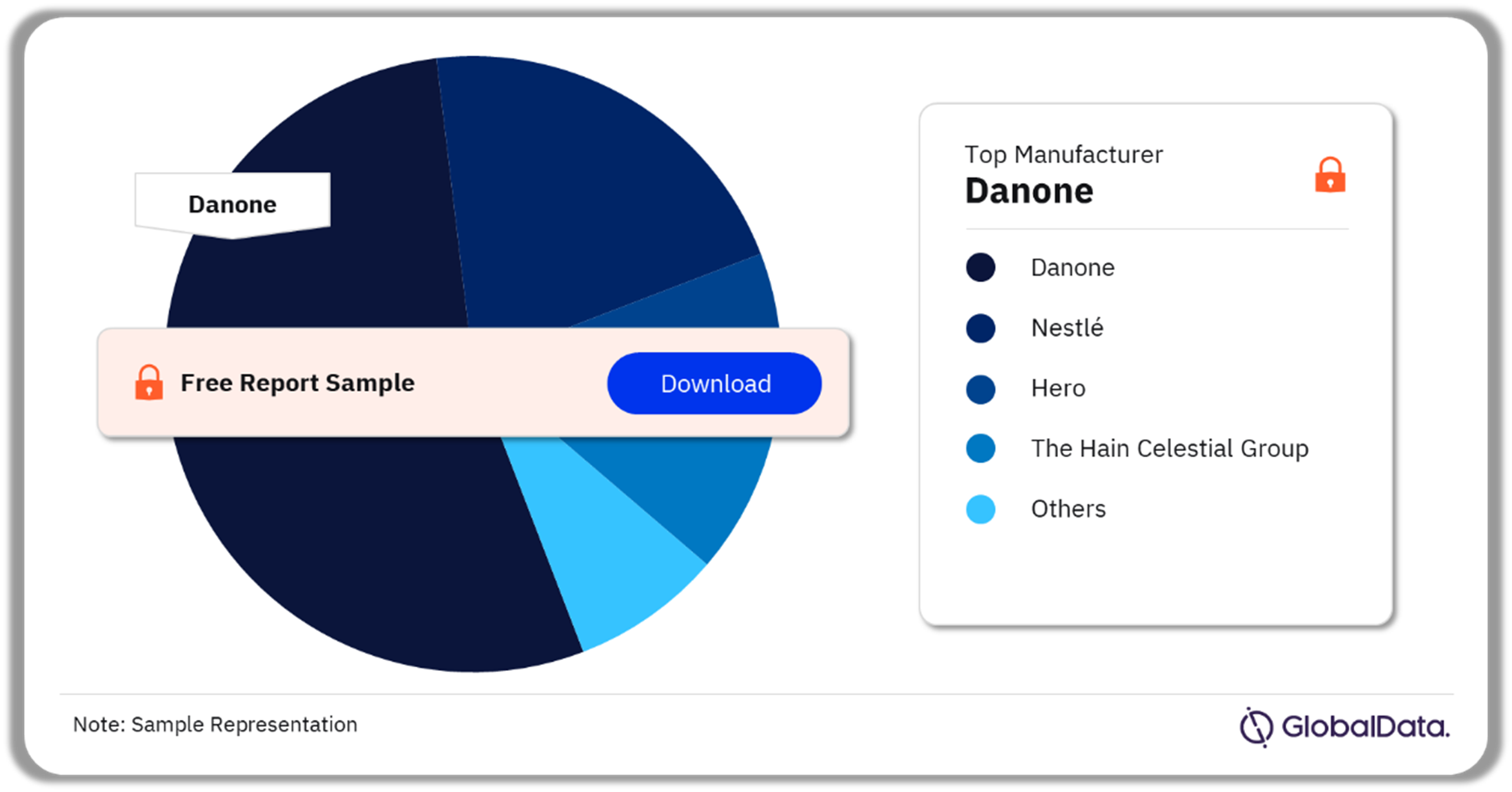

Netherlands Baby Food Market - Competitive Landscape

In 2023, Danone was the leading Dutch baby food company

The leading baby food manufacturers in the Netherlands are:

- Danone

- Nestlé

- Hero

- The Hain Celestial Group

- The Kraft Heinz Company

- Others

Danone accounted for the highest baby food value and volume share across all categories in 2023. The company promoted brands, including Nutrilon, Bambix, and Olvarit among others. Hero and Nestlé followed the lead among other baby food companies.

Buy the Full Report for Leading Netherlands Baby Food Manufacturers

Download a Free Report Sample

Scope

This report provides:

- Consumption data based on a unique combination of industry research, fieldwork, and market sizing work. In-house expertise to offer extensive trends and dynamics data affecting the industry.

- Detailed company profiles considering their entry into the baby food industry with key product sectors.

- Market profile of the various product sectors with their key features & developments. Extensive insights about product segmentation, per capita trends, and the various manufacturers & brands.

- Baby food industry retailing overview with company revenues along with the distribution channel insights.

- Future projections considering various baby food market trends that are likely to affect the industry.

Key Highlights

Value sales of baby milks increased from EUR124.6 million ($140.8 million) in 2017 to EUR166 million ($169.6 million) in 2023, at a CAGR of 4.9%.

Baby cereals & dry meals volumes increased from EUR14.8 million ($16.8 million) in 2017 to EUR18.6 million ($19 million) in 2023, at a CAGR of 3.8%.

Value sales of the baby wet meals & other category increased from EUR87.3 million ($98.6 million) in 2017 to EUR109.5 million ($111.8 million) in 2023, registering a CAGR of 3.8%.

During 2017–23, PCC of baby finger food increased by 4% to reach 2.6kg in 2023.

During 2017–23, PCC of baby drinks fell by 28.2%, totaling 5.1kg in 2023.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyse current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Understand individual product category consumption to align your sales and marketing efforts with the latest trends in the market.

- Investigate which categories are performing the best and how this is changing market dynamics.

Danone

Hero

The Hain Celestial Group

The Kraft Heinz Company

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Netherlands baby food market size in 2023?

The baby food market size in Netherlands was EUR331.8 million in 2023.

-

What will the Netherlands baby food market growth rate be during the forecast period?

The baby food market in Netherlands will achieve a CAGR of more than 1% during 2023-2029.

-

Which was the leading category in the Netherlands baby food market in 2023?

Baby milk was the leading category in the Netherlands baby food market in 2023.

-

Which was the leading distribution channel of the Netherlands baby food market in 2023?

Hypermarkets & supermarkets was the leading distribution channel of the Netherlands baby food market in 2023.

-

Which are the leading manufacturers in the Netherlands baby food market?

A few of the leading manufacturers in the Netherlands baby food market are Danone, Nestlé, Hero, The Hain Celestial Group, and The Kraft Heinz Company among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.