United Kingdom (UK) Extended Warranty Insurance Market Size, Trends, Competitor Dynamics and Opportunities

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Extended Warranty Insurance Market Overview

The estimated UK extended warranty market reached 8.6 million policies in 2022. As restrictions related to the COVID-19 pandemic caused people to work from home, the value of electrical sales increased by more than 6% in 2021.

UK extended warranty insurance market research report analyzes the UK extended warranty insurance market, looking at drivers of uptake for both electrical and motor extended warranties. The report goes on to discuss the distribution landscape in 2022, as well as the claims landscape. Incumbent competitors are analyzed, along with their key partnerships. Future impactors on the market – including the cost-of-living crisis, smart home devices, and the changing working environment – are also examined.

| No of policies (2022) | 8.6 million policies |

| Key Extended Warranty Products | · White Goods

· Consumer Electronics · Motor · Small Appliances

|

| Key Distribution Channels | · Direct

· Retailer · Broker · Bank

|

| Key Purchase Methods | · Bought By Post

· Face To Face · Through The Retailers App · Online (Smartphone/Tablet) · Online (Pc/Laptop) · Telephone

|

| Key Electrical Retailers | · Currys

· Amazon · Argos, · John Lewis & Partners · Apple · AO · The Very Group · Tesco · Appliances Direct · Euronics |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

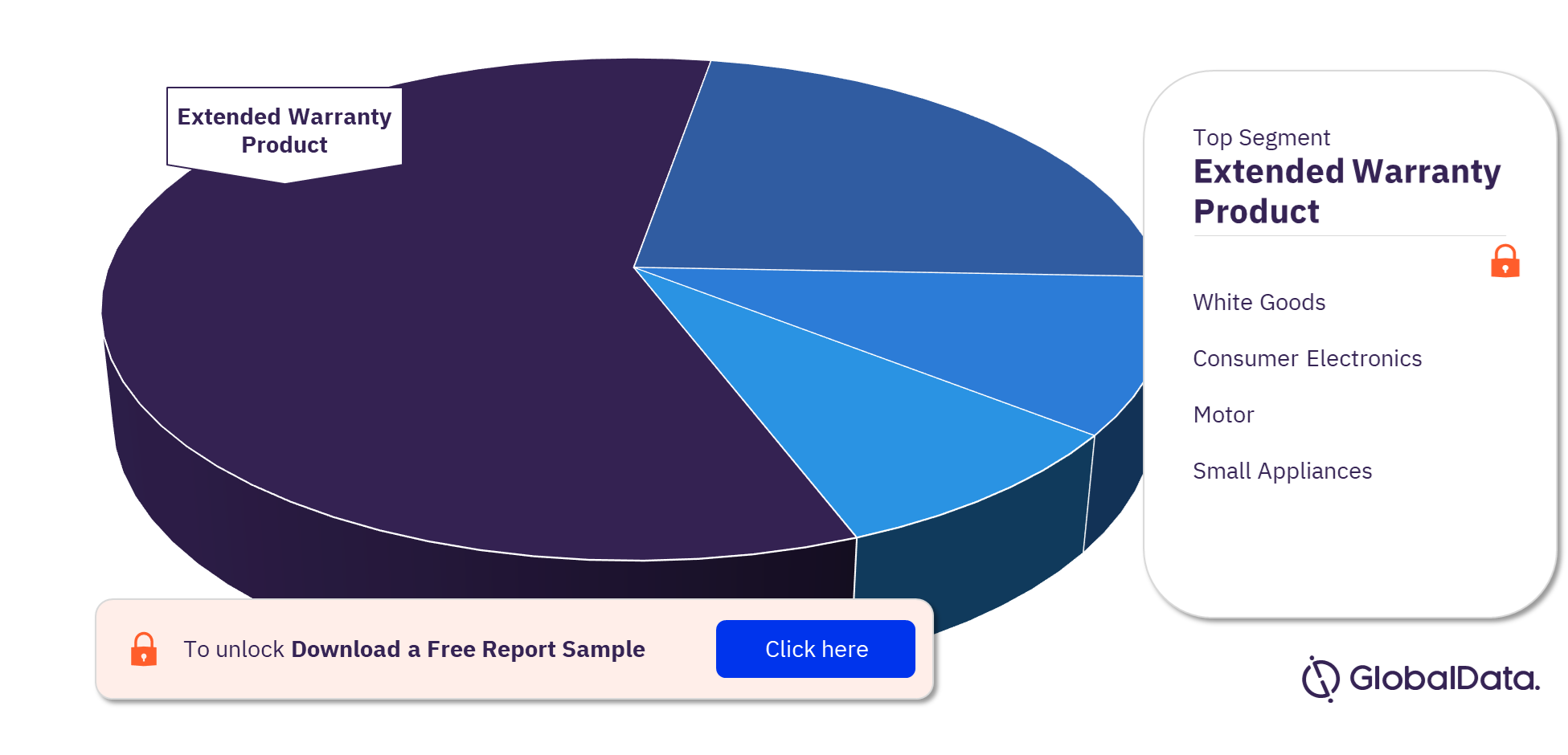

The UK Extended Warranty Insurance Market, Segmentation by Extended Warranty Products

The key extended warranty products in the UK extended warranty insurance market are white goods, consumer electronics, motor, and small appliances. White goods has the highest share in the UK extended warranty insurance market in 2022.

The UK Extended Warranty Insurance Market, by Extended Warranty Products (%)

For insights on the UK extended warranty products, download a free report sample

The UK Extended Warranty Insurance Market, Segmentation by Distribution Channels

The key distribution channels in the UK extended warranty insurance market are direct, retailer, broker, and bank. Together, the direct channel and the retail channel accounted for more than 86% of the distribution of extended warranty insurance in 2021. Traditionally it has been easier to sell policies through retailers as this is done at the POS, which means consumers do not need to search for the product and can have the importance of extended warranty explained to them. Yet the direct channel has managed to remain competitive. This could be a result of consumers looking for more affordable options that perhaps include more specialized cover suited to their needs, as well as the reputation of the insurer.

The UK Extended Warranty Insurance Market, by Distribution Channels (%)

For insights on the key distribution channels, download a free report sample

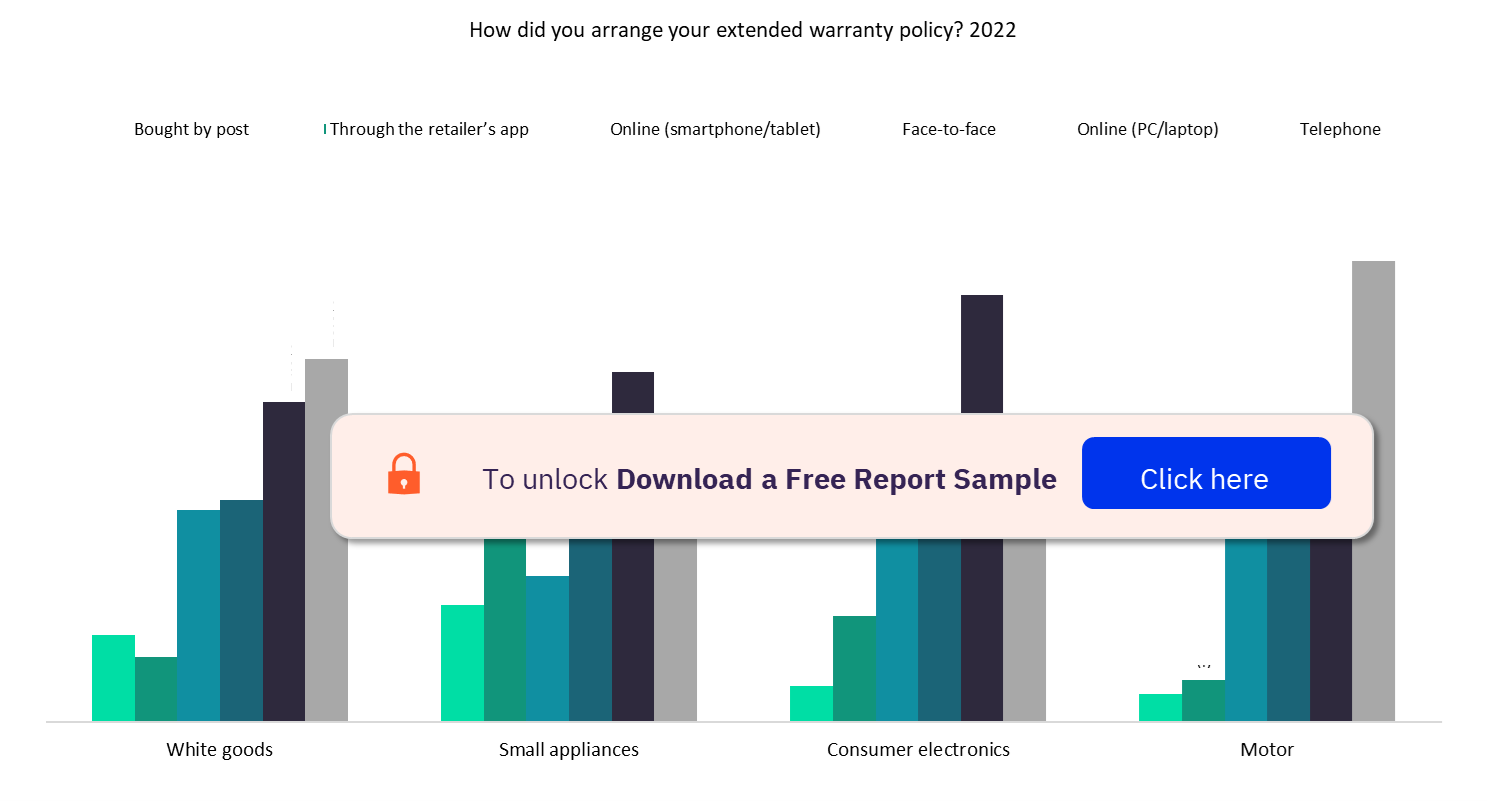

The UK Extended Warranty Insurance Market, Segmentation by Purchase Methods

The key purchase methods in the UK extended warranty insurance market are bought by post, face to face, through the retailers app, online (smartphone/tablet), online (PC/laptop), and telephone. Many consumers have turned to online purchasing methods for their insurance needs, with more than 49% of policies purchased through PCs, laptops, smartphones, tablets, or apps in 2022.

The UK Extended Warranty Insurance Market, by Purchase Methods (%)

For insights on the key purchase methods, download a free report sample

The UK Extended Warranty Insurance Market, Competitor Analysis

Currys, Amazon, Argos, John Lewis & Partners, Apple, AO, The Very Group, Tesco, Appliances Direct, and Euronics are some of the key electrical retailers in the UK extended warranty insurance market. Currys remained the top electricals retailer in the market with an 18.8% share of revenue in 2022.

Segments Covered in the Report

The UK Extended Warranty Insurance Market Outlook, by Extended Warranty Products

- White Goods

- Consumer Electronics

- Motor

- Small Appliances

The UK Extended Warranty Insurance Market Outlook, by Distribution Channel

- Direct

- Retailer

- Broker

- Bank

The UK Extended Warranty Insurance Market Outlook by Purchase Methods

- Bought By Post

- Face To Face

- Through The Retailers App

- Online (Smartphone/Tablet)

- Online (Pc/Laptop)

- Telephone

Scope

• In 2022e, the number of policies in the UK extended warranty market stood at 8.6 million for all products.

• GlobalData’s 2022 UK Insurance Consumer Survey found that 33%, 38.6%, 25%, and 20.7% of people filed an extended warranty claim for white goods, small appliances, consumer electronics, and motor respectively in 2022.

• Retailers are the most popular channel for electrical products, whereas individuals purchasing extended warranty for motor favor insurers. The majority of purchases are completed online via PC/laptop or smartphone/tablet.

Reasons to Buy

- Analyze growth drivers within the UK extended warranty market.

- Determine areas of concern for insurers and the wider market, including within the claims landscape.

- Recognize the impact of the cost-of-living crisis and inflation on the market.

- Discover the leading players with the extended warranty insurance segment.

- Examine future opportunities and challenges within this space.

Kia

Toyota

Curry’s

Domestic & General

Bosch

Argos

MediaMarkt

Amazon

Apple

John Lewis & Partners

AO

The Very Group

Tesco

Appliances Direct

Euronics

Currys Group Limited

Assurant

AIG

Tesco underwriting

MB&G Limited

LHV Kindlustus

RAC

Table of Contents

Table

Figures

Frequently asked questions

-

What was the number of the UK extended warranty market policies in 2022?

The estimated UK extended warranty market reached 8.6 million policies in 2022.

-

Which was the leading extended warranty product in the UK extended warranty market?

White goods have the highest share in the UK extended warranty insurance market in 2022.

-

Which were the leading distribution channels in the UK extended warranty market?

Together, the direct channel and the retail channel accounted for more than 86% of the distribution of extended warranty insurance in 2021.

-

Which are the key purchase methods in the UK extended warranty market?

The key purchase methods in the UK extended warranty insurance market are bought by post, face to face, through the retailers’ app, online (smartphone/tablet), online (PC/laptop), and telephone.

-

Which are the leading electrical retailers in the UK extended warranty market?

Currys, Amazon, Argos, John Lewis & Partners, Apple, AO, The Very Group, Tesco, Appliances Direct, and Euronics are some of the key electrical retailers in the UK extended warranty insurance market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Motor reports