Turkey Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Turkey Cards and Payments Market Overview

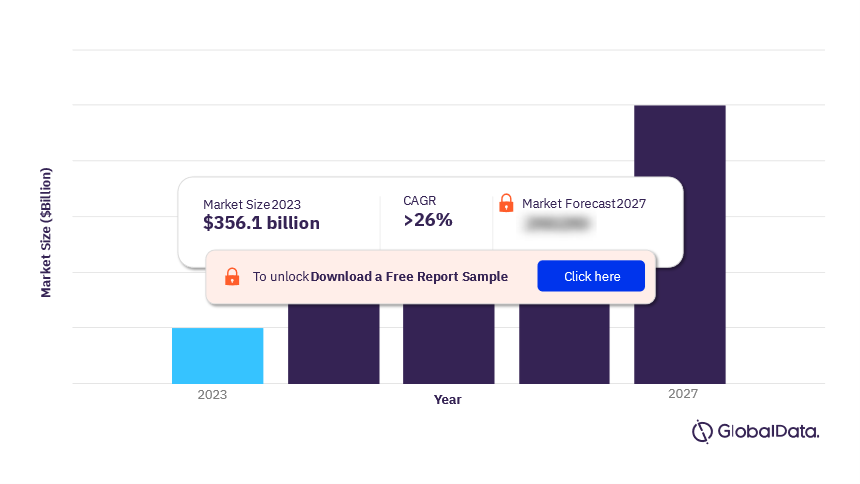

The Turkey cards and payments market size was valued at $356.1 billion in 2023 and is expected to achieve a CAGR of more than 26% during 2023-2026. Turkish consumers are increasingly adopting payment cards, resulting in an increase in overall payment card penetration and usage in the country. With the increase in card usage, payment companies are offering cards with innovative features. For instance, in January 2023, mobile wallet provider Papara launched the Mastercard-branded Voice card for visually impaired consumers. The card is linked to the Papara app, enabling card holders to hear the payment details via a voice message on their mobile phone to avoid incorrect transactions.

Turkey Cards and Payments Market Outlook, 2023-2027 ($ Billion)

To gain more information on the Turkey cards and payments market forecast, download a free report sample

The Turkey cards and payments market research report provides a detailed analysis of market trends in the Turkey’s cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry including credit transfers, cash, mobile wallets, cards, direct debits, and cheques during the review period.

| Market Size (2022) | $356.1 billion |

| CAGR | >26% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Payment Instruments | Cash, Cards, Credit Transfers, and Cheques |

| Key Segments | Card-Based Payments, Merchant Acquiring, Ecommerce Payments, In-Store Payments, Buy Now Pay Later, Mobile Payments, P2p Payments, Bill Payments, and Alternative Payments |

| Leading Players | Ziraat Bank, DenizBank, Vakifbank, HALKBANK, Garanti BBVA, Yapi Kredi, and Akbank |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Turkey Cards and Payments Market Dynamics

Alternative payment solutions are being introduced in Turkey. Samsung Wallet launched in the Debit card penetration is high in Turkiye, with each consumer holding over two debit cards. This has been supported by a rising banked population, which grew from 69.9% in 2019 to 78.5% in 2023e. Government efforts to boost debit card transactions as well as banks offering payroll accounts with no management fees have positively contributed to growth. Contactless card holding is high in Turkiye, with all the country’s major banks offering contactless cards.

Amid the COVID-19 pandemic, Turkish consumers are increasingly using contactless cards; the increased contactless payment limit has supported this trend. Turkish consumers and financial institutions have embraced the technology, with extensive acceptance infrastructure one of the major reasons why these cards are so popular. Furthermore, the growth of the e-commerce market in Turkey due to rising internet and smartphone penetration has further improved online payment infrastructure, as well as increased consumer confidence in online transactions.

For additional Turkey cards and payments market dynamics, download a free sample report

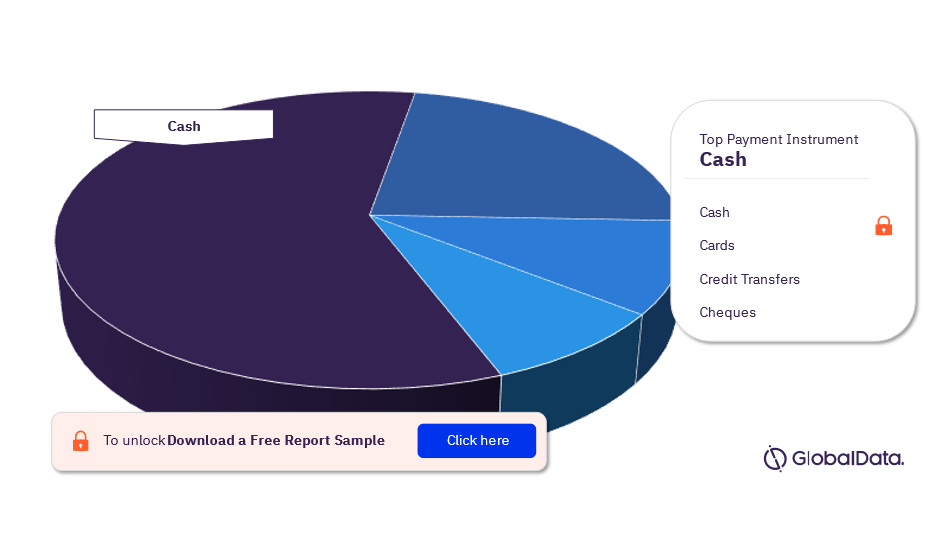

Turkey Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the Turkey cards and payments market are cards, cash, credit transfers, and cheques. In 2023, cash was the major payment instrument in terms of transaction volume in the Turkey cards and payments market. However, the segment will witness a decline due to the growing preference for electronic payments, improving payments infrastructure, and a growing banked population. This trend is expected to continue over 2023e–27. Cards segment, on the other hand, will garner a growth during the projected period mainly due to high consumer awareness, robust payment infrastructure, and rising merchant acceptance. The convenience of electronic payments, robust payment infrastructure, the growing preference for contactless payments, and ecommerce market growth are all facilitating increased payment card usage.

Turkey Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Turkey cards and payments market, download a free report sample

Turkey Cards and Payments Market Segments

The key segments in the Turkey cards and payments market are card-based payments, merchant acquiring, ecommerce payments, in-store payments, buy now pay later, mobile payments, p2p payments, bill payments, and alternative payments.

Card-based Payments: Rising contactless card adoption is a key driver of payment card market growth. Turkiye has a well-penetrated payment card market, with each individual holding 3.5 cards – the second-highest level among its peers. This is partly due to efforts by financial authorities and banks to ensure a strong banked population. Post COVID-19, the growing preference for electronic payments coupled with developing payment acceptance infrastructure have been successful in driving customers to gradually shift to card-based payments for day-to-day transactions. The rising preference for digital banking and growth in ecommerce are expected to further boost electronic payments going forward.

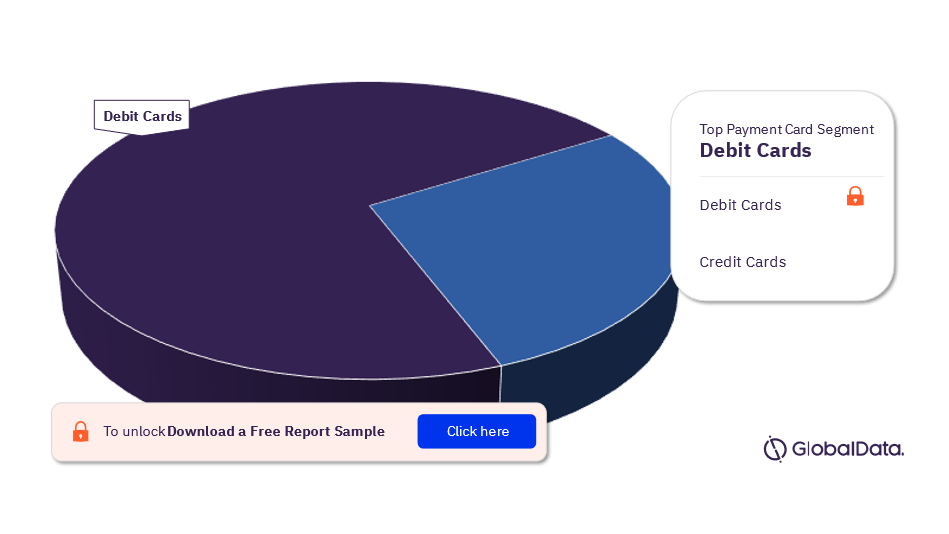

In 2023, debit cards will dominate the Turkish payment and card market in terms of adoption. Rising government support, particularly through financial inclusion and awareness programs, including offering financial support to refugees via funds deposited to debit cards has positively contributed to this growth. Banks offering payroll accounts with no account management fees have further added to high penetration.

Payment Cards Analysis by Segments, 2023 (%)

For more insights on the key payment card segments, download a free sample report

Turkey Cards and Payments Market - Competitive Landscape

Some of the leading players in the Turkey cards and payments market are Ziraat Bank, DenizBank, Vakifbank, HALKBANK, Garanti BBVA, Yapi Kredi, and Akbank, among others.

Segments Covered in the Report

Turkey Cards and Payments Instruments Outlook (Value, $ Billion, 2018-2027)

- Cards

- Credit Transfers

- Cheques

- Cash

Turkey Cards and Payments Market Segments Outlook (Value, $ Billion, 2018-2027)

- Card-Based Payments

- Merchant Acquiring

- Ecommerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

This report provides top-level market analysis, information and insights into the Norwegian cards and payments industry, including:

- Current and forecast values for each market in Turkey’s cards and payments industry, including debit, credit and charge cards.

- Detailed insights into payment instruments including cards, credit transfers, mobile wallets, direct debits, cash, and cheques. It also, includes an overview of the country’s key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the Norwegian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit and charge cards.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Norwegian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Norwegian cards and payments industry.

- Assess the competitive dynamics in the Norwegian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Turkey.

- Gain insights into key regulations governing the Norwegian cards and payments industry.

DenizBank

VakifBank

Halkbank

BBVA

Yapi Kredi

Isbank

Akbank

TEB

QNB Finansbank

BNP Paribas

HSBC

Garanti Bank

TROY

Mastercard

Visa

American Express.

Table of Contents

Frequently asked questions

-

What was the Turkey cards and payments market size in 2023?

The cards and payments market size in Turkey was valued at $356.1 billion in 2023.

-

What is the Turkey cards and payments market growth rate?

The cards and payments market in Turkey is expected to achieve a CAGR of more than 26% during 2023-2027%.

-

Which will be the leading payment instrument in the Turkey cards and payments market in 2022?

Cards will be the leading payment instrument in terms of volume transactions in the Turkey cards and payments market.

-

Who are the leading players in the Turkey cards and payments market?

Some of the leading players in the Turkey cards and payments market are Ziraat Bank, DenizBank, Vakifbank, HALKBANK, Garanti BBVA, Yapi Kredi, and Akbank, among others.

-

Which payment card segment will dominate the Turkey cards and payments market?

Debit cards payment segment will dominate the Turkey cards and payments market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports