Switzerland General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Switzerland General Insurance Market Report Overview

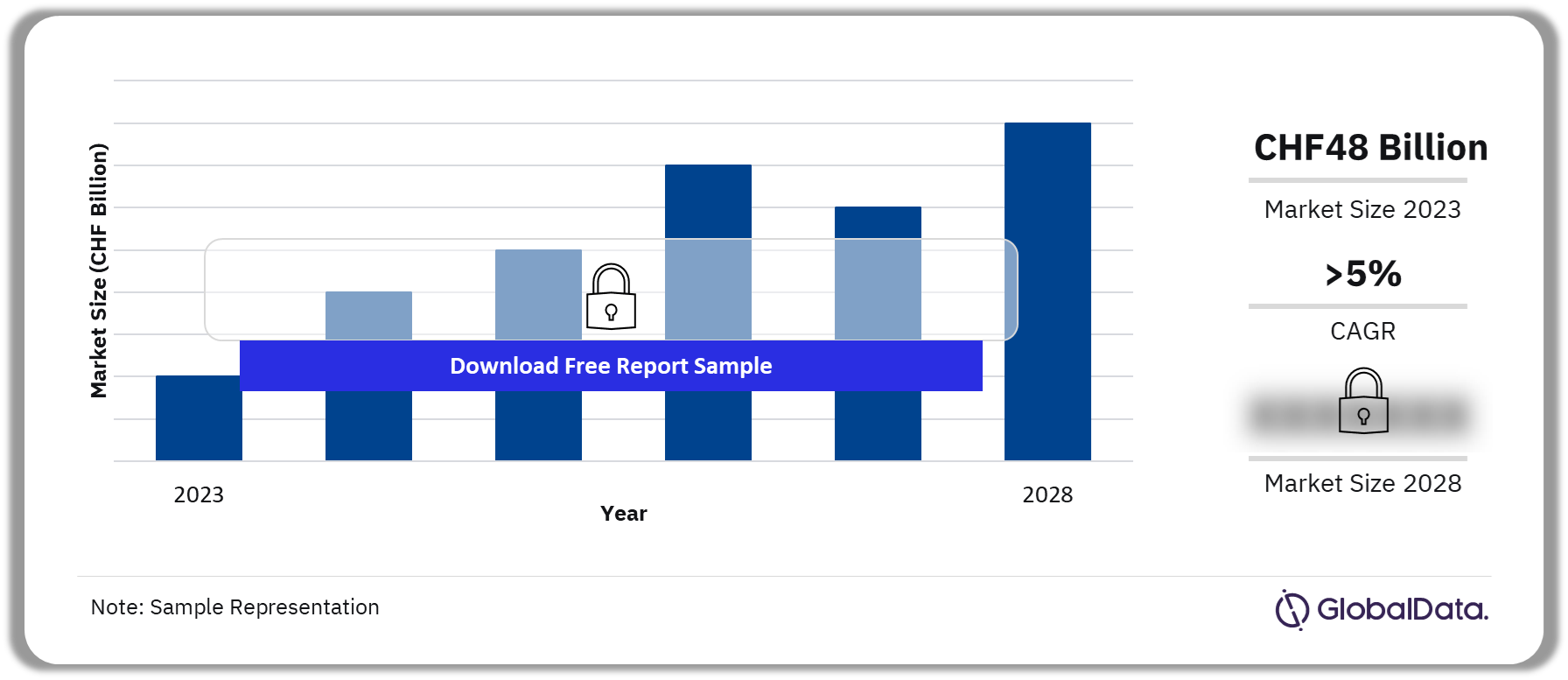

The gross written premium of Switzerland general insurance market was CHF48 billion ($50.8 billion) in 2023 and is expected to achieve a CAGR of more than 5% during 2024-2028. The Switzerland general insurance market research report provides in-depth market analysis, including insights into the lines of business in the country’s general insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including gross written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Switzerland General Insurance Market Outlook, 2023-2028 (CHF Billion)

Buy Full Report to Gain More Information about the Switzerland General Insurance Market Forecast

The Switzerland general insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of Switzerland’s economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | CHF48 billion ($50.8 billion) |

| CAGR (2023-2027) | >5% |

| Forecast Period | 2024-2028 |

| Historical Period | 2018-2023 |

| Key Lines of Business | · Property

· Motor · Liability · Financial Lines · MAT · General Insurance PA&H · Miscellaneous |

| Leading Companies | · Zurich Insurance Company

· Helvetia Schweizerische Versicherungs · AXA Versicherungen · Schweizerische Mobiliar Versicherungs · Allianz Versicher |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Switzerland General Insurance Market Trends

Digitalization and rising demand for cyber insurance, insurtech, ESG, and electric vehicles (EV) are the recurring trends in the Switzerland general insurance market.

- Primarily, Switzerland has emerged to be a leading Insurtech hub in Europe. It offers advantages to traditional insurers because of a lack of specific InsurTech legislation providing them with an existing license. Swiss Insurtechs use blockchain and IoT for improved security, transparency, and personalized insurance offerings. Moreover, incubators and accelerators foster collaborations between insurers and startups for operational efficiency and exploring new models.

- For instance, in November 2023, Bolttech partnered with mobile operators Salt, to offer device insurance for customers in Switzerland under its portfolio.

Switzerland General Insurance Market Segmentation by Lines of Business

General insurance PA&H was the leading general insurance line of business in 2023

The key lines of business in the Switzerland general insurance industry are property, motor, liability, financial lines, MAT, general insurance PA&H, and miscellaneous.

Personal accident insurance is mandatory in Switzerland for all individuals, whether employed, self-employed, or unemployed. Furthermore, for employees working for more than eight hours per week for a single employer, the employer needs to be accountable for their insurance for all accidents. Such an increase in demand for insurance will drive Switzerland general insurance market growth during the forecast period.

Switzerland General Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Switzerland General Insurance Market

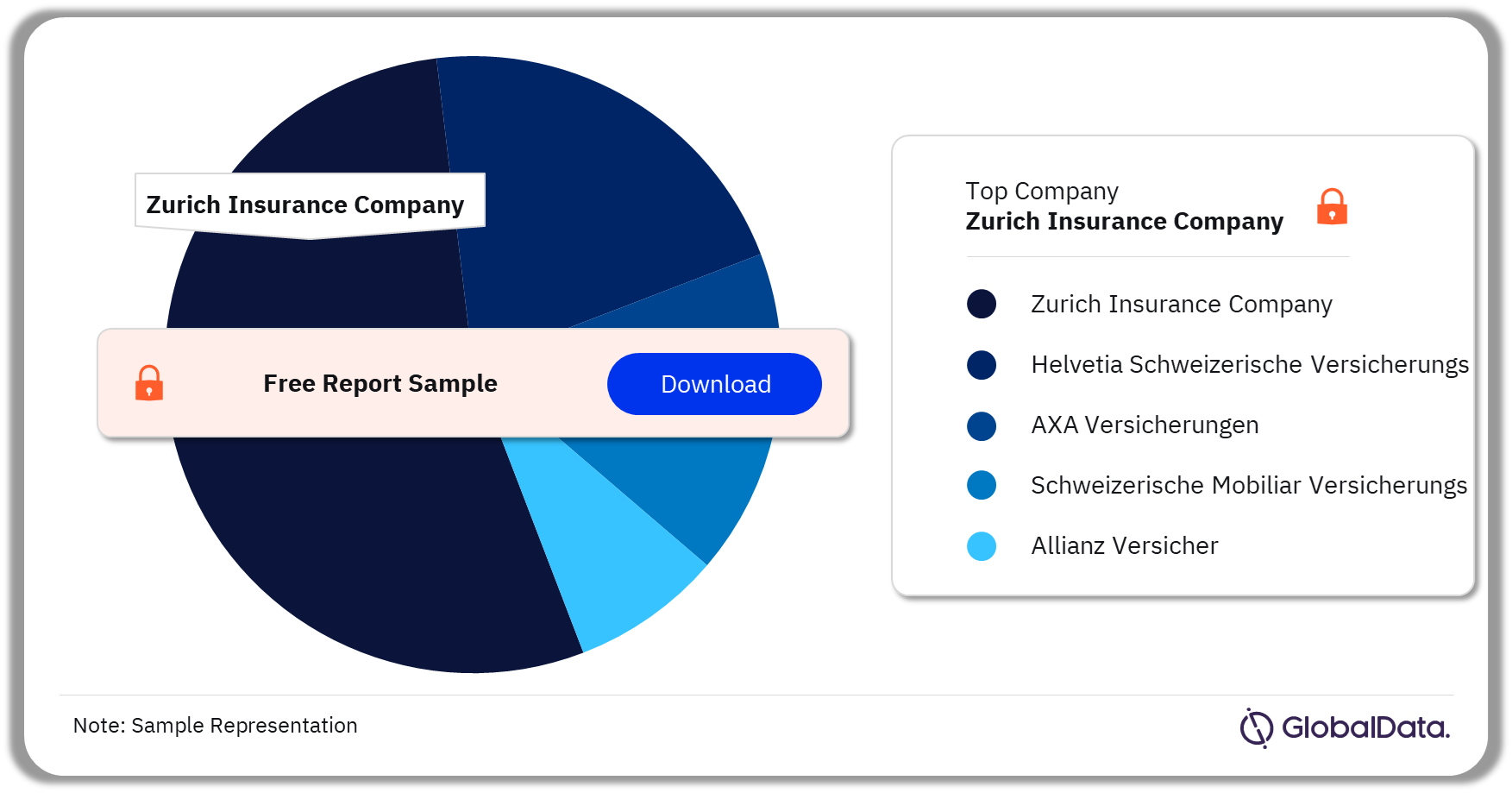

Switzerland General Insurance Market - Competitive Landscape

Zurich Insurance Company was the largest general insurer in 2022

A few of the leading general insurance companies in Switzerland are:

- Zurich Insurance Company

- Helvetia Schweizerische Versicherungs

- AXA Versicherungen

- Schweizerische Mobiliar Versicherungs

- Allianz Versicher

Zurich Insurance Company, in July 2023 announced a partnership with Belgium-based Qover through Zurich Global Ventures as part of which Zurich is also joining the insurtech’s Series C funding round. This collaboration with Zurich Global Ventures emphasizes Zurich’s ambition to find new ways to distribute innovative insurance products and services to reach customers.

Switzerland General Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about the Companies in Switzerland General Insurance Market

Switzerland General Insurance Market - Latest Developments

- On November 9, 2023, the Financial Market Supervisory Authority (FINMA) published its Risk Monitor 2023, identifying significant risks for the financial sector, including insurance.

Segments Covered in the Report

Switzerland General Insurance Lines of Business Outlook (Value, CHF Billion, 2018-2024)

- Property

- Motor

- Liability

- Financial Lines

- MAT

- General Insurance PA&H

- Miscellaneous

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Switzerland.

- Historical values for the Switzerland general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Switzerland and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Switzerland’s general insurance segment.

- A comprehensive overview of Switzerland’s economy, government initiatives, and investment opportunities.

- Switzerland’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Switzerland’s general insurance segment’s market structure gives details of lines of business.

- Switzerland’s general reinsurance business’s market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Switzerland’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Switzerland’s general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Switzerland’s general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Allianz Versicher

Helvetia Schweizerische Versicherungs

Helsana Zusatzversicherungen

AXA Versicherungen

Basler Versicherung

Schweizerische Mobiliar Versicherungs

CSS Versicherung

Table of Contents

Frequently asked questions

-

What was the Switzerland general insurance market gross written premium in 2023?

The gross written premium of the Switzerland general insurance market was CHF48 billion ($50.8 billion) in 2023.

-

What will the growth rate of the Switzerland general insurance market be during the forecast period?

The general insurance market in Switzerland is expected to achieve a CAGR of more than 5% during 2024-2028.

-

Which line of business held the largest share of the Switzerland general insurance market in 2023?

General Insurance PA&H was the leading general insurance line of business in 2023.

-

Which are the key companies operating in the Switzerland general insurance market?

A few of the leading general insurance companies in Switzerland are Zurich Insurance Company, Helvetia Schweizerische Versicherungs, AXA Versicherungen , Schweizerische Mobiliar Versicherungs, Allianz Versicher among others

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports