Uganda Insurance Industry – Key Trends and Opportunities to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Uganda Insurance Market Report Overview

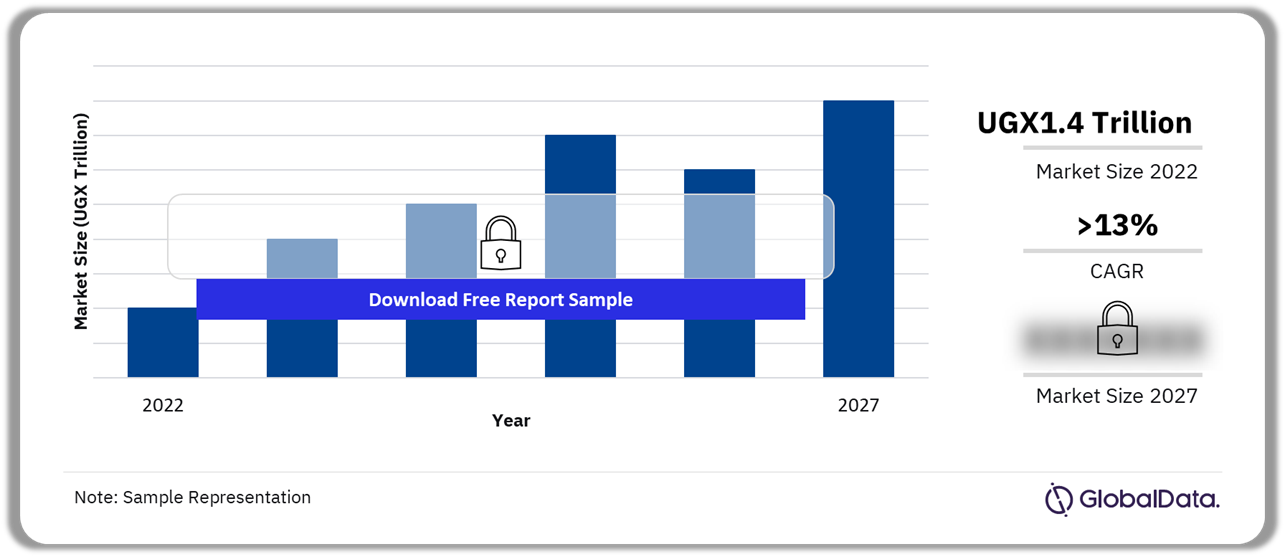

The gross written premium of the Uganda insurance market was UGX1.4 trillion ($380.2 million) in 2022. The market is expected to achieve a CAGR of more than 13% during 2023-2027. The Uganda insurance market report entails a comprehensive understanding of distribution channels operating in the segment and also gives a detailed account of the country’s economy and demographics. It further evaluates the competitive landscape, which includes information on segment dynamics, competitive advantages, and profiles of insurers operating in the country.

Uganda Insurance Market Outlook, 2022-2027 (UGX Trillion)

Buy the Full Report for More Insights into the Uganda Insurance Market Forecast

The report also encompasses particulars of insurance regulations and recent changes in the regulatory structure in Uganda.

| Market Size (2022) | UGX1.4 trillion ($380.2 million) |

| CAGR (2023-2027) | >13% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Segments | · Life Insurance

· General Insurance |

| Leading Companies | · Prudential Insurance

· ICEA · UAP · Sanlam General · Jubilee Insurance · Jubilee Health |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Uganda Insurance Market Trends

Some of the trends impacting the Uganda insurance market are the introduction of index insurance and health insurance with added features, and growing digitalization in the insurance industry.

For instance, in March 2023, Kenyan insurtech startup Turaco partnered with Airtel Money and Prudential and launched a low-cost hospital insurance product with funeral benefits. The Hospital Sente product aims to increase access to insurance for underserved communities as well as low-income individuals and families by distributing insurance via the popular Airtel Money platform. Underwritten by Prudential, the product offers cash payouts if the policyholder is hospitalized.

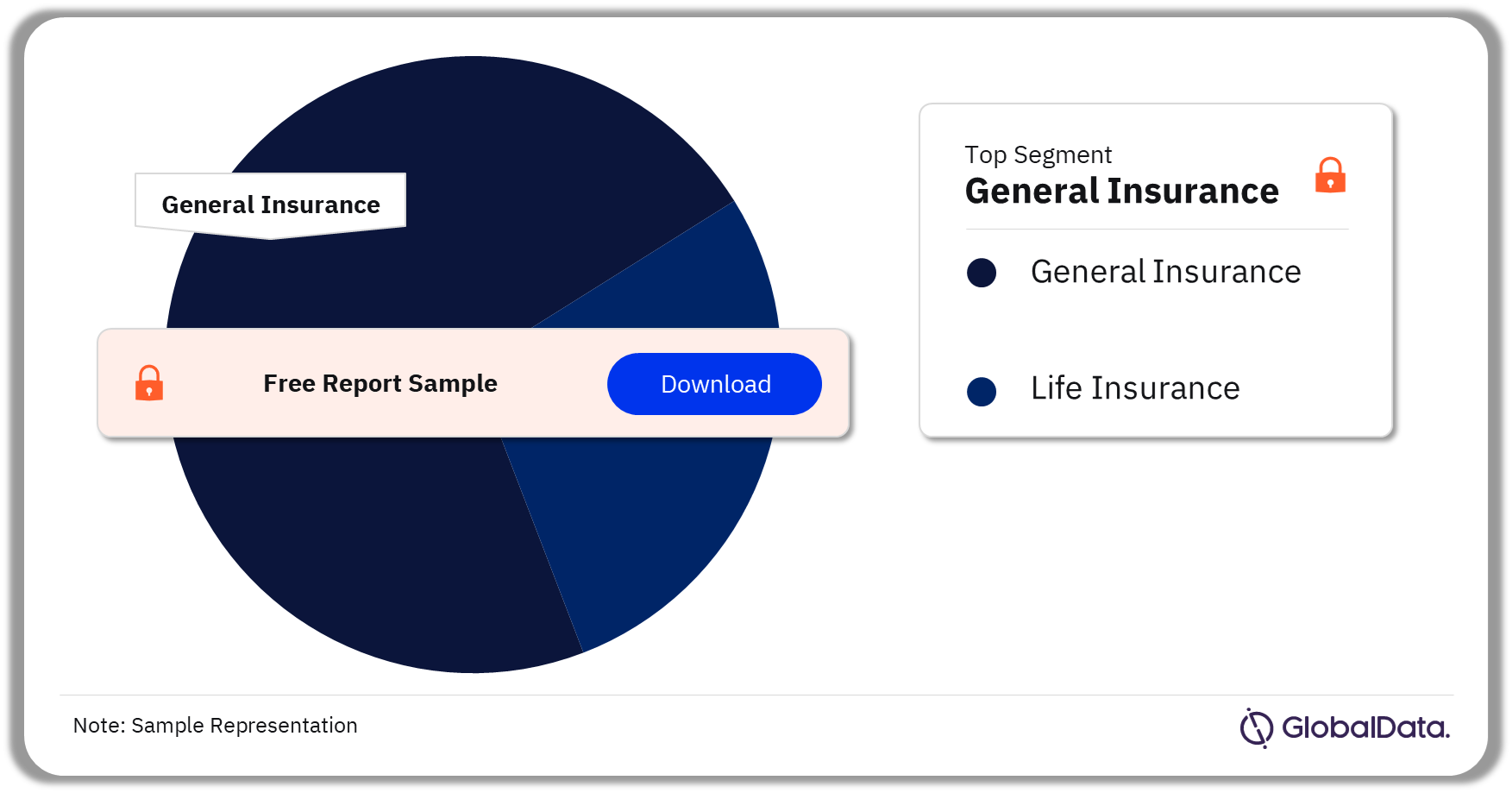

Uganda Insurance Market by Segments

The key segments in the Uganda insurance market are life insurance and general insurance. The general insurance segment dominated the Uganda insurance market in 2022. General insurance lines of business include property, motor, liability, financial lines, MAT, general insurance PA&H, and miscellaneous. Property insurance was the dominant line of business in 2022.

In 2022, the Uganda government increased funding for the National Health Insurance Scheme (NHIS) to improve the quality of services and expand the reach of the scheme. The NHIS is still in its early stages of development, but it has the potential to play a key role in improving the health of Ugandans. The scheme is helping to make healthcare more affordable and accessible, while also promoting preventive care and early detection of diseases.

Uganda Insurance Market Analysis by Segments, 2022 (%)

Buy the Full Report for More Segment Insights into the Uganda Insurance Market

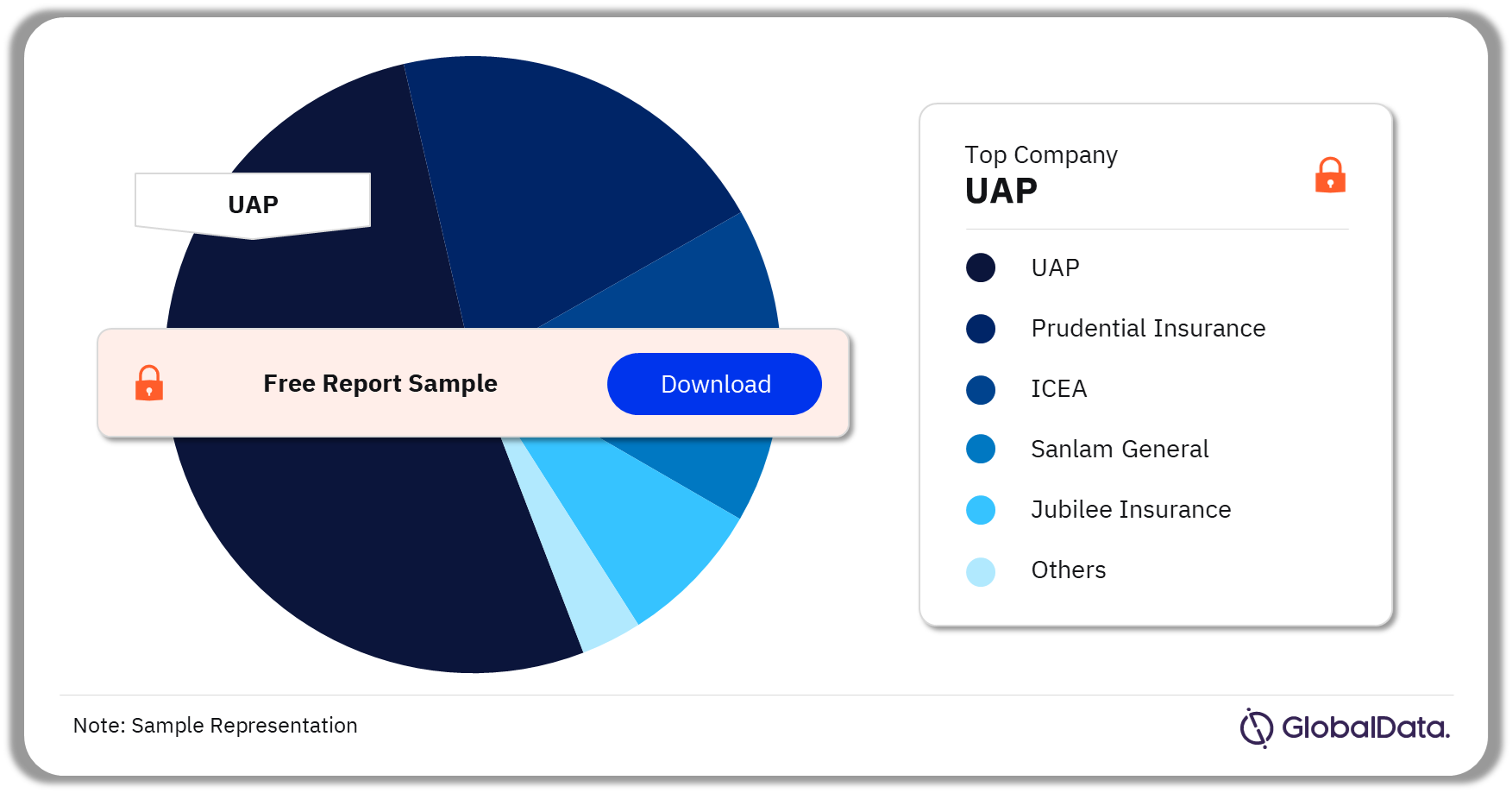

Uganda Insurance Market – Competitive Landscape

UAP was the largest insurer within the total industry in 2022

A few of the key companies in the Uganda insurance market are:

- Prudential Insurance

- ICEA

- UAP

- Sanlam General

- Jubilee Insurance

- Jubilee Health

Uganda Insurance Market Analysis by Companies, 2022(%)

Buy the Full Report for More Company Insights into the Uganda Insurance Market

Uganda Insurance Market – Latest Developments

- On May 25, 2023, the IRA issued a circular that stipulates guidance notes on outsourcing for (re)insurers, (re)insurance brokers, bancassurance, loss assessors, loss adjusters, risk advisors, and health management organizations.

- On May 8, 2023, the IRA issued a circular that stipulates guidelines on the implementation of targeted financial sanctions aimed at countering money laundering, terrorism financing, and proliferation financing.

Uganda Insurance Market Segments Outlook (Value, UGX Trillion, 2018-2027)

- Life Insurance

- General Insurance

Scope

This report provides:

- A comprehensive analysis of the Uganda insurance industry.

- Historical values for the Uganda insurance industry for the report’s review period and projected figures for the forecast period.

- Detailed analysis of the key categories in the Uganda insurance industry and market forecasts up to 2027.

- Profiles of top life insurance companies in Uganda and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of the Uganda insurance industry.

- A comprehensive overview of the Uganda economy, government initiatives, and investment opportunities.

- The Uganda insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- The Uganda insurance industry’s market structure gives details of lines of business.

- Uganda’s reinsurance business’s market structure gives details of premium ceded along with cession rates.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the Uganda insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Uganda insurance industry.

- Assess the competitive dynamics in the Uganda insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

Liberty Life

UAP

Jubilee Life Insurance

Sanlam

ICEA

Britam Insurance

Prudential Insurance

Table of Contents

Frequently asked questions

-

What was the Uganda insurance market gross written premium in 2022?

The gross written premium of the Uganda insurance market was UGX1.4 trillion ($380.2 million) in 2022.

-

What is the growth rate of the Uganda insurance market?

The insurance market in Uganda is expected to achieve a CAGR of more than 13% during 2023-2027.

-

Which segment dominated the Uganda insurance market in 2022?

The general insurance segment dominated the Uganda insurance market in 2022.

-

Who are the major companies operating in the Uganda insurance market?

A few of the key companies in the Uganda insurance market are Prudential Insurance, ICEA, UAP, Sanlam General, Jubilee Insurance, and Jubilee Health.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports