United Kingdom (UK) Protection Insurance – Whole of Life Assurance

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Protection Insurance Market Report Overview

The number of contracts in the UK’s individual protection market declined in 2022. The total number of contracts issued was 2.2 million. Premiums rose 0.1%, mainly led by an increase in income protection and critical illness. However, inflation and the cost-of-living crisis have caused financial constraints for many consumers, making it difficult for them to afford insurance.

The United Kingdom (UK) protection insurance report analyses the market drivers, competitive landscapes, and key contracts by protection cover and distribution channel. The United Kingdom (UK) protection insurance report also briefly explains the post-COVID impacts on the protection market.

| Key Contracts by Protection Cover | · Mortgage-related term

· Non-mortgage-related term · Whole of life · Standalone critical illness · Income protection · Other (non-mortgage related) |

| Key Contracts by Distribution Channel | · Independent advice

· Restricted advice · Non-advised |

| Key Companies | · SunLife

· Scottish Friendly · AIG · iptiQ · OneFamily · Royal London · Promis Life |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Protection Insurance Market Key Drivers

Some of the key factors driving the UK protection insurance market include the post-COVID impact, integration of artificial intelligence (AI), and FCA regulations among others.

Post-COVID impact to the protection market: At the height of the pandemic, actual mortality and morbidity implications on insured lives were less severe than previously anticipated. But, even among a population with a strong vaccination level, COVID-19 still has a significant influence on the UK protection insurance market in terms of mortality and morbidity risks. Owing to this, people may become more aware of potential health problems in the future as the effects of long COVID are still being explored. Thus, with greater awareness of health risks, people may seek protection through whole-of-life products.

AI can be leveraged to enhance and streamline the value chain: The integration of artificial intelligence (AI) in whole-of-life assurance has transformative potential for the claims process, underwriting process, and value chain via automated claims, reducing manual reviews, and improving accuracy. Algorithms can detect fraudulent claims by analyzing data patterns and anomalies. Furthermore, virtual assistants and chatbots powered by AI can improve customer service and engagement during the claims process. Thus, AI integration will open new opportunities for better products, services, and operations allowing whole-of-life insurers to improve their services even further.

FCA regulations will enhance comparability of over-50s policies and funeral plans: Concerns over providers’ behavior led to prepaid funeral arrangements falling under the Financial Conduct Authority (FCA) jurisdiction from January 2021. Prepaid funeral plans and over-50s policies are both made to assist with funeral expenses. The FCA organized a consultation and put standards in place to ensure moral business practices, reasonable pricing, and customer-centered strategies. Such strategies are anticipated to have a positive impact on the UK protection insurance market growth during the forecast period.

Buy the Full Report to Get Access to the UK Protection Insurance Market Drivers or Download a Free Sample Report

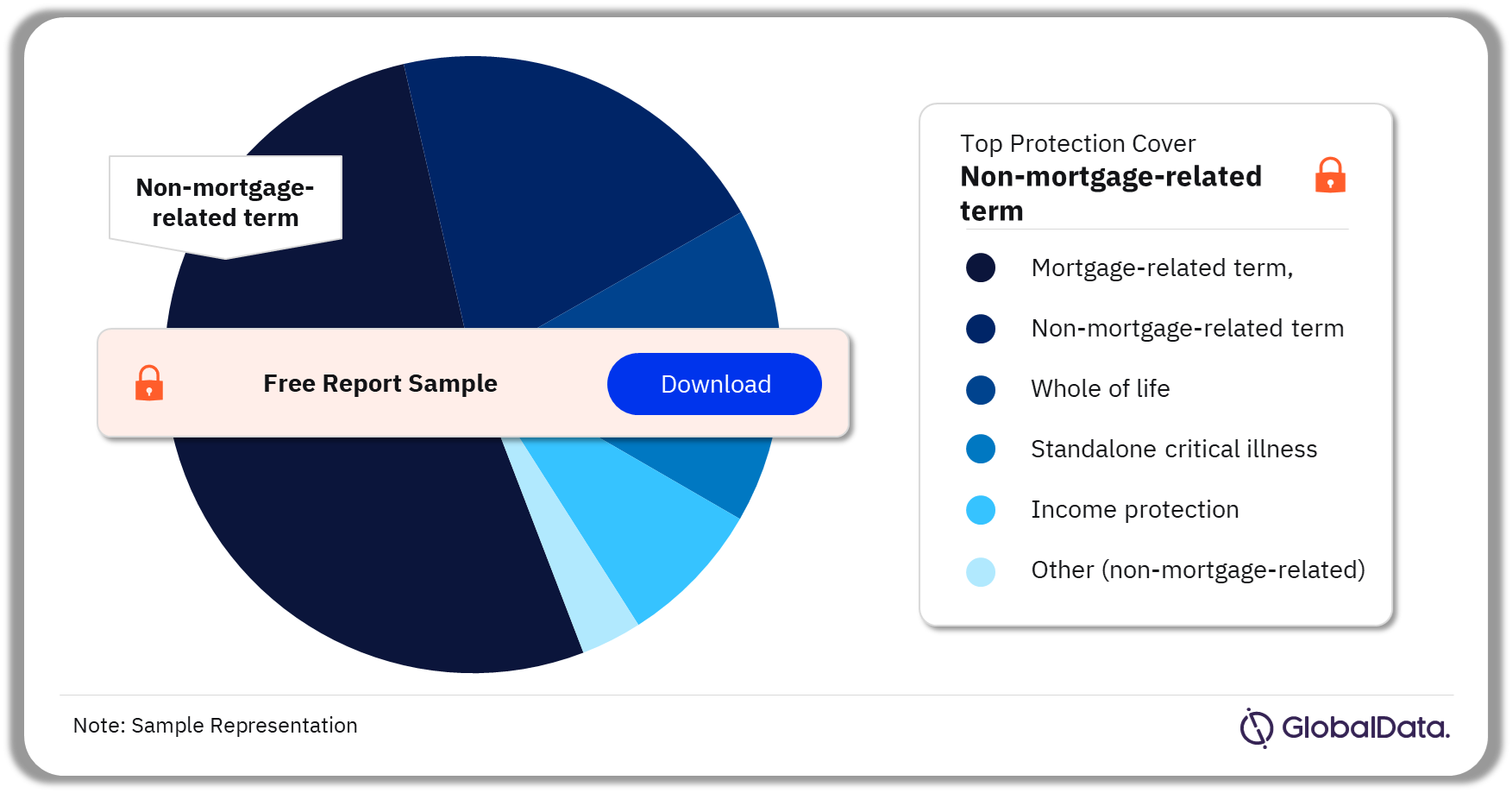

UK Protection Insurance Market Segmentation by Protection Cover

The key protection covers provided in the UK insurance market are mortgage-related term, non-mortgage-related term, whole of life, standalone critical illness, income protection, and other (non-mortgage-related). In 2022, non-mortgage-related term had the highest number of contracts and new business premiums. Despite an overall increase in residential mortgage lending in 2022, the mortgage-related market experienced a decline. This can be attributed to the impact of interest rate hikes and consumer expenditure pressures.

UK Protection Insurance Market Analysis by Protection Cover, 2022(%)

Buy the Full Report to For More Information on the Protection Cover Insights of UK Protection Insurance Market or Download a Free Sample Report

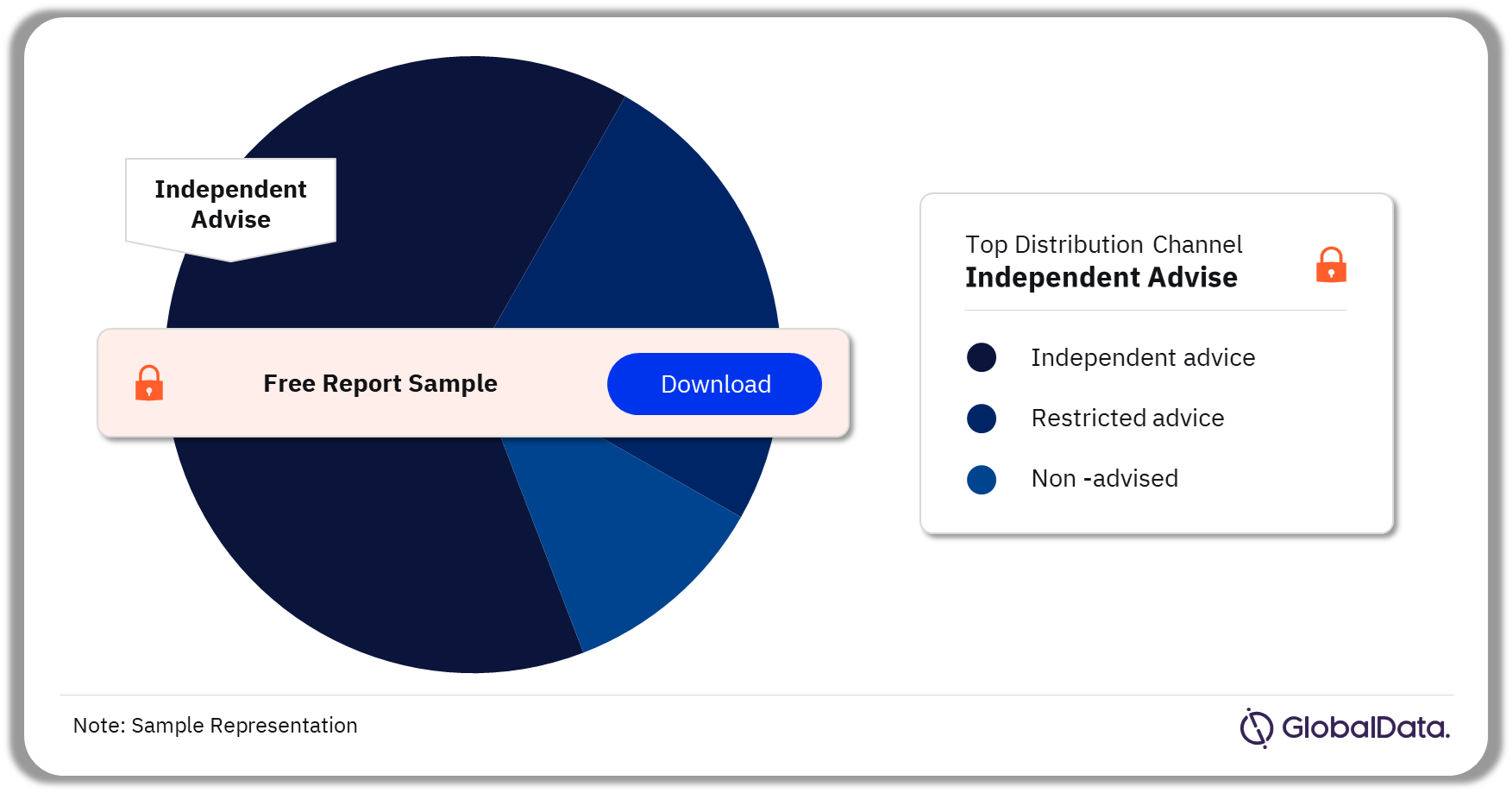

UK Protection Insurance Market Segmentation by Channels

The key channels in the UK protection insurance market are independent advice, restricted advice, and non-advised. In 2022, independent advised had the highest number of contracts and new business premiums.

UK Protection Insurance Market Segmentation by Channels, 2022(%)

Buy the Full Report for More Channel Insights in the UK Protection Insurance Market or Download a Free Sample Report

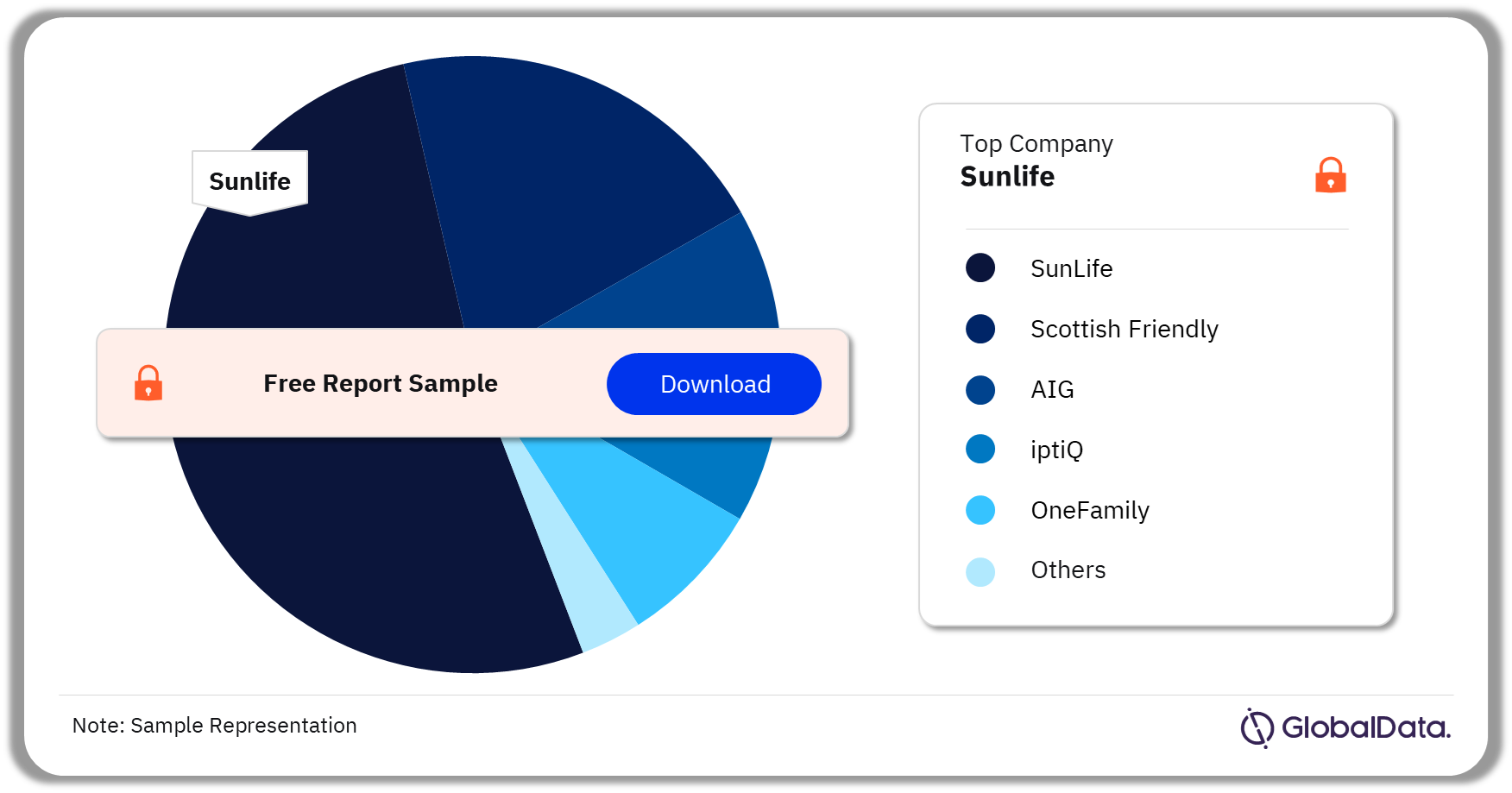

UK Protection Insurance Market – Competitive Landscape

Some of the leading companies in the UK protection insurance market are SunLife, Scottish Friendly, AIG, iptiQ, OneFamily, and others. In 2022, Sunlife accounted for the highest market share, followed by Scottish Friendly. SunLife’s customer-centric focus has contributed to its success. It offers a multitude of services to address a wide variety of consumer needs, such as providing mental health resources and support.

UK Protection Insurance Market Analysis by Leading Companies, 2022(%)

Buy the Full Report to Get Access on the leading Companies in the UK Protection Insurance Market or Download a Free Sample Report

Key Segments Covered in this Report.

UK Protection Insurance Contracts by Protection Cover Outlook (%, 2022)

- Mortgage-related term

- Non-mortgage-related term

- Whole of life

- Standalone critical illness

- Income protection

- Other (non-mortgage related)

UK Protection Insurance Contracts by Distribution Channel Outlook (%, 2022)

- Independent advice

- Restricted advice

- Non-advised

UK Protection Insurance Companies Outlook (%, 2022)

- SunLife

- Scottish Friendly

- AIG

- iptiQ

- OneFamily

- Royal London

- Promis Life

Scope

SunLife was the top provider in 2022 due to its dominant position in the over-50s market. Meanwhile, the market’s top five providers controlled 83.1% of the market.

Innovations target simplifying underwriting for mental conditions, as well as creating products that cater to individuals who cannot make monthly payments due to the cost-of-living crisis.

Further investments in digitalization should make whole of life products more accessible to tech-savvy individuals, potentially increasing the customer base.

Key Highlights

- SunLife was the top provider in 2022 due to its dominant position in the over-50s market.

- Innovations target simplifying underwriting for mental conditions, as well as creating products that cater to individuals who cannot make monthly payments due to the cost-of-living crisis.

- Further investments in digitalization should make whole of life products more accessible to tech-savvy individuals, potentially increasing the customer base.

Reasons to Buy

- Examine the size of the whole of life assurance market.

- Learn about key market drivers, including the impact of COVID-19 and the cost-of-living crisis.

- Discover which providers lead the way in the whole of life assurance space.

- Understand how whole of life assurance claims compare to other protection products.

SunLife

Zurich

iptiQ

Swiss Re

National Friendly

Neilson Financial Services

Royal London

AIG

OneFamily

Promis Life

Unisure

Teladoc Health

Table of Contents

Frequently asked questions

-

Which insurance type had the highest number of contracts and new business premiums in the UK protection insurance market?

In 2022, non-mortgage-related term had the highest number of contracts and new business premiums in the UK insurance market.

-

Which channel led the UK protection insurance market?

Independent advice had the highest number of contracts and new business premiums in the UK insurance market by protection cover.

-

Which are the key companies in the UK protection insurance market?

Some of the key companies in the UK protection insurance are SunLife, Scottish Friendly, AIG, iptiQ, OneFamily, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports