Russia Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Russia Cards and Payments Market Report Overview

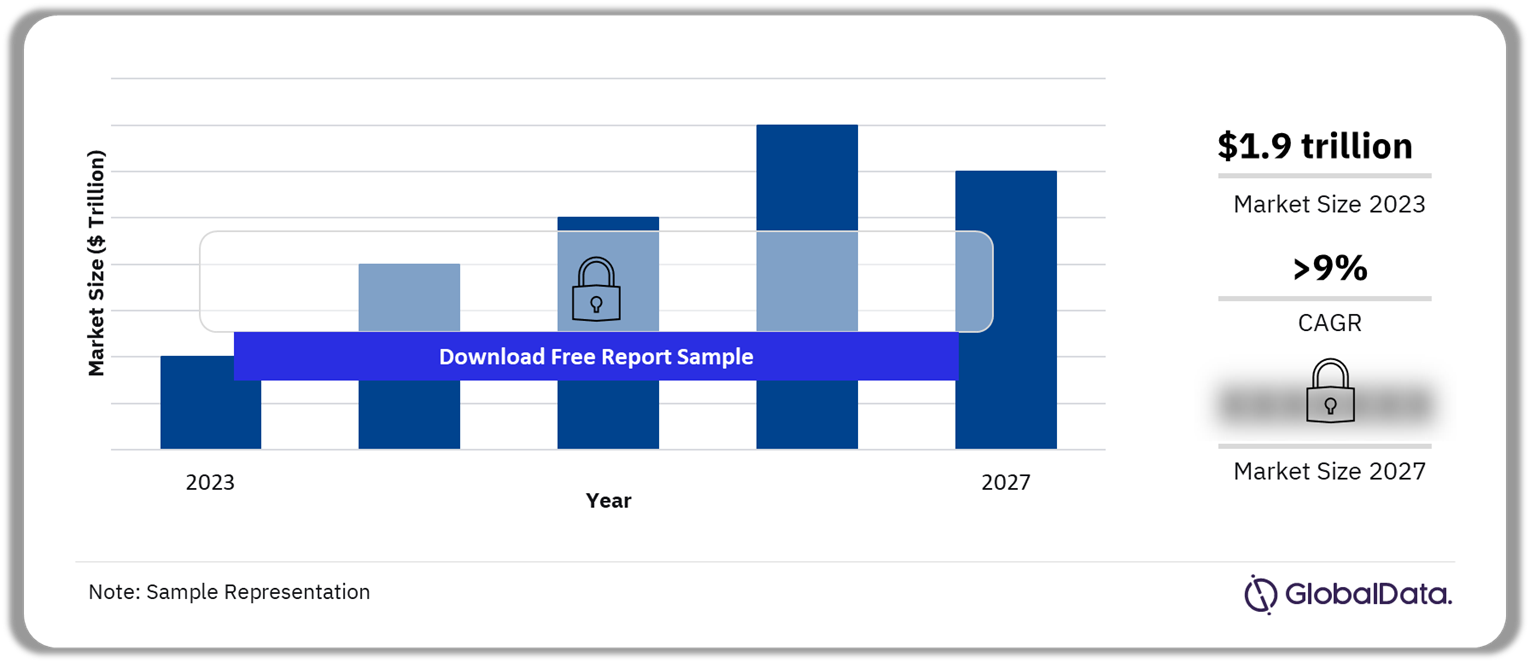

The annual value of card transactions in the Russia cards and payments market is estimated to be $1.9 trillion in 2023 and is expected to grow at a CAGR of more than 9% during 2023-2027.

Debit cards dominate the overall payment card space, accounting for over 96% of total card payment value in 2023. This can be attributed to the growing preference for card-based payments for low-value transactions. Furthermore, a booming e-commerce market, the adoption of alternative payments, improving payment infrastructure, and the growing popularity of contactless payments will boost electronic payments over the forecast period.

Russia Card Transactions Outlook, 2023-2027 ($ Trillion)

Buy the Full Report for More Information on the Russia Cards and Payments Market Forecast Download a Free Sample Report

The Russia cards and payments market research report provides a detailed analysis of market trends in the Russian cards and payments industry. It provides values and volumes for several key performance indicators in the industry including cash, mobile wallets, credit transfers, cards, direct debits, and cheques during the review period. The report also analyzes various payment card markets operating in the industry. It provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also covers regulatory policy details and recent regulatory structure changes. It includes information on the payment instruments that are in use in the Russian market, the key segments within the market, as well as the companies associated with the Russia cards and payments market.

| Annual Value of Card Transactions (2023) | $1.9 trillion |

| CAGR (2023-2027) | >9% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cards

· Cash · Mobile Wallets · Credit Transfers · Direct Debits |

| Key Segments | · Card-Based Payments

· E-Commerce Payments · Alternative Payments |

| Leading Players | · Sberbank

· RSB · VTB Bank · Tinkoff Bank · Yandex · Alfa Bank |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Russia Cards and Payments Market Dynamics

Consumers are embracing new technologies and are increasingly preferring card-based payments in Russia. Domestic card scheme Mir has gained a near monopoly in the Russian card space after Mastercard and Visa suspended their Russian operations in March 2022. Other brands such as Golden Crown and China UnionPay (CUP) also have a small presence in the market. Additionally, rising consumer confidence in online purchases coupled with an increasing number of merchants entering the e-commerce space has driven the e-commerce transaction value growth. Payment solutions such as Tinkoff Pay, Samsung Pay, and YooMoney are also benefitting from the online shopping trend.

Buy the Full Report to Get Additional Russia Cards and Payments Market Dynamics

Russia Cards and Payments Market Segmentation by Payment Instruments

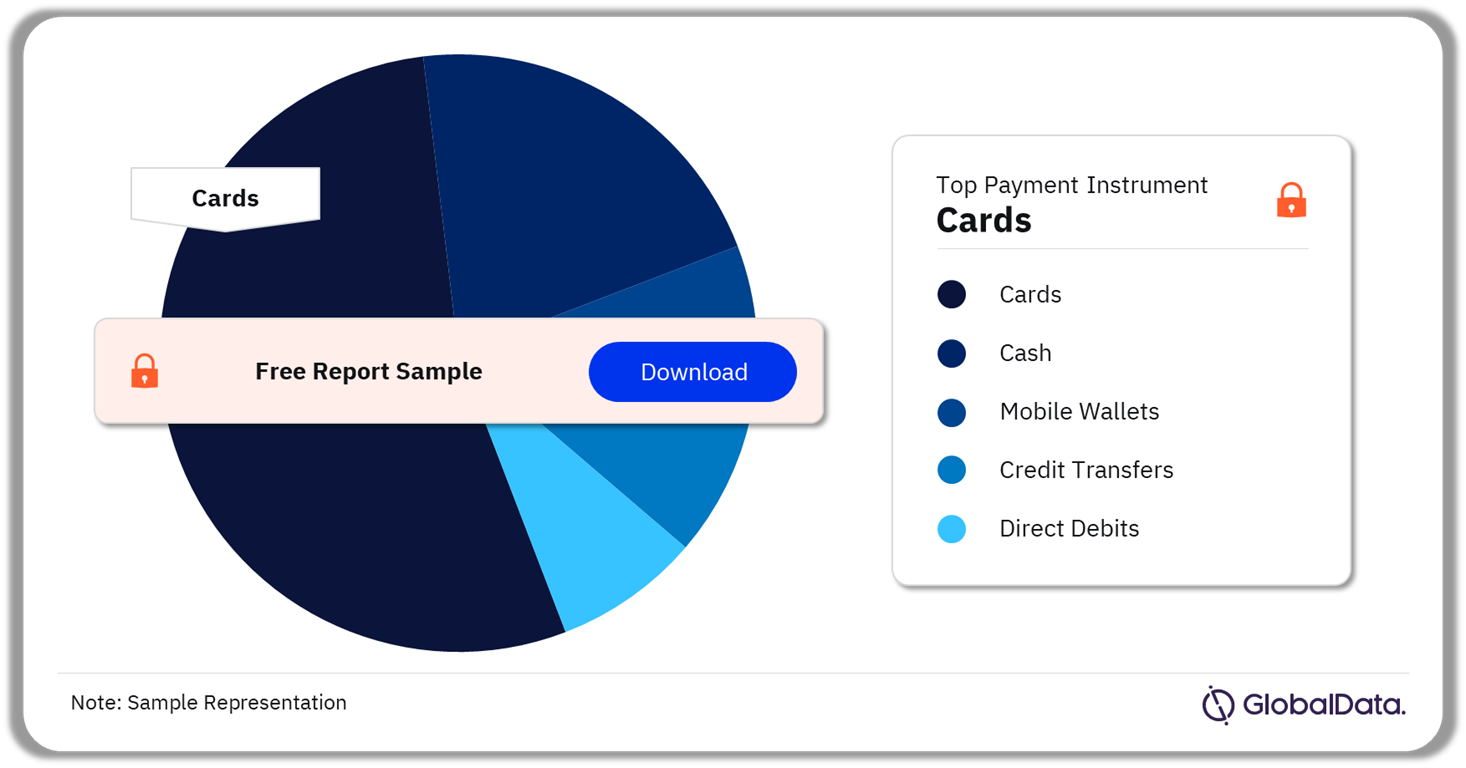

Cards have the highest share of payment transaction volume in 2023

The key payment instruments in the Russia cards and payments market are cards, cash, mobile wallets, credit transfers, and direct debits. Cards are the dominant payment instrument in Russia in 2023 in terms of volume. The government undertook various initiatives to promote electronic payments, including financial inclusion programs and the introduction of the National Payment Card System to encourage card-based transactions. Moreover, marketing campaigns by banks and increased investment in POS terminals also helped boost payment card usage during the review period.

Russia Cards and Payments Market Analysis by Payment Instruments (Volume), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Russia Cards and Payments Market

Russia Cards and Payments Market Segments

Debit cards dominate in terms of cards in circulation

The key segments in the Russia cards and payments market are card-based payments, e-commerce payments, and alternative payments.

Card-Based Payments: Debit card penetration remains high in Russia, with an estimated 273.7 debit cards per 100 individuals in 2023. This is due to growth in banking penetration, increasing financial awareness among consumers, and efforts by banks to promote electronic payments. The growth of Mir cards combined with rising financial literacy drove the use of payment cards during the review period. Meanwhile, the rise in ecommerce activities, the gradual adoption of contactless cards, and a rise in merchant acceptance of payment cards will further drive the payment card market going forward.

Russia Cards and Payments Market - Competitive Landscape

Some of the leading players in the Russia cards and payments market are:

- Sberbank

- RSB

- VTB Bank

- Tinkoff Bank

- Yandex

- Alfa Bank

Sberbank: Sberbank offers SberPay, a mobile wallet launched by Sberbank in July 2020. The solution enables users to make online and in-store payments. Users need to download the SberPay app and add their card details. Sberbank also offers the SberCard for foreigners with zero service and cash withdrawal fees. In addition, cardholders receive reward points on card purchases.

Leading Russia Cards and Payments Players, 2023

Buy the Full Report to Know More about the Leading Russia Cards and Payments Companies

Russia Cards and Payments Market – Latest Developments

- QR code-based payments are increasingly being rolled out for public transport. In June 2023, SberTroika introduced a new fare payment app for public transport in the Astrakhan region. Passengers can add money to the virtual card stored in the app and make contactless payments to pay for their trips. The My Troika app offers two ways to pay for travel: scanning a QR code attached to the vehicle or showing a QR code generated in the app to the vehicle’s reader. Both methods deduct payments from the virtual card.

- The Central Bank of the Russian Federation introduced the Faster Payments System (also known as SBP) in January 2019. The system enables users to make fund transfers in 15 seconds using the recipient’s phone number. Users can make transfers online 24/7 via their bank’s mobile or internet banking service.

Segments Covered in the Report

Russia Cards and Payments Instruments Outlook (Value, $ Trillion, 2019-2027)

- Cards

- Cash

- Mobile Wallets

- Credit Transfers

- Direct Debits

Russia Cards and Payments Market Segments Outlook (Value, $ Trillion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

Scope

This report provides:

- Current and forecast values for each market in the Russian cards and payments industry including debit and credit cards.

- Detailed insights into payment instruments including cards, credit transfers, cheques, and direct debits. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Russian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Russian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Russian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Russian cards and payments industry.

- Assess the competitive dynamics in the Russian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Russia.

- Gain insights into key regulations governing the Russian cards and payments industry.

RSB

VTB

Tinkoff Bank

OTP Bank

Alfa-Bank

Gazprombank

Rosbank

Raiffeisen Bank

Bank Uralsib

UniCredit Bank

Citibank

Societe Generale Group

Vozrozhdenie Bank

Mir

Mastercard

Golden Crown

Visa

American Express

Table of Contents

Frequently asked questions

-

What is the annual value of card transactions in the Russia cards and payments market in 2023?

The annual value of card transactions in the Russia cards and payments market is estimated to be $1.9 trillion in 2023.

-

What is the growth rate of the annual card transactions in the Russia cards and payments market?

The annual value of card transactions in the Russia cards and payments market is expected to grow at a CAGR of more than 9% during 2023-2027.

-

Which is the leading payment instrument in the Russia cards and payments market in 2023?

Cards are the leading payment instrument in volume terms in the Russia cards and payments market in 2023.

-

Which are the leading players in the Russia cards and payments market?

Some of the leading players in the Russia cards and payments market are Sberbank, RSB, VTB Bank, Tinkoff Bank, Yandex, and Alfa Bank among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports