Propylene Industry Installed Capacity and Capital Expenditure Forecast by Region and All Active and Planned Projects to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Propylene Industry Installed Capacity and Capital Expenditure Market Report Overview

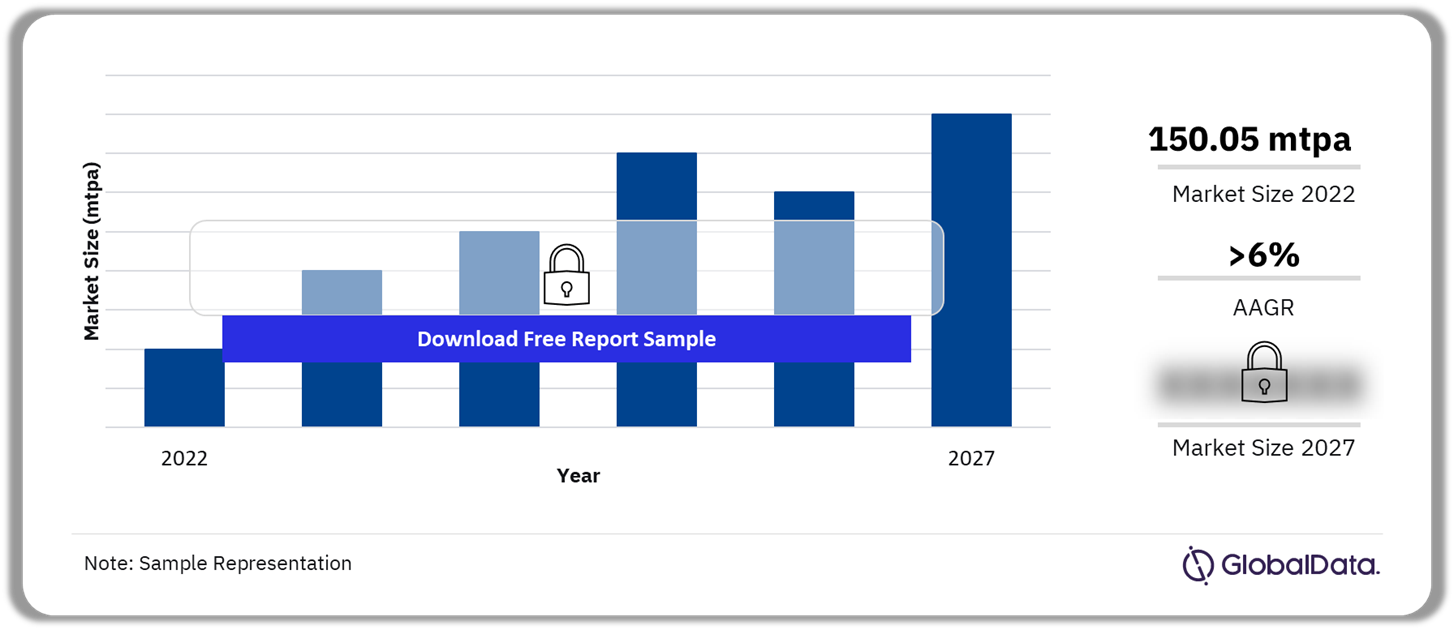

The global Propylene capacity and capital capacity was 150.05 mtpa in 2022 and is expected to grow at an AAGR of more than 6% by 2027. In 2022, China, US, South Korea, Saudi Arabia, and India were the key countries in the world accounting for more than 65% of the total Propylene capacity.

Propylene Industry Installed Capacity and CapEx Market Outlook 2022-2027 (mtpa)

Buy the Full Report for Propylene Industry Installed Capacity and CapEx Forecast, Download a Free Report Sample

The Propylene industry installed capacity and CapEx report covers detailed analysis on all active and upcoming (planned and announced) plants by region and country for the period 2017-2027. It provides global and regional capital expenditure outlook forecasts up to 2027. Furthermore, the report gives a comparative analysis of key countries based on their contribution to global as well as regional propylene capacities.

| Market Size, 2022 (mtpa) | 150.05 mtpa |

| AAGR (2022-2027) | >6% |

| Key Regions | · Asia

· North America · Europe · South America · Former Soviet Union · Middle East · Africa |

| Top Planned and Announced Projects | · Shandong Yulong Petrochemical Longkou Propylene Plant 1

· Reliance Industries Jamnagar Propylene Plant 3 · Fujian Eversun New Material Putian Propylene plant 2 · Oriental Energy Maoming Propylene Plant 3 · Oriental Energy Maoming Propylene Plant 4 |

| Key Companies | · LyondellBasell Industries NV

· Saudi Arabian Oil Co · Formosa Plastics Group · Shell plc · China Petrochemical Corp |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

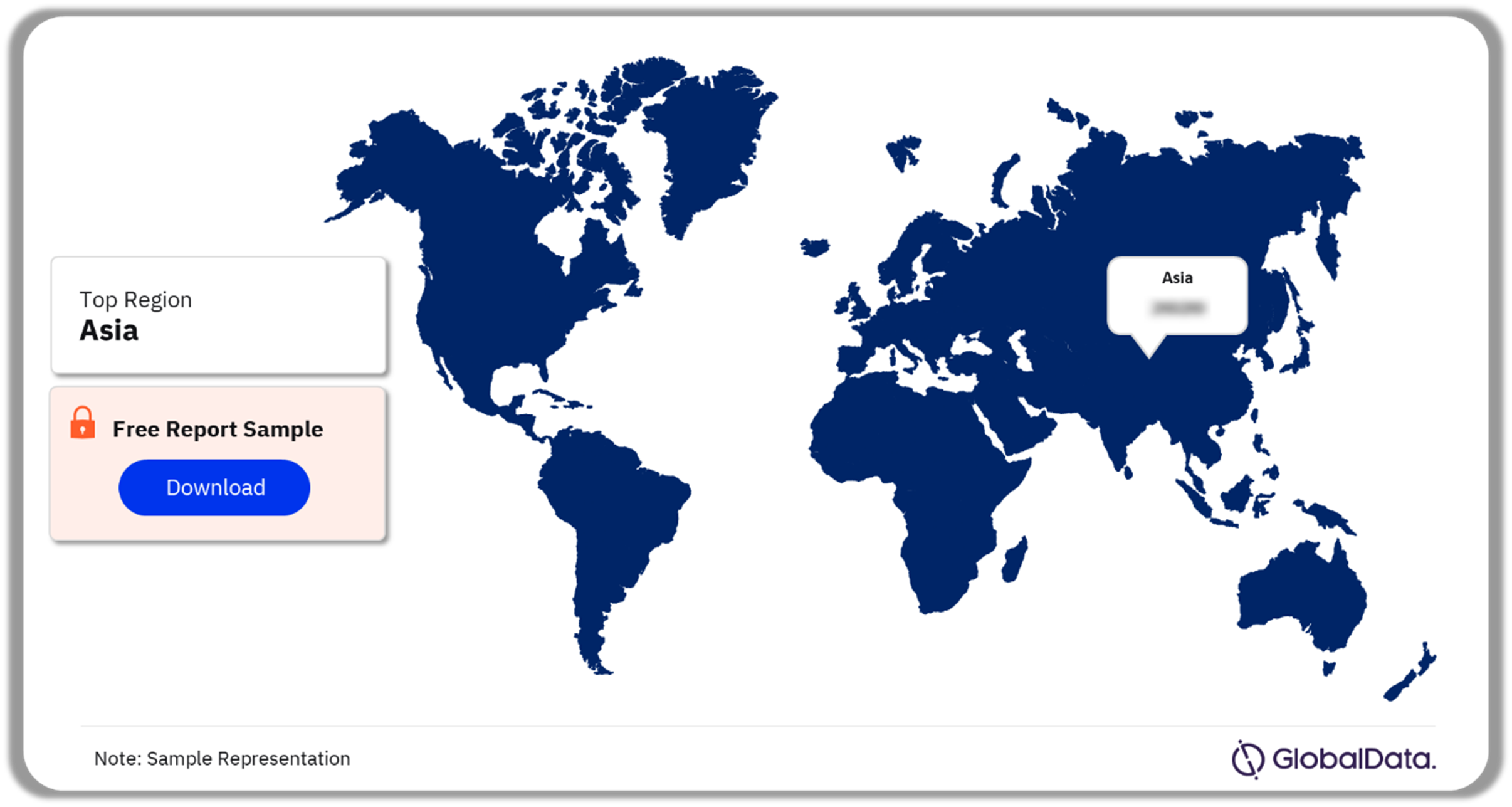

Propylene Industry Installed Capacity and CapEx by Regions

The key regions in the global Propylene industry installed capacity and CapEx are Asia, North America, Europe, South America, the Former Soviet Union, the Middle East, and Africa. Among regions, Asia led the global Propylene capacity and capital market in 2022 and is expected to continue doing so during the forecast period.

In 2022, the capacity contribution of Asia was the highest, of which China accounted for more than 53% share. North America was the second highest. Within North America, the US was the major contributor.

Propylene Industry Installed Capacity and CapEx Market Analysis by Regions, 2022 (%)

Buy the Full Report for More Regional Propylene Industry Installed Capacity And CapEx Outlook, Download a Free Report Sample

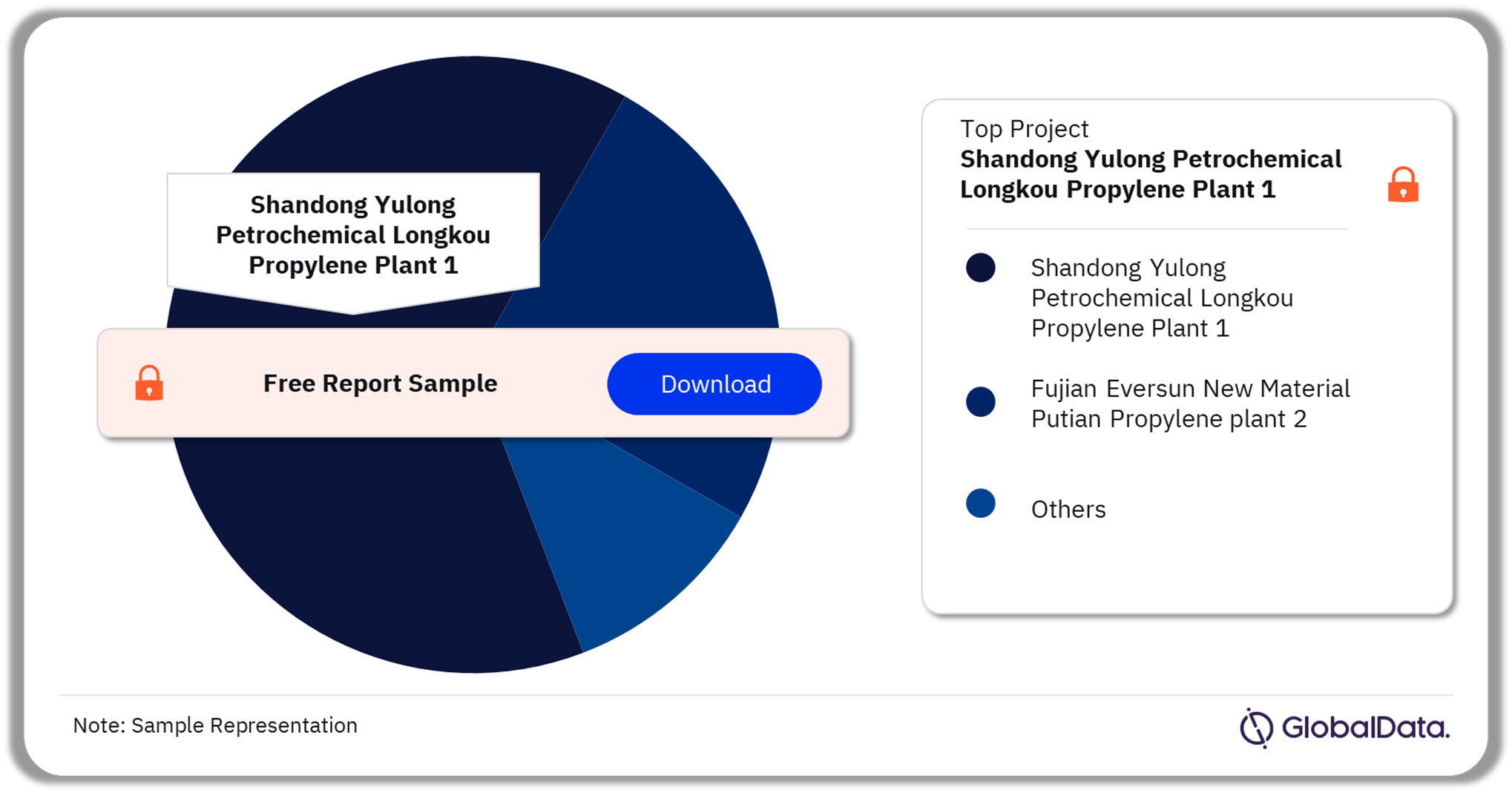

Propylene Market Major Planned and Announced Projects

The major planned and announced projects in the propylene market are Shandong Yulong Petrochemical Longkou Propylene Plant 1, Reliance Industries Jamnagar Propylene Plant 3, Fujian Eversun New Material Putian Propylene Plant 2, Oriental Energy Maoming Propylene Plant 3, and Oriental Energy Maoming Propylene Plant 4 among others. In 2022, the Shandong Yulong Petrochemical Longkou Propylene Plant 1 had the highest valuation.

Propylene Industry Installed Capacity and CapEx Analysis by Planned and Announced Projects 2022 (%)

Buy the Full Report for Planned and Announced Projects with Propylene Industry Installed Capacity and CapEx Analysis, Download a Free Report Sample

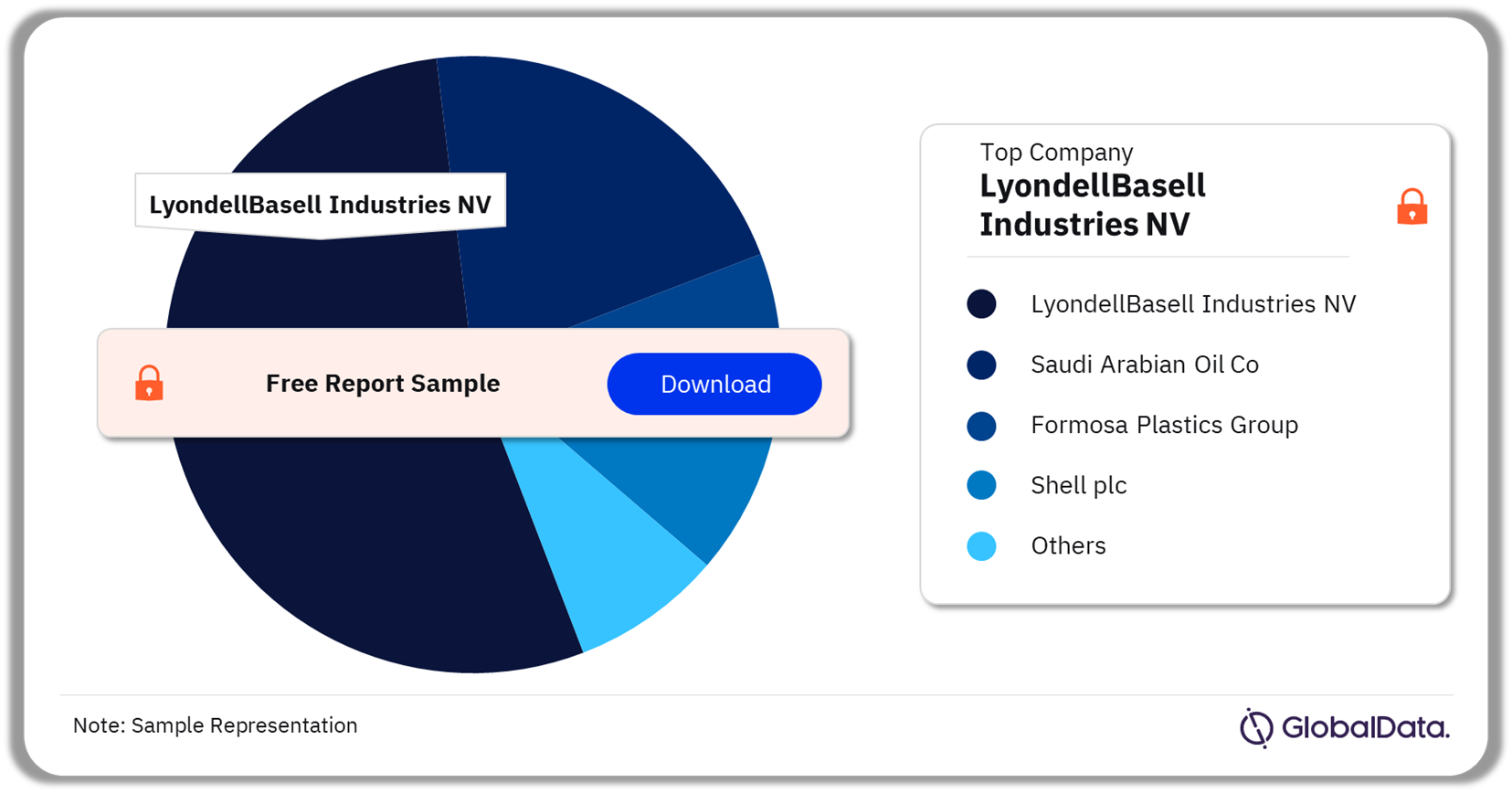

Propylene Capacity and Capital Expenditure Market – Competitive Landscape

The key companies in the Propylene industry installed capacity and CapEx are LyondellBasell Industries NV, Saudi Arabian Oil Co, Formosa Plastics Group, Shell plc, and China Petrochemical Corp among others. LyondellBasell Industries NV led the industry with the highest share in 2022.

Propylene Industry Installed Capacity and CapEx By Companies, 2022 (%)

Buy the Full Report for Company-Wise Propylene Industry Installed Capacity and CapEx Insights, Download a Free Report Sample

Propylene Capacity and Capital Expenditure Market Regional Outlook (mtpa, 2022-2027)

- Asia

- North America

- Europe

- South America

- Former Soviet Union

- Middle East

- Africa

Scope

The report provides

- Global Propylene capacity outlook by region.

- Global Propylene outlook by country.

- Propylene planned and announced projects details.

- Capacity share of the major Propylene producers globally.

- Global Propylene capital expenditure outlook by region.

- Global Propylene capital expenditure outlook by country.

Reasons to Buy

- Obtain the most up-to-date information available on all active, planned, and announced Propylene plants globally

- Identify opportunities in the global Propylene industry with the help of upcoming projects and capital expenditure outlook

- Facilitate decision-making on the basis of strong historical and forecast of Propylene capacity data

Shandong Yulong Petrochemical Ltd

Fujian Eversun New Material Co Ltd

China National Petroleum Corp

Reliance Industries Ltd

The National Petrochemical Co

LyondellBasell Industries NV

Dow Chemical Co

Exxon Mobil Corp

Formosa Plastics Group

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Propylene industry installed capacity and CapEx in 2022?

The Propylene industry installed capacity and CapEx was 150.05 mtpa in 2022.

-

What is the Propylene industry installed capacity and CapEx growth?

The Propylene industry installed capacity and CapEx is expected to grow at an AAGR of more than 6% by 2027.

-

The Propylene industry installed capacity and CapEx is expected to grow at an AAGR of more than 6% by 2027.

Asia led the Propylene industry installed capacity and CapEx in 2022.

-

Which are the key companies in the Propylene industry installed capacity and CapEx?

The key companies in the Propylene industry installed capacity and CapEx are LyondellBasell Industries NV, Saudi Arabian Oil Co, Formosa Plastics Group, Shell plc, and China Petrochemical Corp among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.