United Kingdom (UK) Protection Insurance – Term Assurance Market

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Protection Insurance – Term Assurance Market Report Overview

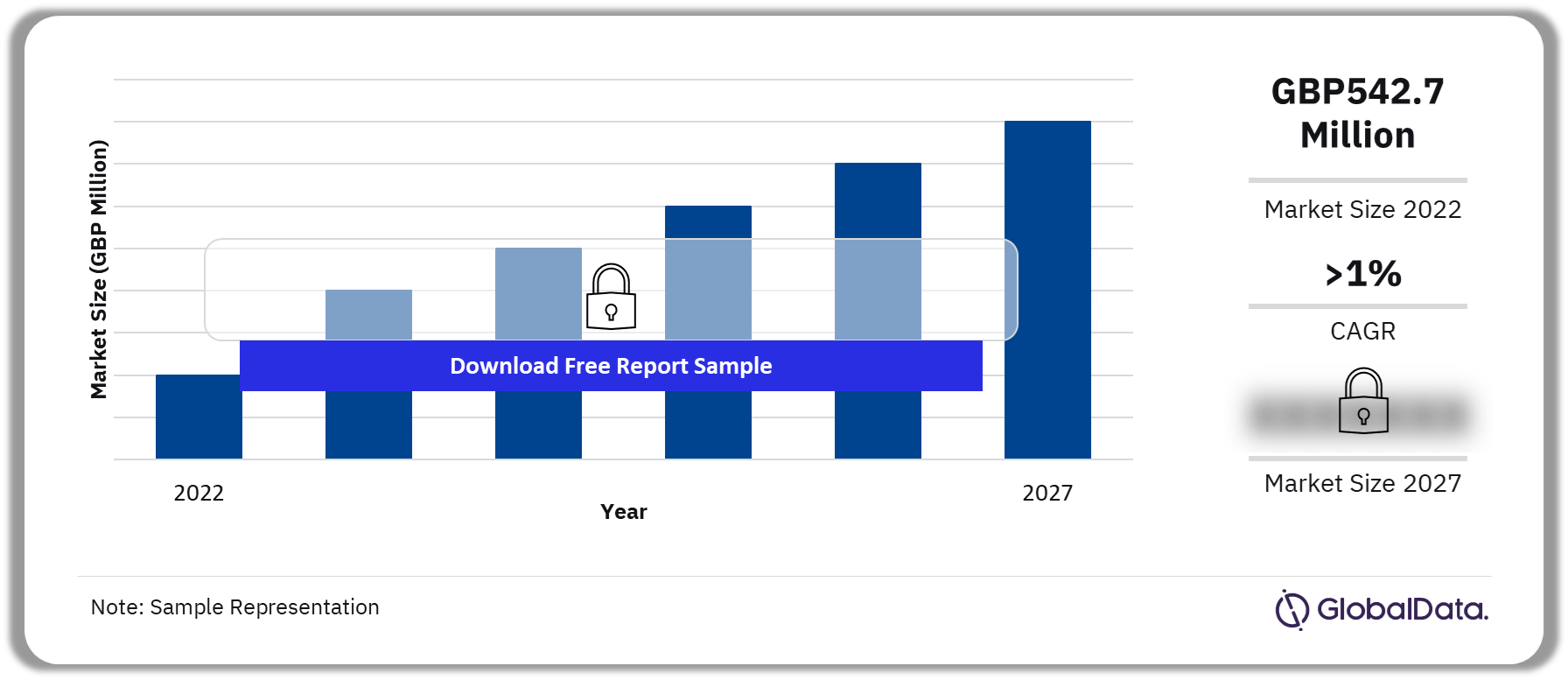

The term assurance market was valued at GBP542.7 million in 2022 and is expected to record a compound annual growth rate (CAGR) of more than 1% during 2022-2027. The number of contracts will also increase over the same period. However, a decline in contracts is also expected for mortgage-related terms in 2023. This will be due to high interest rates and the cost-of-living crisis, which have deterred individuals from taking out mortgages, thus impacting mortgage-related term take-up. The Bank of England’s repeated interest rate hikes also pushed more individuals away from purchasing property due to the growing cost of mortgages.

UK Protection Insurance – Term Assurance Market Report Outlook 2022-2027

The UK Protection Insurance – Term Assurance Market research report provides an in-depth assessment of the term assurance market, looking at current and historical market size with regard to changes in contracts and premiums. It examines how term assurance products are distributed and highlights key changes in the competitive landscape, as well as the propositions of the key market players. The value of claims is also assessed. It provides five-year forecasts of market size in contracts and premiums to 2027. In addition, the report discusses how the market, distribution, and products offered are likely to change in the future, as well as the reasons for these changes.

| Market Size | GBP542.7 Million |

| CAGR (2022-2027) | >1 |

| Key Companies | • Legal & General (L&G)

• Aviva • Royal London • Vitality • Zurich |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for More UK Protection Insurance – Term Assurance Market Forecasts

UK Protection Insurance – Term Assurance Dynamics

Rising house prices and interest rates acted as a driver for the increase in gross advances in 2022. UK mortgage gross advances rose from 2021 to 2022, boosted by rising house prices and a strong refinancing market. However, following the September 2022 mini-budget, the flow of mortgage applications submitted to lenders fell sharply to levels considerably below those seen in Q4 2021 (as per UK Finance).

In the UK, the concept of open banking was introduced in early 2018. The banking industry now has new opportunities after being previously hampered by the Retail Distribution Review put in place in the UK in 2013. Open banking’s data accessibility encourages the creation of more specialized insurance products that better meet client requirements. Multi-cover plans (such as term assurance with CI) can be altered over time to meet changing client needs. This flexibility and customization would improve the value proposition of insurance products.

The government is also coming up with reforms that will increase investment opportunities, boost competition, and improve the selection of products for the life insurance industry. Insurance companies will have the freedom to create novel solutions, such as multi-cover plans that can be altered over time to satisfy shifting client demands.

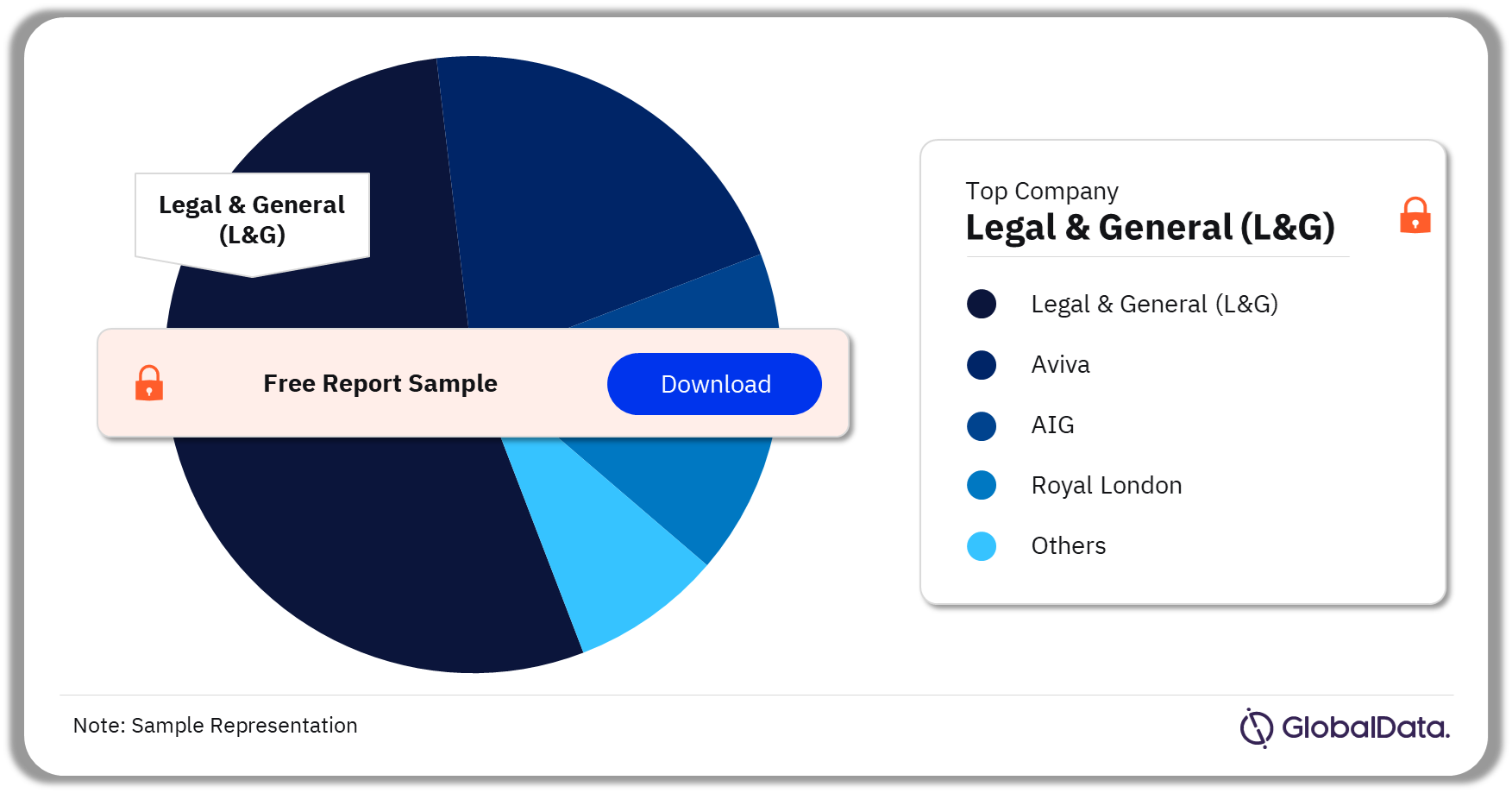

UK Protection Insurance – Term Assurance Market – Competitive Landscape

The key companies in the UK protection insurance – term assurance market are Legal & General (L&G), Aviva, AIG, Royal London, Vitality, and Zurich among others. In 2022, Legal & General (L&G) led the market with the highest number of term assurance contracts. L&G extended the age at which customers can add premium waivers to new protection policies. This will be beneficial amid the cost-of-living crisis, reducing the potential of customers canceling policies.

Aviva’s share also rose in 2021. To lessen the impact of the cost-of-living crisis on its individual protection customers, Aviva launched a new support scheme in conjunction with its payment deferral program, providing clients with protection against financial hardship.

UK Protection Insurance – Term Assurance Market Analysis by Companies, 2022 (%)

Buy the Full Report or Download a Free Sample Report for More Insights on Companies in the UK Protection Insurance – Term Assurance Market

Scope

• Legal and General (L&G) remains the largest player in the term assurance market, with a market share of 29.6% in 2022.

• We forecast a decline in contracts for mortgage-related term in 2023. This will be due to high interest rates and the cost-of-living crisis, which have deterred individuals from taking out mortgages, thus impacting mortgage-related term take-up.

• By analyzing data and spotting trends, AI can increase the accuracy and effectiveness of term assurance underwriting. If incorporated with wearable devices, the real-time data generated can offer insights for customized policies and flexible pricing.

Key Highlights

- Legal and General (L&G) remained the largest player in the term assurance market in 2022.

- We forecast a decline in contracts for mortgage-related terms in 2023. This will be due to high-interest rates and the cost-of-living crisis, which have deterred individuals from taking out mortgages, thus impacting mortgage-related term take-up.

- By analyzing data and spotting trends, AI can increase the accuracy and effectiveness of term assurance underwriting. If incorporated with wearable devices, the real-time data generated can offer insights for customized policies and flexible pricing.

Reasons to Buy

- Examine the size of the term assurance market.

- Learn about the implications of regulation in the market.

- Understand the influence of a range of factors on growth.

Bluezone

Zurich

MetLife

HealthHero

HSBC Life

Countrywide Assured

Royal London

Square Health

Canada Life

Aegon UK

Aviva

AIG

Vitality

Table of Contents

Frequently asked questions

-

What was the term assurance market size in 2022?

The term assurance market was valued at GBP542.7 million in 2022.

-

What is the term assurance market growth rate?

The term assurance market is expected to record a compound annual growth rate (CAGR) of more than 1% during 2022-2027.

-

When the concept of open banking was introduced in the UK?

In the UK, the concept of open banking was introduced in early 2018.

-

Which are the key companies in the UK protection insurance-term assurance market?

Legal & General (L&G), Aviva, AIG, Royal London, Vitality, and Zurich among others are the leading players in the UK protection insurance-term assurance market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports