United Kingdom (UK) Food and Grocery Retailing Market Size, Trends, Consumer Attitudes and Key Players to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Uk Food And Grocery Retail Market Overview

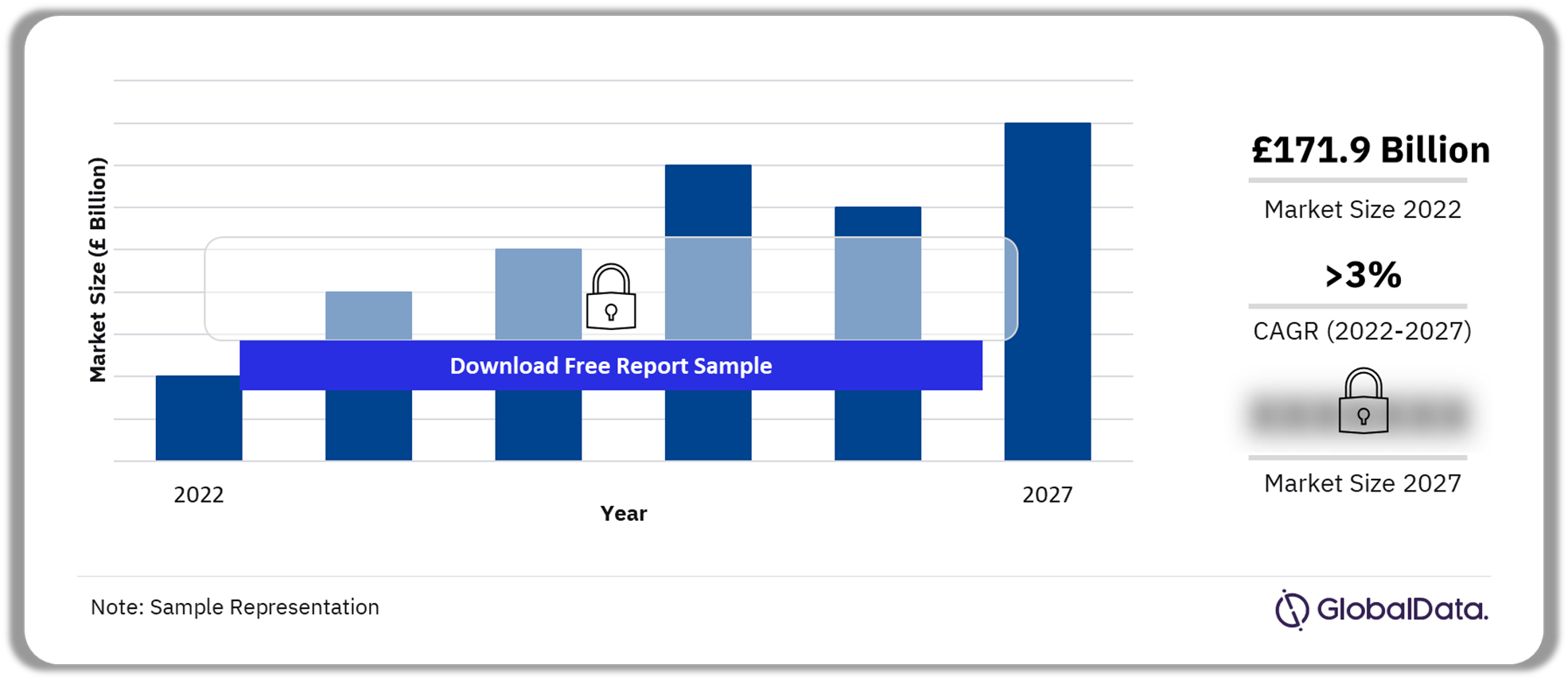

The UK food & grocery retailing market is forecast to rise to £171.9 billion in 2023. The market is anticipated to grow at a CAGR of more than 3% from 2022 to 2027. With inflation remaining high throughout 2023, growth prospects for the sector are strong. Additionally, online growth is anticipated to bolster total food & grocery sales into 2027 as online sales are expected to accelerate from 2024.

UK Food & Grocery Retailing Market Outlook 2022-2027 (£ Billion)

Buy the Full Report for More Insights on the UK Food and Grocery Retailing Market, Download Our Free Report Sample

The UK food & grocery retailing market report offers a comprehensive insight into the food & grocery market in the UK, analyzing the sector, the major players, the main trends, and consumer attitudes, as well as providing market forecasts out to 2027.

| Market Size (2023) | £171.9 billion |

| CAGR (2022-2027) | >3% |

| Key Categories | · Food

· Tobacco and E-cigarettes · Alcoholic Drinks · Soft Drinks · Household Products · Hot Drinks |

| Key Distribution Channels | · Hypermarkets, Supermarkets and Hard Discounters

· Convenience Stores and Gas Stations · Food and Drink Specialists · Other Online Retail |

| Key brands | · Tesco

· Sainsbury’s · ASDA · Aldi · Morrisons · Lidl · Co-op · Marks & Spencer · Waitrose & Partners · Iceland |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

United Kingdom Food & Grocery Retailing Market – Key Trends

Sustainability, loyalty schemes, customer-facing technology, and inflation are some of the trends impacting the UK food & grocery retailing market.

Inflation: High inflation drives consumers to seek out the best value for money when shopping for food & groceries. Inflation has been the most influential factor in the growth of the UK food & grocery market since it rose to double digits for the first time in July 2022. To save money, many consumers have opted to purchase cheaper products from the same retailer.

Loyalty Schemes: Supermarket loyalty schemes providing members’ discounts have become more prevalent as a means of cutting prices in line with discounters. Loyalty schemes that offer exclusive discounts to members, such as Tesco’s Clubcard Prices and Sainsbury’s Nectar Prices, is one such tool being deployed by the Big Four and other grocers that has allowed them to match discounter prices and retain customers. Another way that retailers have been adapting their loyalty schemes to appeal to consumers is via gamification. For example, ASDA’s scheme encourages customers to complete missions and purchase ‘star’ products to gain discounts and money towards future shops.

Buy the Full Report for Additional Information on the Key UK Food & Grocery Retailing Market Trends, Download the Free Sample Report

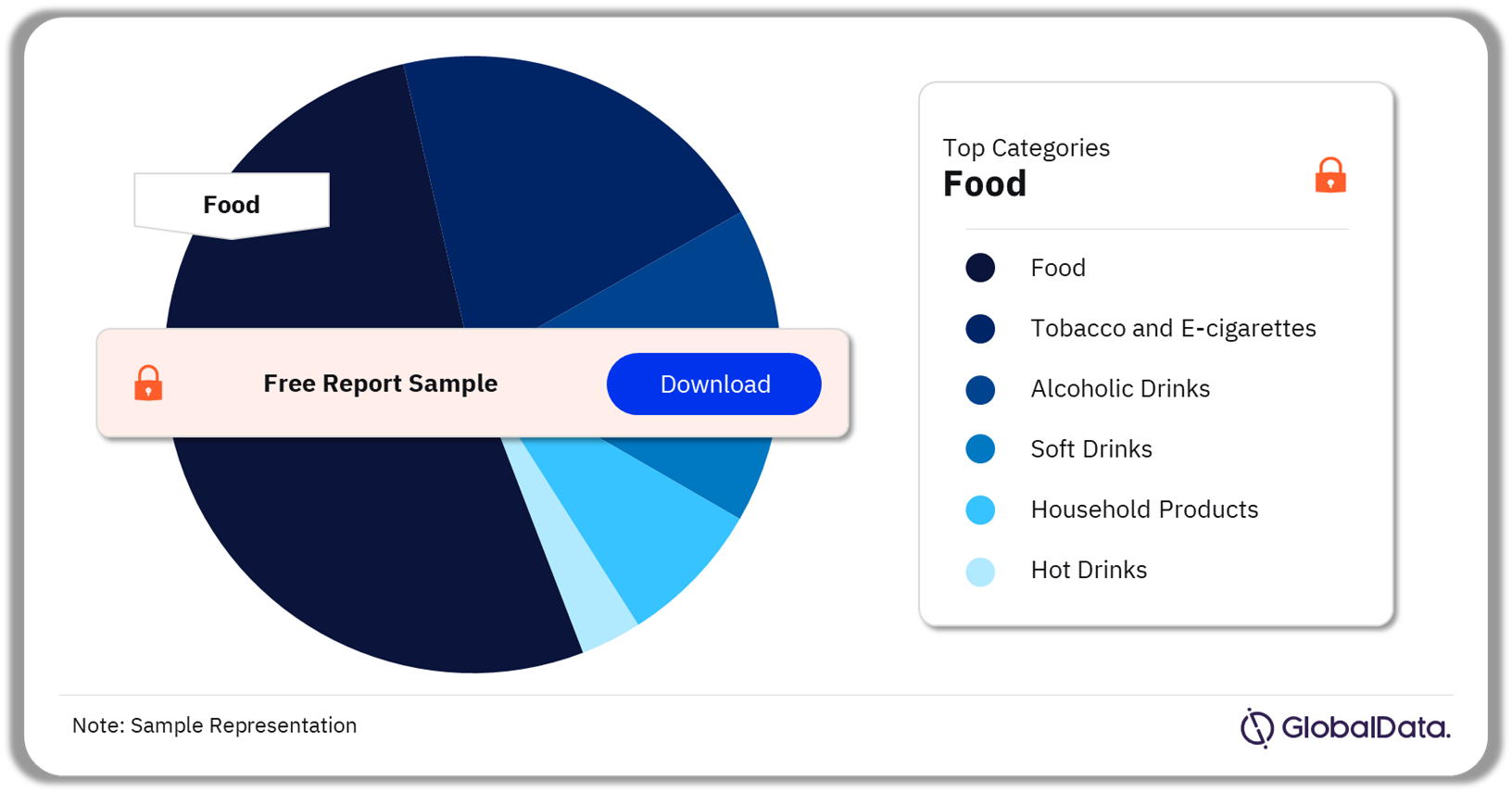

United Kingdom Food and Grocery Retailing Market Segmentation by Categories

The key categories of the UK food and grocery retailing market are food, alcoholic drinks, tobacco & e-cigarettes, soft drinks, household products, and hot drinks. In 2022, the food category dominated the UK food & grocery retailing market share. The category is expected to hold the largest share by the end of the forecast period.

UK Food & Grocery Retailing Market Analysis by Key Categories, 2022 (%)

Buy the Full Report for More Category-Wise Insights on the UK Food & Grocery Retailing Market, Download Our Free Report Sample

