New Zealand Retail Banking Competitor Benchmarking – Financial Performance, Customer Relationships and Satisfaction

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

New Zealand Retail Banking Market Report Overview

All banks in New Zealand improved their profitability in 2022, with 2023 having a more mixed outlook due to rate-induced recession. Despite the turbulent property landscape in New Zealand, all banks experienced growth in their TDA and net interest income. The highest level of concentration in the New Zealand retail banking sector continues to be held by the top four providers. Although New Zealand is known for having a significantly high market concentration, due to its stringent entry requirements and customer loyalty, there have been loses to some of the key player’s market shares.

The New Zealand Retail Banking Competitor Benchmarking report looks at market performance, retention risk, and market shares across key products within the New Zealand banking space. It also ranks the market’s leading banks across a range of criteria from digital adoption and user experience to rewards and money management tools.

| Key Banks | · ANZ

· ASB · BNZ · Westpac |

| Financial Ratios | · Market Shares (Customers by Age)

· Market Shares (Customers by Affluence) |

| Customer Relationships | · Customer Tenure

· Cross-Selling · Current Account Net Promoter Score · Customer Loyalty |

| Customer Satisfaction | · Satisfaction Drivers of NPS

· Overall Satisfaction · Digital Satisfaction |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

New Zealand Retail Banking – Financial Performance

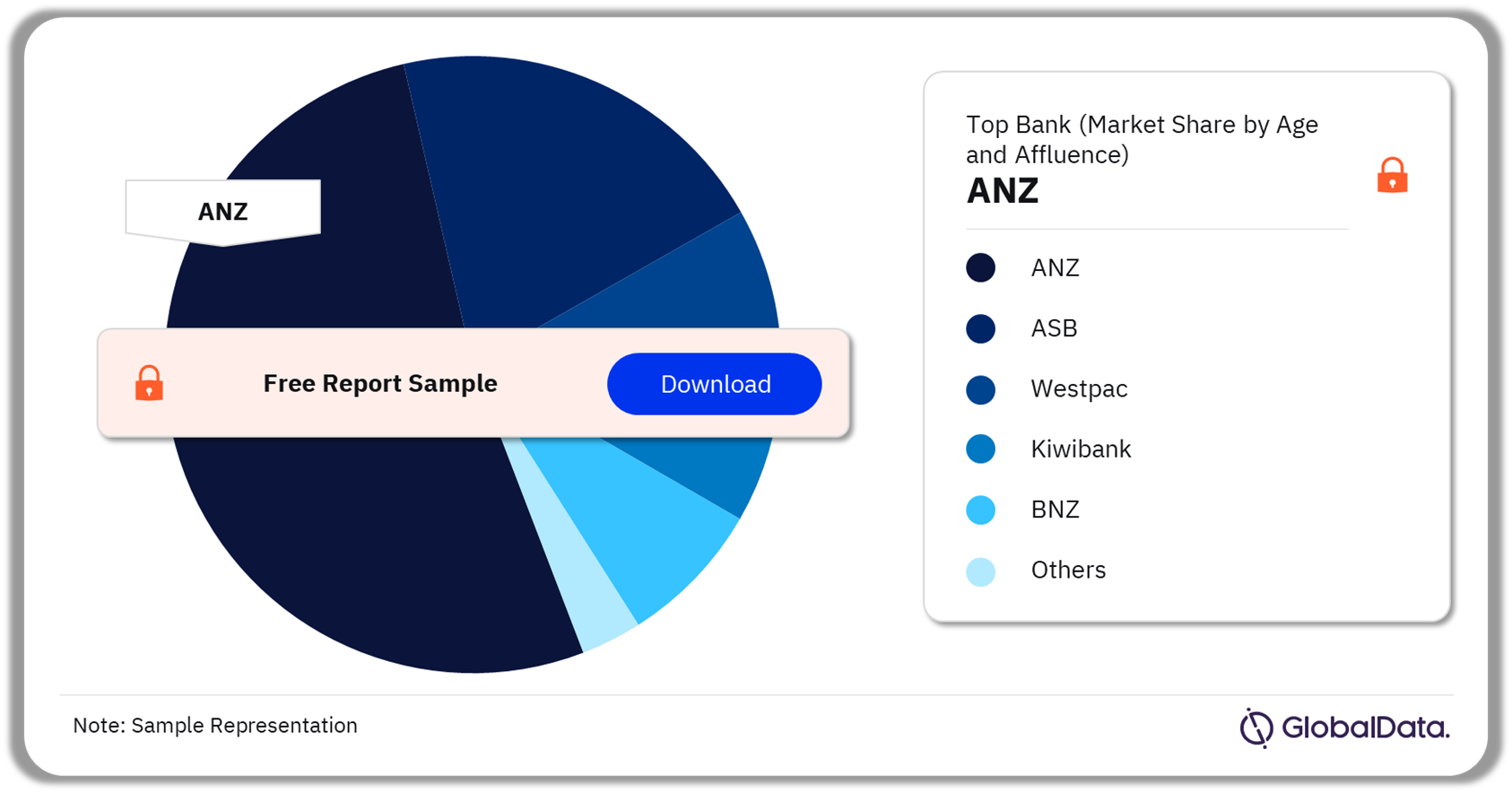

New Zealand’s current account market share is extremely concentrated, with the top five players making up 94% of the market. ANZ has the largest share of current account customers across all age demographics, suggesting its continued dominance is assured. Furthermore, the company has the largest share of customers across all wealth demographics. Top players, such as Westpac, BNZ, and ASB, lost retail deposit market share. BNZ and SBS Bank grew their personal loan market shares substantially from 2012–22. In recent years, BNZ has been actively shifting towards the personal customer segment, which explains why its personal loan share has dramatically increased.

New Zealand Retail Banking Market Analysis by Companies, 2023 (%)

Buy the Full Report for More Company Insights on the New Zealand Retail Banking Market

New Zealand Retail Banking - Customer Relationships

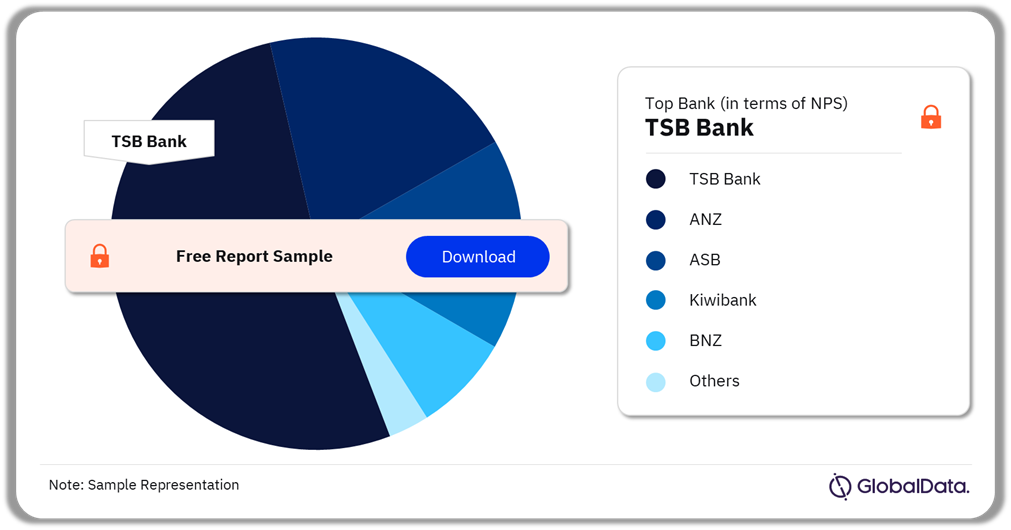

The New Zealand retail banking market research report covers key customer relationship parameters including customer tenure, cross-selling, current account net promoter score (NPS), and customer loyalty. On average, customer tenure is long across all providers in New Zealand, highlighting a lack of churn in the market. New Zealand providers are good at cross-selling products to customers compared to the global average. Cross-selling is a strong point for New Zealand providers, with a substantial number of customers having 1–5 extra products. In terms of Net Promoter Score (NPS), TSB Bank has the highest percentage of promoters, indicating that the majority are very happy with TSB’s services. TSB has the most loyal customer base with 69% unlikely to switch providers. The bank has high satisfaction rates across all categories, indicating customers are happy banking with TSB.

New Zealand Retail Banking Market Analysis by Net Promoter Score, 2023 (%)

Buy the Full Report for More Insights on the Net Promoter Score in the New Zealand Retail Banking Market

New Zealand Retail Banking - Customer Satisfaction

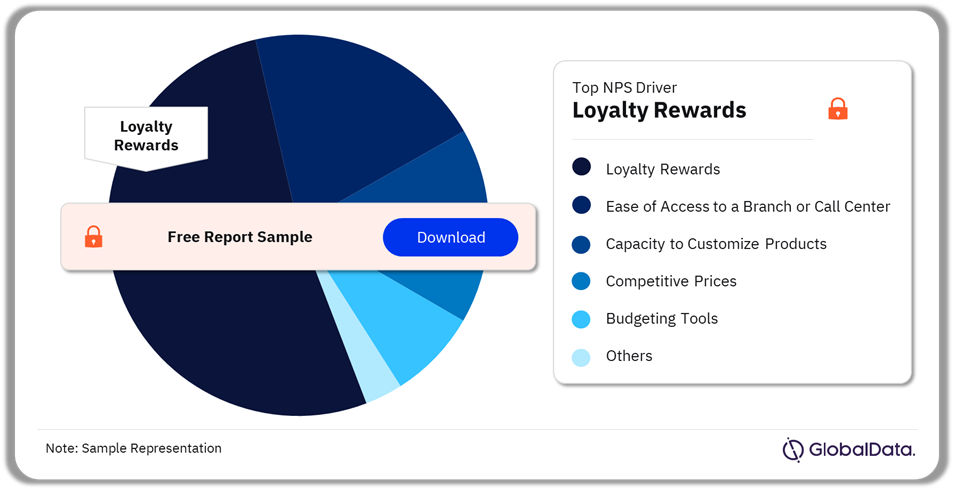

Loyalty rewards is the biggest driver of NPS by some margin in New Zealand, which demonstrates the importance that loyalty rewards hold to customers. Another two key drivers for NPS are ease of access to a branch or call center and the customizability of products. Satisfaction rates are relatively high across all providers. Although, loyalty rewards scored a significantly low average compared to the other metrics. TSB performs the best on average, with satisfaction rates above average for all metrics. TSB bank performs well across all digital metrics, as well as having the second highest NPS across all providers.

New Zealand Retail Banking Market Analysis by NPS Drivers, 2022 (%)

Buy the Full Report for More Insights on the NPS Drivers in the New Zealand Retail Banking Market

Scope

• The top four banks in New Zealand-ANZ, ASB, BNZ, and Westpac-continue to dominate the market.

• Customer tenure remains high across all providers in New Zealand. Long historical ties within the market have helped the top four providers maintain long customer relationships.

• Net Promoter Scores (NPS) are relatively low across all providers, with the top four banks faring worst. Scores such as these indicates that the top four cannot continue to rely on their historical ties and conveniency when it comes to NPS.

• The greatest drivers for NPS in New Zealand are loyalty rewards, access to a branch/call center, product customizability, and competitive prices.

Key Highlights

- The top four banks in New Zealand-ANZ, ASB, BNZ, and Westpac-continue to dominate the market.

- Customer tenure remains high across all providers in New Zealand. Long historical ties within the market have helped the top four providers maintain long customer relationships.

- Net Promoter Scores (NPS) are relatively low across all providers, with the top four banks faring worst. Scores such as these indicate that the top four cannot continue to rely on their historical ties and convenience when it comes to NPS.

- The greatest drivers for NPS in New Zealand are loyalty rewards, access to a branch/call center, product customizability, and competitive prices.

Reasons to Buy

- Identify factors affecting growth prospects across the deposit, credit card, personal loan, and mortgage markets.

- Track competitor gains and losses in market share.

- Assess the financial performances of competitors.

- Unlock detailed analysis of the drivers of customer advocacy.

- Discover the actionable steps required to improve and maximize banking performance in New Zealand.

BNZ

Westpac

ASB

Kiwibank

TSB

SBS Bank

Co-op Bank

Table of Contents

Frequently asked questions

-

What do the key customer relationship parameters include?

The key customer relationship parameters include customer tenure, cross-selling, current account net promoter score, and customer loyalty.

-

Which company holds the largest share of customers by age and affluence?

ANZ holds the largest share of customers across all age groups and across all wealth demographics.

-

What are the key factors driving NPS?

The key factors driving NPS are ease of access to branch/call center, loyalty rewards, personal finance management tools, competitive prices, the capacity to customize products, and clear and simple products, among others.

-

What was the main attribute determining NPS in the New Zealand retail banking market?

Loyalty rewards are the biggest driver of NPS in the New Zealand retail banking market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports