China Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

China Cards and Payments Market Report Overview

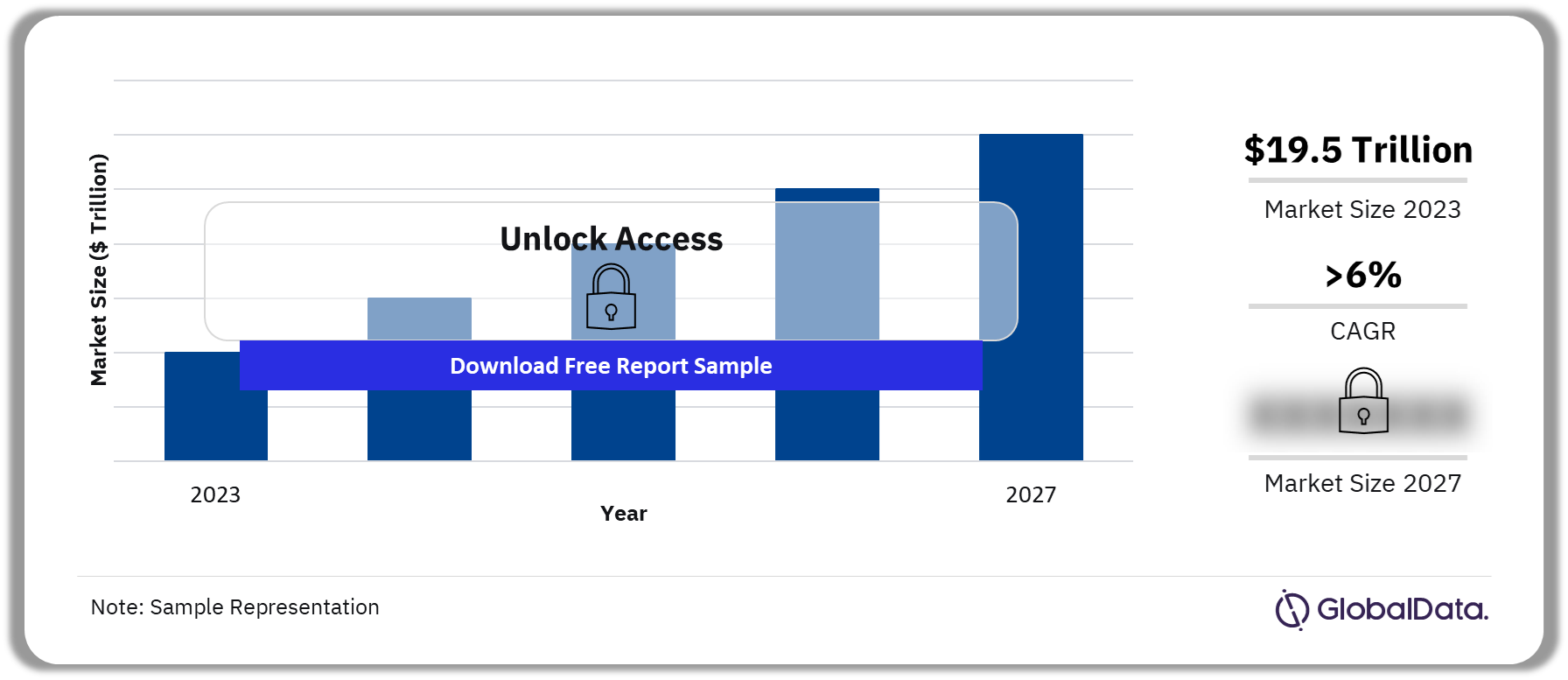

The China cards and payments market size was valued at $19.5 trillion in 2023 and is expected to achieve a CAGR of more than 6% during 2023-2027. China is the world’s largest payment card market in terms of transaction value. The People’s Bank of China (PBOC) (the country’s central bank) and card issuers have launched initiatives such as enforcing a cap on merchant service fees and making efforts to change consumer payment habits. As a result, payment cards are gradually becoming more accepted, with their use growing during 2019–23. Meanwhile, mobile payments have gained widespread adoption, with Chinese consumers favoring mobile wallets such as Alipay and WeChat Pay for day-to-day, low-value transactions. With the government announcing the discontinuation of its zero-COVID policy in December 2022, economic recovery is expected to follow – which will benefit the country’s cards and payments industry.

China Cards and Payments Market Outlook, 2023-2027 ($ Trillion)

To gain more information on the China cards and payments market forecast, download a free report sample

The China cards and payments market research report provides a detailed analysis of market trends in China’s cards and payments industry. It provides values and volumes for several key performance indicators in the industry including cash, cards, credit transfers, direct debits, and cheques during the review-period. The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes.

| Market Size (2023) | $19.5 trillion |

| CAGR | >6% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Mobile Wallets

· Cards · Credit Transfers · Cash · Direct Debits · Cheques |

| Key Segments | · Card-Based Payments

· Merchant Acquiring · Ecommerce Payments · In-store Payments · Buy Now Pay Later · Mobile Payments · P2P Payments · Bill Payments · Alternative Payments |

| Leading Players | · China Construction Bank (CCB)

· Agricultural Bank of China (ABC) · Industrial and Commercial Bank of China (ICBC) · Postal Savings Bank of China · Bank of China (BOC) · ChinaMerchants Bank (CMB) · Ping An · Bank of Communications · China Everbright Bank |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

China Cards and Payments Market Dynamics

China UnionPay continues to dominate the payments landscape. Since its launch in 2002, China UnionPay (CUP) has been the only payment card scheme and network in China. While international schemes are present in the market, they are co-badged with CUP. However, international payment companies have finally gained access to the Chinese market, with the PBOC allowing foreign scheme providers to set up card processing networks. In addition, China is home to one of the most mature mobile wallet markets in the world. Mobile wallets have become a mainstream payment instrument in China; they are widely used for day-to-day transactions at supermarkets, street stalls, and on public transport, as well as for online payments. The rapid adoption of smartphones, growing internet penetration, the availability of secure online payment systems, and the increasing number of online shoppers have supported the healthy growth of E-commerce in China.

For additional China cards and payments market dynamics, download a free report sample

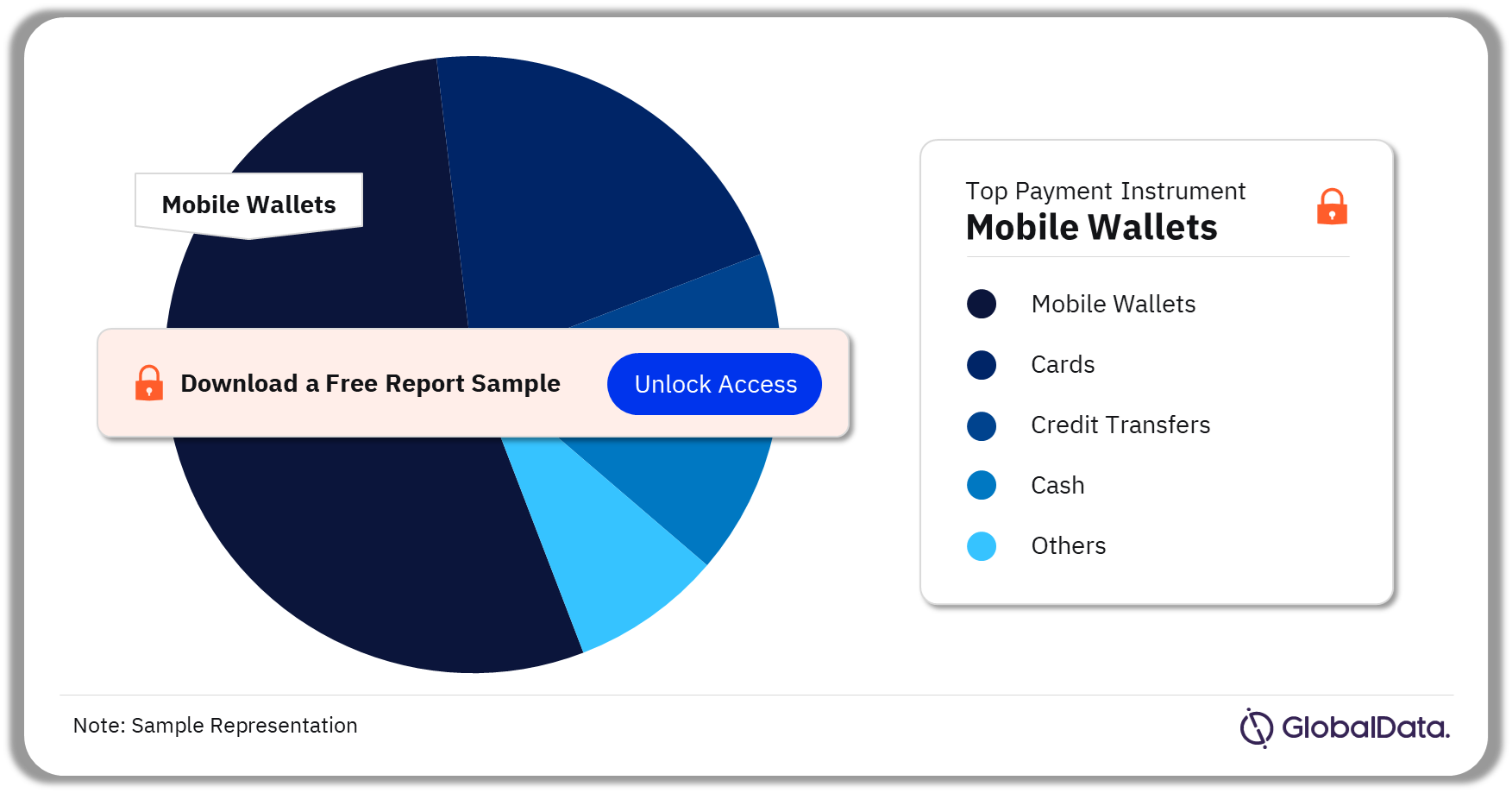

China Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the China cards and payments market are mobile wallets, cards, credit transfers, cash, direct debits, and cheques. In 2023, Mobile Wallets accounted for the largest market share followed by cards, and credit transfers.

China Cards and Payments Market Analysis by Payment Instruments, 2023 (%)

For more payment instrument insights into the China cards and payments market, download a free sample report

China Cards and Payments Market Segments

The key segments in the China cards and payments market are card-based payments, e-commerce payments, and alternative payments among others

Card-based Payments: Card penetration is high in China at 7 cards per individual in 2023e. This has been supported by the rising banked population and improving awareness of banking services. Debit cards dominate the overall payment space, while credit and charge cards are more frequently used for high-value transactions. Chinese consumers are comfortable using their payment cards for a variety of purposes. Clothing and footwear as well as electrical goods rank among the top three across all card types. Contactless card adoption remains low in China, mainly due to the dominance of mobile wallets. However, efforts are being made by banks, card issuers, and payment participants to promote this technology.

Payment Cards Analysis by Segments, 2023 (%)

For more insights on the China payment card segments, download a free report sample

China Cards and Payments Market - Competitive Landscape

Some of the leading players in the China cards and payments market are China Construction Bank (CCB), Agricultural Bank of China (ABC), Industrial and Commercial Bank of China (ICBC), Postal Savings Bank of China, Bank of China (BOC), ChinaMerchants Bank (CMB), Ping An, Bank of Communications, and China Everbright Bank among others.

Segments Covered in the Report

China Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Mobile Wallets

- Cards

- Credit Transfers

- Cash

- Direct Debits

- Cheques

China Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

- Others

Scope

This report provides:

- Top-level market analysis, information, and insights into China’s cards and payments industry

- Current and forecast values for each market in China’s cards and payments industry, including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, cards, credit transfers, direct debits and cheques. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing China cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of China’s cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the China cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the China cards and payments industry.

- Assess the competitive dynamics in the China cards and payments industry.

- Gain insights into marketing strategies used for various card types in China.

- Gain insights into key regulations governing the China cards and payments industry.

CITIC aiBank

China Merchants Bank

China Construction Bank

Industrial and Commercial Bank of China

Bank of China

Postal Savings Bank of China

Ping An Bank

Bank of Communications

China Everbright Bank

PBOC

China UMS

All-in-pay

Lakala

Yeahka

Huifu

Alipay

WeChat Pay

Apple Pay

Huawei PAy

Tenpay

Ant Check Later

PayPal

Mi Pay

QuickPass

China UnionPay

Visa

Mastercard

American Express

Table of Contents

Frequently asked questions

-

What was the China cards and payments market size in 2023?

The cards and payments market size in China was valued at $19.5 trillion in 2023.

-

What is the China cards and payments market growth rate?

The cards and payments market in China is expected to achieve a CAGR of more than 6% during 2023-2027.

-

Which is the leading payment instrument in the China cards and payments market in 2023?

Mobile wallets is the leading payment instrument in terms of volume transactions in the China cards and payments market.

-

Who are the leading players in the China cards and payments market?

Some of the leading players in the China cards and payments market are China Construction Bank (CCB), Agricultural Bank of China (ABC), Industrial and Commercial Bank of China (ICBC), Postal Savings Bank of China, Bank of China (BOC), ChinaMerchants Bank (CMB), Ping An, Bank of Communications, and China Everbright Bank.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports