United Kingdom (UK) Back to School Retail Market – Analyzing Trends, Consumer Attitudes, Occasions and Key Players

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Back-to-School Retail Market Report Overview

Significant inflation across school uniform products forced consumers to spend more on back-to-school retail despite the best efforts of retailers. To deal with the situation, consumers have attempted to cut down their spending by purchasing secondhand items. This has been facilitated by a rise in secondhand sales and pop-up stores across the country, to help consumers battle the cost-of-living crisis. The increased popularity of sites such as Vinted has also supported secondhand sales as thousands of school uniform products have been listed on the app making it easy for parents to locate secondhand options for their children.

The United Kingdom (UK) Back-to-School Retail market research report offers a comprehensive insight into the consumer dynamics and spending habits of British consumers for back-to-school items. The report analyses the major players, the main trends, the key segments within the back-to-school retail market, and consumer attitudes.

| Key Segments | · Uniform

· Sportswear & Sports Equipment · Stationery · School Accessories · Books |

| Key Retailers | · ASDA

· Tesco · Marks & Spencer · WH Smith · Sainsbury’s |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Back-to-School Retail Market Trends

Retailers came up with both online and in-store strategies to promote their products.

- Marks & Spencer: Marks & Spencer’s put a three-year price lock on certain items since 2021 to entice consumers seeking low prices and the reputed quality of the retailer. Side displays with marks for children to measure their height were an addition to keep shoppers entertained, as well as a potential nudge to shoppers to purchase multiple sizes of items.

- Sports Direct: Sports Direct’s focus for its back-to-school sale included several different product categories, with uniform and school shoes being prominently displayed on the homepage. The retailer’s affordable prices on sportswear brands’ accessories, clothing, and footwear ensure the retailer appeals to older children and teens. Having easy access to pages dedicated to specific age ranges and genders also makes navigating the website easy and less time-consuming for shoppers.

Buy Full Report for More Trend Insights into the UK Back-to-School Retail Market

UK Back-to-School Retail Market by Segments

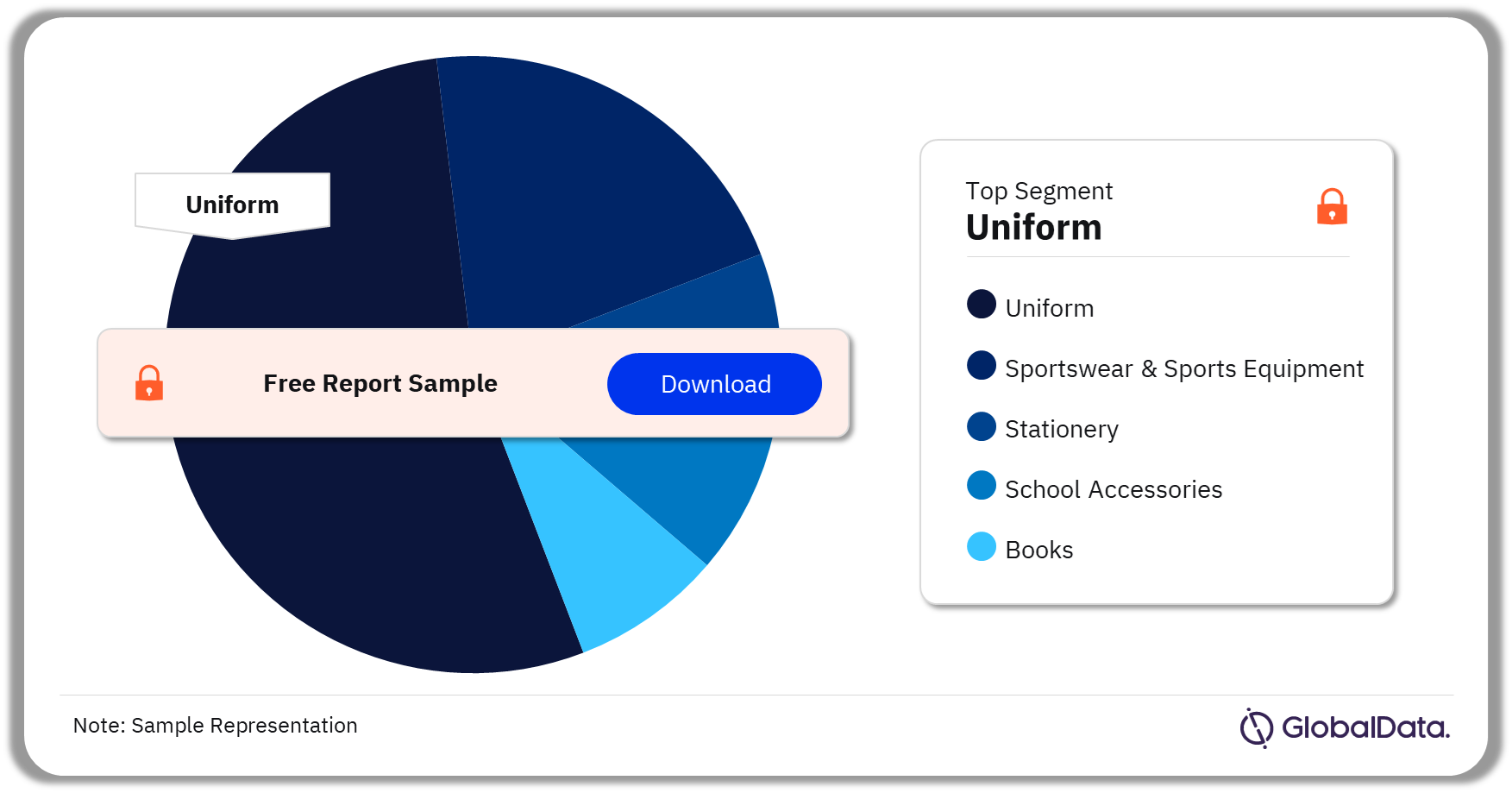

The uniform segment had the highest percentage share in 2023.

The key segments in the UK back-to-school retail market are uniforms, sportswear & sports equipment, stationery, school accessories, and books.

Uniforms: This segment is further divided into trousers, dresses & skirts, shirts & blouses, underwear, blazers & jackets, sweaters, footwear, and accessories. ASDA is the most preferred retailer when shopping for uniforms, followed by Tesco. High street, town center, or in-town shopping center is the preferred channel while purchasing back-to-school uniforms. The top preferred store type for buying uniforms is supermarkets. Moreover, the most preferred device is mobile.

Sportswear & Sports Equipment: This segment is further divided into sportswear, sports footwear, and sports equipment. Sports Direct is the most preferred retailer and high street, town center, or in-town shopping center is the preferred channel for purchasing back-to-school sportswear and equipment. In 2023, the top preferred store type is supermarket, and the most preferred device is mobile.

UK Back-to-School Retail Market Analysis by Segments, 2023 (%)

Buy Full Report for More Segment Insights into the UK Back-to-School Retail Market

UK Back-to-School Retail Market - Competitive Landscape

Some of the key retailers in the UK back-to-school retail market are:

- ASDA

- Tesco

- Marks & Spencer

- WH Smith

- Sainsbury’s

UK Back-to-School Retail Market Analysis by Retailers

Buy Full Report for More Retailer Insights into the UK Back-to-School Retail Market

Segments Covered in the Report

UK Back-to-School Retail Market Segments Outlook (2023)

- Uniform

- Sportswear & Sports Equipment

- Stationery

- School Accessories

- Books

Key Highlights

- High street channel usage for uniform and stationery purchases was down last year, while online channel usage for all categories except books was up. This was likely due to the ability to check for the best offers at multiple retailers easily.

- In 2023, Tesco retained the top spot in retailer rankings among the grocers in terms of range, quality, and display for back-to-school products, while ASDA remained the highest rated for price and narrowly gained first place for its interesting products.

- While a third of consumers stated they spent slightly more on back-to-school than last year, consumers did attempt to cut down their spending by purchasing second-hand items.

Reasons to Buy

- Use our in-depth consumer insight to learn which back-to-school categories are shopped the most by consumers, to adapt back-to-school ranges to current trends.

- Understand what drives consumers to use a retailer for their purchases, such as convenience, value for money, and delivery options, in order to maximize sales potential.

- Use our average spend data to understand how much consumers are prepared to pay in each back-to-school category and which categories consumers are most willing to invest in higher priced items.

Aldi

Amazon

Argos

ASDA

B&M

Blackwells

Boots

Claire's Accessories

Clarks

Co-op

Deichmann

DirectSchoolwear.co.uk

H&M

Home Bargains

JD Sports

John Lewis & Partners

Lidl

Marks & Spencer

Matalan

Morrisons

Next

Nike

Paperchase

Poundland

Primark

Ryman

Sainsbury's

School Uniform Direct

SchoolUniformShop.co.uk

Smiggle

Sports Direct

Staples

Superdrug

Tesco

The Book Depository

The Works

Uniform4Kids

Waitrose & Partners

Waterstones

WH Smith

Wilko

Wynsors

Yourschooluniform.com

Table of Contents

Table

Figures

Frequently asked questions

-

What are the key segments in the UK back-to-school retail market?

The key segments in the UK back-to-school retail market are uniforms, sportswear & sports equipment, stationery, school accessories, and books.

-

Which is the leading segment in the UK back-to-school retail market in 2023?

The uniform segment has the highest percentage share in the UK back-to-school retail market in 2023.

-

Who are the key retailers in the UK back-to-school retail market?

Some of the key retailers in the UK back-to-school retail market are ASDA, Tesco, Marks & Spencer, WH Smith, and Sainsbury’s.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.