Automotive DECODED

Previous edition: 09 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

In data: India market slows, but rebound expected

GlobalData analysis shows that despite a slowdown to LV sales in March, a rebound is expected after the elections

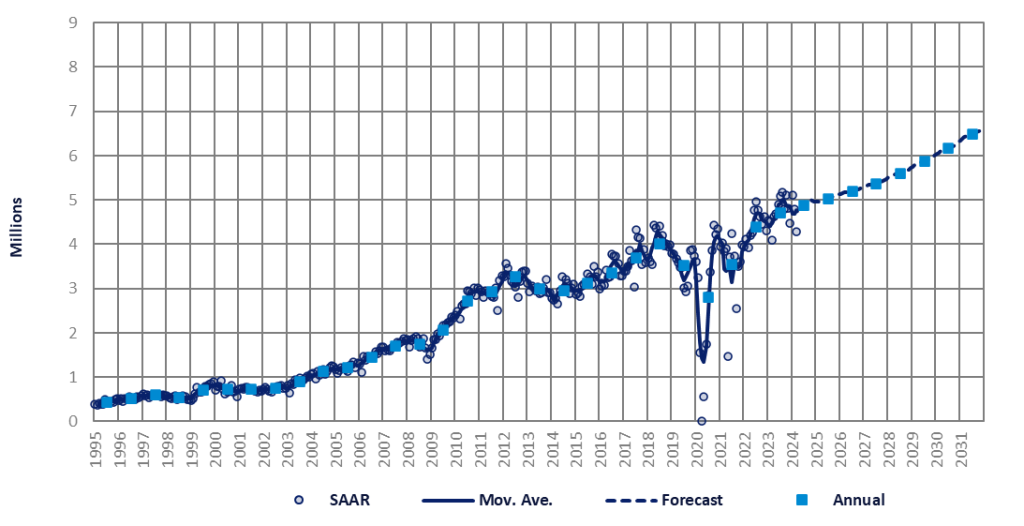

The Indian automotive market experienced a robust start to the year, but this momentum slowed in March, with a notable 11% month-on-month (MoM) decrease in the selling rate to about 4.3 million units. This marked the second consecutive MoM decline.

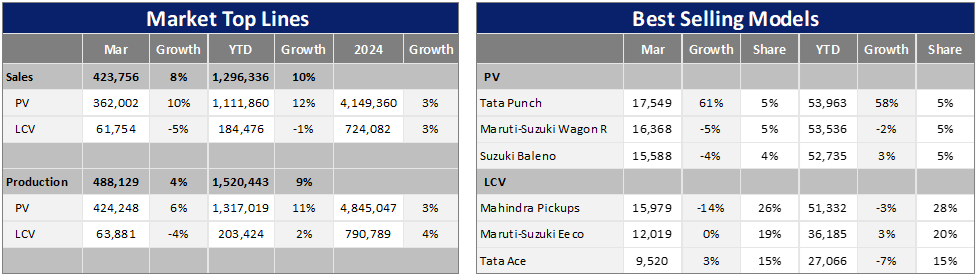

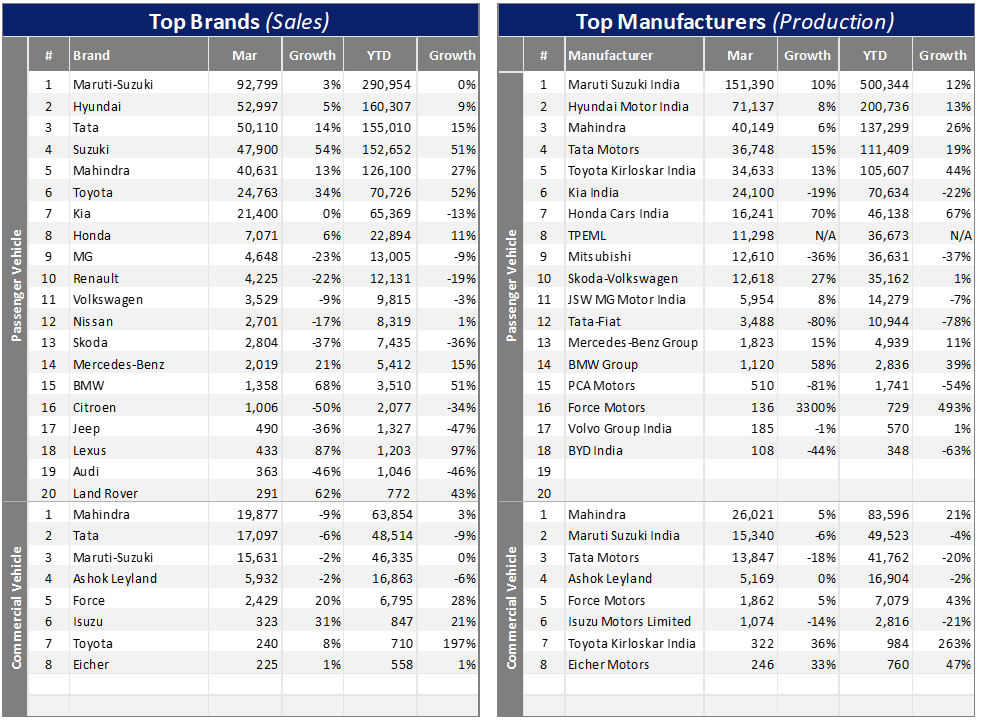

Despite this downturn, Light Vehicle (LV) wholesales remained resilient at 424k units, showing a slight 1% dip from the previous month but an 8% increase year-on-year (YoY). Passenger Vehicle (PV) sales were at 362k units (-1% MoM, +10% YoY), while dispatches of Light Commercial Vehicles (LCVs) with GVW up to 6T stood at 62k units (0% MoM, -5% YoY).

Automakers continued to streamline inventory for older and weak-selling models during the month. Reports indicate that dealership inventories of PVs in India surpassed 300k units at the start of April.

Demand also weakened, as consumers and businesses adopted a wait-and-see attitude because of the April/May general elections.

Nevertheless, a backlog of orders, the recently launched new models (mostly SUVs), and aggressive discounts from OEMs helped sustain sales. SUVs continued to be the market's primary growth engine, as major OEMs have broadened their SUV offerings to include smaller models.

Meanwhile, retail sales of PVs and LCVs declined further to 372k units in March, down from 379k units in February and 443k units in January, according to data from the Federation of Automobile Dealers Associations (FADA).

“The downturn (in the PV segment) was influenced by heavy discounting and selective financing further affected by economic worries and the electoral climate. Nonetheless, positives such as improved vehicle availability, increased stock levels and new model launches did stimulate demand in certain areas,” explained FADA President Manish Raj Singhania.

LV sales in Q1 2024 gained by 10% YoY to 1.3 million units, comprising 1.1 million PVs (+12% YoY) and 184k LCVs (-1% YoY). As a result, the selling rate averaged a robust 4.73 million units per year during the quarter.

Preliminary data for April indicate that PV sales may have remained stable or experienced nominal growth over the high base in April 2023. For example, PV wholesales for Suzuki Group declined by 1% YoY in April, while Hyundai's sales edged up by 1% YoY. Additionally, Tata Motors' PV volumes saw a modest 2% YoY increase.

Buyers are cautious because of the general elections, with entry-level buyers particularly absent from the market due to adverse macroeconomic factors.

Furthermore, FADA suggests that there are signs of weakened consumer confidence among urban Indians, leading to a reduction in discretionary spending amid persistently high financing rates.

Still, we anticipate that sales will pick up after the general elections, bolstered by a variety of new models and new model generations slated for release this year. Most importantly, SUV sales are showing no signs of slowing down, presenting a potential upside risk to our forecast.

Conversely, the downside risks to the 2024 forecast stem from the sticky inflation and high interest rates. Inflation continued to hover above the Reserve Bank of India’s 4% target, which has dampened expectations of an interest rate cut soon. This will likely stifle demand from buyers of small and entry-level cars.

Additional concerns include the impact of global warming on rural India, an uncertain global outlook, and rising oil prices – a significant issue for India as a major oil importer.

Although March sales fell short of our expectations, we maintain our forecasts. We project that LV sales will grow by 3% YoY to a new all-time high of 4.9 million units this year.

Latest news

China PV sales fall 2% in April

Retail sales of light passenger vehicles in China fell 2% year on year to 1.585m units in April and 6% month on month, according to the China Passenger Car Association (CPCA), despite the Chinese government’s ongoing efforts to stimulate domestic consumption.

Toyota foresees FY25 profit decline

Toyota Motor reportedly has forecast a 20% profit decline in the current financial year ending 31 March 2025 citing looming investment in both its suppliers and strategy after it delivered blockbuster fourth quarter earnings.

Hyundai Mobis to build BEV parts plant in Ulsan

South Korean automotive components manufacturer Hyundai Mobis has agreed to invest US$90bn (US66m) to build a plant in the south of the country for the production of modules for battery electric vehicles (BEVs).

Nio partners with BYD to take on Tesla - report

Reuters reports that Nio has made a deal with BYD to source batteries for an EV brand called “Onvo” in English (“Ledao" in Chinese), which will be priced at a lower range in a bid to compete with Tesla.

Nvidia backs UK self-driving startup Wayve

UK self-driving start-up Wayve has announced it has raised $1.05 billion with an investment round led by chipmaker Nvidia and Japanese tech giant SoftBank Group.

Daimler Truck happy despite lower Q1 unit sales

Daimler Truck said it delivered "solid results" in the first quarter of 2024 despite lower unit sales.

Daimler truck testing BEV AV truck in US

Daimler Truck has combined battery electric drive and integrated autonomous driving technology into one semi-truck for the first time: the autonomous Freightliner eCascadia technology demonstrator.

Goodyear reduces quarterly loss

Goodyear's first quarter 2024 sales were US$4.5bn with tyre unit volume totaling 40.4m.

In our previous edition

Automotive Decoded

2024 future product report: Lincoln

08 May 2024

Automotive Decoded

Innoviz: For BMW, Level 3 autonomy is here

07 May 2024

Automotive Decoded

Multi-energy platforms and agility a key strength - Stellantis CFO

06 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Banking & Payments

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer