Top 5 Emerging Countries Hybrid and Electric Cars Market Summary, Competitive Analysis and Forecast, 2017-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

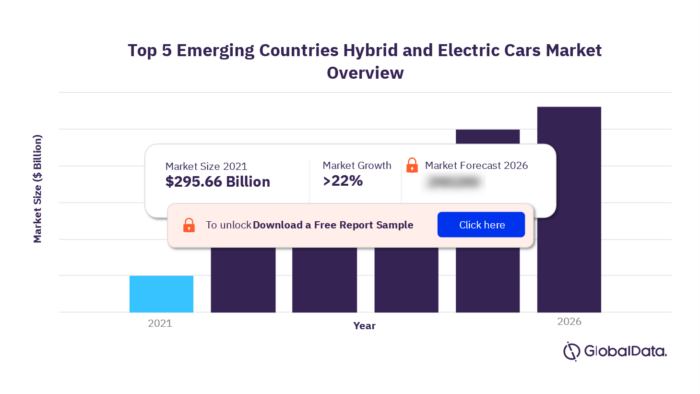

The top 5 emerging countries, which include Brazil, China, India, Mexico, and South Africa, contributed $295.66 billion in 2021 to the global hybrid & electric cars industry. The hybrid & electric cars industry in the top 5 emerging countries is expected to grow at a CAGR of more than 22% during 2021-2026. The top 5 emerging countries hybrid & electric cars market research report provides top-line qualitative and quantitative summary information including market size and forecast. The profile also contains descriptions of the leading players including key financial metrics and an analysis of competitive pressures within the market.

For more insights, download a free report sample

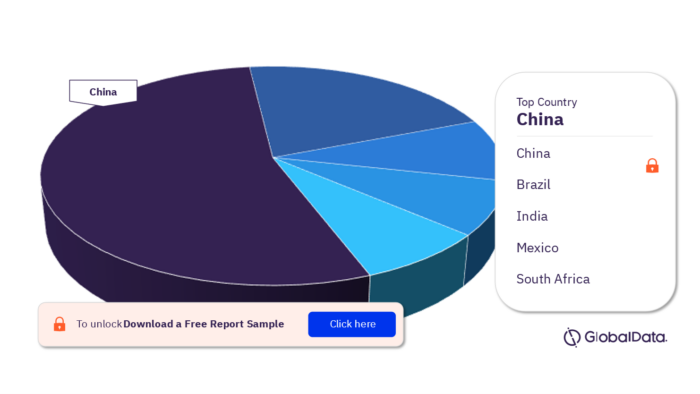

Key Nation in the Top 5 Emerging Countries Hybrid and Electric Cars Market

The top 5 emerging countries include China, Brazil, India, Mexico, and South Africa. China is leading the top 5 emerging countries hybrid & electric cars market in terms of revenue.

China

The Chinese market saw decelerated sales growth in 2021 compared to 2020. Although consumer confidence improved during 2021, as the COVID-19 pandemic had receded, pent-up demand was largely exhausted during the second half of 2020. Moreover, the COVID-19 pandemic exacerbated the already strenuous supply conditions in the semiconductor industry, on which the automotive industry and particular electric cars are reliant for crucial input parts.

Additionally, in a bid to relieve the impact of the pandemic and support the market and the local automotive industry, the government announced that the purchase of electric cars and plug-in hybrids will remain exempt from VAT until the end of 2022, extending the initial plan of ending it after 2020.

Brazil

The market is set to follow a double-digit growth during the forecast period as the adoption of hybrid and electric cars will continue to increase, driven by increasing affordability and a greater number of offerings, also facilitated by government incentives and expanding infrastructure.

India

The Indian market saw decelerated sales growth in 2021 compared to 2020. However, the sales of hybrid and electric cars will continue to grow strongly over the coming years given that the market is set to expand both in demand and supply terms.

Mexico

In Mexico, the share of hybrid and electric car sales has grown from 2017 to 2021, according to in-house research, indicating a relatively low adoption rate compared to other markets. The sales of hybrid and electric cars will continue to grow strongly over the coming years given that the market is set to expand both in demand and supply terms.

