Netherlands Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Netherlands Cards and Payments Market Report Overview

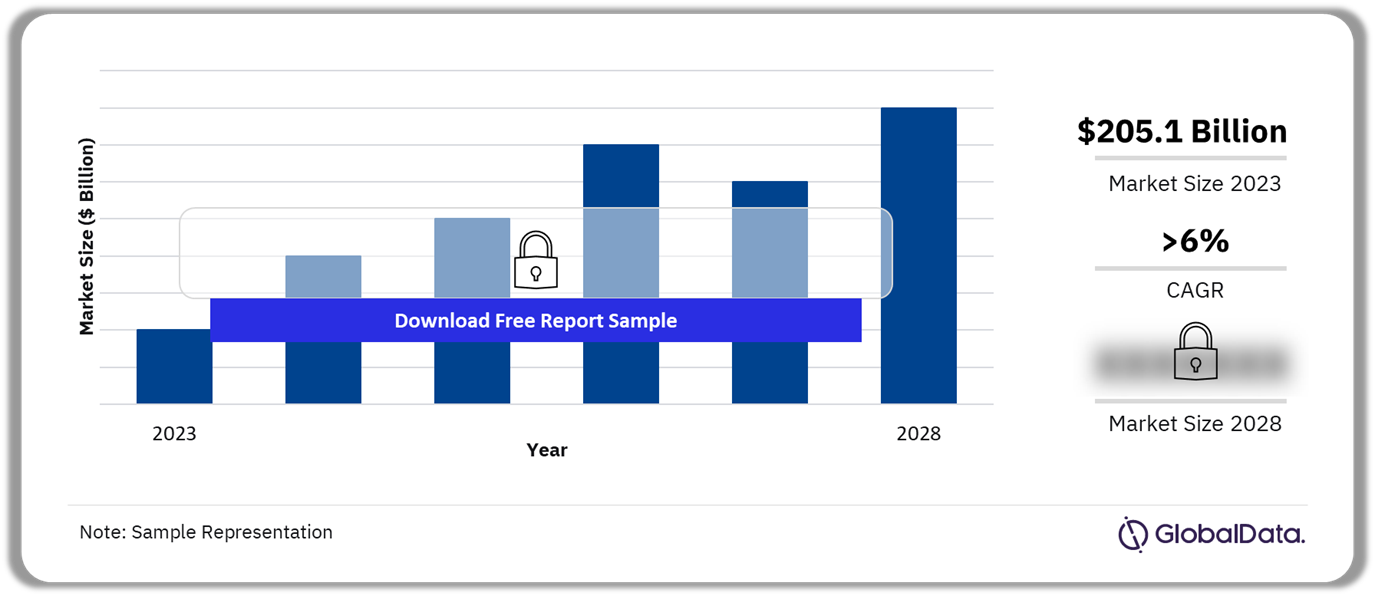

The annual value of card transactions in the Netherlands cards and payments market was $205.1 billion in 2023. The Dutch cards and payments market will grow at a CAGR of more than 6% during 2024-2028. Dutch banks are progressively switching from Maestro and V PAY to Mastercard- and Visa-branded debit cards. Since July 2023, Mastercard and Visa have no longer issued Maestro and V PAY cards.

Netherlands Card Transactions Outlook, 2024-2028 ($ Billion)

Buy the Full Report for More Information on the Netherlands Cards and Payments Market Forecast Download a Free Sample Report

The Netherlands cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Netherlands cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $205.1 billion |

| CAGR (2024-2028) | >6% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Payment Instruments | · Cards

· Credit Transfers · Direct Debits · Cash · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments |

| Leading Players | · De Nederlandsche Bank (DNB)

· ABN AMRO · de Volksbank · ING · Rabobank |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Netherlands Cards and Payments Market Dynamics

The growing number of fintech companies and digital-only banks will drive competition in the banking space. This will help in boosting debit card holding. For instance, in January 2022, Revolut launched its banking services in the country. It offers Standard, Plus, Premium, Metal, and Ultra accounts, as well as a Mastercard debit card in the country.

The adoption of contactless payments on public transport is also increasing contactless payments in the country. According to the DPA, in 2023, many used contactless payments (payment cards, mobile wallets, and wearables) for public transportation in the country. This was attributed to the collaboration between Mastercard and the Dutch public transport system developer Translink in June 2023. This collaboration enabled the OVpay payment service on all public transport, including trams, trains, buses, and metros, making the Netherlands the first country globally to launch a fully contactless public transport payments system nationwide.

Buy the Full Report to Get Additional Netherlands Cards and Payments Market Dynamics

Netherlands Cards and Payments Market Segmentation by Payment Instruments

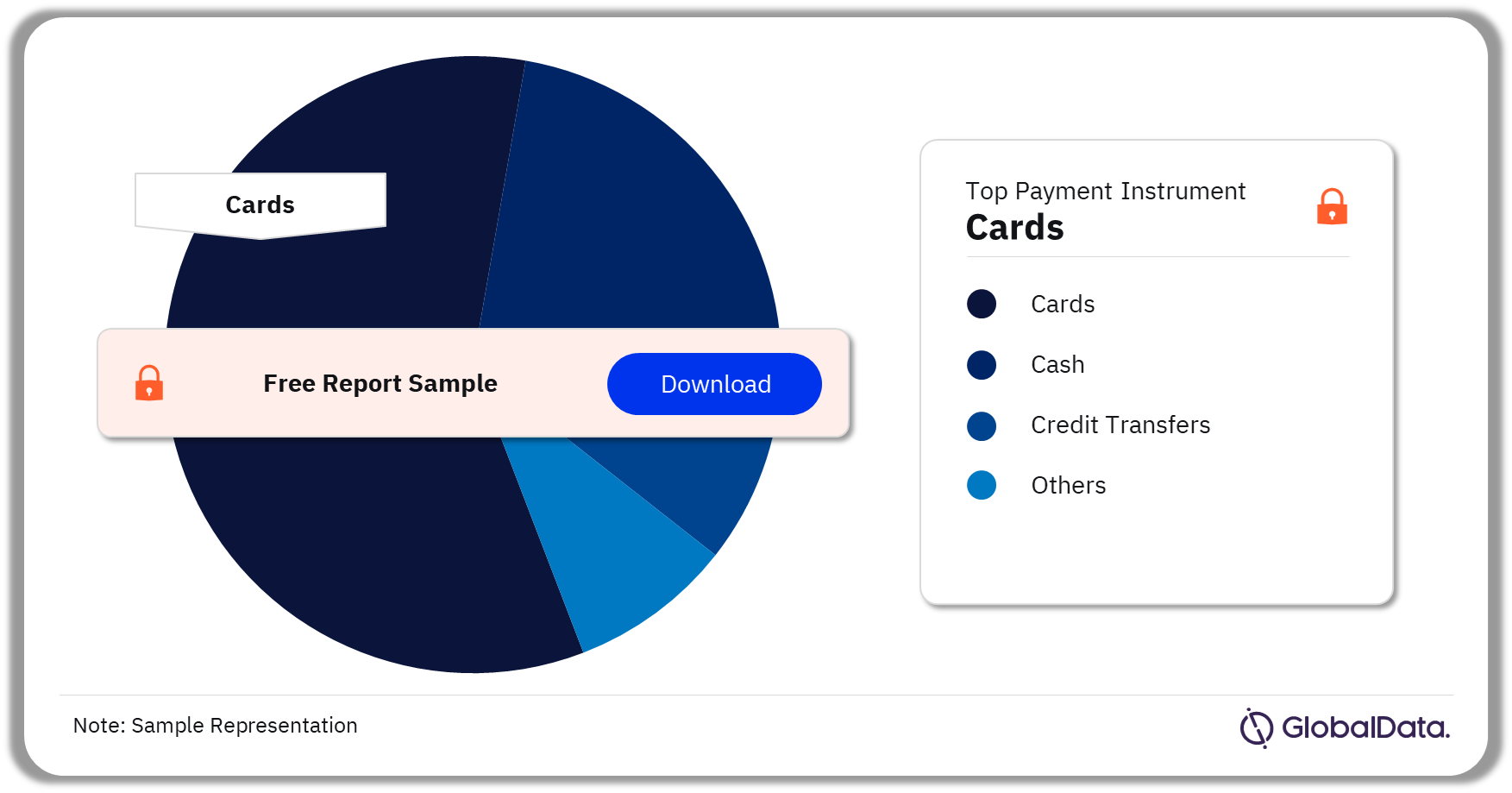

Payment cards had the highest transaction volume in the Netherlands payments space in 2023

The key payment instruments in the Netherlands cards and payments market are cards, credit transfers, direct debits, cash, and cheques. Payment card usage is gaining popularity at the expense of cash. A high-banked population and widespread financial awareness have ensured the strong adoption of payment cards. Going forward, the emergence of digital-only banks, a growing e-commerce market, and the rising adoption of contactless payments in the country will further support payment card usage.

Netherlands Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Netherlands Cards and Payments Market

Netherlands Cards and Payments Market Segments

The key segments in the Netherlands cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, and mobile payments among others.

Card-Based Payments: The Dutch payment card market is well developed and mature, with consumers holding over two cards each, more than in many other countries in the region. This is attributed to a high level of awareness of electronic payments, combined with a well-developed payment acceptance infrastructure. Debit cards dominated the payment card market both in terms of cards in circulation and transaction value.

Buy the Full Report for More Market Segment Insights into the Netherlands Cards and Payments Market

Netherlands Cards and Payments Market - Competitive Landscape

A few of the leading players in the Netherlands cards and payments market are De Nederlandsche Bank, ABN AMRO, de Volksbank, ING, and Rabobank among others.

Netherlands Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Leading Players in the Netherlands Cards and Payments Market

Netherlands Cards and Payments Market – Latest Developments

- In June 2022, Klarna introduced a loyalty card feature, enabling users to make payments using loyalty cards via the Klarna app.

- In July 2022, supermarket chain Aldi opened a checkout-free store called Aldi Shop & Go in Utrecht. Customers enter and exit the store using a dedicated app. Once customers complete their shopping and leave the store, the amount is debited from their preferred payment method linked to the app.

Segments Covered in the Report

Netherlands Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2028)

- Cards

- Credit Transfers

- Direct Debits

- Cash

- Check

Netherlands Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2028)

- Card-Based Payments

- Merchant Acquiring

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

• In 2020, European Payments Initiative (EPI), an instant payment scheme, was launched by 16 banks and financial services with the aim of creating a unified payment solution in Europe for consumers and merchants with mobile wallets. EPI finally announced the brand name of this solution, wero, in September 2023. In October 2023, EPI completed the acquisition of Dutch payment scheme iDEAL, which will be rebranded as wero and replace iDEAL from 2025. wero will be available through EPI-member bank apps and as a standalone mobile app. Initially, EPI will support person-to-person and consumer-to-business payments, then online and POS payments. EPI plans to commercially launch wero in mid-2024 in Belgium, France, and Germany, followed by the Netherlands and other European countries.

• Dutch banks are progressively switching from Maestro and V PAY to Mastercard- and Visa-branded debit cards. Since July 2023, Mastercard and Visa have no longer issued Maestro and V PAY cards. According to the Dutch Payments Association, more than 30 million Dutch debit cards bearing Maestro or V PAY branding will be gradually replaced by the end of 2028, and all Dutch payment cards will bear the Visa Debit or Mastercard Debit brand. Meanwhile, consumers with a valid V PAY or Maestro debit card can continue to make payments and withdraw cash anywhere in Europe.

• The growing number of fintech companies and digital-only banks will drive competition in the banking space, thus helping boost debit card holding. In January 2022, Revolut launched its banking services in the country. It offers Standard, Plus, Premium, Metal, and Ultra accounts, as well as a Mastercard debit card in the country. Furthermore, in December 2023, the Dutch Payments Association (DPA) endorsed Revolut as its newest member. This allows Revolut to participate in collective Dutch payment transaction facilities such as the Switching Service, as well as debit card acceptance agreements.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Netherlands cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Netherlands cards and payments industry.

- Assess the competitive dynamics in the Netherlands cards and payments industry.

- Gain insights into marketing strategies used for various card types in the Netherlands.

- Gain insights into key regulations governing the Netherlands cards and payments industry.

ABN AMRO

de Volksbank

ING

Rabobank

Dutch Payments Association

American Express

Visa

Mastercard

Adyen

Klarna

PayPal

Apple Pay

Google Pay

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Netherlands cards and payments market in 2023?

The annual value of card transactions in the Netherlands cards and payments market was $205.1 billion in 2023.

-

What will the Netherlands cards market growth rate be during the forecast period?

The Netherlands annual cards market value will grow at a CAGR of more than 6% during 2024-2028.

-

Which was the leading payment instrument in the Netherlands cards and payments market in 2023?

The card was the leading payment instrument in terms of transaction volume in the Netherlands cards and payments market in 2023.

-

Which are the leading players in the Netherlands cards and payments market?

A few of the leading players in the Netherlands cards and payments market are De Nederlandsche Bank, ABN AMRO, de Volksbank, ING, and Rabobank among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports