Data Privacy in Banking – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Data Privacy in Banking Overview

Data underpins and enriches all aspects of a service or product in retail banking, whether optimizing channel interactions, personalizing risk assessment (across credit, market, and operational), or helping customers make better financial decisions. Data is also critical to the development of transformative new technologies such as artificial intelligence (AI), big data, and the Internet of Things (IoT).

The data privacy in banking thematic intelligence report provides a comprehensive overview of various types of privacy-enhancing technologies such as encryption, anonymization, and pseudonymization.

Key Trends

The key trends that are related to the data privacy theme can be classified into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Technology trends – Some of the key technology trends impacting the data privacy theme include tensions between new technologies and privacy, growth in emerging privacy-enhancing technologies, data mapping, data democratization, ongoing legacy technology challenges amid data privacy/sharing mandates, IoT in banking, cloud migration, voice banking, tokenization, and edge computing.

- Macroeconomic trends – The key macroeconomic trends that will shape the data privacy theme are increased focus on privacy during the pandemic, ultra-low interest rates driving data-driven revenue generation, the rise of super-apps in banking, privacy is expensive to get right but more expensive to get wrong, and ad-driven business models.

- Regulatory trends – Some of the key regulatory trends shaping the data privacy theme include increment in the volume of privacy regulation, new entrants seeking voluntarily standards, focusing on the legal basis for data usage, consent management, fragmented regulations, regulatory limits to ‘platformification’, compliance language, cookies, and data storage.

For more insights on key trends shaping the data privacy in banking theme, download a free report sample

Data Privacy in Banking – Industry Analysis

The financial services firms within the banking industry collect data with customers’ consent and protect that data while using it to deliver an enhanced and highly personalized experience.

The data privacy in banking industry analysis also covers:

- Fraud prevention

- Recommendation engines

- The ‘splinternet’

- Mergers & Acquisitions

- Timeline

Data Privacy in Banking - Value Chain Analysis

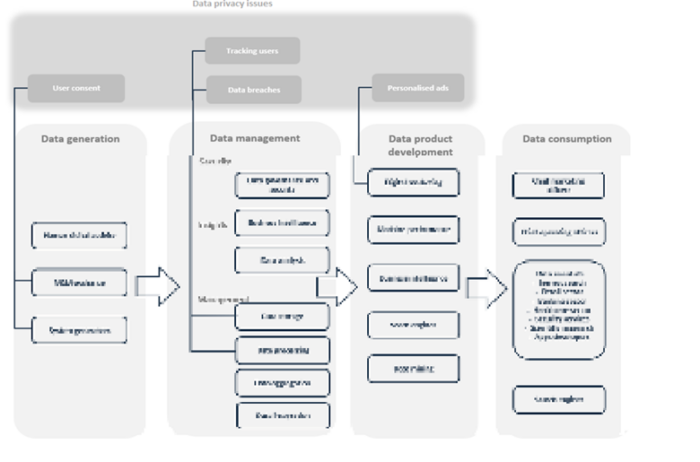

GlobalData’s data privacy value chains can be divided into four segments: data generation, data management, data product development, and data consumption.

Data Generation

Data is generated by individuals through activities like browsing the web, purchasing items online, and interacting with social media. Businesses are also keen to gather and analyze as much data as they can for their commercial use.

Data Privacy Value Chain Analysis

For more insights on the data privacy value chains, download a free report sample

Leading Tech Companies

Some of the leading tech companies associated with the data privacy theme are:

- Alibaba

- Apple

- ByteDance

Leading Retail Banks

Some of the leading retail banks associated with the data privacy theme are:

- Banco Bradesco

- BBVA

- Citibank

Leading Technology Vendors

Some of the leading technology vendors associated with the data privacy theme are:

- Cornami

- Decentriq

- Immuta

To know more about leading companies associated with the data privacy theme, download a free report sample

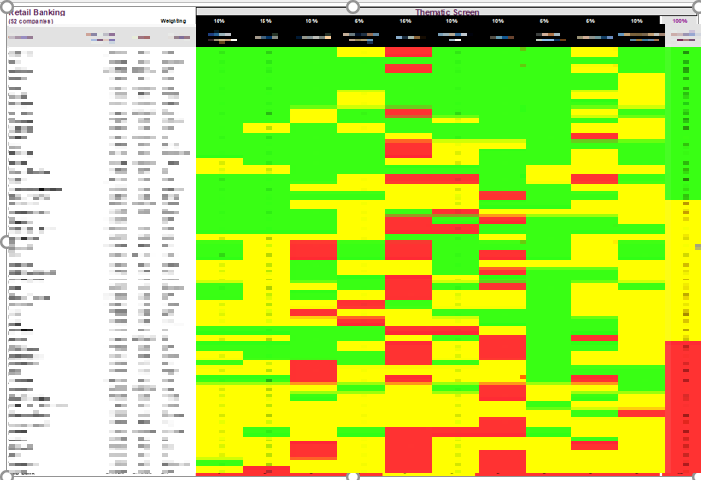

Retail Banking Sector Scorecard – Data Privacy Theme

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The retail banking sector scorecard has two screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

Retail Banking Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Data Privacy in Banking Market Overview

| Report Pages | 39 |

| Regions Covered | Global |

| Key Trends | Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Value Chains | Data Generation, Data Management, Data Product Development, and Data Consumption |

| Leading Tech Companies | Alibaba, Apple, and ByteDance |

| Leading Retail Banks | Banco Bradesco, BBVA, and Citibank |

| Leading Technology Vendors | Cornami, Decentriq, and Immuta |

Reasons to Buy

- Understand key technology, macroeconomic, and regulatory trends impacting the data privacy theme.

- Identity priority application areas for privacy-enhancing technologies and the vendors and banks delivering these experiences to end users.

- Access firm-level insight on the leading players within data privacy.

Facebook/Meta

Apple

Alphabet

Tinkoff Bank

AIB

Capital One

WeBank

MYbank

Monzo

NatWest/RBS

Danske Bank

DBS

TSB

BBVA

Citibank

mBank

Revolut

Credit Agricole

Barclays

CreditLadder

NovaCredit

Experian

Equifax

TransUnion

Tink

Bud

Plaid

TrueLayer

Cornami

Decentriq

Immuta

Inpher

Statice

Table of Contents

Frequently asked questions

-

What are the key technology trends shaping the data privacy theme in the banking sector?

Some of the key technology trends shaping the data privacy theme in the banking sector include tensions between new technologies and privacy, growth in emerging privacy-enhancing technologies, data mapping, data democratization, ongoing legacy technology challenges amid data privacy/sharing mandates, IoT in banking, cloud migration, voice banking, tokenization, and edge computing.

-

What are the key macroeconomic trends shaping the data privacy theme in the banking sector?

The key macroeconomic trends that will shape the data privacy theme in the banking sector are increased focus on privacy during the pandemic, ultra-low interest rates driving data-driven revenue generation, the rise of super-apps in banking, privacy is expensive to get right but more expensive to get wrong, and ad-driven business models.

-

What are the key regulatory trends shaping the data privacy theme in the banking sector?

Some of the key regulatory trends shaping the data privacy theme in the banking sector are increment in the volume of privacy regulation, new entrants seeking voluntarily standards, focusing on the legal basis for data usage, consent management, fragmented regulations, regulatory limits to ‘platformification’, compliance language, cookies, and data storage.

-

What are the components of the data privacy value chains in the banking industry?

GlobalData’s data privacy value chains can be divided into four segments: data generation, data management, data product development, and data consumption.

-

Which leading tech companies are associated with the data privacy theme?

Some of the leading tech companies within the data privacy theme are Alibaba, Apple, and ByteDance.

-

Which are the leading retail banks associated with the data privacy theme?

Some of the leading retail banks making their mark in the data privacy theme are Banco Bradesco, BBVA, and Citibank.

-

Which companies are the leading technology vendors of the data privacy theme?

Some of the leading technology vendors associated with the data privacy theme are Cornami, Decentriq, and Immuta.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports