Spain Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain Life Insurance Market Report Overview

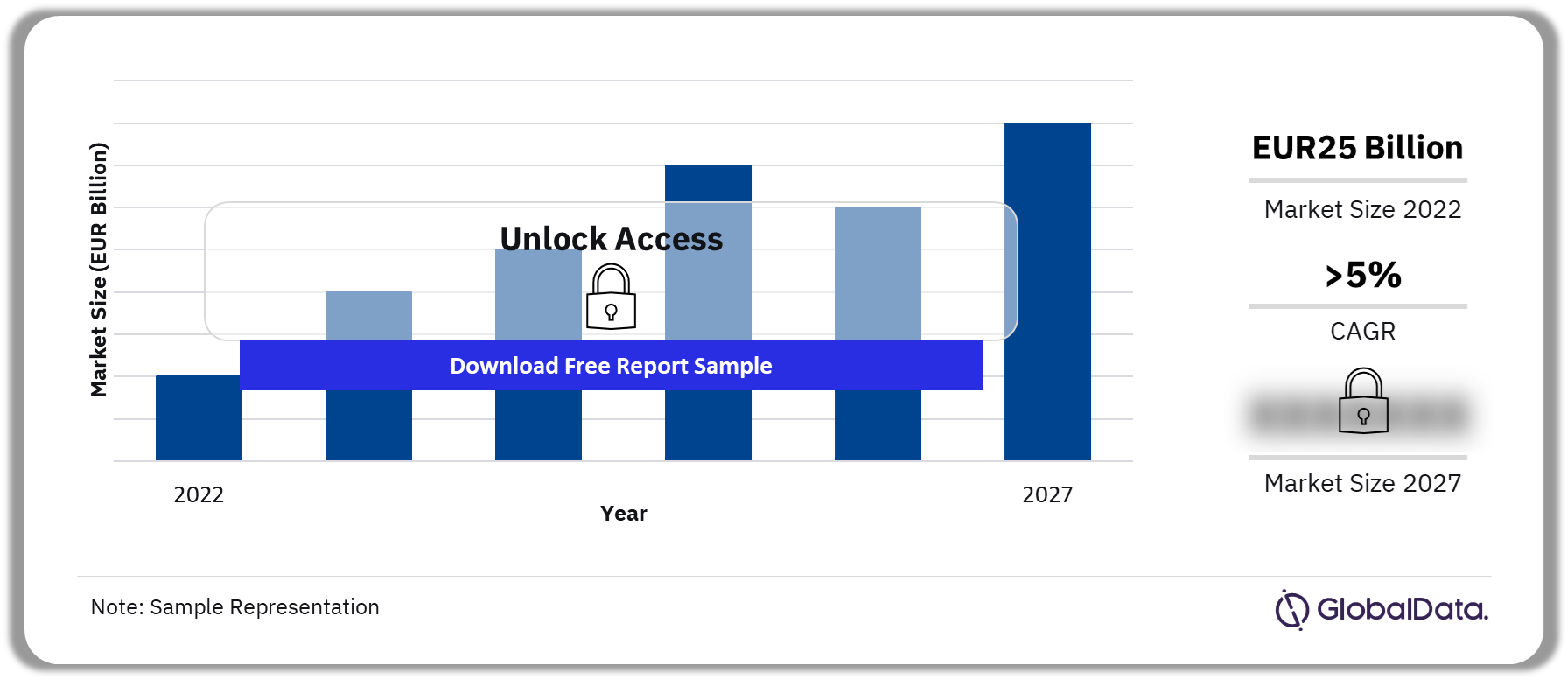

The gross written premium of the Spain life insurance market was EUR25 billion ($48.1 billion) in 2022 and is expected to achieve a CAGR of more than 5% during 2023-2027. The Spain life insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for Spain’s life insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

Spain Life Insurance Market Outlook, 2022-2027 (EUR Billion)

To gain more information about the Spain life insurance market forecast, download a free report sample

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the Spanish economy and demographics, and provides detailed information on the competitive landscape in the country. It also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | EUR25 billion ($48.1 billion) |

| CAGR (2023-2027) | >5% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Lines of Business | · Whole Life

· Life PA&H · Endowment · Term Life · Capitalization |

| Key Distribution Channels | · Direct Marketing

· E-Commerce · Insurance Brokers · Bancassurance · Agencies · Other Distribution Channels |

| Leading Companies | · VidaCaixa

· Mapfre Vida · Bansabadell Vida · Ibercaja Vida · Axa Aurora Vida · Santander Seguros · Allianz · BBVA Seguros |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Spain Life Insurance Market Trends

- Due to rising activism, shareholder pressures, increased regulatory monitoring, and customer interest in the ESG standards of the companies they buy from, insurance companies have strengthened their ESG commitments in recent years.

- A lack of understanding of specific insurance risks, limited research on mortality risks, and perceived greater health risks have historically curtailed the development of affordable life insurance coverage for individuals who do not conform to traditional binary identities. Men are charged higher life insurance premiums compared to women due to their lower life expectancy. Hence, the medical history of transgender people complicates the underwriting process. With greater emphasis on this matter across regions, the industry is noting development.

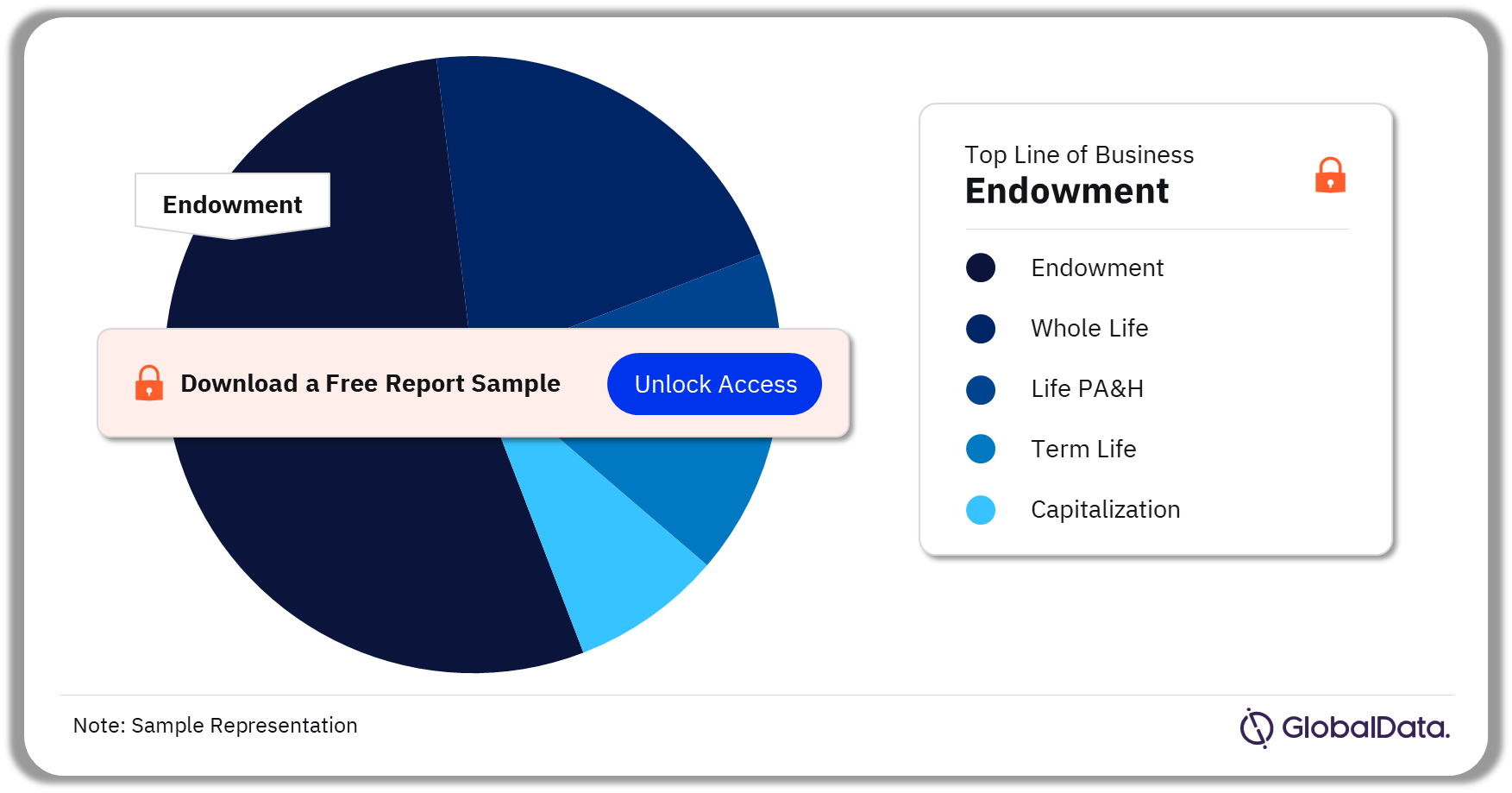

Spain Life Insurance Market Segmentation by Lines of Business

Endowment was the largest insurance line in 2022.

The key lines of business in the Spain life insurance industry are whole life, life PA&H, endowment, term life, and capitalization. The growth of endowment insurance will be supported by low-interest rates currently offered by banks that have encouraged consumers to invest in unit-linked life insurance policies as they provide better returns compared to bank deposits.

Spain Life Insurance Market Analysis by Lines of Business, 2022 (%)

For more lines of business insights into the Spain life insurance market, download a free report sample

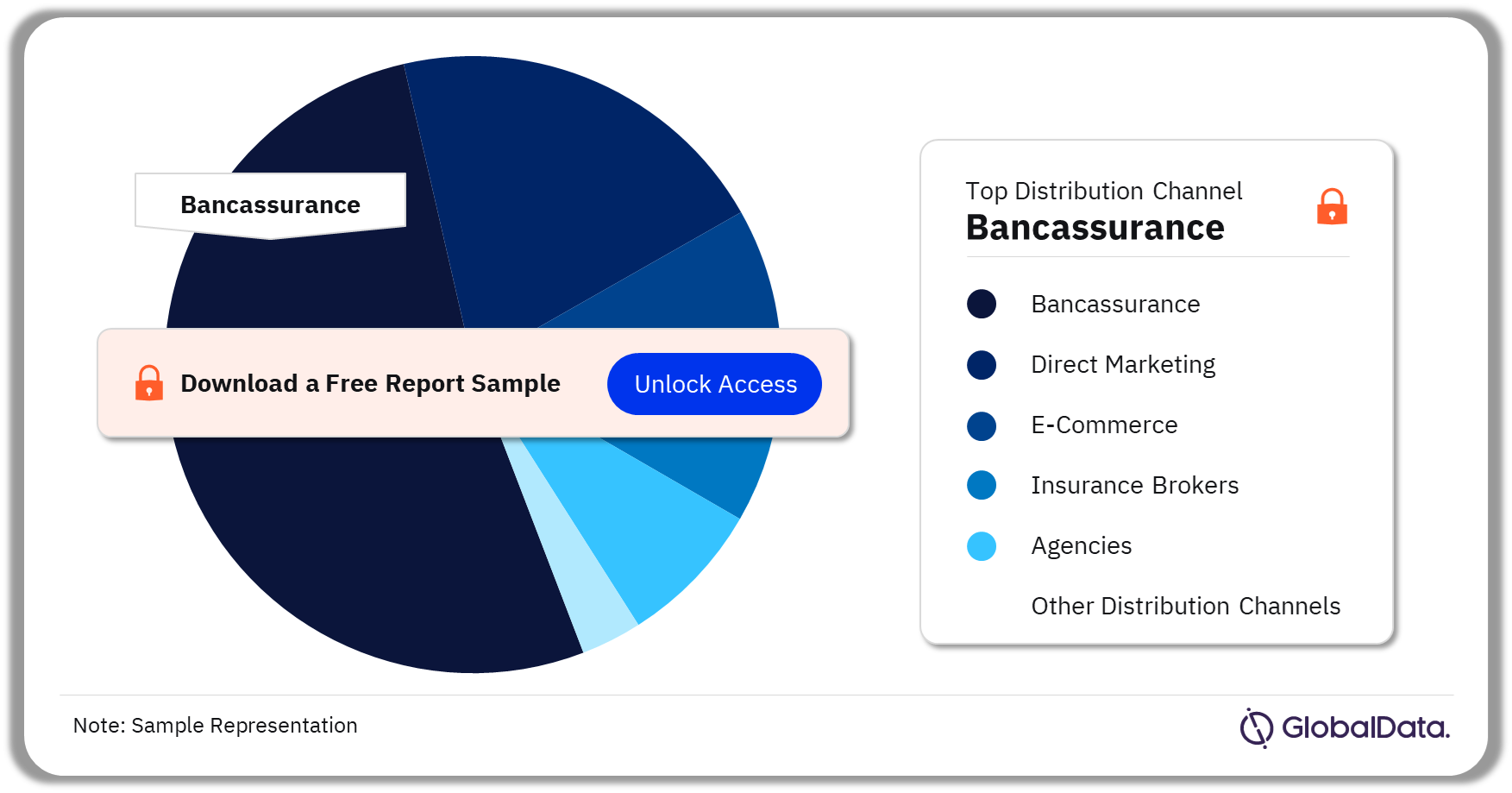

Spain Life Insurance Market Segmentation by Distribution Channel

Bancassurance was the most preferred channel for purchasing life insurance policies in 2022.

Spanish insurers adopt a multi-channel approach for the distribution of insurance products. The key distribution channels in the Spanish life insurance industry are direct marketing, e-commerce, insurance brokers, bancassurance, agencies, and other distribution channels. Distribution through banks was very popular as banks employed various cross-selling techniques to sell life insurance products for customers availing of mortgage loans.

Spain Life Insurance Market Analysis by Distribution Channels, 2022 (%)

For more distribution channel insights into the Spain life insurance market, download a free report sample

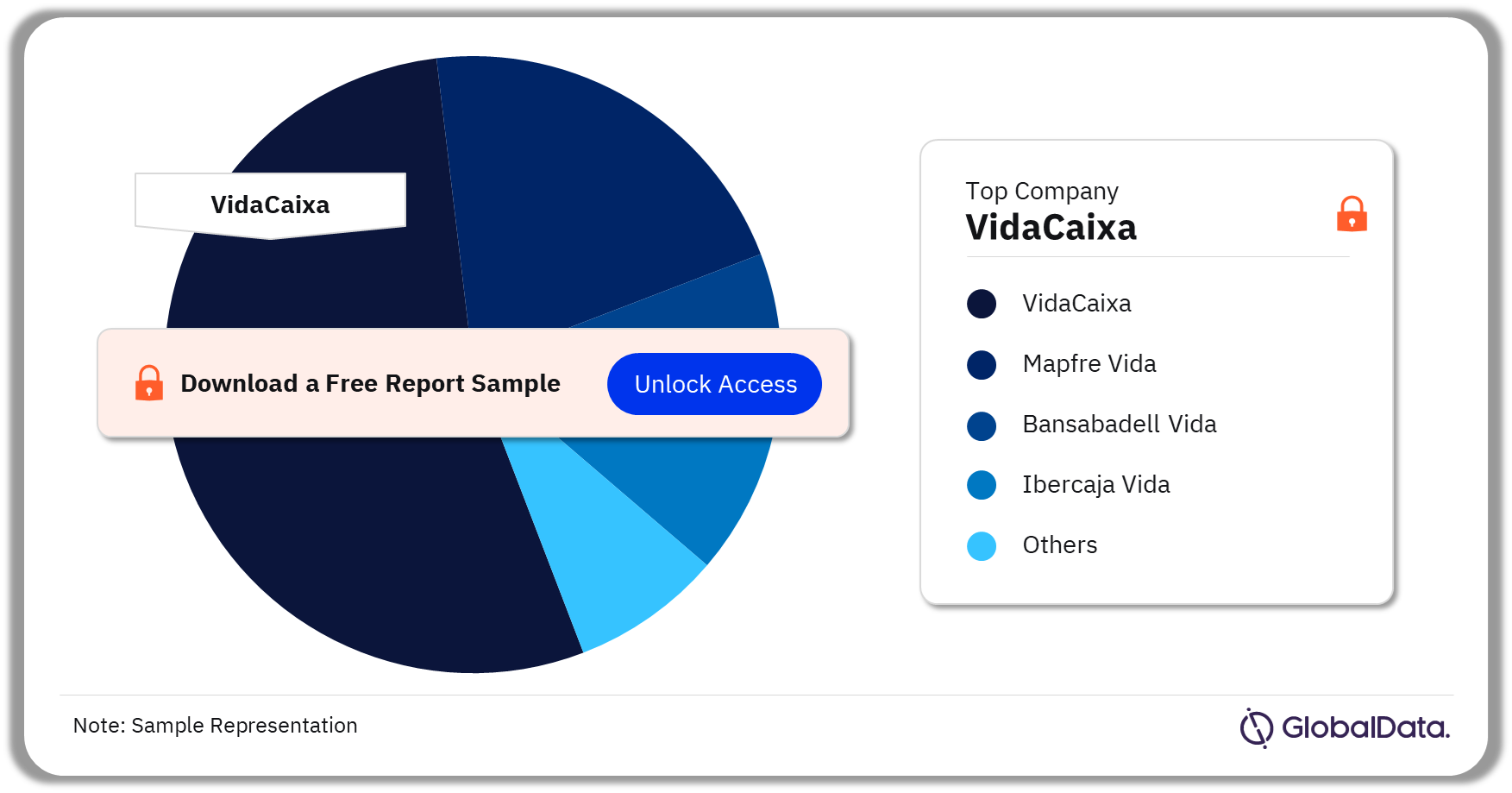

Spain Life Insurance Market - Competitive Landscape

Among the top 10 insurers, Axa Aurora recorded the highest review-period CAGR.

The life insurance segment is dominated by domestic insurers. Some of the leading life insurance companies in Spain are:

- VidaCaixa

- Mapfre Vida

- Bansabadell Vida

- Ibercaja Vida

- Axa Aurora Vida

- Santander Seguros

- Allianz

- BBVA Seguros

VidaCaixa was the largest insurer in 2021, followed by Mapfre Vida and Bansabadell Vida in 2021.

Spain Life Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading life insurance companies in Spain, download a free report sample

Spain Life Insurance Market – Latest Developments

- On January 20, 2023, the DGSFP published the maximum interest rate to be used in the accounting calculation of the life insurance provision, applicable to the year 2023.

- In March 2023, Mapfre Vida introduced MAPFRE Puente Garantizado III FP and MAPFRE Puente Garantizado II in the insurance market. MAPFRE Puente Garantizado III FP is a pension fund for clients who want a guaranteed minimum return of more than 10% over 4.96 years whereas MAPFRE Puente Garantizado II is a social security plan which gives the clients the option of reducing their tax base by a certain amount.

- In October 2022, Vida Caixa announced an innovative service that provides periodic and protected savings for retirement. This target capital and monthly savings plan can be achieved through a service that provides pension plan/Voluntary Social Provision Entities (Entidades de Previsión Social Voluntaria; EPSV), unit linked, and life insurance, in a single solution for customers.

Segments Covered in the Report

Spain Life Insurance Lines of Business Outlook (Value, EUR Billion, 2018-2027)

- Whole Life

- Life PA&H

- Endowment

- Term Life

- Capitalization

Spain Life Insurance Distribution Channel Outlook (Value, EUR Billion, 2018-2027)

- Direct Marketing

- E-Commerce

- Insurance Brokers

- Bancassurance

- Agencies

- Other Distribution Channels

Scope

This report provides:

- A comprehensive analysis of the life insurance segment in Spain

- Historical values for the Spanish life insurance segment for the report’s review period and projected figures for the forecast period

- Profiles of the top life insurance companies in Spain and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of the Spanish life insurance segment.

- A comprehensive overview of the Spanish economy, government initiatives and investment opportunities.

- The Spanish insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- The Spanish life insurance segment’s market structure gives details of lines of business.

- The Spanish life reinsurance business’ market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by the Spanish life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Spanish life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Spanish life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Santander Seguros

Bansabadell Vida

Mapfre Vida

Ibercaja Vida

BBVA Seguros

Axa Aurora Vida

Allianz

Table of Contents

Frequently asked questions

-

What was the Spain life insurance market gross written premium in 2022?

The gross written premium of the Spain life insurance market was EUR25 billion ($48.1 billion) in 2022.

-

What is the growth rate of the Spain life insurance market?

The life insurance market in Spain is expected to achieve a CAGR of more than 5% during 2023-2027.

-

Which line of business held the largest share of the Spain life insurance market?

Endowment was the leading life insurance line of business in the Spanish life insurance market in 2022.

-

Which distribution channel held the highest share in the Spain life insurance market?

Bancassurance was the leading channel in 2022 in the Spanish life insurance market.

-

Which are the key companies operating in the Spain life insurance market?

Some of the leading life insurance companies in Spain are VidaCaixa, Mapfre Vida, Bansabadell Vida, Ibercaja Vida, Axa Aurora Vida, Santander Seguros, Allianz, and BBVA Seguros, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports