Impact of Inflation on United Kingdom (UK) Personal Lines Insurance Market

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Impact of UK Personal Lines Insurance Market Overview

This rapid rate of price increase in the UK is causing a huge strain on businesses’ and consumers’ finances, leading to a cost-of-living crisis. Many factors have coalesced in creating an economic situation that has consumers concerned about their current financial situation. These factors include global issues such as the COVID-19 pandemic and related supply-chain problems as well as domestic issues such as Brexit and economic mismanagement. Across all four primary personal lines of business (motor, home, pet, and travel), consumers have canceled policies, and more are considering taking such action.

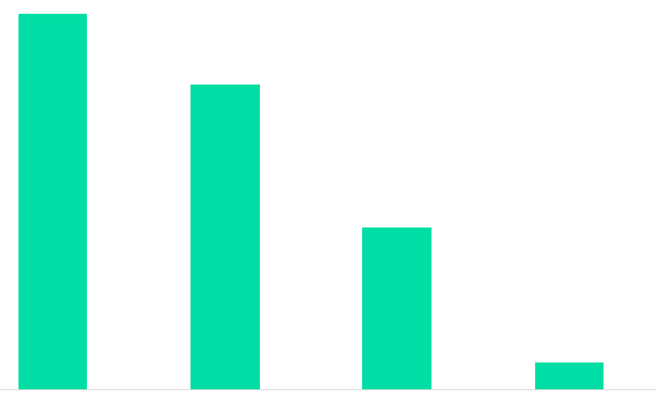

Furthermore, other consumers are looking to adjust their policies, either cover levels, excess, or both, while others have looked to switch providers in search of better value for money. Cancellations have been most common in the pet and travel lines. The cost of claims is rising across all lines of business, forcing insurers to raise premium prices to cover these costs. This could drive further cancellations as consumers are increasingly unable to absorb any extra costs that come their way.

The UK Personal lines insurance market inflationary impact insights report provides an overview of some of the leading macroeconomic trends driving inflation in the UK economy, as well as those set to affect future inflation and GDP growth rates in 2023 and beyond. It analyzes how consumer behavior has changed in the insurance industry in the past 12 months and how it is expected to change in the future, with specific analysis of the motor, household, pet, and travel insurance sectors. The report also looks at the UK economy heading into 2023 and how insurers can be best prepared to deal with the trials and tribulations the coming years may bring.

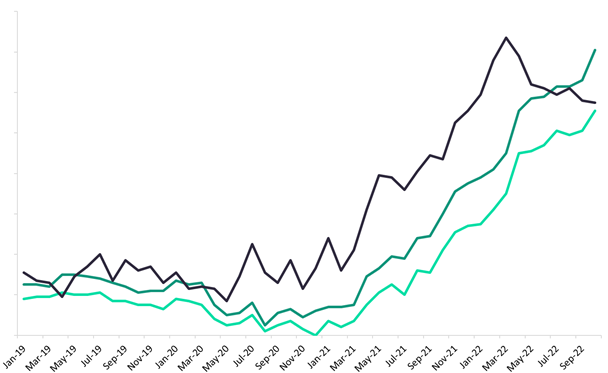

UK Inflation Indicators

For more insights on the UK personal lines insurance market report, download a free report sample

UK Personal Lines Insurance Market – Key Findings

The most pressing concern of UK consumers in Q3 2022 was the rising energy bills. Furthermore, over 40% of former consumers in the home, pet, and travel lines indicated that they canceled their policy as a cost-cutting measure due to the cost-of-living crisis. A further two in five current policyholders in the pet and travel lines indicated that they have considered switching or canceling their policy, with over one in five consumers in the home and motor lines indicating similarly. More than 80% motor insurance customers and more than 73% home insurance customers have switched providers for a lower premium. Additionally, more than 35% of pet and travel customers switched because their new policy offered better cover limits.

UK Consumers with Cancelled Policies

For more insights into the UK personal lines insurance market report, download a free report sample

UK Personal Lines Insurance Market – Critical Success Factors

As consumer finances are increasingly squeezed, many will seek cheaper alternatives to their current policy. Therefore, offering a cheaper policy with lower cover limits will enable insurers to retain business as a growing number of consumers seek value for money and low-cost alternatives. Many leading insurers offer alternative policies, with others looking to follow suit as business dries up. Also, many insurtech brands offer consumers highly customizable and tailored policies, allowing consumers to pay only for the exact cover they need. These forms of policy are likely to grow in popularity soon as consumers look to stretch their incomes as far as possible and get cover for exactly what they require.

Allowing consumers an element of leeway in the way the providers structure the repayments for their insurance policy is likely to help many consumers stay covered. Offering credit finance to some of these consumers can be a useful tool for covering short-term shortfalls in disposable income. Not only will this help insurers retain business during inflation, but it is also likely to drive an element of brand loyalty going forward, in turn driving better retention rates in the future.

Reasons to Buy

- Understand the extent and underlying drivers of inflation and the subsequent economic downturn facing the UK economy.

- Discover why consumers are canceling their insurance policies and how to reduce these actions.

- See how and why consumers are adjusting their policies and switching their providers in 2022.

- Determine the effects of inflation on premium prices and changes in demand for policies.

- Ascertain how long-term trends in consumer behavior may be affected by the economic situation in the UK.

Direct Line

LV=

RSA

ManyPets

Wapp Travel

Getsafe

Arma Karma

Urban Jungle

Quotemehappy.com

Compare the Market

Confused.com. GoCompare

MoneySuperMarket

Root

By Miles

insurethebox

American Family

Nationwide

Hiscox

Ondo InsurTech

PitPat

Zesty.ai

Lemonade

Allianz

Table of Contents

Figures

Frequently asked questions

-

What are the factors leading UK consumers to worry about their current financial situation?

The factors leading UK consumers to worry about their current financial situation include global issues such as the COVID-19 pandemic and related supply-chain problems as well as domestic issues such as Brexit and economic mismanagement.

-

Which line of insurance has faced the greatest number of cancellations in the UK personal lines insurance market?

Cancellations have been most common in the pet and travel lines in the UK personal lines insurance market.

-

What was the most pressing concern of UK consumers in Q3 2022?

The most pressing concern of UK consumers in Q3 2022 was the rising energy bills.

-

What is the purpose of offering a cheaper insurance policy with lower cover limits to UK consumers?

Offering a cheaper insurance policy with lower cover limits will enable insurers to retain business as a growing number of consumers seek value for money and low-cost alternatives.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports