United Arab Emirates (UAE) Projects, H1 2022 – Outlook of Major Projects in United Arab Emirates – MEED Insights

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UAE Projects Market Report Overview

UAE has $654.6 billion worth of projects planned or underway currently, making it the second largest in the MENA region. Though the Dubai expo also did some magic in giving a boost to the tourism sector, the overall market will depend on the resurgence of key sectors such as oil and gas, construction, and transport in 2022.

The UAE projects market research report offers a comprehensive analysis of the projects from various sectors. The report also covers the insights on estimates pertaining to the revenue and expenditure incurred on various projects underway or in the pipeline in UAE updated to H1 2022. The UAE projects market outlook report covers key clients for the projects and prominent sponsors along with the sector-by-sector breakdown of future project plans and key drivers influencing these sectors.

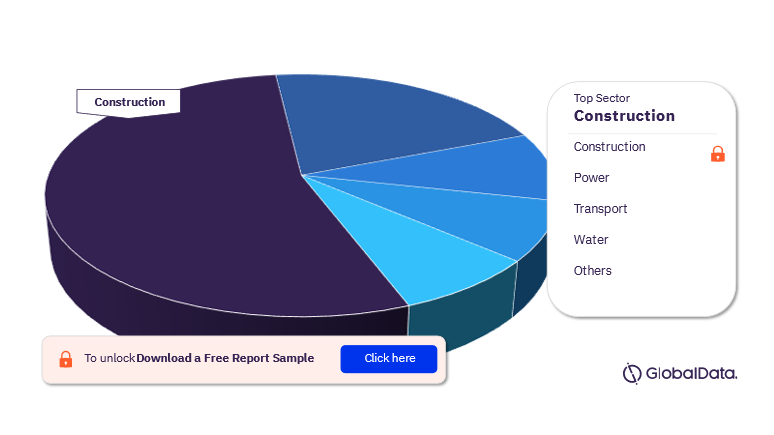

UAE Projects Market Segmentation by Sectors

The key sectors in the UAE projects market are oil and gas, construction, transport, power, industrial, gas, and water. The largest current sector in terms of work under execution is construction, followed by transport and power.

UAE Projects Market Analysis, by Sectors

For more insights on sectors in the UAE projects market analysis, download a free sample report

For more insights on sectors in the UAE projects market analysis, download a free sample report

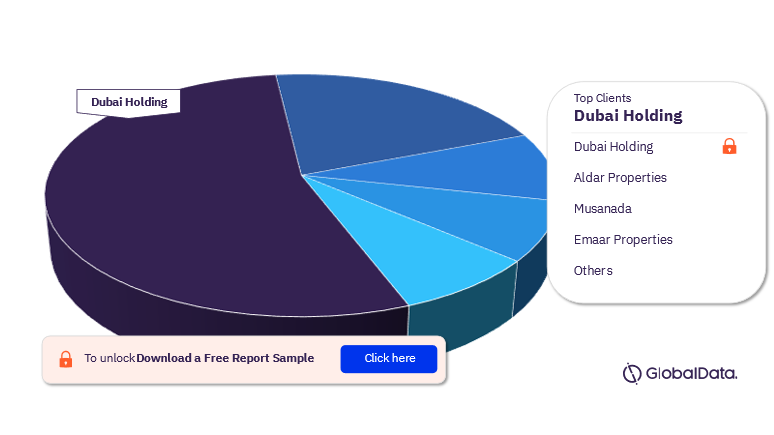

UAE Projects Market – Key Clients

Some of the key clients in the UAE projects market are Dubai Holding, Aldar Properties, Musanada, Emaar Properties, Nakheel, Dubai Electricity & Water Authority, Abu Dhabi Future Energy Company, Dubai South, and Etihad Rail among others. Dubai Holding is the largest client by the value of work under execution.

UAE Projects Market Analysis, by Clients

For more insights on clients in the UAE projects market analysis, download a free sample report

For more insights on clients in the UAE projects market analysis, download a free sample report

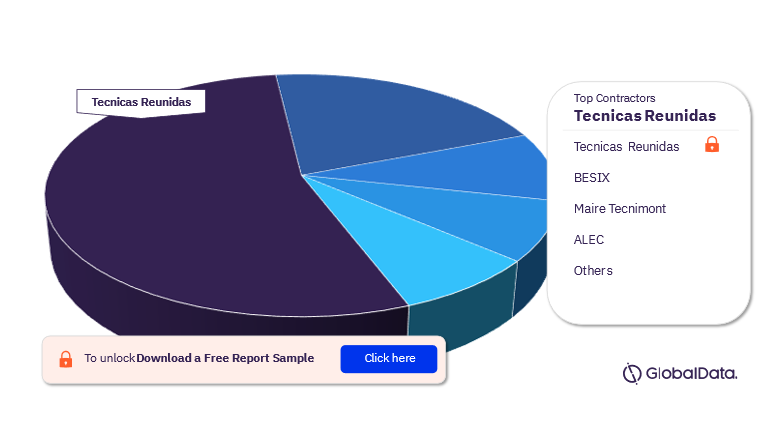

UAE Projects Market - Key Contractors

Some of the key contractors in the UAE projects market are Tecnicas Reunidas, BESIX, Maire Tecnimont, ALEC, Samsung C&T, National Petroleum Construction Company, Target Engineering, Shanghai Electric Group, and Samsung Engineering among others. The Spain-based Technicas Reunidas is first ranked in terms of contracts.

UAE Projects Market Analysis, by Contractors

For more insights on contractors in the UAE projects market analysis, download a free sample report

For more insights on contractors in the UAE projects market analysis, download a free sample report

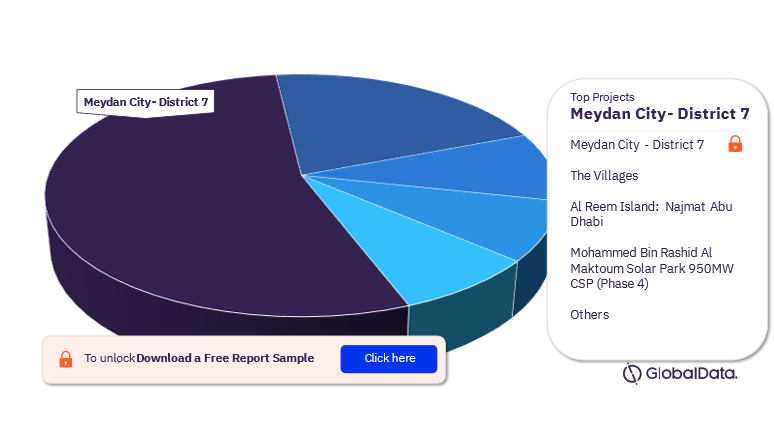

UAE Projects Market - Key Projects

Some of the largest projects under construction in UAE are Meydan City – District 7, The Villages, Al Reem Island: Najmat Abu Dhabi, Mohammed Bin Rashid Al Maktoum Solar Park 950MW CSP (Phase 4), Dubailand: Tilal Al Ghaf, and Sub-Sea Power Transmission Network among others. The Meydan City – District 7 has the highest budget with expected completion in 2025.

UAE Projects Market Analysis, by Projects

For more insights on projects in the UAE projects market analysis, download a free sample report

For more insights on projects in the UAE projects market analysis, download a free sample report

UAE Projects Market Report Outlook

| Projects Market Worth | $654.6 billion |

| Key Sectors | Oil and Gas, Construction, Transport, Power, Industrial, Gas, and Water |

| Key Clients | Dubai Holding, Aldar Properties, Musanada, Emaar Properties, Nakheel, Dubai Electricity & Water Authority, Abu Dhabi Future Energy Company, Dubai South, and Etihad Rail |

| Key Contractors | Tecnicas Reunidas, BESIX, Maire Tecnimont, ALEC, Samsung C&T, National Petroleum Construction Company, Target Engineering, Shanghai Electric Group, and Samsung Engineering |

| Key Projects | Meydan City – District 7, The Villages, Al Reem Island: Najmat Abu Dhabi, Mohammed Bin Rashid Al Maktoum Solar Park 950MW CSP (Phase 4), Dubailand: Tilal Al Ghaf, and Sub-Sea Power Transmission Network |

Reasons to Buy

- Opportunities and challenges in UAE’s projects market

- Analysis of the pipeline of planned projects and contract awards

- Key policies and drivers shaping the outlook for projects in UAE

- Political and economic background

- The barriers and challenges that may arise

- Sector-by-sector breakdown of future project plans

- Key drivers of projects in each sector

- UAE’s most valuable key projects and major project sponsors

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UA projects market size in 2021?

The projects market size in the UAE was valued at $654.6 billion in 2021.

-

What are the key sectors in the UAE projects market?

The key sectors in the UAE projects market are oil and gas, construction, transport, power, industrial, gas, and water.

-

Who are the key clients associated with the UAE projects market?

Some of the key clients associated with the UAE projects market are Dubai Holding, Aldar Properties, Musanada, Emaar Properties, Nakheel, Dubai Electricity & Water Authority, Abu Dhabi Future Energy Company, Dubai South, and Etihad Rail among others.

-

Who are the key contractors associated with the UAE projects market?

Some of the key contractors associated with the UAE projects market are Tecnicas Reunidas, BESIX, Maire Tecnimont, ALEC, Samsung C&T, National Petroleum Construction Company, Target Engineering, Shanghai Electric Group, and Samsung Engineering among others.

-

What are the key projects associated with UAE?

Some of the key projects associated with UAE are Meydan City – District 7, The Villages, Al Reem Island: Najmat Abu Dhabi, Mohammed Bin Rashid Al Maktoum Solar Park 950MW CSP (Phase 4), Dubailand: Tilal Al Ghaf, and Sub-Sea Power Transmission Network among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Construction Projects reports