South Africa

The South African market saw accelerated sales growth in 2021 compared to 2020. Sales were stronger in 2021 through pent-up demand, as consumer confidence improved after a turbulent year characterized by lockdown measures and economic uncertainty. Moreover, the monetary stimulus in response to the economic recession brought by the COVID-19 pandemic supported new car sales through cheap credit.

Leading Nation in the Top 5 Emerging Countries Hybrid and Electric Cars Market, by Revenue

For more country insights, download a free report sample

Key Company in the Top 5 Emerging Countries Hybrid and Electric Cars Market

There are many companies in the top 5 emerging countries hybrid and electric cars market such as Toyota Motor Corporation, Bayerische Motoren Werke AG, General Motors Company, BYD Company Limited, BAIC Motor Corporation Ltd, SAIC Motor Corp Ltd, Tesla, Inc., Tata Motors Limited, and Hyundai Corporation.

Toyota Motor Corporation

Toyota Motor Corporation (Toyota or ‘the company’) is a manufacturer and seller of motor vehicles. The company is headquartered in Toyota City, Aichi, Japan.

Tesla

Tesla, Inc. (Tesla or ‘the company’) is a US-based automotive company that designs, manufactures, and markets electric vehicles, components, and energy storage and generation systems. The company is headquartered in Palo Alto, California, the US.

General Motors Company

General Motors Company (GM or ‘the company’) is engaged in the design, development, production, and marketing of cars, trucks, and automobile parts. The company is headquartered in Detroit, Michigan, US.

BYD Company

BYD Company Limited (BYD or ‘the company’) manufactures and sell automobile and related products. The key customers of the company include the top brands such as Huawei, Samsung, Apple, Lenovo, Vivo, Xiaomi, Dell, and global leading professional robot brands such as Ecovacs and iRobot. BYD is headquartered in Shenzhen, Guangdong, China.

Market Report Overview

| Market Size 2021 | $295.66 billion |

| CAGR % (2021-2026) | >22% |

| Key Top 5 Emerging Countries | Brazil, China, India, Mexico, and South Africa |

| Leading country | China |

| Key Companies | Toyota Motor Corporation, Bayerische Motoren Werke AG, General Motors Company, BYD Company Limited, BAIC Motor Corporation Ltd, SAIC Motor Corp Ltd, Tesla, Inc., Tata Motors Limited, and Hyundai Corporation |

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the top 5 emerging hybrid & electric car industry

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the top 5 emerging hybrid & electric car industry

- Leading company profiles reveal details of key hybrid & electric car industry players’ top 5 emerging operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the top 5 emerging hybrid & electric car Industry with five year forecasts by both value and volume

- Compares data from Brazil, China, India, Mexico, and South Africa, alongside individual chapters on each country

Reasons to Buy

The report includes:

- The size of the top 5 emerging hybrid & electric car industry by value in 2021

- The size of the top 5 emerging hybrid & electric car industry in 2026

- Factors are affecting the strength of competition in the top 5 emerging hybrid & electric car industry

- The industry performance over the last five years

- The top competitors in the top 5 emerging hybrid & electric car industry

Bayerische Motoren Werke AG

General Motors Company

BYD Company Limited

BAIC Motor Corporation Ltd

SAIC Motor Corp Ltd

Tata Motors Limited

Hyundai Corporation

Tesla, Inc.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the size of the top 5 emerging countries hybrid and electric cars market in 2021?

The top 5 emerging countries contributed $295.66 billion to the global hybrid and electric cars industry in 2021.

-

What is the growth rate of the top 5 emerging countries hybrid and electric cars market?

The countries are expected to accelerate at a CAGR of more than 22% over the forecast period.

-

Which countries are included in the top 5 emerging nations hybrid and electric cars market?

Brazil, China, India, Mexico, and South Africa are included in the top 5 emerging countries hybrid and electric cars market.

-

Which country will be leading the top 5 emerging nations hybrid and electric cars market in terms of revenue?

China will be leading the top 5 emerging countries hybrid and electric cars market in terms of revenue.

-

What are the key companies in the top 5 emerging countries hybrid and electric cars market?

There are many companies in the top 5 emerging countries hybrid and electric cars markets such as Toyota Motor Corporation, Bayerische Motoren Werke AG, General Motors Company, BYD Company Limited, BAIC Motor Corporation Ltd, SAIC Motor Corp Ltd, Tesla, Inc., Tata Motors Limited, and Hyundai Corporation.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.