Wellbeing in Insurance – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Wellbeing in Insurance Thematic Report Overview

Insurers are improving their wellness solutions and going above and beyond just offering standard insurance. Companies currently provide a large variety of products designed to help with some of the key pillars of well-being, especially those about physical, emotional, and financial issues. Much of the innovation seen in the industry has been sparked by the pandemic and current cost-of-living crisis, which has highlighted and brought awareness to the importance of physical and mental wellbeing.

The wellbeing in the insurance industry report provides an overview of the wellbeing value chain. It explores key challenges in the insurance industry, and how focus on wellbeing can help solve them. Market size and growth forecasts for the market are also provided, along with case studies showing use cases for the wellbeing across the insurance industry.

| Key Value Chain Components | · Product Development

· Marketing and Distribution · Underwriting and Risk Profiling · Claims Management · Customer Service. |

| Leading Public Companies | · AXA

· Chubb · Cigna · Discovery · Aviva |

| Leading Private Companies | · Aetna

· Bupa · dacadoo · Sanitas · SilverCloud |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

For more information on the wellbeing in the insurance industry, download a free sample report

Wellbeing in Insurance Industry Value Chain

The key wellbeing in insurance industry value chain components includes product development, marketing & distribution, underwriting & risk profiling, claims management, and customer service.

Product development: There will be good opportunities for insurers to develop new products or redesign existing ones as the shift toward health promotion and illness prevention continues. The rising cost of medical care will continue to prompt insurers to incorporate wellness components in their products given their potential to reduce the severity of claims. Furthermore, the gig economy offers an opportunity for insurers looking to expand their consumer base, with many consumers moving into this space because of inflation and the cost-of-living crisis.

Wellbeing in Insurance Industry Value Chain Analysis

For more insights on the wellbeing in the insurance industry value chain, download a free sample report

Wellbeing in Insurance Industry Analysis

Insurers have traditionally focused their efforts on supporting an individual’s wellbeing by providing financial protection to them and their loved ones, as well as providing access to medical treatment and facilitating mental health support. Since the pandemic, awareness of health and wellbeing has been on the rise, with many individuals looking at ways to improve their overall wellbeing. Healthcare systems in many countries have received longer waiting times, pushing the need for private health insurance, due to the faster service provided.

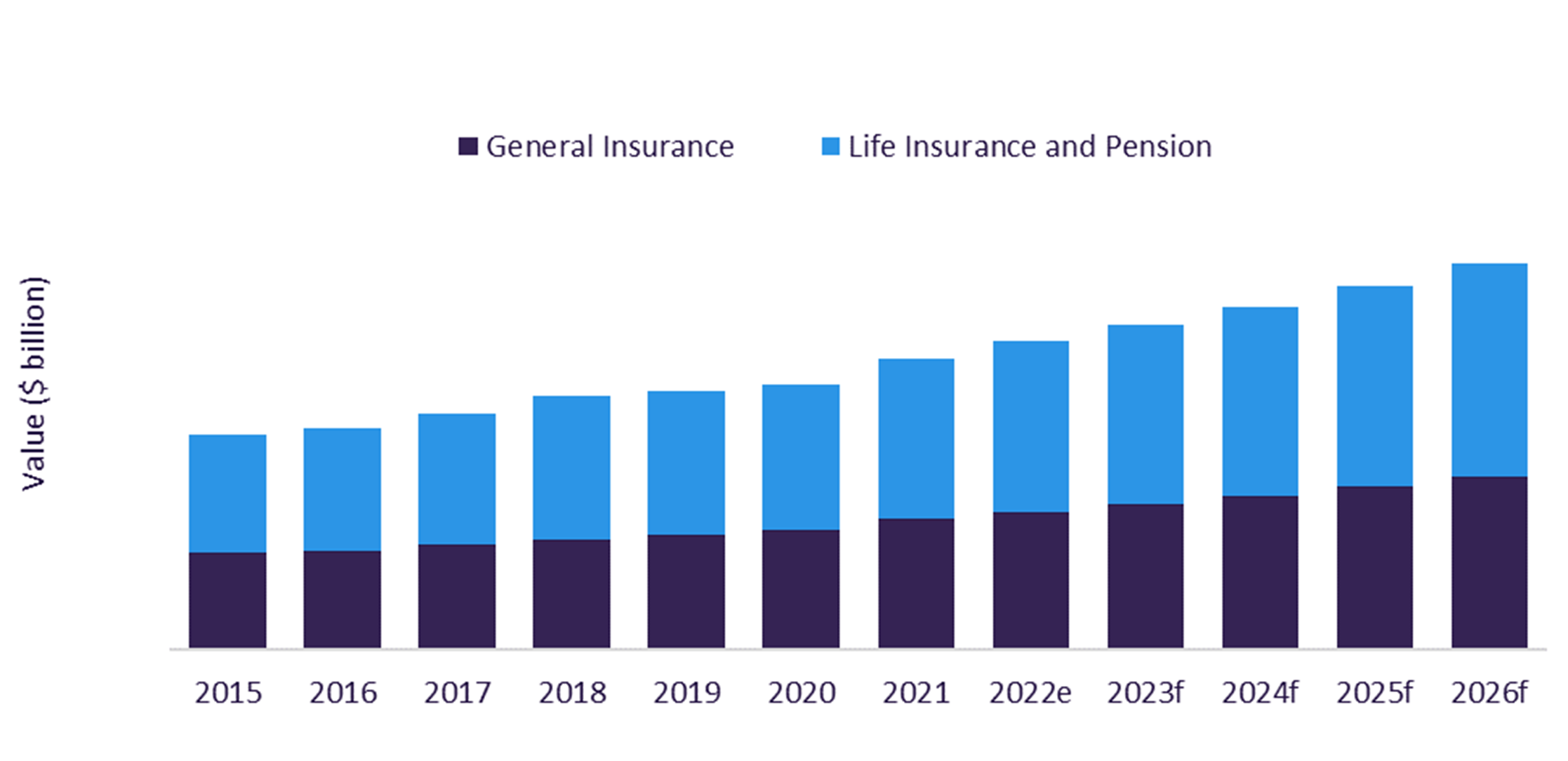

At the end of 2022, the size of the global insurance market was estimated to be $7.8 trillion. Health insurance, life insurance, and pensions are all insurance products that can enhance wellbeing. Particularly concerning group health insurance and individual health policies, the wellbeing movement is more pronounced.

The wellbeing in the insurance industry report also covers –

- Market size and growth forecast

- Individual wellbeing

- Workplace wellbeing

- Use Cases

- The rise of gig economy

- Timeline

Global Insurance Market Analysis, by Premiums, 2015–26f

For more information on the wellbeing in the insurance industry, download a free sample report

Wellbeing in Insurance – Competitive Landscape

The wellbeing in insurance industry report highlights companies making their mark within the wellbeing theme as –

Public Companies – AXA, Chubb, Cigna, Discovery, and Aviva among others

Private Companies: Aetna, Bupa, Dacadoo, Sanitas, and SilverCloud among others.

To know more about the leading wellbeing, download a free sample report

Life Insurance Scorecard

The life insurance scorecard approach predicts tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen.

Life Insurance Scorecard Analysis

For more insights on the scorecard analysis, download a free sample report

Scope

- The theme of wellbeing in insurance is particularly gaining traction within the private medical and health insurance space. Wellness components are being introduced in both group and individual policies.

- Insurers are shifting from paying out medical claims to promoting customers’ health and wellbeing to reduce the likelihood of illnesses and thereby the severity of claims.

- Some insurers are shaking up traditional business models, incentivizing customers to get fit and adopt healthy habits by rewarding them with points that can be exchanged for retailer coupons.

- COVID-19 has raised consumer awareness about health and wellbeing, creating new opportunities for insurers.

Key Highlights

- The theme of wellbeing in insurance is particularly gaining traction within the private medical and health insurance space. Wellness components are being introduced in both group and individual policies.

- Insurers are shifting from paying out medical claims to promoting customers’ health and wellbeing to reduce the likelihood of illnesses and thereby the severity of claims.

- Some insurers are shaking up traditional business models, incentivizing customers to get fit and adopt healthy habits by rewarding them with points that can be exchanged for retailer coupons.

- COVID-19 has raised consumer awareness about health and wellbeing, creating new opportunities for insurers.

Reasons to Buy

- Understand how businesses and employees view different employee benefits.

- Ensure you remain competitive as new innovations and insurance models begin to enter the market.

- Be prepared for how regulation will impact the use of biometric devices in insurance over the next few years.

- Understand key market drivers and consumers’ degree of concern around different health and wellbeing aspects.

UnitedHealthcare

Ping An

Aetna

Bupa

YuLife

John Hancock

Alan

Oscar Health

Apple

Amazon

Humana

AXA Health

Nuffield Health

PureGym

Virgin Active

Prudential

Elevance Health

L&G

Allianz

Generali

Swiss Re

Nervotec

SquareHealth

Babylon Health

Doctor on Demand

Cigna

Dacadoo

Onebright

Deliveroo

Zego

Chubb

Aviva

Verily

Sanitas

SilverCloud

Table of Contents

Frequently asked questions

-

Which are the key wellbeing in the insurance industry value chain components?

The key wellbeing in insurance industry value chain components includes product development, marketing and distribution, underwriting and risk profiling, claims management, and customer service.

-

Who are the leading public insurance companies associated with wellbeing theme?

AXA, Chubb, Cigna, Discovery, and Aviva among others are some of the leading public insurance companies associated with wellbeing theme.

-

Who are the leading private insurance companies associated with wellbeing theme?

Aetna, Bupa, Dacadoo, Sanitas, and SilverCloud among others are some of the leading private insurance companies associated with wellbeing theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports