Western Europe Infrastructure Construction Market Size, Trends, Analysis and Forecasts by Key Countries, Sector (Railway, Roads, Water and Sewage, Electricity and Power, Others), and Segment Forecasts, 2022-2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in the ‘Western Europe Infrastructure Market’ report:

- Analysis of historical figures and forecasts of revenue opportunities from the sector (roads, railways, electricity and power, water and sewage, and others) and regional segments.

- Outlook for the Western Europe infrastructure construction industry to 2026.

- Analysis of the infrastructure investment in major countries: France, Germany, Italy, the UK, and the Rest of Western Europe.

- Insight into the project pipelines for sectors such as roads and railways.

How is the ‘Western Europe Infrastructure Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the ‘Western Europe Infrastructure Market’ report today, which will help you to:

- Evaluate regional trends in infrastructure development from insight into output values and project pipelines. Identify the fastest growers to enable assessment and targeting of commercial opportunities in the markets best suited to strategic focus.

- Identify the drivers in the Western Europe infrastructure construction market and consider growth in developed economies. Formulate plans on where and how to engage with the market while minimizing any negative impact on revenues.

- Examine the assumptions and drivers behind ongoing and upcoming trends in the Western Europe infrastructure construction market.

We recommend this valuable source of information to anyone involved in:

- Contractors Including Civil Works, Electrical, HVAC, and Others

- Consultants/Designers

- Building Material Merchants/Players

- Management Consultants and Investment Banks

- Portfolio Managers/Buy-Side Firms

- Strategy and Business Development

- Investment Banking

To Get a Snapshot of the Western Europe Infrastructure Market Report, Download a Free Report Sample

Western Europe Infrastructure Construction Report Overview

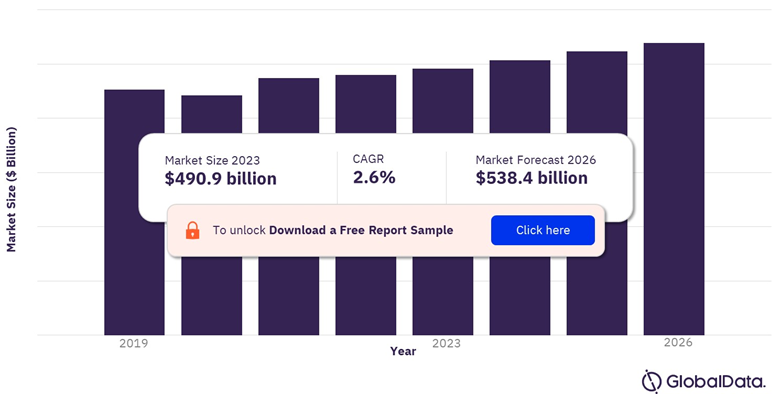

The Western Europe infrastructure construction market size will be valued at US$ 490.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 2.6% over the forecast period. The growth is supported by the government’s efforts to revive economic development via intense public investments.

Growth in the Western Europe infrastructure construction output gathered strong momentum in 2021, primarily driven by the strong output values from France, Italy, and the UK. However, the short-term outlook is gloomy, with the region facing major economic challenges amid a surge, in inflation, driven by soaring energy prices. High materials prices and product shortages have constrained growth since then, and the situation has worsened following Russia’s invasion of Ukraine, resulting in a major energy crisis across the region.

Western Europe Infrastructure Construction Market Outlook, 2019-26 ($ billion)

View Sample Report for Additional Insights on the Western Europe Infrastructure Construction Market Size Forecast, Download a Free Report Sample

According to GlobalData estimates, the Western Europe infrastructure construction market took a dip of nearly 2.4% in 2020 owing to the emergence of the pandemic. Post-pandemic in 2021, the sector observed a significant growth of more than 7.0% backed by public investments in the regional infrastructure space to revive the economic activities. These measures by the regional governments proved fruitful and created a strong pipeline of projects for the near future.

| Market Size in 2023 | US$ 490.9 billion |

| Market Size in 2026 | US$ 538.4 billion |

| CAGR | 2.6% from 2022 to 2026 |

| Historic Years | 2016-2021 |

| Forecast period | 2022-2026 |

| Report scope & coverage | Sector Overview, Construction Output Value (US$ Million), Project Pipeline by Country and Sector, Regional Outlook by Key Sectors, Top 20 Project Details by Sector |

| Key Segments | Roads, Railways, Electricity and power, Water and Sewage, Others |

| Key Countries | France, Germany, Italy, the UK, Rest of Western Europe |

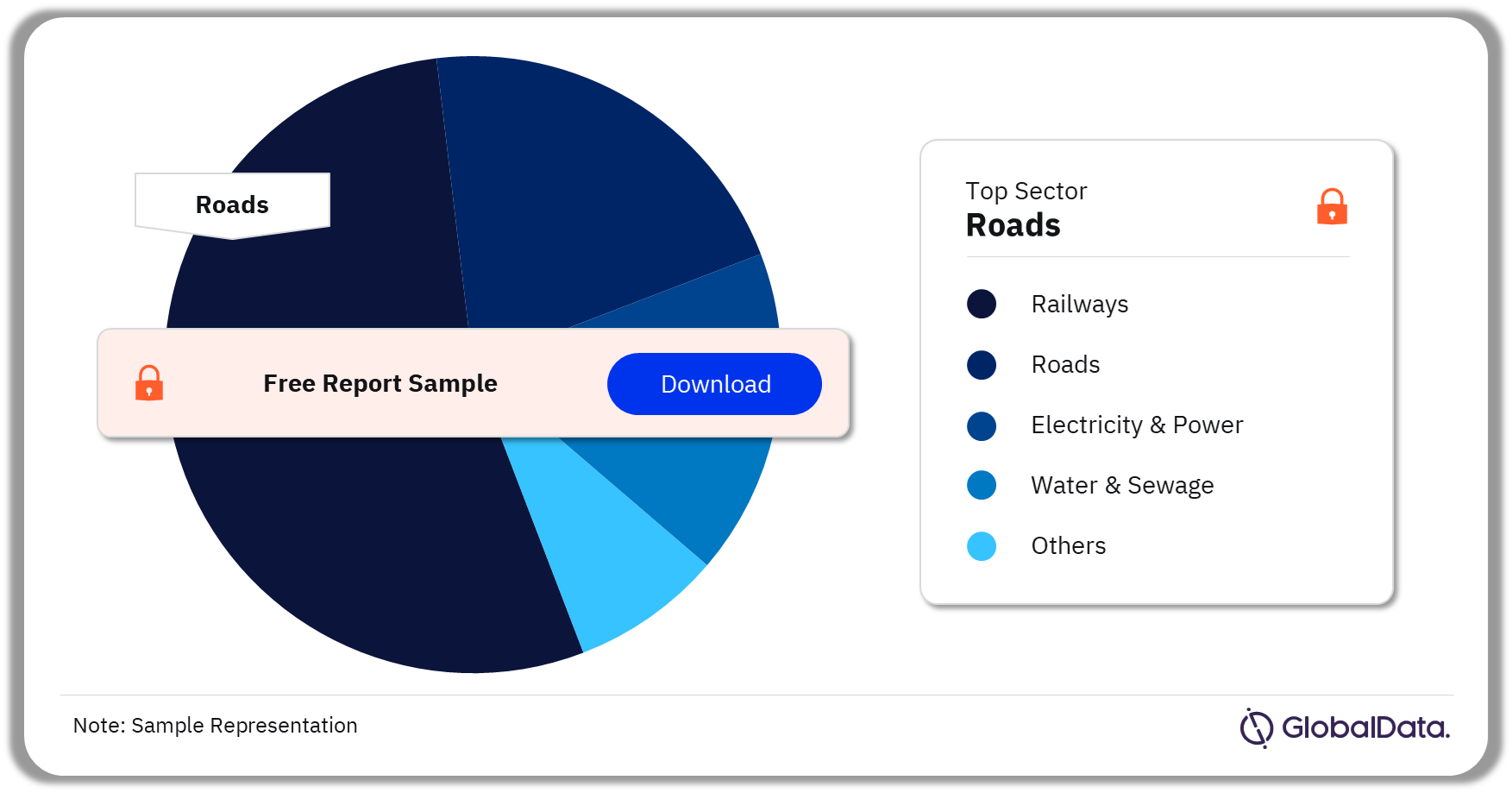

Western Europe Infrastructure Construction Market Segmentation by Sectors

The Western European infrastructure construction industry covers sectors including railways, roads, water and sewage, electricity and power, and others. Among these, the roads category accounted for over 46.1% of the overall share in 2022 and is projected to continue its dominance over the forecast period.

Roads: The roads sector in the Western Europe region is highly developed and represents a strong pre-existing network connected across key cities and rural areas of the region. The road quality in this region is among the highest in the world with investments mostly directed towards maintenance of the existing network. Still, the roadway infrastructure construction in the region is likely to witness steady growth with new projects in the pipeline. For instance, Oosterweel Link project in Belgium with a total value of more than US$ 4.9 billion includes the building of the underground tunnel roadway along with security barriers, bridges, and other related facilities.

Electricity and Power: The next largest segment in terms of its market share in the overall Western Europe infrastructure construction market is the electricity and power sector. The region is projected to witness intense efforts by the domestic governments to enhance focus on the production of clean energies while pushing energy-saving initiatives. However, rise in the energy prices and shortfall in energy supply impacted these net-zero initiatives, with few countries opting for coal as a source of electricity generation. For instance, Germany re-opened five coal-fired power plants in 2022 as a temporary measure. Despite this, investment in the electricity and power sector is likely to remain strong over the forecast period.

Water and Sewage: The water and sewage segment accounted for the smallest market share in 2021 in terms of construction output value (Real $ billion, 2017). Western Europe region remained a front runner in terms of the reliability of water supplies along with access to safely managed sanitation. Public investment in this sector is projected to remain sturdy despite the ongoing economic challenges.

Many water and sewage projects in the region are currently undergoing modernization, reconstruction, renovation, and upgradation. For instance, two treatment plants with a total project cost of more than US$ 5.3 billion are in the execution stage in France. Similarly, in Ireland, two sewage plants are under the design and execution stage with a total construction cost of more than US$ 1.0 billion. Thus, continuous development and upgradation of water and sewage projects in the region are estimated to drive the segment’s growth over the forecast period.

Others: The other category comprises of airports, ports, marine, and inland waterways. The airport’s segment is projected to observe steady growth mostly driven by the expansion projects in Western European countries. For instance, in Germany, Frankfurt International Airport expansion for terminal III is in the execution stage and is estimated to be completed by Q4 2023. The total project cost for this expansion is anticipated at more than US$ 3.0 billion. Similarly, Paris Charles de Gaulle Airport in France is in the pre-planning stage for the construction of Terminal IV. This project is estimated to have a project cost of nearly US$ 7.9 billion and is likely to complete its construction activities by Q4 2037.

Western Europe Infrastructure Construction Market Share by Sectors, 2023 (%)

Buy the Full Report for More Insights into the Western Europe Infrastructure Construction Market Segments, Download a Free Report Sample

Western Europe Infrastructure Construction Market Analysis by Countries

France is projected to remain the largest country in terms of output value in 2022, accounting for a market share of more than 17.0%. The infrastructure segment accounted for the second-largest share in the overall domestic construction industry in 2022. The country’s growth is estimated to be primarily driven by the railway segment over the near future as the nation hosts the 2024 Olympics. The country is planning to develop and construct nearly 200km of new metro lines with a total investment of nearly US$ 33.0 billion by 2024. This new investment is likely to assist the growth of the infrastructure construction industry over the forecast period.

Western Europe Infrastructure Construction Market Share by Country, 2023 (%)

View Sample Report for Regional Insights on the Western Europe Infrastructure Construction Market, Download a Free Report Sample

The UK is estimated to emerge as the second-largest country in terms of construction output value over the forecast period. The government’s focus on fixing the existing railways and road networks in the country is likely to generate new avenues of development soon. For instance, the development of high-speed 2 rail link phase I between London and Birmingham is in the execution stage. The total project cost is estimated beyond US$ 56.0 billion. Thus, new projects of infrastructure development in the country are projected to augment the sector’s growth over the predicted timeline.

Germany’s infrastructure sector emerged as the third-largest segment of the overall domestic construction industry in 2022. The growth in the infrastructure sector in the country is driven by strong public and private investments, particularly in the nation’s transport sector. For instance, the government announced the allocation of nearly US$ 298.0 billion under the Federal Transport Infrastructure Plan to develop domestic roads, rails, and waterways by 2030. Thus, steady investment in the country’s hard infrastructure is projected to positively aid the growth over the forecast period.

Italy accounted for more than 10.0% of the overall market share in Western Europe’s infrastructure construction sector in 2022. The infrastructure industry remained the second-largest segment of the overall nation’s construction sector over the same period. The development of new metro lines in the country is anticipated to aid market growth soon.

Key Players

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Western Europe infrastructure construction market size in 2023?

The infrastructure construction market size in Western Europe will be valued at $490.9 billion in 2023.

-

What is the Western Europe infrastructure construction market growth rate?

The infrastructure construction market in Western Europe is expected to grow at a CAGR of 2.6% during the forecast period (2022-2026).

-

What are the key sectors in the Western Europe infrastructure construction market?

The key sectors in the Western Europe infrastructure construction market are roads, railways, electricity and power, water and sewage, and others.

-

Which are the key countries in the Western Europe infrastructure construction market?

The key countries in the Western Europe infrastructure construction market are the UK, France, Germany, Italy, and Rest of Western Europe.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Construction reports