15 Apr, 2020 Top ten M&A financial advisers in North America for coronavirus-hit Q1 2020 according to GlobalData

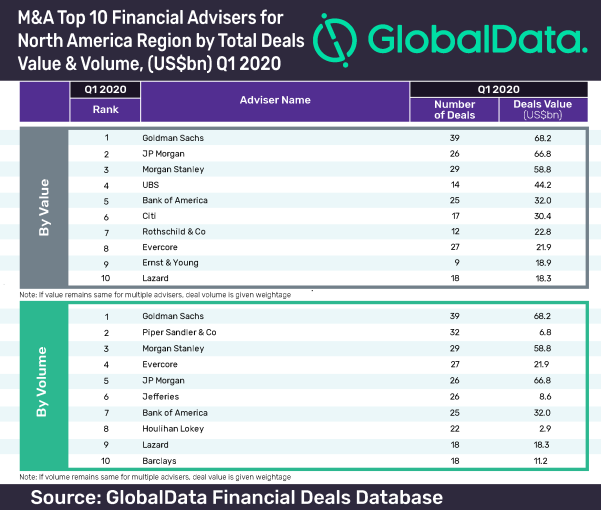

Posted in Business FundamentalsGlobalData has revealed the latest mergers and acquisitions (M&A) league table of the top ten financial advisers in North America by value and volume for the coronavirus-hit Q1 2020, which witnessed decline in overall deal activity in the region.

Goldman Sachs leads by value and volume

Goldman Sachs has secured the top position in the latest mergers and acquisitions (M&A) league table of the top ten financial advisers in North America based on deal value and volume for the first quarter of 2020, according to GlobalData, a leading data and analytics company.

The American investment bank, with a total deal value of US$68.2bn on the strength of 39 deals, emerged as the clear winner by deal value and volume.

According to GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world to compile the league tables, JP Morgan, occupied the second position with transaction worth US$66.8bn, in value terms. In volume terms, Piper Sandler & Co ranked second with 32 deals.

Ravi Tokala, Financial Deals Analyst at GlobalData, comments: “The North America experiencing fewer megadeals (>US$10bn) and M&A activity targeting the region witnessing a down trend, leads to a significant decrease of 47.11% in total deals value in Q1 2020 over Q1 2019.

“Goldman Sachs emerged as the clear winner in value and volume terms in the region. However, in value terms, there was tough competition between Goldman Sachs and JP Morgan for the top spot, with the former taking lead by a mere ~$1.4bn. Despite advising 32 deals Piper Sandler & Co did not figure in the top 10 value table due to its involvement low volume transactions.”

Goldman Sachs, which topped the league table of M&A financial advisers North America also claimed top position in GlobalData’s recently released global league table of top 20 M&A financial advisers by value.

North America deals market in Q1 2020

The deal volume in North America saw a decrease by 19.67% from 7,255 to 5,828 deals in the first quarter of 2020. Deal value also declined by 47.11% from US$477.7bn in the first quarter of 2019 to US$252.7bn in Q1 2020.