UK Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Life Insurance Market Report Overview

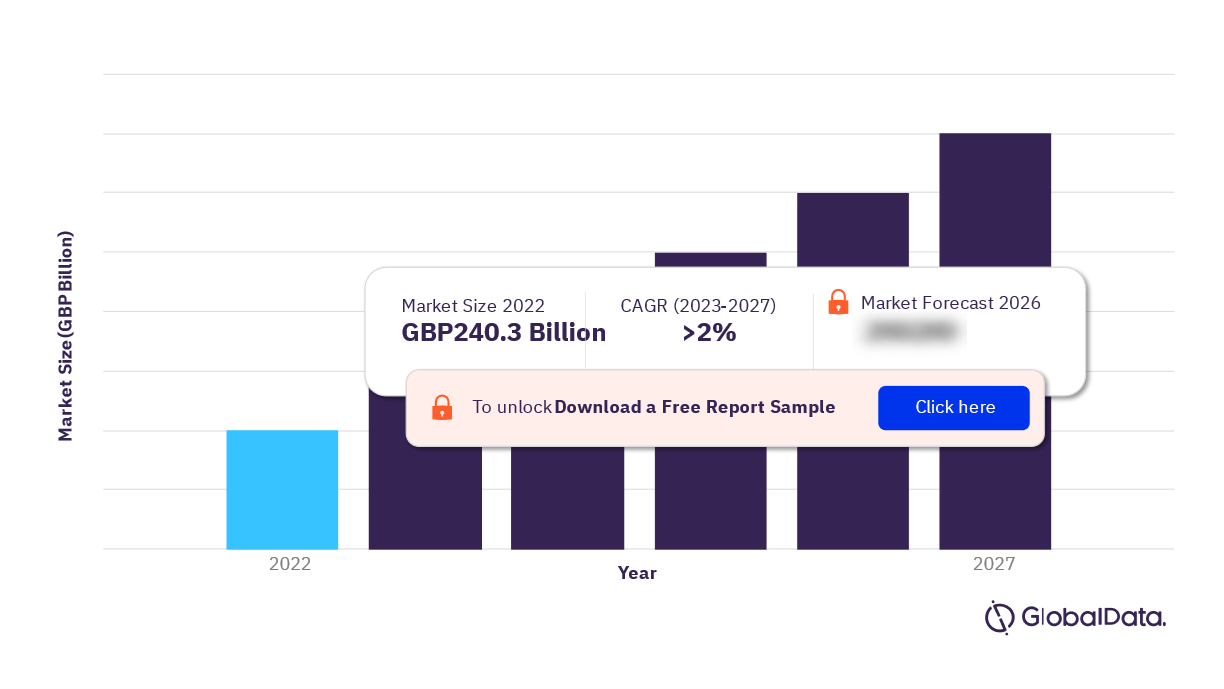

The gross written premium of the UK life insurance market was GBP240.3 billion ($298.7 billion) in 2022 and is expected to achieve a CAGR of more than 2% during 2023-2027. The UK life insurance market research report provides in-depth market analysis, information, insights, and a detailed outlook by product category for UK’s life insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded & cession rates during the review period and forecast period.

UK Life Insurance Market Outlook, 2022-2027 (GBP Billion)

To gain more information about the UK life insurance market forecast, download a free report sample

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the UK’s economy and demographics, and provides detailed information on the competitive landscape in the country. It also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | GBP240.3 billion ($298.7 billion) |

| CAGR | >2% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Lines of Business | Pension, General Annuity, Endowment, Term Life, Life PA&H, and Other Life Insurance |

| Key Distribution Channel | Agencies, Direct Marketing, and Other Distribution Channels |

| Leading Companies | Legal and General Assurance (Pensions Management), Aviva Life & Pension and Legal, General Assurance Society Limited, Scottish Widows Limited (United Kingdom), and The Royal London Mutual Insurance Society Limited |

UK Life Insurance Market Trends

LGBTQ life insurance, ESG, and inflation rates/cost-of-living crisis are some of the key trends impacting the UK life insurance market.

The environmental, social, and governance (ESG) theme has vastly increased in importance in various industries—especially insurance—and it is significantly influencing how insurers operate. Due to rising activism, shareholder pressures, increased regulatory monitoring, and customer interest in the ESG standards of the companies they buy from, insurance companies have strengthened their ESG commitments in recent years. Businesses may benefit financially from adopting ESG into investment and underwriting strategies because research indicates that organizations with good ESG practices may perform better financially in the long run. Overall, as insurers in the UK negotiate the numerous opportunities and difficulties posed by climate change and sustainable finance, ESG has grown to be a critical factor.

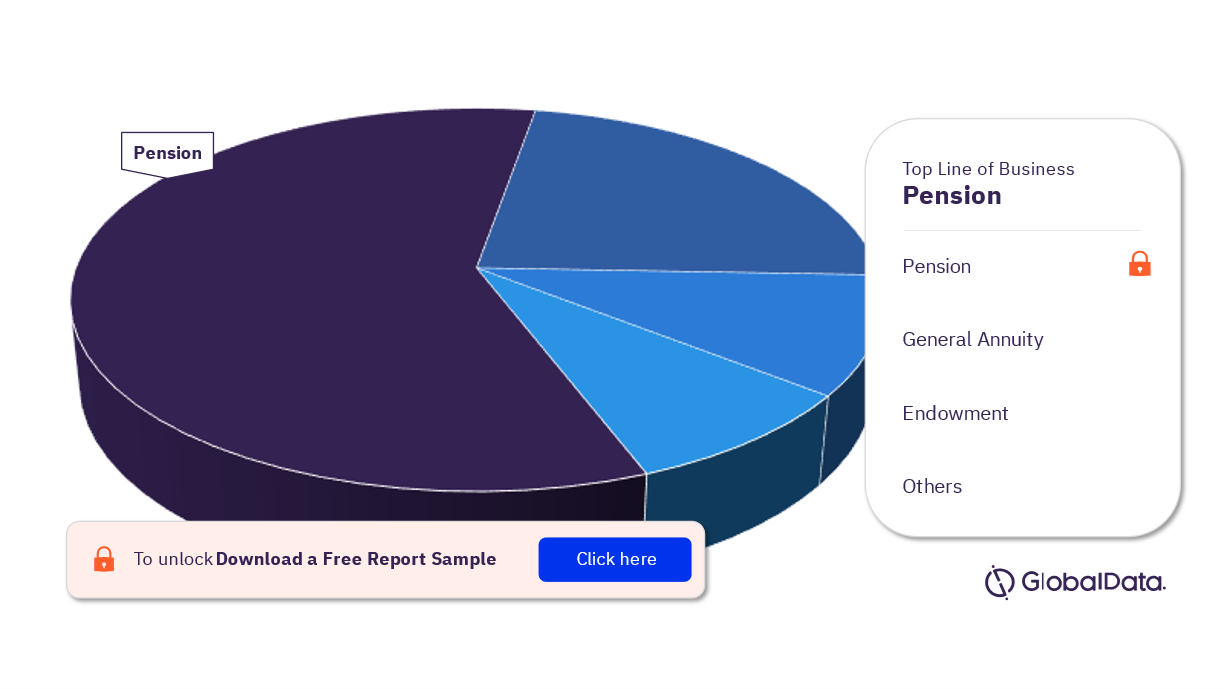

UK Life Insurance Market Segmentation by Lines of Business

The key lines of business in the UK life insurance industry are pension, general annuity, endowment, term life, life PA&H, and other life insurance. Pension is the leading life insurance line of business.

UK Life Insurance Market Analysis by Lines of Business, 2022 (%)

For more lines of business insights into the UK life insurance market, download a free report sample

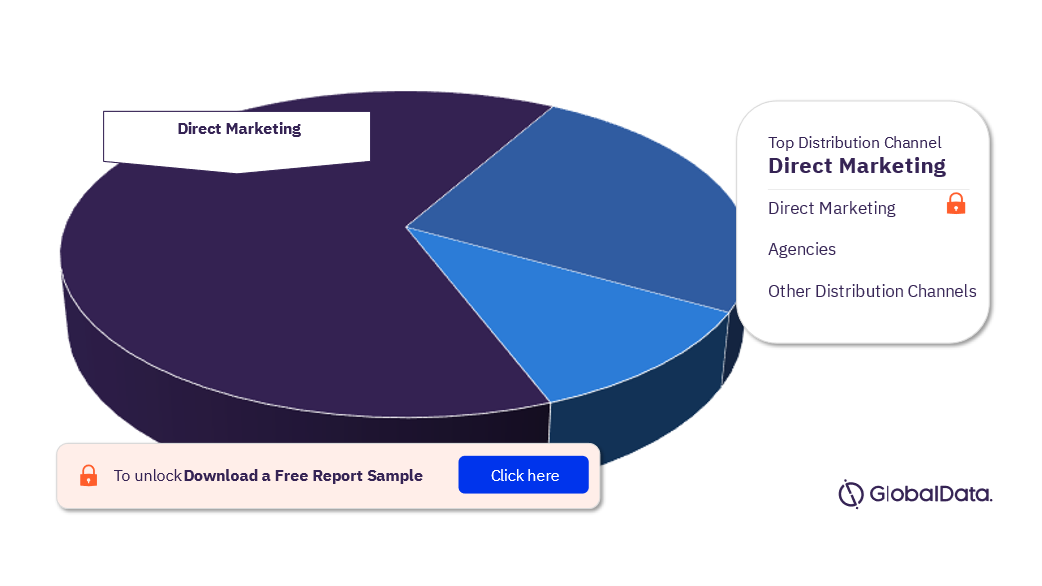

UK Life Insurance Market Segmentation by Distribution Channel

The key distribution channels in the UK life insurance industry are agencies, direct marketing, and other distribution channels. Direct marketing was the leading channel in new business DWP in 2022 in the UK life insurance industry. The pandemic accelerated digital transformation within the insurance industry. Increasingly, significant investments are being made into different types of technology. Going forward, distributors that continue to develop their digital capabilities will have the highest chance of bringing in additional new business.

UK Life Insurance Market Analysis by Distribution Channel, 2022 (%)

For more distribution channel insights into the UK life insurance market, download a free report sample

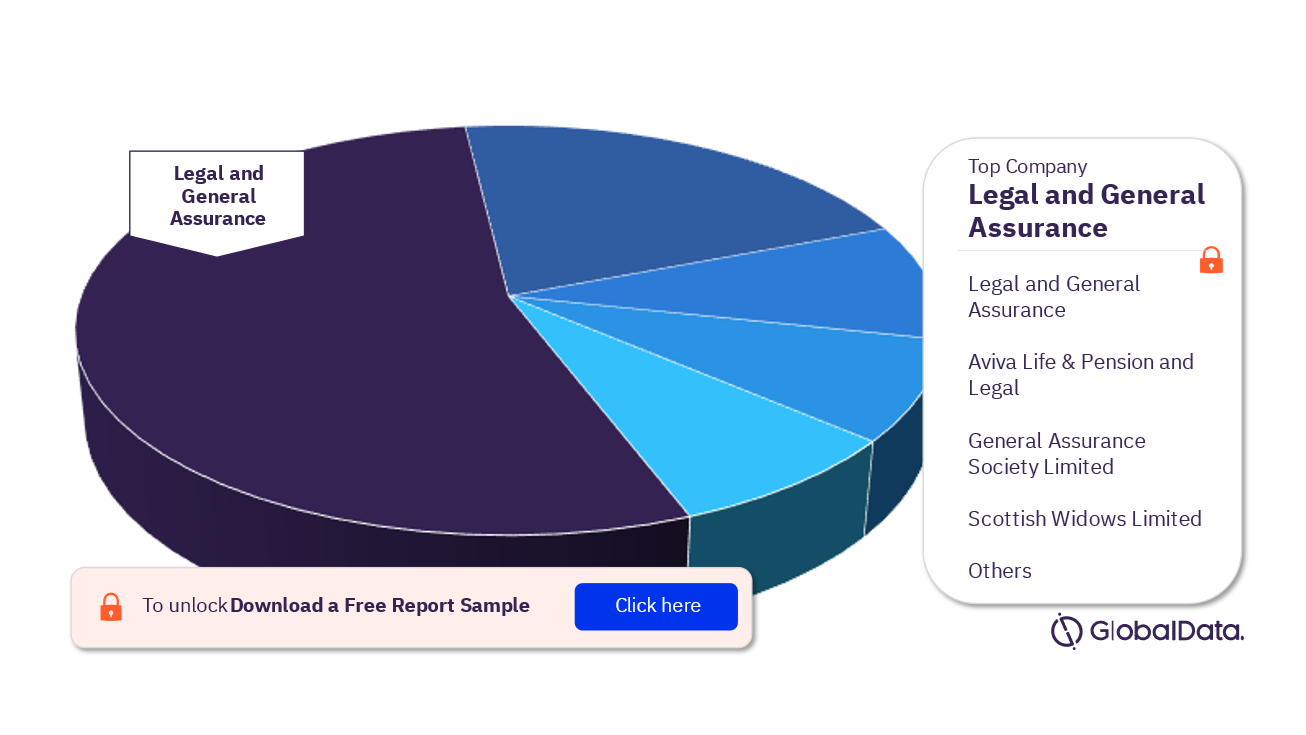

UK Life Insurance Market - Competitive Landscape

The leading life insurance companies in the UK are Legal and General Assurance (Pensions Management), Aviva Life & Pension and Legal, General Assurance Society Limited, Scottish Widows Limited (United Kingdom), and The Royal London Mutual Insurance Society Limited among others. The life insurance sector was dominated by domestic insurers. Legal and General Assurance (Pensions Management) was the largest insurer, followed by Aviva Life & Pension and Legal and General Assurance Society Limited in 2021.

UK Life Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading life insurance companies in the UK, download a free report sample

https://www.globaldata.com/store/talk-to-us/?report=3053513

UK Life Insurance Lines of Business Outlook (Value, GBP Billion, 2018-2027)

- Pension

- General Annuity

- Endowment

- Term Life

- Life PA&H

- Other Life Insurance

UK Life Insurance Distribution Channel Outlook (Value, GBP Billion, 2018-2027)

- Agencies

- Direct marketing

- Other distribution channels

Scope

This report provides a comprehensive analysis of the life insurance segment in the UK –

- It provides historical values for UK’s life insurance segment for the report’s review period and projected figures for the forecast period.

- It profiles the top life insurance companies in the UK and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of the UK life insurance segment.

- A comprehensive overview of the UK economy, government initiatives, and investment opportunities.

- The UK insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- The UK life insurance industry’s market structure gives details of lines of business.

- The UK life insurance reinsurance business’s market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by UK life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the UK life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the UK life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Aviva Life & Pensions

Scottish Widows

BlackRock Life

St Jame's Place

The Royal London Mutual Insurance Society

Scottish Equitable

Standard Life Assurance

Table of Contents

Frequently asked questions

-

What was the UK life insurance market gross written premium in 2022?

The gross written premium of the UK life insurance market was GBP240.3 billion ($298.7 billion) in 2022.

-

What is the growth rate of the UK life insurance market?

The life insurance market in the UK is expected to achieve a CAGR of more than 2% during 2023-2027.

-

Which line of business holds the largest share of the UK life insurance market?

Pension is the leading life insurance line of business in the UK life insurance market.

-

Which distribution channel holds the highest share in the UK life insurance market?

Direct marketing was the leading channel in new business DWP in 2022 in the UK life insurance industry.

-

Which are the key companies operating in the UK life insurance industry?

The leading life insurance companies in the UK are Legal and General Assurance (Pensions Management), Aviva Life & Pension and Legal, General Assurance Society Limited, Scottish Widows Limited (United Kingdom), and The Royal London Mutual Insurance Society Limited.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports