Skincare Market Summary, Competitive Analysis and Forecast, 2017-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

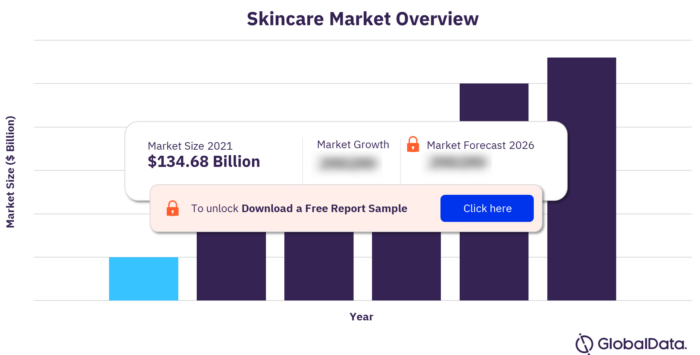

The global skincare market reached $134.68 billion in 2021. The market in focus grew by more than 4% in 2021. The global skincare market research report provides an overview of the current industry scenario regarding the future outlook in terms of ingredients, product claims, labeling, and packaging. The report also covers a regional overview of Asia-Pacific, Middle East & Africa, Americas, Western Europe, and Eastern Europe, highlighting industry size, growth drivers, latest developments, and future inhibitors for the regions.

For more insights, download a free report sample

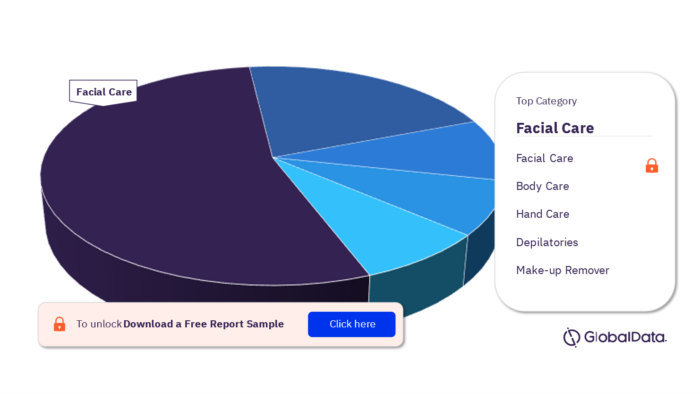

Key Categories in the Global Skincare Market

Facial care, body care, hand care, depilatories, and make-up remover are the key categories in the global skincare market. Facial care is the largest segment of the global skincare market, in terms of market’s total value.

Global Skincare Market, by Category

For more category insights, download a free report sample

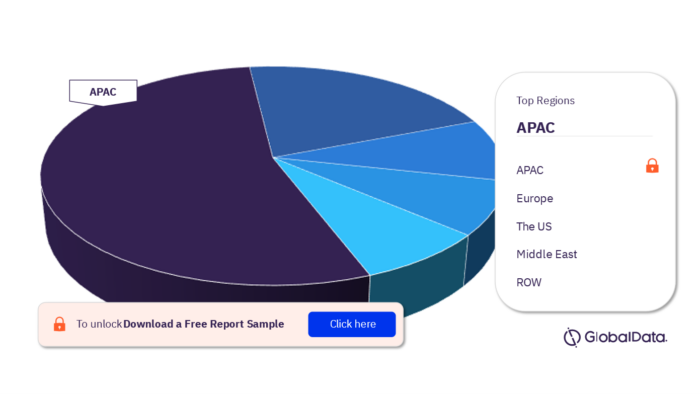

Key Geographic Segments in the Global skincare Market

Asia-Pacific, Europe, United States, Middle East, and ROW (Rest of the World) are the key geography segments in the global skincare market. APAC has the largest market share in terms of value.

Global Skincare Market, by Geographic Segment Analysis

For regional insights, download a free report sample

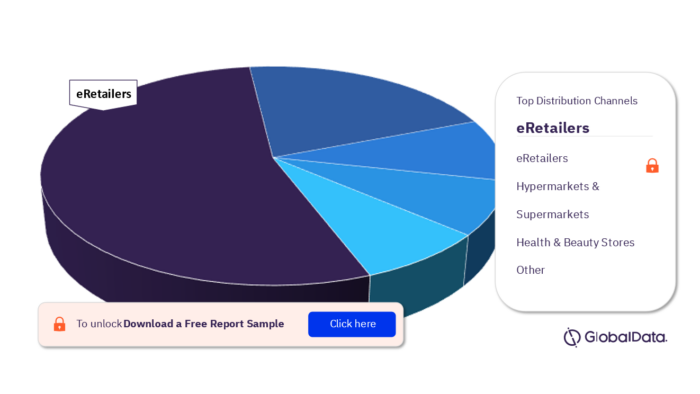

Key Distribution Channel in the Global Skincare Market

E-retailers, Hypermarkets & Supermarkets, Health & Beauty Stores Parapharmacies/Drugstores, and Other are the key distribution channels in the market in focus. Eretailers form the leading distribution channel in the global skincare market.

Global Skincare Market, by Distribution Channel

For more distribution channel insights, download a free report sample

Key Companies in the Global Skincare Market

There are many companies in the global skin care market such as L’Oreal S.A., Amorepacific Corp, Laboratoires Pierre Fabre SA, Clarins USA Inc, Shiseido Company, Kao Corporation, KOSE Corp, POLA Orbis Holdings Inc, Natura & Co Holding SA, Mary Kay (China) Cosmetics Co Ltd, The Estee Lauder Companies Inc, Johnson & Johnson Pvt Ltd, Beiersdorf Ag, Unilever, and Procter & Gamble.

Unilever NV (Inactive)

Unilever NV (Unilever) is a producer and marketer of fast-moving consumer goods. Unilever is headquartered in Rotterdam, the Netherlands.

Johnson & Johnson Pvt Ltd

Johnson & Johnson Pvt Ltd (J&J), a subsidiary of Johnson & Johnson, manufactures and supplies consumer healthcare products, medical devices, and pharmaceuticals. J&J is headquartered in Mumbai, Maharashtra, India.

Natura & Co Holding SA

Natura & Co Holding SA (Natura & Co) is a manufacturer and supplier of personal care products. Natura & Co is headquartered in Sao Paulo, Brazil.

Grupo Boticario

Grupo Boticario (Boticario) is a retailer of beauty and personal care products. Boticario is headquartered in Curitiba, Parana, Brazil.

Shiseido Company, Limited

Shiseido Company, Limited (Shiseido or ‘the company’) is a manufacturer and marketer of cosmetics, personal care, and healthcare products. The company is headquartered in Chuo-ku, Tokyo, Japan.

Global Skincare Market, by Companies

For more insights on competitors, download a free report sample

Global Skincare Market Report Overview

| Market Size 2021 | $134.68 billion |

| Key Categories | Facial Care, Body Care, Hand Care, Depilatories, and Make-Up Remover |

| Key Regions | Asia-Pacific, Europe, United States, Middle East, and ROW (Rest of the World) |

| Key Companies | L’Oreal S.A., Amorepacific Corp, Laboratoires Pierre Fabre SA, Clarins USA Inc, Shiseido Company, Kao Corporation, KOSE Corp, POLA Orbis Holdings Inc, Natura & Co Holding SA, Mary Kay (China) Cosmetics Co Ltd, The Estee Lauder Companies Inc, Johnson & Johnson Pvt Ltd, Beiersdorf Ag, Unilever, and Procter & Gamble |

| Key Distribution Channel | eRetailers, Hypermarkets & Supermarkets, Health & Beauty Stores, Parapharmacies/Drugstores, and Other |

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the skincare market

- Use the five forces analysis to determine the competitive intensity and therefore attractiveness of the skincare market

- Leading company profiles reveal details of key skincare market players’ operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the skincare markets with five-year forecasts by both value and volume

Reasons to Buy

- The size of the skincare market by value in 2021

- The size of the skincare market in 2026

- Factors affecting the strength of competition in the emerging five skincare industries

- The industry performance over the last five years

- The top competitors in the skincare market

Amorepacific Corp

Beiersdorf AG

Laboratoires Pierre Fabre SA

Clarins USA Inc

Shiseido Company, Limited

Kao Corporation

KOSE Corp

POLA Orbis Holdings Inc

Natura & Co Holding SA

Mary Kay (China) Cosmetics Co Ltd

The Estee Lauder Companies Inc

L'Oreal SA

Johnson & Johnson Pvt Ltd

Unilever NV (Inactive)

Table of Contents

Table

Figures

Frequently asked questions

-

What was the global skincare market size in 2021?

The global skincare market was valued at $134.68 billion in 2021.

-

What are the key categories in the global skincare market?

Facial care, body care, hand care, depilatories, and make-up remover are the key categories in the global skincare market.

-

What are the key regions in the global skincare market?

Asia-Pacific, Europe, United States, Middle East, and ROW (Rest of the World) are the key geography segments in the global skincare market.

-

What are the key distribution channels in the global skincare market?

E-retailers, hypermarkets & Supermarkets, health & beauty stores, parapharmacies/drugstores, and other are the key distribution channels in the market in focus.

-

What are the key companies in the global skincare market?

There are many companies in the global skin care market such as L’Oreal S.A., Amorepacific Corp, Laboratoires Pierre Fabre SA, Clarins USA Inc, Shiseido Company, Kao Corporation, KOSE Corp, POLA Orbis Holdings Inc, Natura & Co Holding SA, Mary Kay (China) Cosmetics Co Ltd, The Estee Lauder Companies Inc, Johnson & Johnson Pvt Ltd, Beiersdorf Ag, Unilever, and Procter & Gamble.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.