Key Payments Trends for 2024

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Exploring trends and insights from the ‘Payments Trends’ report will help you:

- Identify the top trends impacting the payment industry – mobile payments, social commerce, alternative solutions, AI, open banking, and blockchain.

- Analyze the leading trends in the industry and learn how they provide fast and frictionless user experiences.

- Understand each trend in detail to gain a competitive advantage in the market.

- Identify factors driving the growth of the payments landscape, including super apps, mobile payments, and blockchain.

- Understand the impact of innovation such as generative AI on the payments market.

- Analyze the payment trends in detail with our proprietary data and extensive research.

How is our ‘Key Payments Trends’ report unique from other reports in the market? Here are a few insights you will gain by purchasing the report:

- Key trends impacting the growth of the theme over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Multiple data sets, including patents and M&A trends, alongside a timeline highlighting milestones in the development of the batteries.

- Detailed value chain that discusses the core segments, including raw materials, smelting and refining, component makers, battery technologies, end markets, and end-of-life.

We recommend this valuable source of information to anyone involved in:

- Bankers/Fintech Companies/Lending Companies

- Digital Payment Companies/Insurance Companies/Retail Banks

- Financial Service Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Payments Trends Report

Key Payments Trends for 2024 Overview

The major payment trends for 2024 will focus on providing fast, frictionless user experiences owing to the growing demand for seamless online payments. Payment providers and merchants are focusing on multiple payment solutions to remain competitive. In addition, Western nations are taking notice of other successful online payment avenues, such as super apps and social commerce, exploited by Southeast Asian countries. Furthermore, technological innovations such as generative AI have revolutionized the sector, with fraud prevention potentially becoming one of its most valuable use cases.

| Top Payment Trends | · Mobile Payments

· Social Commerce · Blockchain · Alternative Solutions · Artificial Intelligence · Open Banking |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

The Key Payments Trends for 2024 research report explores the key trends that are poised to disrupt the payments ecosystem in 2024. The discussion in the report centers around mobile payments and the rise of super apps; social commerce; the growth of alternative payment rails such as instant payments and buy now, pay later solutions; and the adoption of technology such as generative AI, open banking, and blockchain.

Mobile Payments: The global mobile wallet market will grow at a fast pace owing to the rise in mobile payments by consumers. According to GlobalData’s 2023 Financial Services Consumer Survey, convenience drives the mobile payments market, with more than 62% of active consumer base. The SoftPOS, or Tap to Pay, continues to gain traction, accelerated during the COVID-19 pandemic, due to its cost-effectiveness. The SotfPOS offers merchants the possibility to turn their smartphones and tablets into contactless payment terminals without deploying additional hardware.

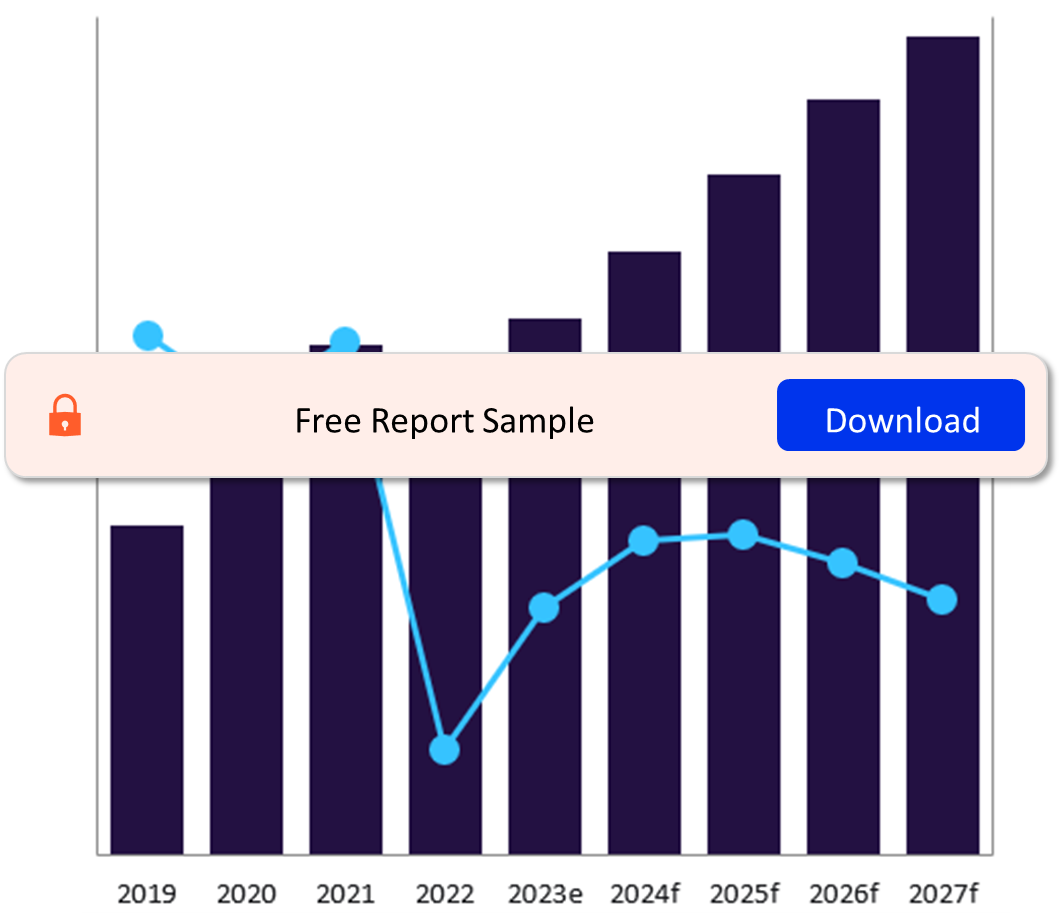

Mobile Wallet Transactions Market, 2019-2027 (Trillion)

Buy Full Report to Know More About Top Payment Trends

Open Banking: In the last few years, open banking has witnessed significant growth owing to the need for increased competition and innovation in the financial sector. Open banking is a system that allows customers to share their financial data with third parties through APIs. This has helped financial institutions to offer their customers a wider range of products and services, including customization. Payments using open banking technology will continue growing strongly. For instance, according to the Open Banking Organization, more than 11 million open banking payments were made in July 2023 in the UK.

Leading Software Companies Creating Open Banking APIs

Buy Full Report to Know More About Top Payment Trends

Scope

– Demand for buy now, pay later will be high as banks are creating a more difficult environment for consumers to take on credit as they tighten lending conditions.

– Account-to-account transfers are becoming faster as more instant payment systems are rolled out, including instant cross-border payments. These could reduce the use of international card networks going forward.

– The growing reliance on non-cash transactions has brought both fraud and the potential for generative AI to tackle it into the spotlight.

Reasons to Buy

- Identify the factors driving the growth of the wider payments landscape, including super apps, mobile payments, and blockchain.

- Understand the impact of innovation such as generative AI.

- Understand the trends in detail with our proprietary data and extensive research.

Fiserv

Clover

ACI Worldwide

Ingenico

PrivatBank

Intesa Sanpaolo

J.P. Morgan

Westpac

NatWest

Tencent

Safaricom

X

Meta

Apple

Amazon

PayPal

Revolut

Klarna

TikTok

Snapchat

SWIFT

Mastercard

Visa

Afterpay

Zip

Lloyds

Halifax

TSB

Monzo

Checkmarx

NEC Corporation

Telpo

Token

Envestnet Yodlee

Salt Edge

DirectID

Plaid

Stripe

Tink

TrueLayer

Yapily

GoCardless

HSBC

Sofort

Trustly

Volt

Banked

Token.io

Commerzbank

Onafriq

Table of Contents

Frequently asked questions

-

What are the top payment industry trends of 2024?

The top payment industry trends of 2024 are mobile payments, alternative solutions, social commerce, artificial intelligence, blockchain, and open banking.

-

What is driving the popularity of SoftPOS?

The SoftPOS, or Tap to Pay, continues to gain traction, accelerated during the COVID-19 pandemic, due to its cost-effectiveness.

-

What is open banking?

Open banking is a system that allows customers to share their financial data with third parties through APIs.

-

What is driving the mobile payments market?

Convenience is driving the mobile payments market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports