Egypt Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Egypt Cards and Payments Market Overview

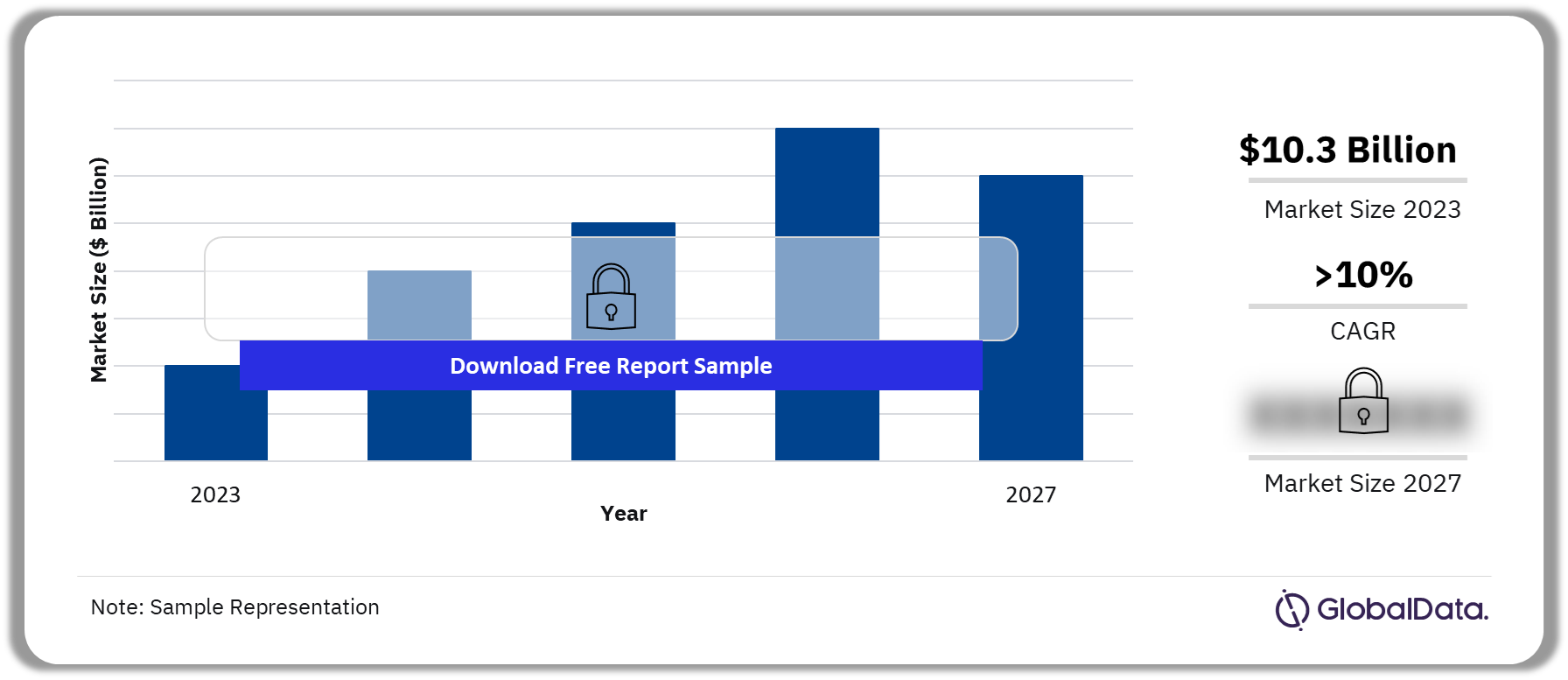

The annual value of card transactions in the Egypt cards and payments market is estimated to be $10.3 billion in 2023 and is expected to grow at a CAGR of more than 10% during 2023-2027. Electronic payments are gradually gaining ground in Egypt. The usage and adoption of payment cards are steadily increasing because of government initiatives to boost financial inclusion as well as improvements to the country’s payment infrastructure. Meanwhile, banks offer value-added benefits such as reward points, cashback, and discounts in addition to flexible installment options to increase the use of payment cards.

Egypt Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Egypt Cards and Payments Market Forecast Download a Free Sample Report

The Egypt cards and payments market research report provides a detailed analysis of market trends in the Egyptian cards and payments industry. It provides values and volumes for several key performance indicators in the industry including cash, mobile wallets, credit transfers, cards, direct debits, and cheques during the review period. The report also analyzes various payment card markets operating in the industry. It provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also covers regulatory policy details and recent regulatory structure changes. It includes information on the payment instruments that are in use in the Egyptian market, the key segments within the market, as well as the companies associated with the Egypt cards and payments market.

| Annual Value of Card Transactions (2023) | $10.3 billion |

| CAGR (2023-2027) | >10% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cash

· Mobile Wallets · Credit transfers · Cards · Direct debits · Cheques |

| Key Segments | · Card-Based Payments

· E-Commerce Payments · Alternative Payments |

| Leading Players | · PayPal

· WE Pay · NBE PhoneCash · Orange Cash · Etisalat Cash · Vodafone Cash |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Egypt Cards and Payments Market Dynamics

Egypt is predominantly a cash-based economy and cash is generally favored for low-value, day-to-day transactions. However, the growing acceptance of payment cards by retailers and the advent of contactless technology mean card-based payments will gradually displace cash. Moreover, scheme providers are launching campaigns to raise awareness around payment security and encourage the use of electronic payments. The government has launched the IPN instant payment system as well which will enable consumers to make fund transfers within seconds. The proliferation of digital-only banks and alternative payment methods as well as growth in the e-commerce market are set to support payment card growth going forward.

Buy the Full Report to Get Additional Egypt Cards and Payments Market Dynamics

Egypt Cards and Payments Market Segmentation by Payment Instruments

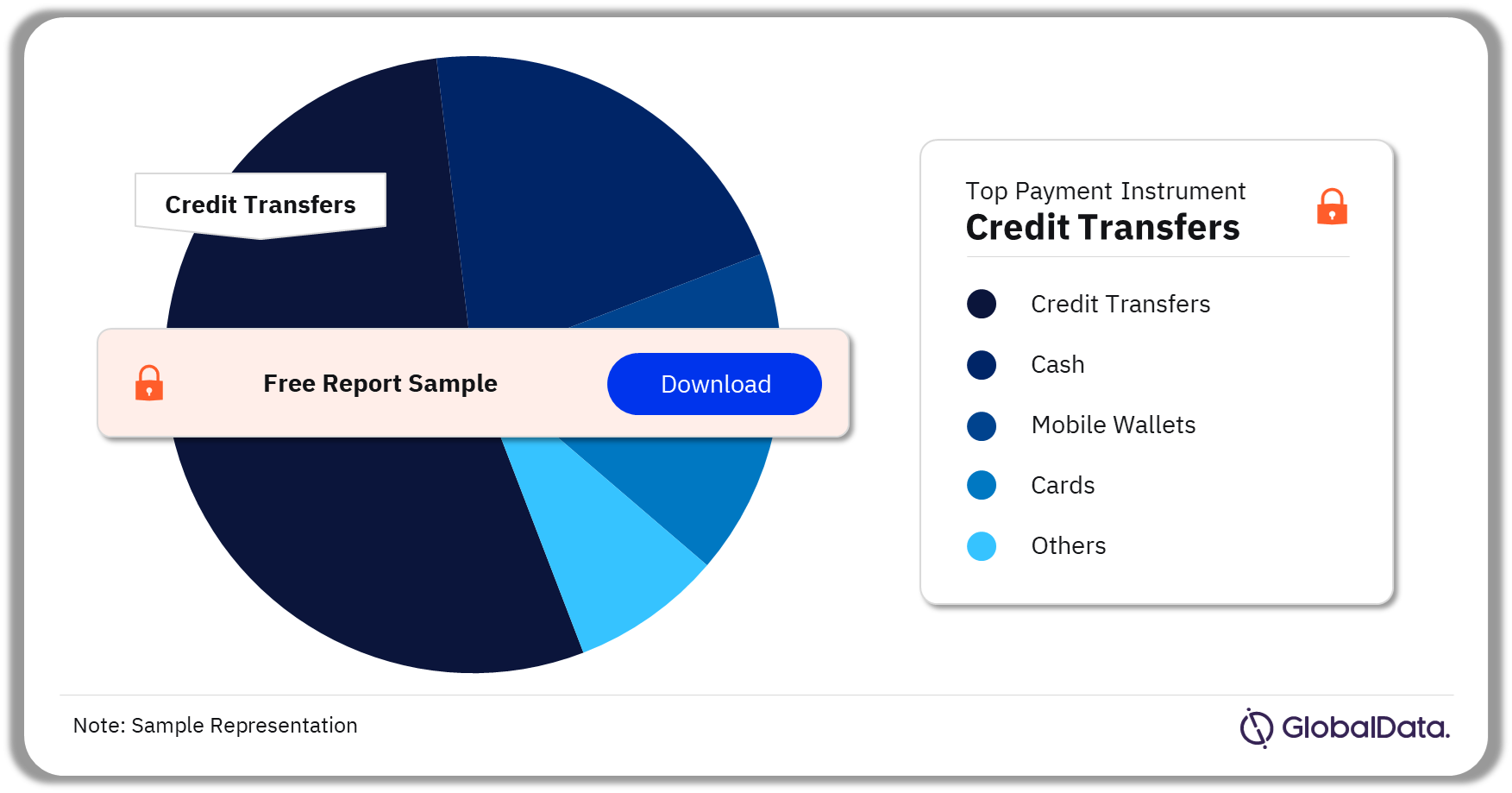

Cash has the highest share of payment transaction volume in 2023.

The key payment instruments in the Egypt cards and payments market are cash, mobile wallets, credit transfers, cards, direct debits, and cheques. Credit transfers lead the market in 2023 in terms of value and are mainly used by the government, banks, and businesses to handle transactions such as salary payments, pension deposits, wire transfers, and payments to suppliers. Urgent, high-value credit transfers are processed via the real-time gross settlement system while lower-value transactions are handled by the Automated Clearing House.

Egypt Cards and Payments Market Analysis by Payment Instruments (Value Terms), 2023 (%)

Buy Full Report for More Payment Instrument Insights into the Egypt Cards and Payments Market

Egypt Cards and Payments Market Segments

Visa and Mastercard are the main players in the Egyptian credit card market.

The key segments in the Egypt cards and payments market are card-based payments, e-commerce payments, and alternative payments.

Card-Based Payments: Even though cash is the preferred mode of payment in Egypt, the use of payment cards is increasing. The government and central bank are taking initiatives to provide banking access to the wider population and to promote electronic payments. This includes the launch of the Financial Inclusion Strategy 2022-2025, the availability of basic accounts with free debit cards, and various regulations designed to boost financial inclusion.

Buy the Full Report for More Market Segment Insights into the Egypt Cards and Payments Market

Egypt Cards and Payments Market - Competitive Landscape

Some of the leading players in the Egypt cards and payments market are:

- PayPal

- WE Pay

- NBE PhoneCash

- Orange Cash

- Etisalat Cash

- Vodafone Cash

PayPal: It is a money transfer and e-commerce payment provider that allows customers to transfer money from their bank account to their PayPal account to make online payments without using bank cards. PayPal also offers the One Touch instant checkout service in Egypt that allows users to skip the login process at partner sites in order to accelerate the payment process.

Leading Egypt Cards and Payments Players, 2023

Buy the Full Report to Know More about the Leading Egypt Cards and Payments Companies

Egypt Cards and Payments Market – Latest Developments

- In April 2023, to boost financial inclusion and promote debit card usage, the central bank mandated banks to provide accounts with no minimum deposits and fees, including a free debit card. For example, Al Ahli Bank of Kuwait offers financial inclusion accounts called Sohoula and Bedaya (for freelancers) with no account opening fees, no minimum balance requirements, and free debit cards.

- Tokenization allows payment cards to be registered on mobile apps and used for online and in-store payments in a secure way. In March 2023, the central bank issued regulations for the tokenization of payment cards on electronic devices. The regulations pave the way for international providers such as Apple Pay, Samsung Pay, and other fintech companies to launch their services in the country and allow issuing banks to digitize all types of payment cards.

Segments Covered in the Report

Egypt Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cash

- Mobile Wallets

- Credit transfers

- Cards

- Direct debits

- Cheques

Egypt Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

Scope

This report provides:

- Current and forecast values for each market in the Egyptian cards and payments industry including debit and credit cards.

- Detailed insights into payment instruments including cards, credit transfers, cheques, and direct debits. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Egyptian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit and credit cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Egyptian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Egyptian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Egyptian cards and payments industry.

- Assess the competitive dynamics in the Egyptian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Egypt.

- Gain insights into key regulations governing the Egyptian cards and payments industry.

Bank Misr

QNB ALAHLI

CIB

Arab African International Bank

Intesa Sanpaolo

Credit Agricole

HSBC

Attijariwafa Bank

Mastercard

Meeza

Visa

123 Network

Table of Contents

Frequently asked questions

-

What is the annual value of card transactions in the Egypt cards and payments market in 2023?

The annual value of card transactions in the Egypt cards and payments market is estimated to be $10.3 billion in 2023.

-

What is the growth rate of the annual card transactions in the Egypt cards and payments market?

The annual value of card transactions in the Egypt cards and payments market is expected to grow at a CAGR of more than 10% during 2023-2027.

-

Which is the leading payment instrument in the Egypt cards and payments market in 2023?

Credit transfer is the leading payment instrument in value terms in the Egypt cards and payments market in 2023.

-

Which are the leading players in the Egypt cards and payments market?

Some of the leading players in the Egypt cards and payments market are PayPal, WE Pay, NBE PhoneCash, Orange Cash, Etisalat Cash, and Vodafone Cash, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports