06 May, 2020 Big beauty and grooming players are learning from indie brands, says GlobalData

Posted in ConsumerBeauty and grooming behemoths are taking a page out of the book of indie by incorporating innovations that have been popularized by independent brands such as digitalization, personalization, wellness and sustainability. These trends are shaped by increasing consumer demand for products that reflect their lifestyles and ethics, according to GlobalData, a leading data and analytics company.

The company’s latest report, ‘Top Trends in Beauty and Grooming 2020, reveals that these key trends are driven by social media platforms, environmental issues and niche communities.

Yamina Tsalamlal, Consumer Analyst at GlobalData, says: “In 2019, there were 115 completed mergers and acquisitions (M&As) in the beauty space. One of the most notable was Shiseido’s acquisition of indie American brand Drunk Elephant for $845m in October 2019. Many consumer trends are launched on social media platforms, and Drunk Elephant offers the company a way to connect with younger customers with its bright and colourful social media channels.

“Young consumers are connecting with indie brands because they are seen as authentic and agile, connecting with consumers in a unique way. Shiseido’s acquisition demonstrates how large legacy brands that may struggle to reach younger consumers use acquisitions as a way to connect with a new audience and continue to grow.”

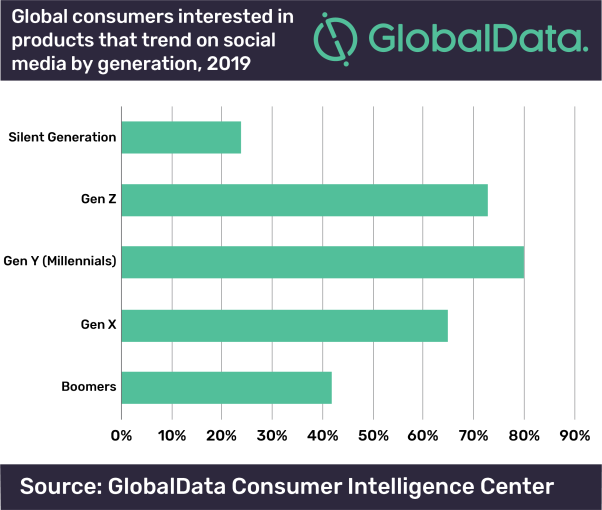

Generations Y, Z and X are most influenced by brands’ trending social media pages and products, as found in a survey by GlobalData. For example, in the company’s Q3 2019 survey, 80% of Gen Y said they were interested in products that are trending on social media, followed by Gen Z (73%) and Gen X (65%). In comparison, only 24% of the Silent Generation said they were interested in such products.

Another key component to indie brands’ success that can be leveraged by larger players is the potential for a tailored service or product. Another survey by GlobalData found that 89% of global consumers said they are always/often/somewhat influenced by how tailored a product or service is to their personality and lifestyle.2 While personalization is not a new trend, the meaning of the term has diversified.

Tsalamlal continues: “In 2020, we can expect to see more tailored products for previously unmet needs of different groups. For example, the personalization of makeup based on age is a newer concept with L’Oreal’s makeup line for mature women and a Netflix star’s makeup line for teens called Florence by Mills.”

Personalization is also highly relevant in the strongest performing category—skincare. With 2019 global sales at $139,495m, the category has seen robust growth over the past few years.3

Tsalamlal adds: “Skincare products are also used as part of customers’ personalized wellness rituals as moments when consumers can spend time taking care of themselves. Recent years have seen celebrity endorsed campaigns advocating that all skin types are unique and beautiful – this, in essence, leverages personalised claims to create a feeling of wellness and confidence in the customer.”

Beauty and grooming products, particularly in terms of skincare, are also defined by wellness and ‘look good, feel good’ positioning. Similarly to personalization, the attributes of wellness claims continue to expand, and is largely a hybrid between tailoring ethical and ‘pure’ claims with consumers’ lifestyles. Product launches that reflect this include those that promote natural beauty with natural products and packaging.

Tsalamlal concludes: “Looking ahead, we expect consumers to continue to demand that brands meet their lifestyle needs and be integrated into a wellness regime, particularly in a year filled with uncertainty.”

Source:

- GlobalData Global Consumer Survey, Q3 2019

- GlobalData Global Consumer Survey Q4 2018