United Arab Emirates (UAE) Dairy and Soy Food Market Size and Trend Analysis by Categories and Segments, Distribution Channel, Packaging Formats, Market Share, Demographics, and Forecast, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

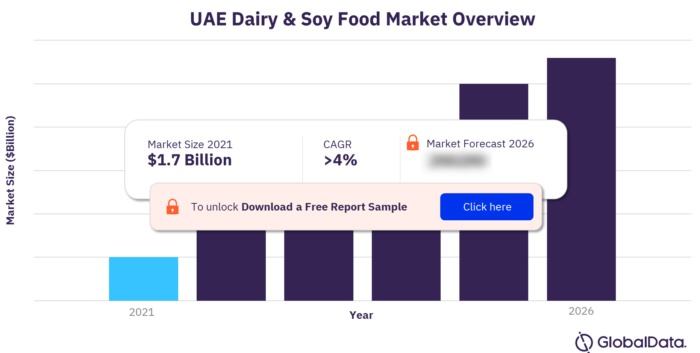

The UAE dairy & soy food market was valued at $1.7 billion in 2021 and is expected to grow at a CAGR of more than 4% during 2021-2026. In volume terms, the sector reached 533 million kg in 2021 and is expected to grow at a CAGR of more than 2% during the forecast period.

The UAE dairy & soy food market research report provides a comparative analysis of UAE’s value and volume shares in the Middle East and Africa and global dairy & soy food sector. It offers an overview of the growth at a sector level and analyzes the various categories and distribution channels. Additionally, the report analyzed leading companies in the UAE dairy & soy food sector in 2021.

To gain more information on the market forecast, download a free report sample

Top Cities of UAE Dairy and Soy Food Market

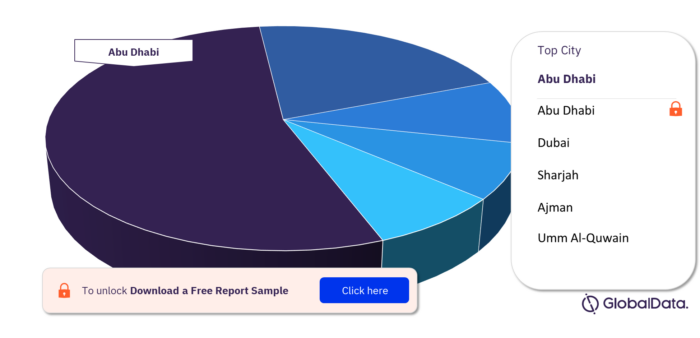

The top cities in the UAE dairy & soy sector are Abu Dhabi, Dubai, Sharjah, Ajman and Umm Al-Quwain. Abu Dhabi emerged as the largest dairy & soy market in UAE, followed by Dubai and Sharjah.

UAE Dairy and Soy Food Market, by City Analysis

For more insights on city analysis, download a free report sample

Key Categories of UAE Dairy and Soy Food Market

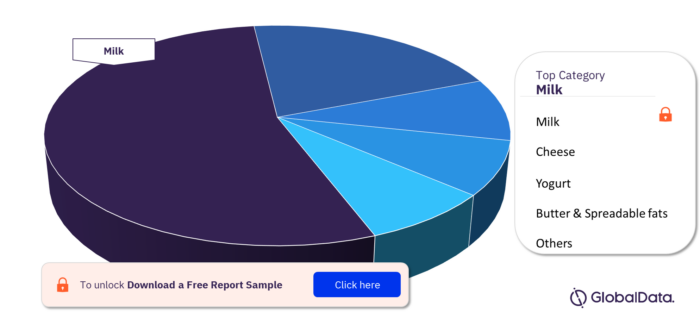

The UAE dairy & soy food market’s key categories are butter & spreadable fats, cheese, cream, dairy-based & soy-based desserts, drinkable yogurt, grain, nut, rice, seed milk alternatives, milk, soymilk & soy drinks and yogurt. Milk was the largest category, followed by cheese and yogurt. The grain, nut, rice and seed milk alternatives category is expected to gain the maximum market share in value terms during the forecast period.

UAE Dairy and Soy Food Market, by Categories

For more insights on categories, download a free report sample

Key Distribution Channel of UAE Dairy and Soy Food Market

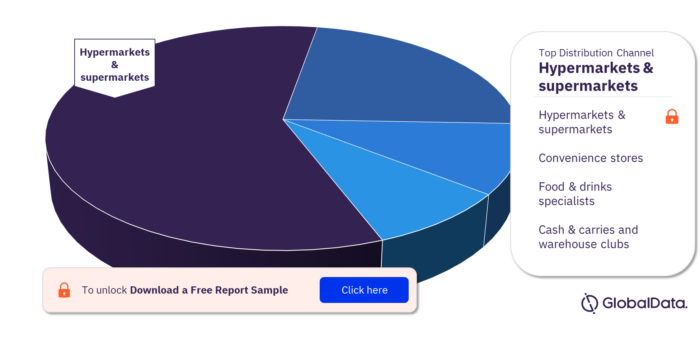

The key distribution channel in UAE’s dairy and soy food market are hypermarkets & supermarkets, food & drinks specialists, convenience stores, dollar stores, cash & carries and warehouse clubs, and e-retailers among others. Hypermarkets & supermarkets was the largest distribution channel in the UAE dairy & soy food sector.

UAE Dairy and Soy Food Market, by Distribution Channel

For more insights on distribution channel, download a free report sample

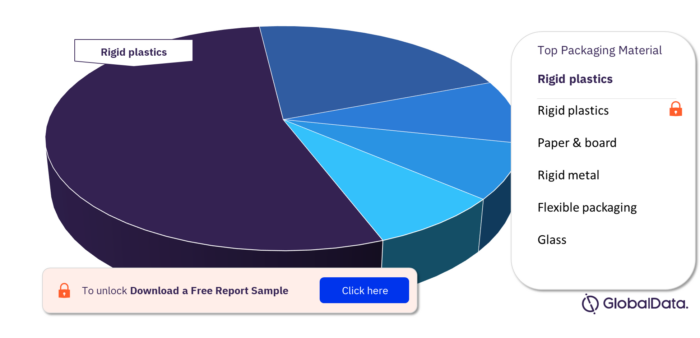

Packaging Analysis of UAE Dairy and Soy Food Market

The key packaging materials in the UAE dairy & soy food sector are rigid plastics, paper & board, rigid metal, flexible packaging and glass. Rigid plastics was the most used pack material in the UAE dairy & soy food sector, followed by paper & board and rigid metal.

UAE Dairy and Soy Food Market, by Packaging Material

For more insights on packaging material, download a free report sample

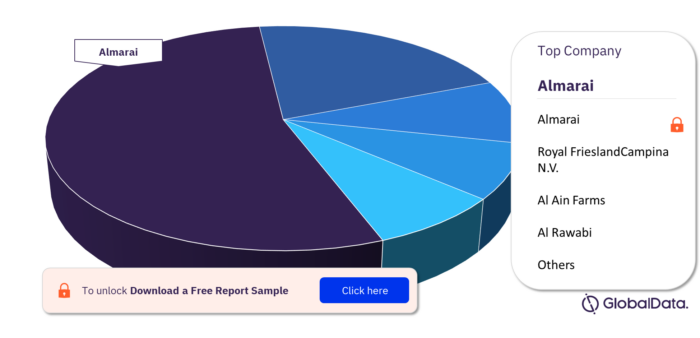

Key Companies of UAE Dairy and Soy Food Market

Some of the key companies in UAE’s dairy and soy food market are Almarai, Royal FrieslandCampina N.V., Al Ain Farms, Al Rawabi, and Arla among others.

UAE Dairy and Soy Food Market, by Key Companies

For more insights on key companies, download a free report sample

UAE Dairy and Soy Food Market - Overview

| Market Value (2021) | $1.7 billion |

| CAGR (2021-2026) | > 4% |

| Key Cities | Abu Dhabi, Dubai, Sharjah, Ajman and Umm Al-Quwain |

| Key Categories | Butter & Spreadable Fats, Cheese, Cream, Dairy-Based & Soy-Based Desserts, Drinkable Yogurt, Grain, Nut, Rice, Seed Milk Alternatives, Milk, Soymilk & Soy Drinks and Yogurt |

| Key Distribution Channel | Hypermarkets & Supermarkets, Food & Drinks Specialists, Convenience Stores, Dollar Stores, Cash & Carries and Warehouse Clubs, and E-Retailers |

| Key Packaging Material | Rigid Plastics, Paper & Board, Flexible Packaging, Rigid Metal and Glass |

| Key Companies | Almarai, Royal FrieslandCampina N.V., Al Ain Farms, Al Rawabi, and Arla |

Scope

- Per capita consumption of Dairy & soy was higher in UAE than the global level but lower than the regional level.

- Hypermarkets & supermarkets was the leading distribution channel in the UAE Dairy & soy sector

- Rigid plastics was the most used pack material in the UAE Dairy & soy sector, followed by paper & board

- “Older young adults” represent the largest subset of the Dairy & soy sector in UAE

Reasons to Buy

- Identify high potential categories and explore further market opportunities based on detailed value and volume analysis

- Existing and new players can analyze key distribution channels to identify and evaluate trends and opportunities

- Gain an understanding of the total competitive landscape based on detailed company share analysis to plan effective market positioning

- Our team of analysts have placed a significant emphasis on changes expected in the market that will provide a clear picture of the opportunities that can be tapped over the next five years, resulting in revenue expansion

- The packaging analysis report helps manufacturers, in identifying the most commonly used packaging materials in the sector

- Analysis on key macro-economic indicators such as real GDP, nominal GDP, consumer price index, household consumption expenditure, population (by age group, gender, rural-urban split, and employed people and unemployment rate. It also includes economic summary of the country along with labor market and demographic trends.

Royal FrieslandCampina N.V.

Al Ain Farms

Al Rawabi

Arla

Danone Group

Nestle

Gulf & Safa Dairies

Mondelez International, Inc

Yasar Holding A.S.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the market value of the UAE dairy and soy food market in 2021?

The UAE dairy and soy food market was valued at $1.7 billion in 2021.

-

What was the CAGR of the UAE dairy and soy food market during the forecast period 2021-2026?

The UAE dairy and soy food market was forecast to grow at a CAGR of more than 4% during the forecast period.

-

What are the key cities in the UAE dairy and soy food market?

The key cities in the UAE dairy & soy sector are Abu Dhabi, Dubai, Sharjah, Ajman and Umm Al-Quwain.

-

What are the key categories of the UAE dairy and soy food market?

The key categories of UAE dairy & soy food market are butter & spreadable fats, cheese, cream, dairy-based & soy-based desserts, drinkable yogurt, grain, nut, rice, seed milk alternatives, milk, soymilk & soy drinks and yogurt.

-

What are the key distribution channels of the UAE dairy and soy food market?

The key distribution channel in UAE’s dairy and soy food market are hypermarkets & supermarkets, food & drinks specialists, convenience stores, and cash & carries and warehouse clubs.

-

What are the key packaging materials used in the UAE dairy and soy food market?

The key packaging materials used in the UAE dairy and soy food market are flexible packaging, rigid plastics, paper & board, rigid metal and glass.

-

What are the key companies in the UAE dairy and soy food market?

Some of the key companies in the UAE dairy and soy food market are Almarai, Royal FrieslandCampina N.V., Al Ain Farms, Al Rawabi, and Arla.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.