Paraguay Telecom Operators Country Intelligence Report

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Paraguay Telecom Operators Country Intelligence Overview

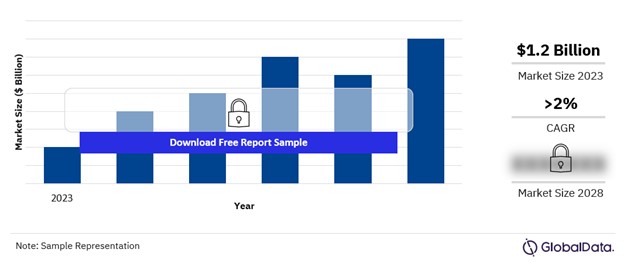

The total telecom and pay-TV service revenue in Paraguay increased to $1.2 billion in 2023. The market size growth has been estimated to progress at a CAGR of more than 2% during 2023-2028, driven by constant developments in fixed broadband and mobile data segments. The Paraguay Telecom Services market growth is also attributed to National Telecommunication Plan 2021-2025 aimed at the expansion of telecoms/ICT services coverage (such as mobile and fixed broadband networks coverage), increasing adoption of telecoms/ICT services, and improving the quality of telecom services in the country.

Paraguay Telecom Services Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report to Gain More Information on the Paraguay Telecom Services Market Forecast

Download a Free Sample

The ‘Paraguay Telecom Operators Country Intelligence’ report provides an executive-level overview of the telecom services market in Paraguay today, with detailed forecasts of key indicators up to 2028. Published annually, the report provides a detailed analysis of the near-term opportunities, competitive dynamics, and evolution of demand by service type and technology/platform across the fixed telephony, broadband, mobile, and pay-TV markets, as well as a review of key regulatory trends.

| Market Size 2023 | $1.2 billion |

| CAGR | >2% |

| Forecast Period | 2023-2028 |

| Telecom Service Segment | Mobile Services, Fixed Voice Services, Fixed-Broadband Services, and Pay-TV services |

| Leading Companies | Tigo Paraguay, Personal Paraguay, Claro Paraguay, VOX, Copaco

|

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Paraguay Telecom Services Market Regulatory Highlights

In October 2023, the country’s telecom regulator issued license to Starlink to offer low-latency satellite broadband connectivity across the country, especially in remote areas. Paraguay is looking to connect all the regions in the country, including the most remote zones, with broadband services.

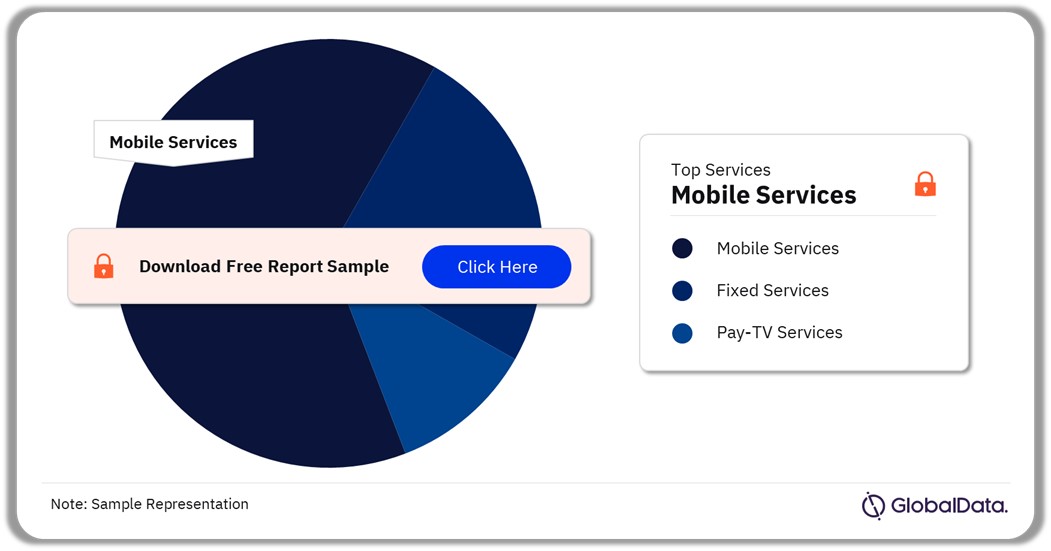

Paraguay Telecom Services Market Analysis by Service

- Mobile Services

- Fixed Services

- Pay-TV Services

Paraguay Telecom Services Market Share by Service, 2023-2028 (%)

Buy Full Report for More Service Insights on Paraguay Telecom Services Market

Download a Free Sample

Mobile Services Market in Paraguay – Deep Dive

Average monthly mobile voice use will decrease during 2023-2028, with growing user preference for OTT-based communication solutions and operators such as zero-rated data for OTT applications as a part of their mobile plans.

Mobile monthly churn rate will decline during 2023-2028, because of expanding postpaid subscriber base (including M2M/IoT) over the forecast period and operators’ focus on customer retention through reward or loyalty programs.

The Paraguay telecom services market research report offers mobile services segment coverage on the following KPIs:

- Subscription & User Analysis

- Subscription Analysis by Device Type, Payment Type and Technology Type

- Churn Analysis

- Voice & Data Usage Analysis

- Mobile Subscription Market Share Analysis

- Revenue Analysis & ARPU Analysis

Fixed Services Market in Paraguay - Deep Dive

The number of circuit-switched lines will decline drastically during 2023-2028, as users continue to shift from traditional telephony to VoIP, mobile, and OTT communication services.

The Paraguay telecom services market research report offers fixed services segment coverage on the following KPIs:

- Fixed Voice & Fixed Broadband Penetration Analysis

- Subscription Trends Analysis by Access Lines

- Subscription Analysis by Technology

- Fixed Subscription Market Share Analysis

- Revenue Analysis & ARPU Analysis

Pay-TV Services Market in Paraguay - Deep Dive

Aggregate pay-TV service ARPU will drop during 2023-2028, as operators such as Claro Paraguay offer discounts and promotions, and benefits for subscribers that bundle pay-TV with broadband.

The Paraguay telecom services market research report offers pay-TV services segment coverage on the following KPIs:

- Pay-TV Household Penetration Analysis

- Subscription Analysis by Technology Type

- Pay-TV Subscription Market Share Analysis

- Revenue Analysis & ARPU Analysis

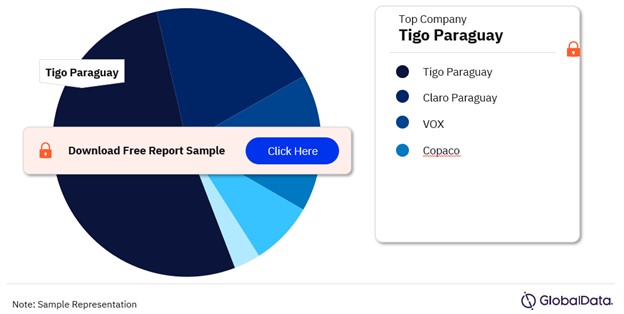

Paraguay Telecom Services Market - Competitive Landscape

Tigo Paraguay led the mobile, fixed broadband, and pay-TV markets in Paraguay in 2023. It will continue to lead the mobile market over the forecast period, supported by its focus on mobile network expansion and modernization.

Leading Telecom Companies in the Paraguay

- Tigo Paraguay

- Personal Paraguay

- Claro Paraguay

- VOX

- Copaco

Paraguay Telecom Services Market Share by Companies, 2023 (%)

Buy Full Report to Know More About Leading Telecom Companies in Paraguay

Download a Free Sample

Scope

The country intelligence report provides an in-depth analysis of the following:

- The demographic and macroeconomic context in Paraguay.

- The regulatory environment and trends: A review of the regulatory setting and agenda for the next 18-24 months as well as relevant developments pertaining to spectrum licensing, national broadband plans, tariff regulation, and more.

- Telecom and pay-TV services market outlook: Analysis as well as historical figures and forecasts of service revenue from the fixed telephony, broadband, mobile voice, mobile data, and pay-TV markets.

- The competitive landscape: An examination of the positioning of leading players in the telecom and pay-TV services market as well as subscription market shares across segments.

- Company snapshots: Analysis of the financial position of leading service providers in the telecommunications and pay-TV markets.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Reasons to Buy

- This country intelligence report offers a thorough, forward-looking analysis of the Paraguay’s telecommunications markets, service providers, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the Paraguay’s mobile communications, fixed telephony, broadband markets, including the evolution of service provider market shares.

- With more than 20 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in the Paraguay’s telecommunications markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help operators, equipment vendors, and other telecom industry players succeed in the challenging telecommunications market in Paraguay.

Personal

Claro Paraguay

Copaco/VOX

Table of Contents

Frequently asked questions

-

What was the Paraguay telecom services market size in 2023?

The telecom services market size in Paraguay reached $1.2 billion in 2023.

-

What will the Paraguay telecom services market growth rate be during the forecast period?

The telecom services market in Paraguay is expected to grow at a CAGR of more than 2% during the forecast period, 2023-2028.

-

What are the key telecom services market drivers in Paraguay?

The Paraguay Telecom Services market growth is also attributed to National Telecommunication Plan 2021-2025 aimed at expansion of telecoms/ICT services coverage (such as mobile and fixed broadband networks coverage), increasing adoption of telecoms/ICT services, and improving the quality of telecom services in the country.

-

Which will be the leading telecom service market segment in Paraguay during 2023-2028?

Mobile services will be the leading telecom service market segment in the Paraguay during 2023-2028

-

Which are the leading telecom companies in Paraguay?

The leading companies in the telecommunications services market in Paraguay are Tigo Paraguay, Personal Paraguay, Claro Paraguay, VOX, Copaco

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Telecom Infrastructure reports