Outlook for Viral Vector Contract Manufacturing – Gene Therapies, Cell Therapies, and COVID-19 Vaccines

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The bio/pharmaceutical industry is experiencing a shortage of viral vectors, a component needed to produce gene therapies and gene-modified cell therapies, as well as certain COVID-19 vaccines that require a viral vector, notably those from AstraZeneca and Johnson & Johnson (J&J). This report reveals that viral vector production is limited by insufficient manufacturing capacity, an inefficient manufacturing process, and the requirement for complex specialist facilities.

There are 14 therapies/vaccines that use a viral vector (gene therapies, gene-modified cell therapies, and recombinant vector vaccines) marketed in the EU, Japan, US, and/or UK (post-Brexit).

Fiona Barry, Associate Editor of GlobalData PharmSource, comments: “We predict that this number will soar in the near future. We anticipate that over 100 more gene therapies and gene-modified cell therapies will be approved over approximately the next six years. These therapies will all need viral vectors and will exacerbate the manufacturing shortage.

“A second and more immediate stress on the viral vector supply chain is their use in some COVID-19 vaccines, specifically recombinant vector vaccines. AstraZeneca’s and Johnson & Johnson’s vaccines, as well as some COVID-19 vaccines in use in Russia and China, are of this molecule type.”

Barry continues: “The pharmaceutical industry is working to solve this shortage through scaling up facilities and developing more efficient processes. Top contract manufacturing organisations are investing in more sites, and the industry is working on increasing the efficiency of viral vector production by improving upstream and downstream processes.”

Although these were not the first COVID-19 vaccines to reach the public—mRNA vaccines made by Pfizer/BioNTech and Moderna were first to be administered in North America and Europe under Emergency Use Authorizations (EUAs) or equivalent temporary authorizations—there is a significant need for other vaccine types too. Governments have in aggregate placed orders of approximately 900 million doses for AstraZeneca’s and J&J’s COVID-19 vaccines.

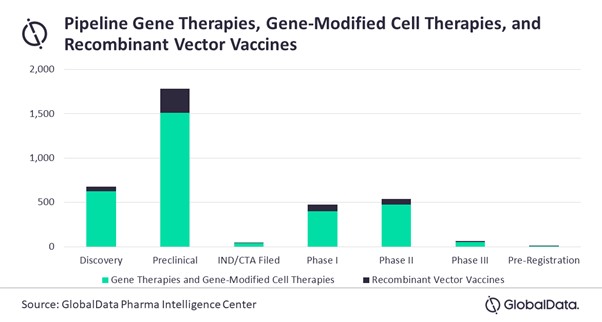

On top of the already approved drugs, there are more than 3,000 gene therapies, gene-modified cell therapies, and recombinant vector vaccines in the development pipeline.

Pipeline Gene Therapies, Gene-Modified Cell Therapies, and Recombinant Vector Vaccines

Barry adds: “Regulatory changes would also ease the viral vector bottleneck. If agencies approve standardized viral platforms that could be used interchangeably by therapy developers, this would speed up development, approval, and technology transfer to CMOs.”

Scope

This report is the companion to GlobalData’s Gene Therapy Market Opportunity for CMOs – 2019 Edition and Cell Therapy Market Opportunity for CMOs – 2018 Edition reports, which described the demand and supply for contract manufacturing in the gene and cell therapy markets. This latest report examines the approvals and manufacturing outlook for three drug molecule types that all require viral vectors in their production: gene therapies, gene-modified cell therapies, and recombinant vector vaccines. The report is critical for benchmarking the CMO industry’s capacity to manufacture these vital vaccines and drugs and forecasting future approvals.

This 62-page report gives important, expert insight you won’t find in any other source. 22 figures and 15 tables throughout the report illustrate major points and trends. This report is required reading for:

• CMO executives who must have deep understanding of the vaccine, cell therapy, and gene therapy marketplace to make strategic planning and investment decisions about viral vector manufacturing.

• Sourcing and procurement executives who must understand crucial components of the supply base in order to make decisions about supplier selection and management.

• Private Equity investors that need a deeper understanding of the market to identify and value potential investment targets.

Reasons to Buy

Detailed view of the geographic distribution of viral vector contract manufacturing facilities worldwide and the proportion belonging to dedicated CMOs and excess capacity manufacturers

Leader and disruptor companies in the viral vector space

Analysis of pipeline and marketed gene therapies, cell therapies, and recombinant vector vaccines, by geography, development stage, and clinical trials

A detailed model forecasting future gene therapy, cell therapy, and recombinant vector vaccine approvals, and associated manufacturing volumes

Contract manufacturing agreements for the active pharmaceutical ingredient (API) component of these vaccines and therapies

Abeona Therapeutics Inc

ActogeniX NV

Adaptimmune Ltd

Adrenas Therapeutics Inc Aspa Therapeutics Inc BridgeBio Pharma Inc

Advanced BioScience Laboratories Inc

Advantagene Inc

Advaxis Inc

Advent Srl

AGC Biologics SpA

Ajinomoto Bio-Pharma Services

Albany Molecular Research Inc

Albert B. Sabin Vaccine Institute Inc

Aldevron LLC

Almac Group Ltd

Altimmune Inc

Amicus Therapeutics Inc

Anchiano Therapeutics Ltd

Aruvant Sciences Inc

ASC Therapeutics Inc

Aslan Pharmaceuticals Ltd

Aspen Pharmacare Holdings Ltd

AstraZeneca KK

AstraZeneca Plc

AstraZeneca Plc University of Oxford

Attwill Medical Solutions

Batavia Biosciences BV

Baxter Biopharma Solutions

Benitec Biopharma Inc

BioCell Corp Ltd

Biological E Ltd

BioReliance Corp

bluebird bio Inc

Boehringer Ingelheim Biopharmaceuticals GmbH Boehringer Ingelheim RCV GmbH & Co KG

BriaCell Therapeutics Corp

Caladrius Biosciences Inc

Candel Therapeutics

Catalent Inc

Cell and Gene Therapy Catapult

Cell Therapies Pty Ltd

Cellectis SA

CELLforCURE

Celsion Corp

Centaur Biopharmaceutical Services Inc

Centre C3i

Chinook Therapeutics Inc

City of Hope

Coalition for Epidemic Preparedness Innovations Public Health Vaccines LLC

Cobra Biologics Ltd

CombiGene AB

Corautus Genetics Inc. (Inactive)

CRISPR Therapeutics AG

Daiichi Sankyo Biotech Co Ltd

Decibel Therapeutics Inc

DiNAQOR AG

Dompe Farmaceutici SpA

Editas Medicine Inc

Eiger BioPharmaceuticals Inc

ElevateBio LLC

Emergent BioSolutions Inc

enGene Inc

Flexion Therapeutics Inc

Forte Biosciences Inc

Fraunhofer-Gesellschaft zur Forderung der Angewandten Forschung eV

Freeline Therapeutics Holdings Plc

Fujifilm Diosynth Biotechnologies USA Inc

Gamaleya Federal Research Center of Epidemiology and Microbiology

Genethon SA Sarepta Therapeutics Inc

Genprex Inc

Genscript Biotech Corp

GenVec LLC

GeoVax Labs Inc

German Center for Infection Research

GlaxoSmithKline Plc

Grand River Aseptic Manufacturing Inc

Halix BV

Handl Therapeutics BV

Helocyte Biosciences Inc

Helocyte, Inc.

Hookipa Pharma Inc

IDT Biologika GmbH

IN8bio Inc

Indapta Therapeutics Inc

Innobation Co Ltd

Insud Pharma

International AIDS Vaccine Initiative

Ion Channel Innovations LLC

iosBio Pharma Ltd

Iovance Biotherapeutics Inc

IVERIC bio Inc

Janssen Pharmaceutica NV

Janssen Pharmaceutica NV Janssen Pharmaceuticals Inc

Janssen Pharmaceuticals Inc

JCR Pharmaceuticals Co Ltd

Jenner Institute

Johnson & Johnson

Juventas Therapeutics Inc

KBI Biopharma Inc

Kite Pharma Inc

Laboratorio Reig Jofre SA

Lentigen Technology Inc

Les Laboratoires Servier SAS

Lonza Group Ltd

Lysogene SAS

Massachusetts General Hospital

MaSTherCell SA

MaxCyte Inc

Merck KGaA

MilliporeSigma

Minaris Regenerative Medicine GmbH

Minaris Regenerative Medicine LLC

Minaris Regenerative Medicine LLC Showa Denko Materials Co Ltd

MTG Biotherapeutics Inc

Mustang Bio Inc

Noga Therapeutics Ltd

Novartis AG

Novartis Gene Therapies

Novartis International AG

Novasep Holding SAS

Novavax Inc

Ology Bioservices Inc

OncoSec Medical Inc

Oncternal Therapeutics

Orchard Therapeutics Plc

Otsuka Holdings Co Ltd

Oxford BioMedica Plc

Oxford-Emergent Tuberculosis Consortium Limited (Inactive)

Passage Bio Inc

Patheon NV

Patheon NV Patheon Viral Vector Services

Pfizer Inc

Pharmasyntez

Poseida Therapeutics Inc

Prevail Therapeutics Inc

ProBioGen AG

Profectus BioSciences Inc

Provecs Medical GmbH

PTC Therapeutics Inc

Rega Institute for Medical Research

RegenxBio Inc

ReiThera Srl

Renova Therapeutics Inc

Richter-Helm BioLogics GmbH & Co KG

Rocket Pharmaceuticals Inc

SanBio Company Limited

Sangamo Therapeutics France SAS

Sanofi

Sarepta Therapeutics Inc

Scenic Biotech BV

Selecta Biosciences Inc

Selexis SA

Sensorion SA

SGS Life Science Services

Sio Gene Therapies Inc

SK Bioscience

Spark Therapeutics Inc

Symbiosis Pharmaceutical Services Ltd

Synlogic Inc

Takara Bio Inc

Taysha Gene Therapies

TCR2 Therapeutics Inc

Themis Bioscience GmbH

T-Knife GmbH

Tonix Pharmaceuticals Holding Corp

Triumvira Immunologics Inc

TTY Biopharm Co Ltd

Ultragenyx Pharmaceutical Inc

UniQure NV

University of Oxford

Valneva SE

Vaxart Inc

VGXI Inc

Vibalogics GmbH

Vigene Biosciences Inc

ViGeneron GmbH

Vir Biotechnology Inc

Viralgen

Vivebiotech SL

Vivet Therapeutics SAS

Wacker Chemie AG

Waisman Biomanufacturing

WuXi AppTec (Shanghai) Co Ltd

WuXi AppTec Co Ltd

Xyphos Biosciences Inc

Yposkesi SAS

Zhejiang Hisun Pharmaceutical Co Ltd

ZIOPHARM Oncology Inc

Table of Contents

Table

Figures

Frequently asked questions

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports