United Kingdom (UK) Wealth Management Market Size, Trends, Competitor Dynamics and Opportunities

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Wealth Management Competitive Analysis Report Overview

The top 20 UK wealth managers saw assets under management (AUM) growth in 2020. The top three by AUM were St. James’s Place Wealth Management, Barclays, and the now-merged Tilney Smith & Williamson. Despite the COVID-19 pandemic, 2020 closed positively for the largest 20 players, as each saw year-on-year growth. Overall, this group grew AUM by 11.3%. Across most top 20 players, positive market performance was the strongest driver of growth in 2020 due to the bounce back following the Coronavirus Crash, while mergers also played a key role.

However, wealth managers in the UK continue to face regulatory hurdles in the crypto space. The FCA does not allow crypto investments in any UK-registered funds or portfolios provided to retail investors. However, this is changing as the FCA discusses further regulation, and we expect wealth managers to be able to jump on the crypto bandwagon in the coming years.

The UK wealth management report provides an overview of the top wealth managers in the UK, based on the business model and minimum investment thresholds as well as rankings based on assets under management. It explores regulations that pertain to wealth managers and offers insight into recent M&A activity, new entrants to the UK market, and divestment activity. The report also examines product and service innovations and personalized offerings.

UK Wealth Management Market Segmentation by Providers

The UK wealth management market is mature and well-developed. All investor demographics – from the mass market to the UHNW – have a wide range of servicing options to choose from. The key type of providers in the market is integrated private banks, standalone private banks, asset and investment managers, brokerages, family offices, IFAs, investment banks, and standalone digital platforms. The key competitors in integrated private banks are Barclays, HSBC, and Lloyds.

To know more about the wealth management providers in the UK, download a free report sample

UK Wealth Management Market – Regulatory Trends

Regulatory requirements remain a high priority for UK wealth managers. The crash owing to the COVID-19 pandemic, forced regulators to prioritize mitigating the negative impact of the downturn for both clients and advisors in the UK. In 2021, the FCA placed increased focus on warning about potential issues with high-risk investments as investors increasingly look to take advantage of this recessionary period and more wealth players market themselves to the masses.

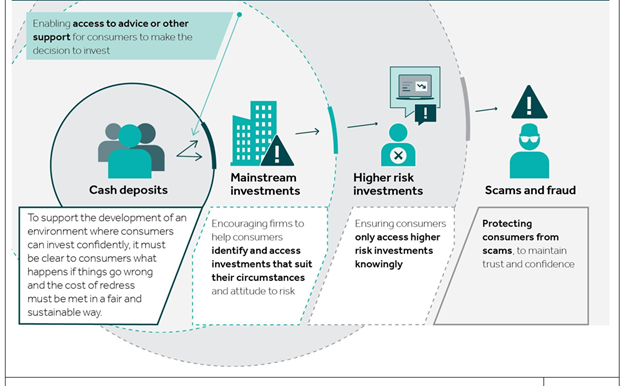

Steps to Create the Right Environment for Consumers to Invest

To know more about the regulatory trends in the UK wealth management market, download a free report sample

UK Wealth Management Market – Competitive Trends

The UK wealth management market continued to experience strong M&A activity in 2021. The top 20 wealth managers have made moves to increase their footprint in the UK. Some players merged with their competitors, while others stocked up on smaller firms and acquired the investment operations of financial services companies.

The market has not seen a significant number of new entrants since the pandemic-induced market downturn. Although robo-advisors have continued to expand their product range, achieving profitability remains a key challenge, and players are getting swallowed up by larger universal firms.

UK Wealth Management Trends Report Overview

| Top 3 Players by AUM | St. James’s Place Wealth Management, Barclays, and Tilney Smith & Williamson. |

| Key Wealth Management Providers | Integrated Private Banks, Standalone Private Banks, Asset And Investment Managers, Brokerages, Family Offices, IFAs, Investment Banks, and Standalone Digital Platforms |

Scope

This report provides an overview of the top wealth managers in the UK, based on the business model and minimum investment thresholds as well as rankings based on assets under management. It explores regulations that pertain to wealth managers and offers insight into recent M&A activity, new entrants to the UK market, and divestment activity. The report also examines product and service innovations and personalized offerings.

Key Highlights

- James’s Place and Barclays retained the top two spots for the sixth year in a row. The Tilney Smith & Williamson merger landed it in third place.

- South East England continues to account for the largest proportion of UK HNW liquid assets.

- Investor protection, crypto assets, and greenwashing are key regulatory topics. In the environmental, social, and governance (ESG) space, the Financial Conduct Authority proposed a package of new measures including investment product sustainability labels and restrictions on how terms like ‘ESG’ can be used. More fines are likely as the regulator cracks down on greenwashing.

Reasons to Buy

- Benchmark your market share against the top 20 UK performers.

- Understand drivers for AUM growth among leading wealth managers in the UK.

- Gain insight into M&A activity and organic growth for both new entrants and incumbents.

- Understand changes made to UK regulations.

- Learn about product and service innovations among traditional wealth managers.

- Understand the growth within the robo-advice space.

Barclays

Brewin Dolphin

Canaccord Genuity

Cazenove Capital

Charles Stanley

Chip

Citi

Coutts

Credit Suisse

Moneybox

EFG

Goldman Sachs

HSBC

Investec

J.P. Morgan

JPMorgan Chase

Julius Baer

LGT

Lloyds Banking Group

Moneyfarm

Nutmeg

Quilter Cheviot

Rathbones

Raymond James

RBC

Schroders

St. James's Place

Tilney Smith & Williamson

UBS

Wealthify

Wealthsimple

Table of Contents

Table

Figures

Frequently asked questions

-

Who were the top three players by AUM in the UK wealth management market?

The top three players by AUM were St. James’s Place Wealth Management, Barclays, and the now-merged Tilney Smith & Williamson.

-

What are the key types of providers in the UK wealth management market?

The key type of providers in the market are integrated private banks, standalone private banks, asset and investment managers, brokerages, family offices, IFAs, investment banks, and standalone digital platforms.

-

What are the key regulatory trends in the UK wealth management market?

The key regulatory trends include the increased focus on warning about potential issues with high-risk investments by the FCA in 2021. This is because investors increasingly look to take advantage of this recessionary period and more wealthy players market themselves to the masses.

-

What actions are the key players taking to increase their footprint in the UK wealth management market?

The top 20 wealth managers have made moves to increase their UK footprint. Some players merged with their competition while others stocked up on smaller firms and acquired the investment operations of financial services companies.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports