Saudi Arabia GIGA Construction Projects Overview, Key Players and Supplier Registration Process, 2023 Update – MEED Insights

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore actionable market insights from the following data in our ‘Saudi Arabia GIGA Construction Projects’ report:

- A detailed and comprehensive breakdown of individual contracts and packages on each of the 14 GIGA projects plus future phasing, timelines, and spending plans

- Identification of the key stakeholders and decision-makers at each GIGA project

- Analysis of the key challenges and opportunities of each GIGA project

- Details on how companies can register and prequalify for each GIGA project

- Information on risks and project opportunities with client and procurement details.

- Identification of new and potential opportunities and challenges in the market.

- Ideas to minimize risk.

How is the ‘Saudi Arabia GIGA Construction Projects’ report different from other reports in the market?

- The report provides a comprehensive analysis of key opportunities on each giga project, including NEOM – the world’s largest single project – the Red Sea Development, Amaala, Diriyah Gate, Qiddiya, Jeddah Central, and Roshn among many others that are a part of Saudi Arabia’s 2030 Vision.

- The report lists the contracts and packages already awarded on each project, current and future package breakdowns, leading contractors already working on each scheme, a complete description and phasing of the giga project as well as the key stakeholders involved.

- Includes a detailed overview of each project and its components and phasing as well as details of each contract already awarded and the consultants and contractors working on it.

- A breakdown of individual future packages together with budgets and timelines as well as details of key stakeholders involved in project procurement at the client.

We recommend this valuable source of information to:

- Manufacturers, Contractors, and Suppliers

- Financiers and Bankers

- Policymakers and Economists

- Business and Data Analysts

- Engineering Consultants

- PPP investors

- Power Developers

- Technology Companies

- Academics and Researchers

To get a snapshot of the Saudi Arabia GIGA construction projects report, download a free report sample

Saudi Arabia GIGA Construction Projects Overview

The total pipeline value of Saudi Arabia GIGA construction projects has grown to more than $850 billion with the addition of the King Salman International Airport and New Murabba projects. The Saudi Arabia GIGA Project Program consists of a series of geographically diverse tourist, residential, commercial, retail, and industrial capital projects. The program is the centerpiece of the Saudi Arabia 2030 Vision aimed at transforming the Kingdom into a tourism and entertainment hub while creating hundreds of thousands of new jobs. It includes NEOM, which at $500 billion is the world’s largest single project, as well as Red Sea tourism projects including The Red Sea Development and Amaala, housing projects such as Jeddah Central and Roshn, and entertainment schemes like Qiddiya and SEVEN.

The terms ‘GIGA project’ or ‘GIGAproject’ are rarely used words and come without a standard definition. In this case, they are used in specific reference to Saudi Arabia’s capital program to market and emphasize the importance and enormity of the individual projects. However, officially there are just five developments called GIGA projects – NEOM, the Red Sea Project, Qiddiya, Roshn and Diriyah Gate. It is likely that as other mega projects become more developed, they will come under the official ‘GIGA project’ umbrella. The Saudi Arabia GIGA construction projects report will help to understand each of the 14 individual GIGA projects in Saudi Arabia.

| Project Size | >$850 billion |

| Key Projects | NEOM, Roshn, New Murabba, King Salman International Airport, Diriyah Gate, Jeddah Central, Red Sea Project, AlUla, SEVEN, Aseer/Al Soudah, Rua Al Madinah, Qiddiya, Amaala, Saudi Downtown, Sports Boulevard, King Salman International Park, and Boutique Group |

| Leading Contractors | L&T, Alfanar Construction, Almabani, Modern Building Leaders, Shibh Al Jazira Contracting, and Nesma & Partners |

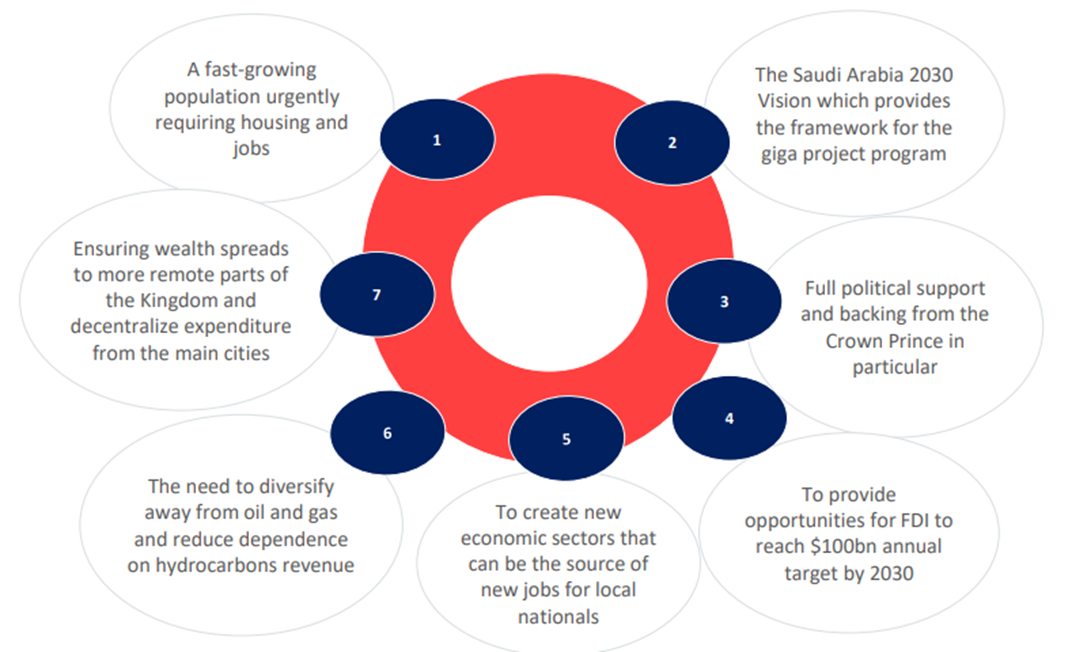

Saudi Arabia GIGA Construction Projects - Drivers and Objectives

There are a number of drivers behind the government’s GIGA project program. The most important is the need for the Kingdom to diversify economically by creating new sectors, particularly in leisure and tourism. By doing so it hopes to create jobs and attract foreign investment. At the same time, GIGA projects like NEOM, Roshn, and Jeddah Central are focused on the construction of housing for local nationals to meet ambitious home-ownership targets. Others, like Green Riyadh and Sports Boulevard, have the aim of making Saudi Arabia a more attractive place to live, an important factor if it is to try and grow its expatriate population and attract foreign investment

Saudi Arabia GIGA Construction Projects Drivers and Objectives

For more insights into the Saudi Arabia GIGA construction projects market drivers and objectives, download a free report sample

Saudi Arabia GIGA Construction Projects - Expenditure and Financing

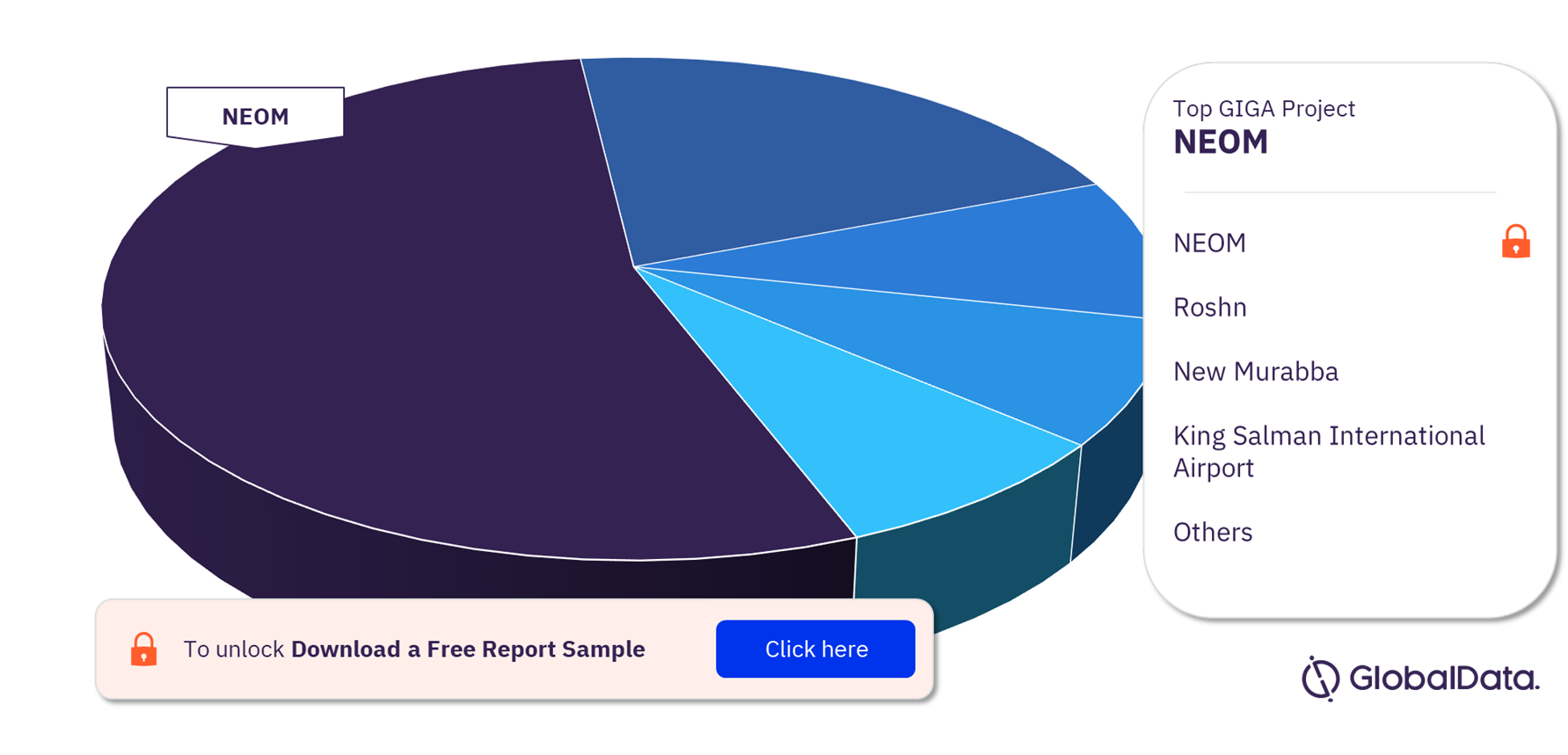

The key GIGA projects in the Saudi Arabia GIGA construction projects are NEOM, Roshn, New Murabba, King Salman International Airport, Diriyah Gate, Jeddah Central, Red Sea Project, AlUla, SEVEN, Aseer/Al Soudah, Rua Al Madinah, Qiddiya, Amaala, Saudi Downtown, Sports Boulevard, King Salman International Park, and Boutique Group. NEOM has the highest estimated value among all the projects as of March 2023. Quantifying the precise size of the giga project capital expenditure program is challenging as the values announced are frequently best-guess estimates based on masterplans that are liable to change and/or have a development period of many years. NEOM is a good case in point. With an announced value of $500 billion and a development period of two decades as a minimum, there is great degree of uncertainty about the actual end cost, a claim which can also be applied to many of the other giga projects.

To date, almost all the capital expenditure on the GIGA project program has come from the state directly or from its sovereign wealth fund, the Public Investment Fund (PIF). This is not surprising given that the focus has hitherto been on the construction of the necessary infrastructure upon which to build revenue-generating assets. The government has been able to fund its part of the GIGA projects thanks in large to increasing oil prices over the past 18 months which have enabled a comfortable surplus and the financial firepower to proceed with its capital projects program.

Saudi Arabia GIGA Construction Projects Analysis by Expenditure, March 2023 (%)

For more insights into the Saudi Arabia GIGA construction projects expenditure and financing, download a free report sample

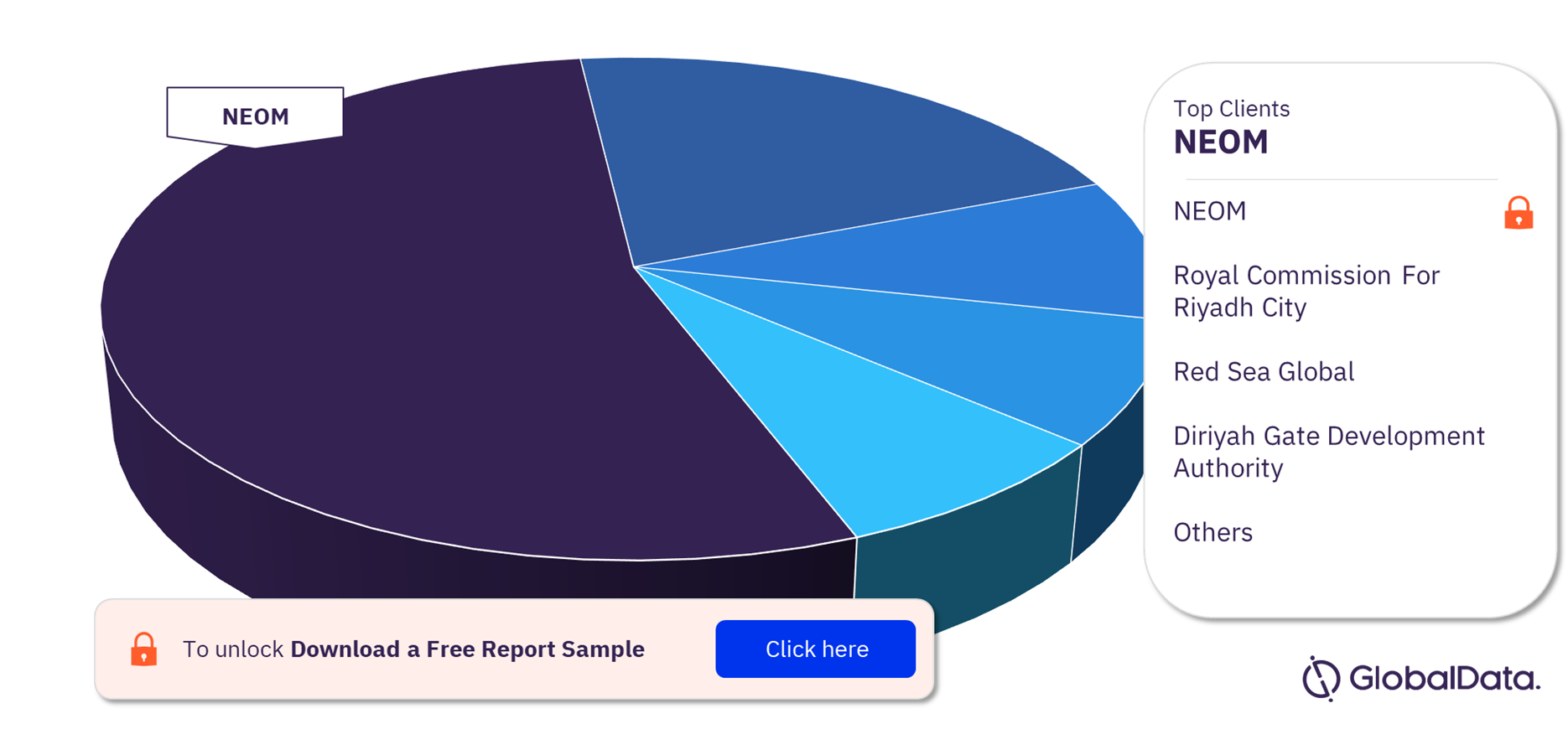

Saudi Arabia GIGA Construction Projects – Top Clients

The biggest GIGA project clients so far in terms of contracts awarded in Saudi Arabia are NEOM, Royal Commission for Riyadh City, Red Sea Global, Diriyah Gate Development Authority, Rua Al Madinah Holding, and ROSHN among others. NEOM is unsurprisingly the leading client to date among Saudi Arabia’s GIGA construction projects.

Saudi Arabia GIGA Construction Projects Analysis by Clients, (%)

To know more about top Saudi Arabia GIGA construction projects clients, download a free report sample

Saudi Arabia GIGA Construction Projects - Largest Contractors

The top GIGA construction projects contractors in Saudi Arabia by value of work under construction are L&T, Alfanar Construction, Almabani, Modern Building Leaders, Shibh Al Jazira Contracting, and Nesma & Partners among others. Korean, Indian, and Chinese contractors have so far won much of the work awarded to international firms to date. Larsen & Toubro accounted for the highest value of work under construction among all GIGA construction projects contractors.

Saudi Arabia GIGA Construction Projects Analysis by Contractors, (%)

To know more about top Saudi Arabia GIGA construction projects contractors, download a free report sample

Saudi Arabia’s 2030 Vision GIGA Projects that are Covered in the ‘Saudi Arabia GIGA Construction Projects’ Report are:

- NEOM

- The Red Sea Development Company

- Amaala

- Diriyah Gate

- Qiddiya

- Roshn

- SEVEN

- Boutique Group

- Rua al Madinah

- Jeddah Central

- Arabian Highland

- King Salman International Park

- Green Riyadh

- Al Ula

Scope

- Detailed project information

- Top contractors and values

- Project packaging and phasing

- Key stakeholders and decision makers

- Future contracts and packages

- Visualisation of each gigaproject

- Details of supplier and contractor registration

- Key challenges

- Explains the structure of each gigaproject

- Details the main projects being planned, under development and those due to be awarded in 2022/23 and beyond

- Projects opportunities with client and procurement details

- Investment drivers and client spending plans

- Understand risks and set strategy

- Identifies the biggest spending clients

- Identifies the most successful contractors

- Identifies risks and opportunities

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total value of Saudi Arabia GIGA construction projects?

The total pipeline value of Saudi Arabia GIGA construction projects has grown to more than $850 billion.

-

Which are the key drivers and objectives supporting the construction of GIGA projects in Saudi Arabia?

There are several drivers behind the government’s GIGA project program. The most important is the need for the Kingdom to diversify economically by creating new sectors, particularly in leisure and tourism.

-

Which project holds the highest Saudi Arabia GIGA construction projects share?

NEOM has the highest estimated value among all the projects in the Saudi Arabia GIGA construction projects.

-

Who is the leading client among all Saudi Arabia GIGA construction projects?

NEOM is the leading client to date among all Saudi Arabia GIGA construction projects.

-

Who are the major contractors of Saudi Arabia GIGA construction projects?

The top contractors of Saudi Arabia GIGA construction projects are L&T, Alfanar Construction, Almabani, Modern Building Leaders, Shibh Al Jazira Contracting, and Nesma & Partners among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Construction reports