01 Apr, 2020 Copper 2020 production forecasts cut to 21 million tonnes as coronavirus impact spreads, says GlobalData

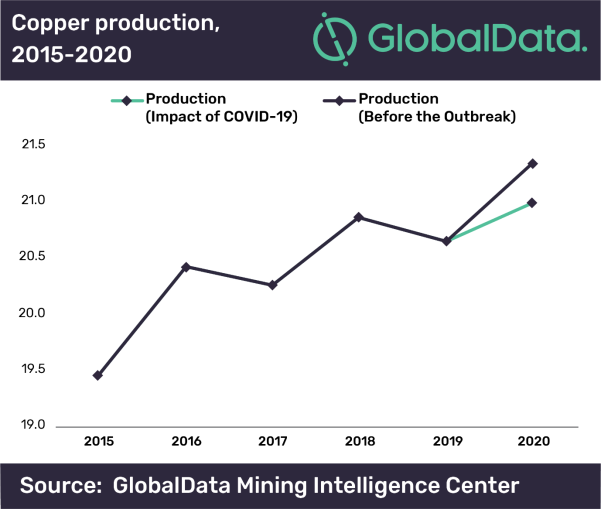

Posted in CoronavirusGlobal copper production in 2020 is expected to be impacted by the coronavirus (COVID-19) outbreak. After declining by 1.9% in 2019 to 20.6 million tonnes (Mt) due to lower ore grades and production disruptions, copper production was initially expected to grow by 3.4% in 2020 due to an anticipated increase in production from Chile, China and Peru. However, with falling demand and ongoing disruption to mining activities due to lockdowns, this has been reduced to just 1.9% – with production of 21Mt in 2020. The ongoing disruptions will be offset by production from the Cobre Panama and Grasberg mines, says GlobalData, a leading data and analytics company.

Vinneth Bajaj, Senior Mining Analyst at GlobalData, says: “Production growth in China is forecast to be around 6%, which is down from the 9.6% forecasted before the outbreak. Lockdowns in Chile and Peru will reduce the output in two markets that currently account for 40% of the global supply. Production in Chile is forecast to grow by 0.3% and in Peru by 2% – compared with a 1.4% decline and 2.6% growth respectively in 2019. There is also expected to be a slowdown in development of new projects.”

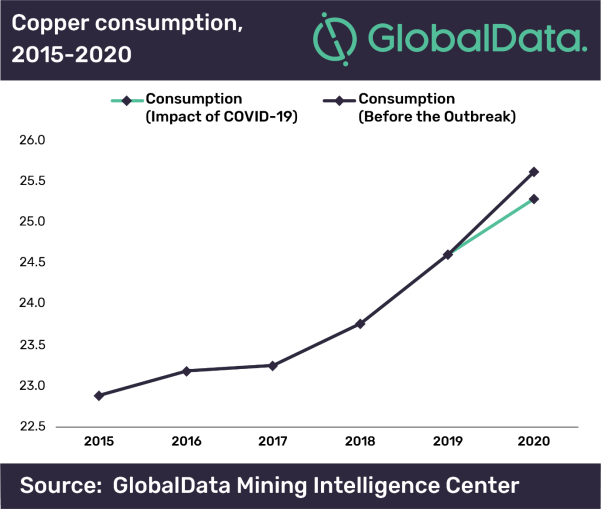

Around 40-45% of the global copper demand is from the construction sector and this is expected to be heavily impacted by the COVID-19 outbreak.

Bajaj adds: “GlobalData’s latest expectations are for global construction output to grow by just 0.5% in 2020, from an original forecast of 3.1%. The direct impact on construction has been the halting of work – with labor unable to get to the construction sites – and disruption to supply chains with delays in the delivery of key materials and equipment, due to quarantines and travel restrictions. Widespread postponement and cancellations of projects is also expected.”

Overall expectations are for copper demand growth of 2.7% versus the 4.1% predicted before the outbreak. The lower growth rates are linked heavily to lower construction activity in China from mid-January 2020, although the situation is gradually improving with restrictions and lockdowns being eased. However, there continues to be reduced activity globally as more countries move to limit non-essential business operations.

Vinneth adds: “The current forecast assumes that the outbreak is contained across all major markets by the end of the second quarter – following which conditions would allow for a return to normalcy in terms of economic activity and freedom of movement in the second half of the year. However, there will be a lingering and potentially heavy impact on private investment due to the financial toll that is being inflicted upon businesses and investors across a wide range of sectors.”

After the prolonged US-China trade war, which undermined copper market sentiment in 2019, with prices down by 8% over 2018, copper price improved during the fourth quarter of 2019, reaching US$5,893.2 per ton owing to the optimism regarding the US-China trade. However, prices initially fell steeply on the news of the spread of the virus between the middle of January and early February 2020 and, despite demonstrating resilience by reaching US$5,694 per ton on 4 March, with the outbreak of COVID-19 progressing globally, copper prices fell to US$4,775 per ton on 26 March. With weak industrial and construction activity and shrinking demand, the copper price is expected to remain low, averaging between US$4,900 per ton to US$4,700 per ton for the coming three months.