Opportunities in the Western European Spirits Sector

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

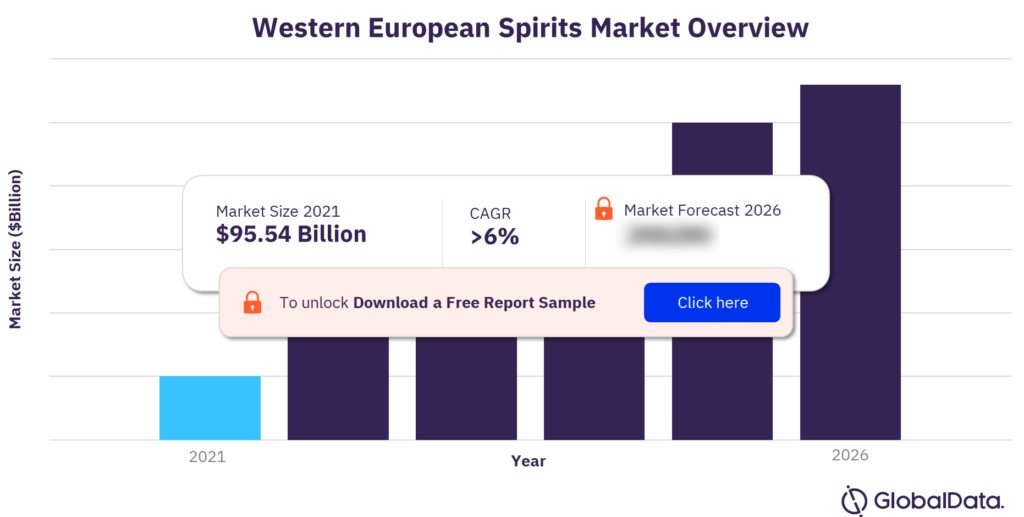

The Western Europe spirits market size was valued at $95.54 billion in 2021. The market is projected to grow at a CAGR of more than 6% during the forecast period. Based on the relative performance of countries on multiple metrics, the UK, Switzerland, Finland, and France have been shortlisted as high potential countries, primarily due to their large spirits market sizes, projected high-value growth rates, and projected rising per capita value growth levels. Hypermarkets & supermarkets were the largest distribution channel in 2021. The glass was the most used pack material in the Western Europe spirits sector and was followed by rigid metal.

The Western Europe spirits market research report brings together multiple data sources to provide a comprehensive overview of the Western Europe spirits sector. It includes the market overview, high-growth country analysis, top companies, key distribution channels, packaging formats, and case studies.

Western Europe Spirits Market Overview

To gain more information on the Western Europe spirits market forecast, download a free report sample

What are the market dynamics in the Western Europe spirits market?

Due to their growing awareness of the negative health effects of alcohol, Western European consumers are increasingly opting for non-alcoholic spirits drinks. However, consumers demand a variety of flavors in this space. Moreover, consumers primarily seek low-/no-alcohol drinks for three types of occasions, namely casual conversations, relaxing moments during the day (such as while reading a book or watching a movie), and social gatherings with friends.

The use of botanical ingredients such as juniper, pink grapefruit, and elderflower is on the rise in the spirits sector, with connoisseurs seeking a superior consumption experience. Furthermore, for some people, the consumption of spirits containing botanicals is said to generate a feeling of being connected with nature. The use of botanicals is particularly high in the gin category. Another factor to has boosted the demand for botanicals in the spirits sector is the growing interest in locally sourced ingredients.

What is the country-level outlook of the Western Europe spirits market?

This market report offers detailed insights into the spirits market segmentation of Western Europe in the countries of the UK, Switzerland, Finland, and France.

Spirits market in the UK

British consumers’ growing health consciousness is causing them to seek spirits made from natural extracts and related claims. Furthermore, Gin is a popular choice among female consumers in the UK.

Spirits market in Switzerland

Swiss consumers are actively trying to reduce their intake of alcohol and shifting to drinks with little or no alcohol content. This growing health consciousness is sparking the introduction of new non-alcoholic options which offer the same taste as alcoholic drinks. Some of these healthier options are also often available in unusual, novel flavors.

Spirits market in Finland

Finnish consumers are becoming more and more interested in the ingredients used in the products they buy, including those in the spirits sector. This trend has been accelerated by the COVID-19 crisis, which has encouraged consumers to focus more on quality. This, in turn, has resulted in the growth in popularity of somewhat unusual ingredients, such as botanicals.

Spirits market in France

Alcoholic drinks containing berry and floral flavors are rising in popularity in France. This is due to the growth of veganism and vegetarianism, which aligns with the demand for fresh and natural ingredients.

What are the key categories in the Western Europe spirits market?

The key categories in the Western Europe spirits market are whiskey, vodka, liqueurs, specialty spirits, gin & genever, rum, brandy, flavored alcoholic beverages, tequila & mezcal, and non-alcoholic spirits drinks. Whiskey recorded the highest per capita consumption in 2021 and was followed by flavored alcoholic beverages.

Western Europe Spirits Market Analysis by Category

For more category insights, download a free report sample

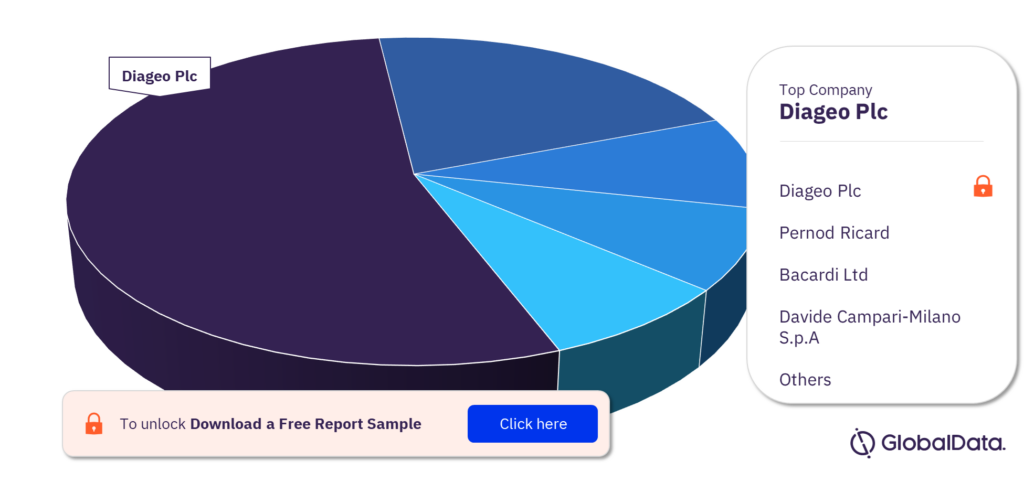

Which are the key companies in the Western Europe spirits market?

Some of the key companies in the Western Europe spirits market are Diageo plc, Pernod Ricard, Bacardi ltd, Davide Campari-Milano S.p.A., Marie Brizard Wine & Spirits SA, Suntory Holdings Ltd, The SHS Group Ltd, Societe des Vins et Spiritueux La Martiniquaise SAS, Brown-Forman Corporation, and Mast-Jagermeister SE.

Western Europe Spirits Market Analysis by Companies

To know more about key companies, download a free report sample

Market report scope

| Market size (Year – 2021) | $95.54 billion |

| Growth rate (CAGR) | >6% |

| Forecast period | 2021-2026 |

| Key countries | The UK, Switzerland, Finland, and France |

| Key categories | Whiskey, Vodka, Liqueurs, Specialty Spirits, Gin & Genever, Rum, Brandy, Flavored Alcoholic Beverages, Tequila & Mezcal, and Non-Alcoholic Spirits Drinks |

| Key companies | Diageo plc, Pernod Ricard, Bacardi ltd, Davide Campari-Milano S.p.A., Marie Brizard Wine & Spirits SA, Suntory Holdings Ltd, The SHS Group Ltd, Societe des Vins et Spiritueux La Martiniquaise SAS, Brown-Forman Corporation, and Mast-Jagermeister SE |

Scope

This report brings together multiple data sources to provide a comprehensive overview of the Western European spirits sector, analyzing data from 19 countries in the region. It includes an analysis of the following –

Market environment: Includes sector size, market size, and growth analysis by category.

- High-potential countries’ analysis: Indicates changing share of value consumption in the various spirits categories across high-potential countries in Western Europe. It also provides

Risk-Reward analysis of four countries across the region based on market assessment, economic development, socio-demographic trends, governance indicators, and technological infrastructure. - Country deep-dive: Provides the overview, demographic analysis, and key trends across high-potential countries.

- Success stories: Provides some of the most compelling spirits manufacturers, brands, products, and marketing campaigns in Western Europe. It also provides a better understanding of how certain manufacturers achieved success in the sector and insights.

- Competitive environment: Provides an overview of leading companies in Western Europe, besides analyzing the growth of private labels in the region.

- Distribution analysis: Provides analysis of the leading distribution channels in the Western European spirits sector in 2021. It covers hypermarkets & supermarkets, health & beauty stores, para pharmacies/drugstores, chemists/pharmacies, e-retailers, department stores, direct sellers, convenience stores, “dollar stores”, variety stores & general merchandise retailers, cash & carries & warehouse clubs, and others.

- Packaging analysis: The report provides percentage share (in 2021) and growth analysis (during 2016-2026) for various pack materials, pack types, closures, and primary outer types based on the volume sales (by pack units) of spirits.

- Challenges and future outlook: Provides the challenges and future outlook about the Western European spirits sector.

Reasons to Buy

- Manufacturing and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region.

- The report provides a detailed analysis of the countries in the region, covering the key challenges, competitive landscape, and demographic analysis, that can help companies gain insight into the country-specific nuances

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region than can help companies in revenue expansion

- To gain competitive intelligence about leading companies in the sector in the region with information about their market share and growth rates

Pernod Ricard

Bacardi ltd

Davide Campari-Milano S.p.A.

Marie Brizard Wine & Spirits SA

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Western Europe spirits market size in 2021?

The spirits market size in Western Europe was valued at $95.54 billion in 2021.

-

What is the Western Europe spirits market growth rate?

The spirits market in Western Europe is projected to grow at a CAGR of more than 6% during the forecast period.

-

What are the key countries in the Western Europe spirits market?

The key countries in the Western European spirits market are the UK, Switzerland, Finland, and France.

-

What are the key categories in the Western Europe spirits market?

The key categories in the Western European spirits market include whiskey, vodka, liqueurs, specialty spirits, gin & genever, rum, brandy, flavored alcoholic beverages, tequila & mezcal, and non-alcoholic spirits drinks.

-

Which are the key companies in the Western Europe spirits market?

Some of the key spirits companies in Western Europe are Diageo plc, Pernod Ricard, Bacardi ltd, Davide Campari-Milano S.p.A., Marie Brizard Wine & Spirits SA, Suntory Holdings Ltd, The SHS Group Ltd, Societe des Vins et Spiritueux La Martiniquaise SAS, Brown-Forman Corporation, and Mast-Jagermeister SE.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.