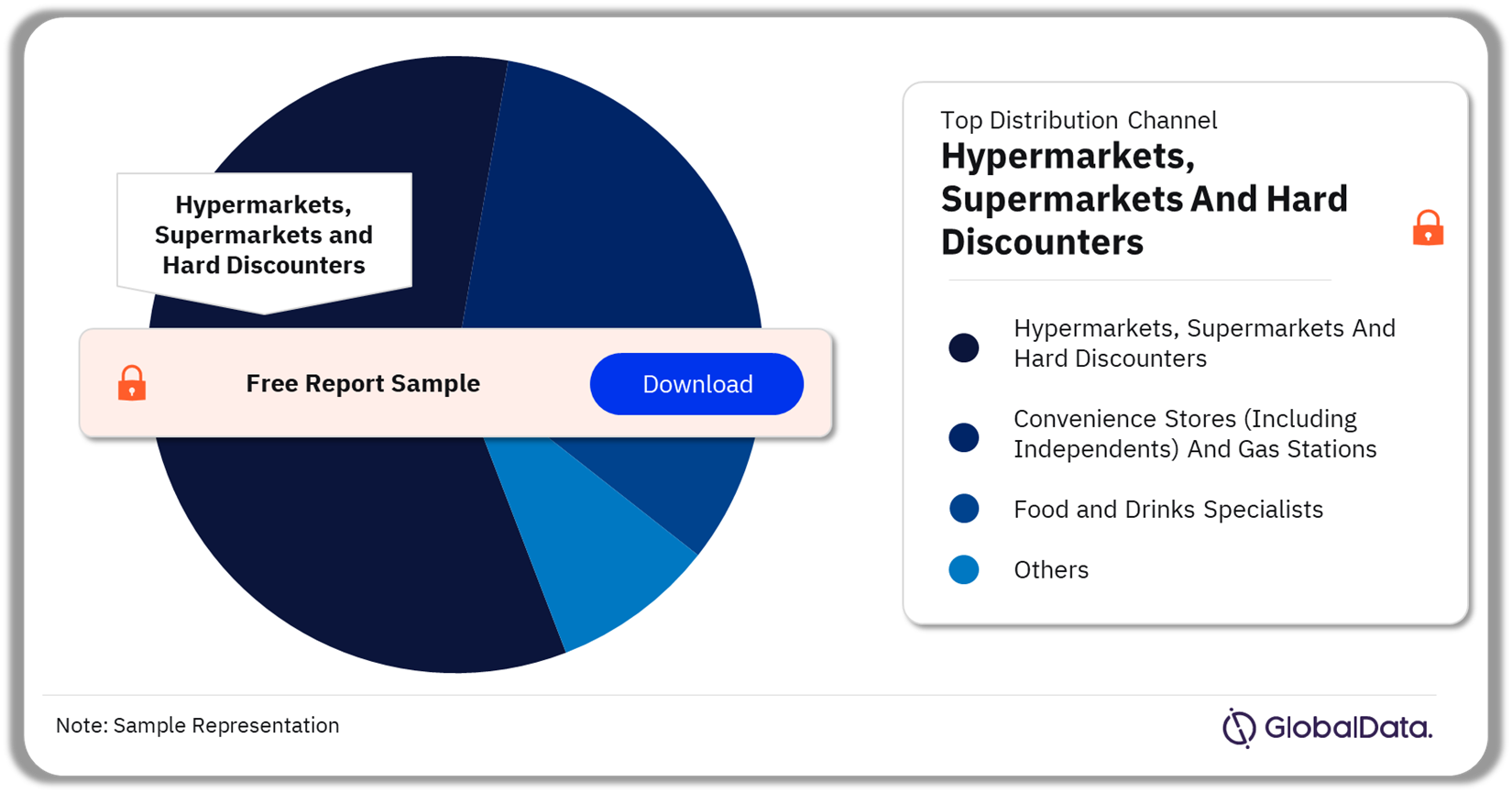

UK Food & Grocery Retailing Market Segmentation by Channels

The key distribution channels of the UK food & grocery retailing market are hypermarkets, supermarkets and hard discounters, convenience stores and gas stations, and food and drink specialists among others. Hypermarkets, supermarkets, and hard discounters dominated the market in 2022 and are expected to continue doing so during the forecast period.

UK Food & Grocery Retailing Market Analysis by Key Distribution Channel, 2022 (%)

Buy the Full Report for More Channel-Wise Insights on the UK Food & Grocery Retailing Market, Download Our Free Report Sample

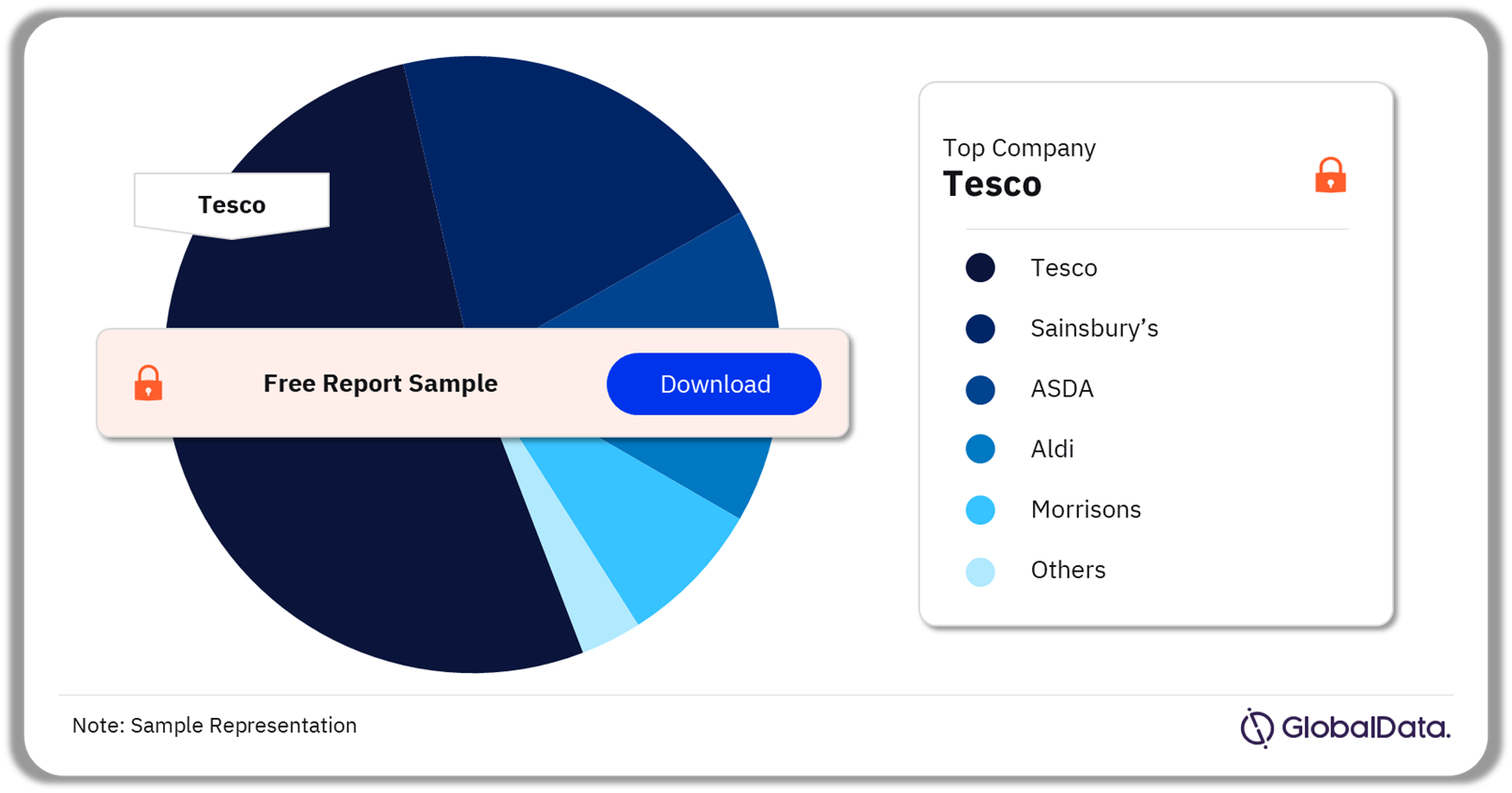

UK Food & Grocery Retailing Market – Competitive Landscape

The leading players in the UK food & grocery retailing market are Tesco, Sainsbury’s, ASDA, Aldi, Morrisons, Lidl, Co-op, Marks & Spencer, Waitrose & Partners, and Iceland among others.

UK Food & Grocery Retailing Market Analysis by Companies, 2022 (%)

Buy the Full Report for More Company-Wise Insights on the UK Food & Grocery Retailing Market, Download Our Free Report Sample

Segments Covered in this Report

UK Food & Grocery Retailing Category Outlook (£ Billion, 2017-2027)

- Food

- Tobacco and E-cigarettes

- Alcoholic Drinks

- Soft Drinks

- Household Products

- Hot Drinks

UK Food & Grocery Retailing Distribution Channel Outlook (£ Billion, 2017-2027)

- Hypermarkets, Supermarkets and Hard Discounters

- Convenience Stores and Gas Stations

- Food and Drink Specialists

- Other Online Retail

Key Highlights

The online UK food & grocery market declined 12.0% in 2022 to £20.0bn against strong comparative sales in 2020 and 2021. The outlook for the online food & grocery market is limited in 2023, with online growth forecast to remain broadly flat versus the previous year as consumers trade down to discounters operating predominantly in the offline channel and the added expense of online shopping will lead to a fall in demand for online orders.

Despite food inflation having reached a peak of 19.2% in March 2023, a decline in the rate of inflation has been slower to materialize than previously expected. Value for money, price and quality are the most significant drivers for those purchasing food & groceries.

Aldi and Lidl are expected to see the most significant increase in market share this year as the discounters continue to gain new customers who are trading away from traditional supermarkets to save money on their food & grocery bills.

Reasons to Buy

- Using our five-year forecasts to 2027, learn which subcategories in the food & grocery market will be the fastest performing to enable focus and investment in these winning product areas.

- Understand how drivers of food & grocery purchases, such as range, price, and quality, vary in importance among different demographics to maximize sales potential.

- Use our in-depth analysis of the challenges faced by key retailers in the sector to understand how to steal shoppers and market share.

Amazon

ASDA

B&M

Co-op

Costco

Deliveroo

Discount Dragon

Farmfoods

Getir

Heron Foods

Home Bargains

Iceland

Lidl

Marks & Spencer

Morrisons

Nisa

Ocado

One Stop

Poundland

Premier

Sainsbury's

Spar

Tesco

Uber Eats

Waitrose & Partners

Zapp

Table of Contents

Table

Figures

Frequently asked questions

-

What is the UK food & grocery retailing market size in 2023?

The UK food & grocery retailing market size in 2023 is £171.9bn.

-

What is the UK food & grocery retailing market growth rate?

The UK food & grocery retailing market is expected to grow at a CAGR of more than 3% during 2022-2027.

-

What are the key categories of the UK food & grocery retailing market?

The key categories of the UK food & grocery retailing market are food, alcoholic drinks, tobacco & e-cigarettes, soft drinks, household products, and hot drinks.

-

What are the key distribution channels of the UK food & grocery retailing market?

The key distribution channels of the UK food & grocery retailing market are hypermarkets, supermarkets and hard discounters, convenience stores and gas stations, and food and drink specialists among others.

-

Which are the leading players in the UK food & grocery retailing market?

The leading players in the UK food & grocery retailing market are Tesco, Sainsbury’s, ASDA, Aldi, Morrisons, Lidl, Co-op, Marks & Spencer, Waitrose & Partners, and Iceland among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.