United Kingdom (UK) Pensions Market Size, Trends, Competitive Landscape and Forecasts to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Pensions Market Overview

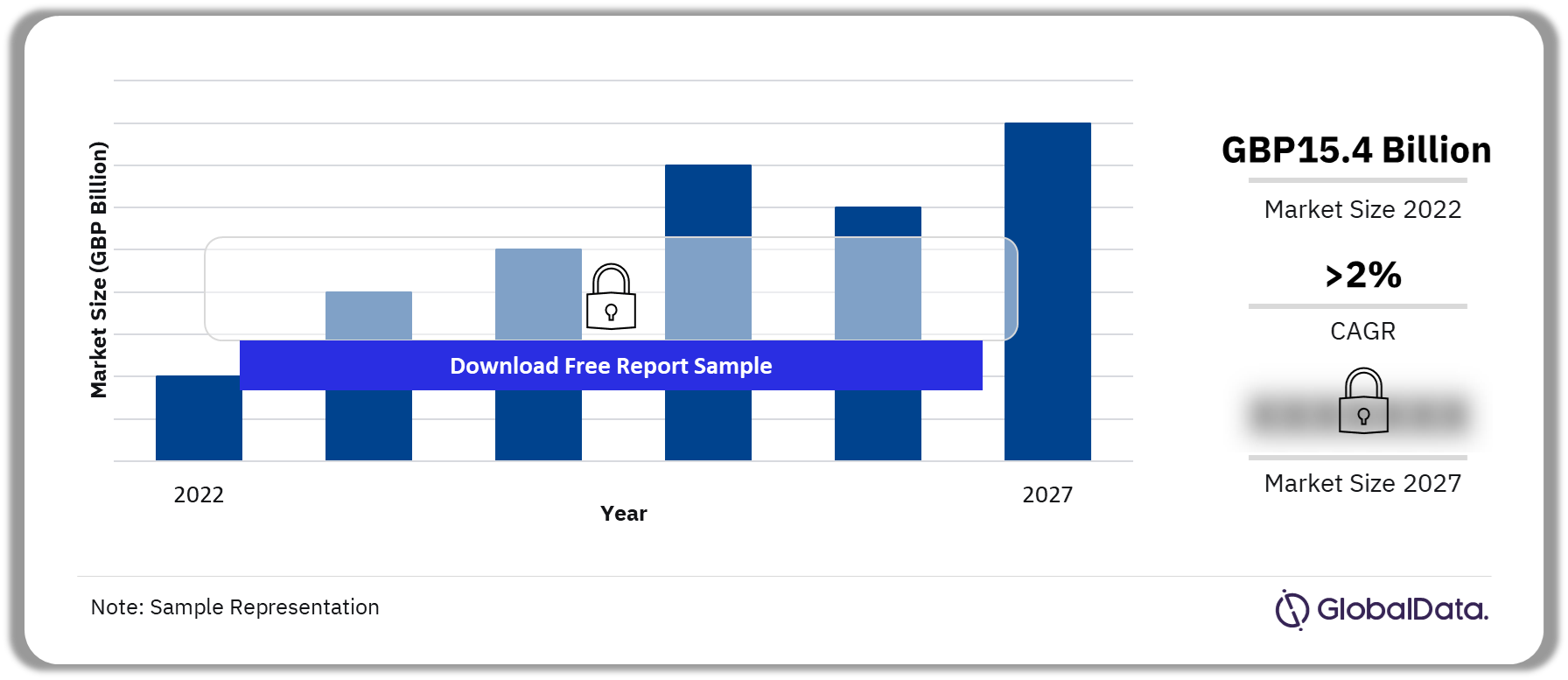

The UK pensions market size was GBP15.4 billion in terms of annual premium equivalent (APE) in 2022. The market is expected to achieve a CAGR of more than 2% during 2022-2027. Due to a rise in workplace pension enrolment, it achieved a very strong growth rate in 2022 while all other pension types contracted. Most pension withdrawals are used to cover everyday expenses and a sizable portion is used to pay off mortgages. Annuities saw a dip in 2022, but income drawdowns increased.

UK Pensions Market Outlook, 2022-2027 (GBP Billion)

Buy Full Report for More Insights into the UK Pensions Market Forecast

The United Kingdom (UK) Pensions market research report examines the changes in the pensions market. The report explores how consumers’ attitudes and behaviors towards long-term saving, planning for retirement, and accessing private pensions are changing. The report also provides current and historical data on the size of the market by product type covering individual pensions, workplace pensions, and trust-based pensions. Moreover, data on common retirement products and pension providers is also provided.

| Market Size (2022) | GBP15.4 Billion |

| CAGR (2022-2027) | >2% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2027 |

| Pension Types | · Work-Based Pensions

· Trust-Based Pensions · Individual Pensions · Master Trusts |

| Leading Providers | · BlackRock

· Royal London Mutual · Aviva plc · Lloyds Banking Group · Phoenix Group Holdings · M&G Plc · FIL Ltd · Liverpool Victoria Financial Services · Vitality Life Limited · Wesleyan Assurance |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Pensions Market Dynamics

Life expectancy has fallen in the UK because of the pandemic, changing the state pension landscape. This means the UK Government has delayed the plan for the state pension age (SPA) to increase to 68 by 2039. The high inflationary trend that has been present throughout 2022 and 2023 has influenced retirement trends, especially for people between the ages of 55 and 59. Notably, many individuals are concerned about their pension’s capacity to pay rising bills. Consequently, in reaction to the ongoing cost-of-living crisis, a trend towards later retirement is starting to emerge. This is further supported by an increase in the number of individuals who plan to retire after the state retirement age.

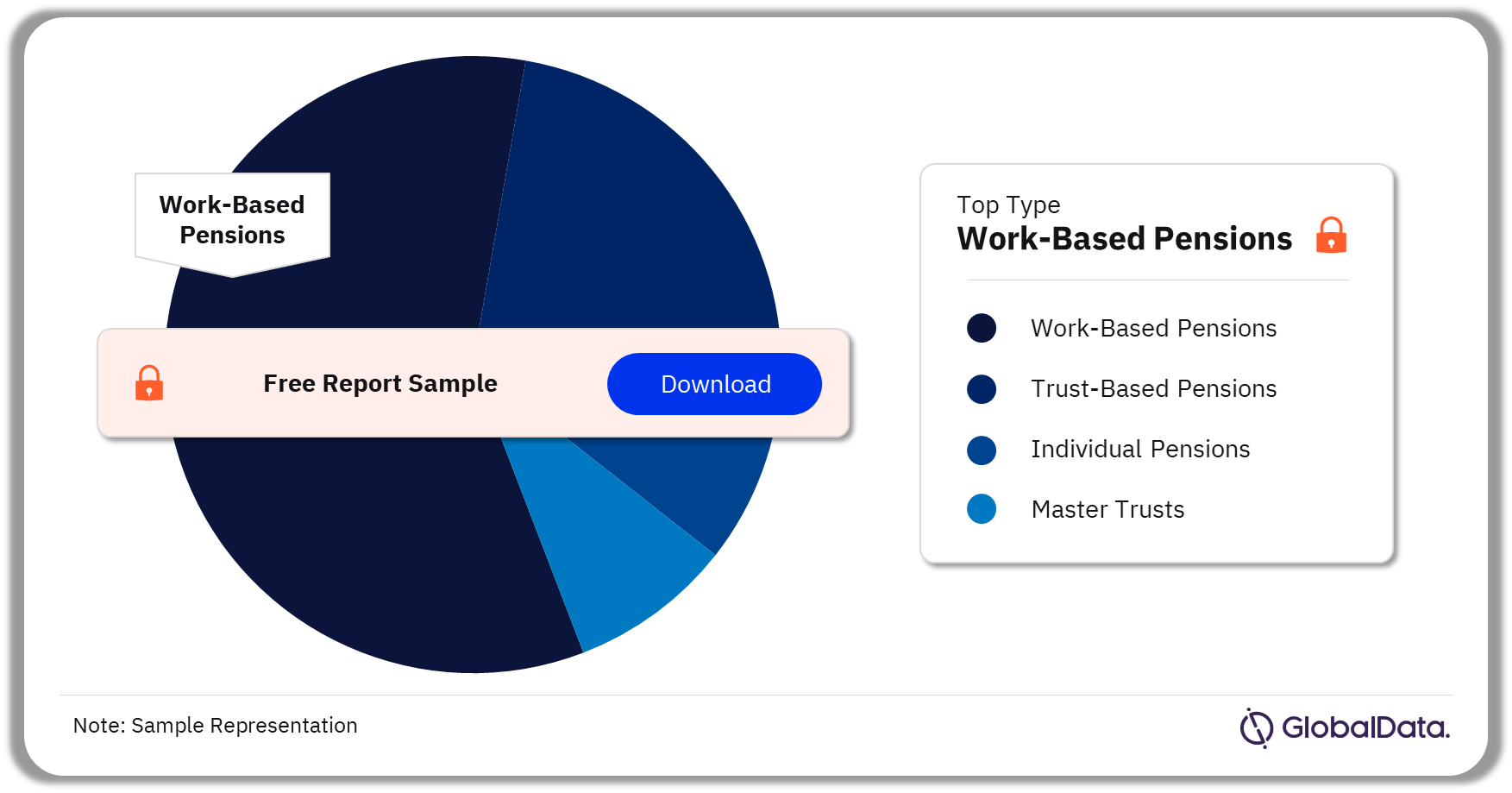

UK Pensions Market Segmentation by Types

In 2022, work-based pensions held the highest share of the pensions market.

The key pension types in the UK pensions market include work-based pensions, trust-based pensions, individual pensions, and master trusts. The main driver behind the comeback of the pensions market in 2022 after collapsing in 2020 due to the pandemic was the large expansion of work-based pensions. This increase is due to favorable legislative environments that support employer-based pension plans and growing acknowledgment of the significance of retirement planning. Workplace pensions have become more appealing and available due to employer contributions, employee payments, and potential government incentives under automatic enrolment (AE), which has increased participation. The minimum contribution amount required by the policy has helped increase pension savings.

UK Pensions Market Analysis by Types, 2022 (%)

Buy Full Report for More Type Insights into the UK Pensions Market

UK Pensions Market - Competitive Landscape

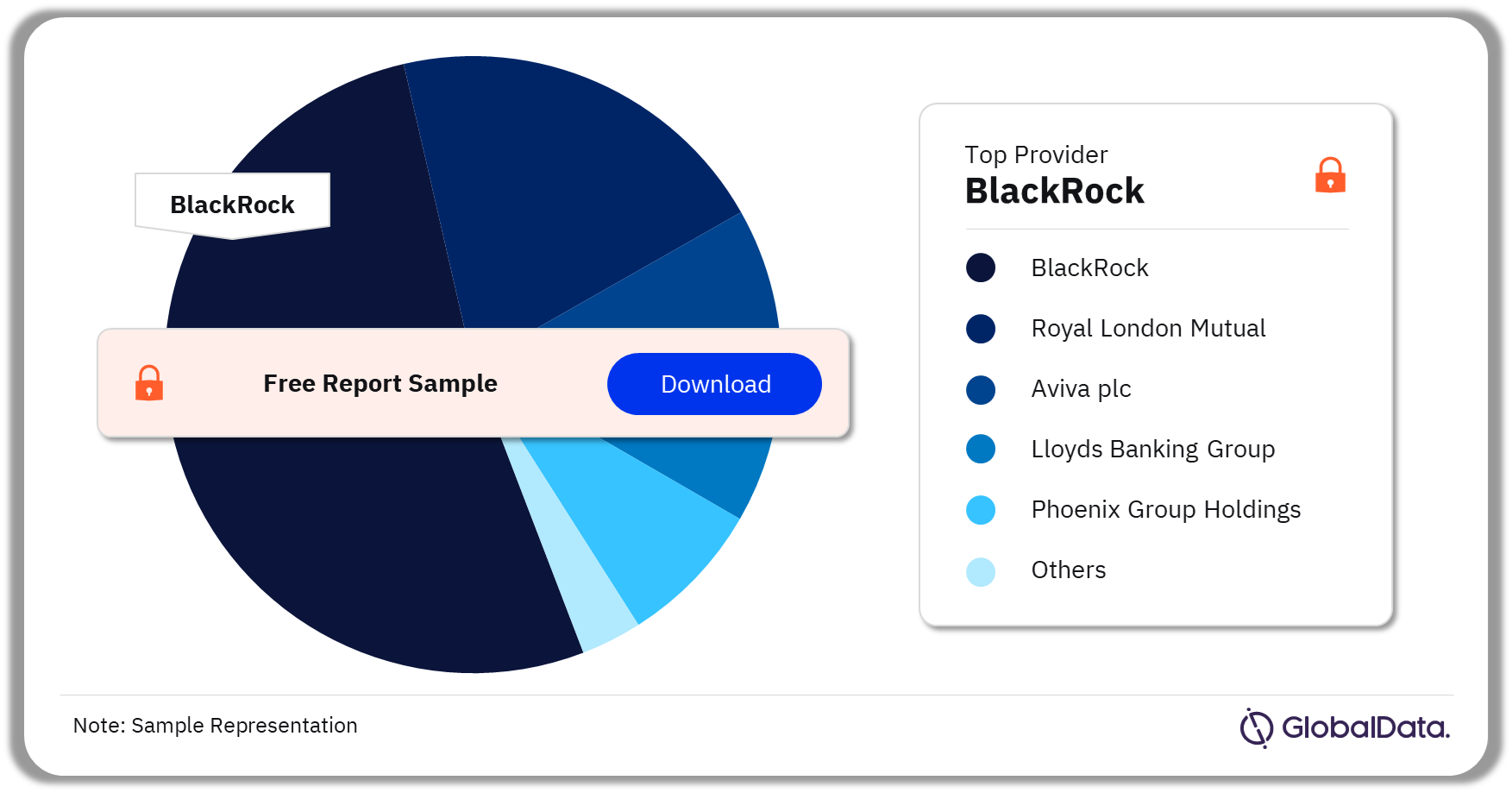

BlackRock was the largest provider of individual and workplace pensions in 2021.

Some of the leading providers in the UK pensions market are:

- BlackRock

- Royal London Mutual

- Aviva plc

- Lloyds Banking Group

- Phoenix Group Holdings

- M&G Plc

- FIL Ltd

- Liverpool Victoria Financial Services

- Vitality Life Limited

- Wesleyan Assurance

UK Pensions Market Analysis by Providers, 2021 (%)

Buy Full Report for More Insights into the UK Pensions Market Providers

Segments Covered in the Report

UK Pensions Market Types Outlook (Value, GBP Billion, 2018-2027)

- Work-Based Pensions

- Trust-Based Pensions

- Individual Pensions

- Master Trusts

Scope

• Single individuals (i.e., those not in a legally-recognized relationship) must supplement their state pension by over GBP14,000 per annum in order to achieve a moderate standard of living in retirement, given that the full state pension pays roughly GBP9,000.

• According to our 2023 UK Life and Pensions Survey, 61.9% of people contributed at least 6% of their salary towards their pension in 2023. 18.2% increased their pension contribution in 2023 despite the cost-of-living crisis.

• 56% of pension pots were completely withdrawn upon its first time accessed. 17.7% of over 55s decided to take money out of their pension plans. However, 62.8% of these people did not consult a financial expert, which may have led them to make financially reckless decisions.

Reasons to Buy

- Examine the size of the pensions market

- Discover how individuals save toward retirement

- Learn how individuals access their private pensions for the first time

- Understand trends in the income drawdown and annuities segments

- Explore the gender gap in pensions

- Understand the impact of the cost-of-living crisis on the market, sentiment, and customer behavior

Royal London Mutual

Aviva

Lloyds Banking Group

Phoenix Group

M&G

Fidelity International

Liverpool Victoria Financial Services

Vitality

Wesleyan

British Airways

Royal Mail

NatWest Group

Cushon

Smart Pension

Evolve Pensions

Rothesay Life

Standard Life

Chubb

Agfa UK

Sun Life UK

Threadneedle

Cobham Pension Plan

NTL

Pension Insurance Corporation (PIC)

Just Group

Canada Life

Bfinance

Uber

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK pensions market size in 2022?

In terms of APE, the pensions market size in the UK was GBP15.4 billion in 2022.

-

What is the UK pensions market growth rate?

The UK pensions market is expected to achieve a CAGR of more than 2% during 2022-2027.

-

What were the types in the UK pensions market?

The key pension types in the UK pensions market include work-based pensions, trust-based pensions, individual pensions, and master trusts.

-

Who are the key providers in the UK pensions market?

Some of the leading providers in the UK pensions market are BlackRock, Royal London Mutual, Aviva plc, Lloyds Banking Group, Phoenix Group Holdings, M&G Plc, FIL Ltd, Liverpool Victoria Financial Services, Vitality Life Limited, and Wesleyan Assurance.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports