5G Infrastructure Market Trends and Analysis by Component, Frequency, Deployment Architecture, Region and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘5G Infrastructure’ report can help you:

- Make informed decisions about market entry, technology adoption, and project planning

- Identify your competitors’ capabilities to stay ahead in the market

- Identify promising segment analysis (component, frequency range, deployment architecture, and end-use vertical), growth trends, regional trends, and markets to expand your regional presence, product portfolio, or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify ongoing potential projects across regions

How is our 5G Infrastructure report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for 14 countries, including historical and forecast analysis for 2020-2030 for market assessment.

- Detailed segmentation by Component, Frequency Bands, and Deployment Architecture

- The report highlights segmentation at End-Use level – Commercial, Residential, Industrial, and Government

- The report offers technological trends, along with driving and challenging factors impacting the 5G Infrastructure market. The report further presents an overview of different use cases and capabilities of 5G infrastructure, which is expected to help stakeholders to understand and identify new application areas.

- The growth innovation matrix included in the report divides the market players into four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help the value chain participants to understand how competition is performing based on their revenue growth and R&D efforts.

- Competitive landscape includes 5G RAN Competitive Landscape Assessment and 5G Fixed Wireless – Vendor Landscape

- Competitive profiling and benchmarking of key players in the market to provide a deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Network infrastructure companies

- Telecommunications companies

- Network equipment vendors

- Regulatory agencies

- Head of market intelligence

- Management consultants

- Equity partners

- Venture capital firms

To Get a Snapshot of the 5G Infrastructure Market Report, Download a Free Report Sample

5G Infrastructure Market Overview

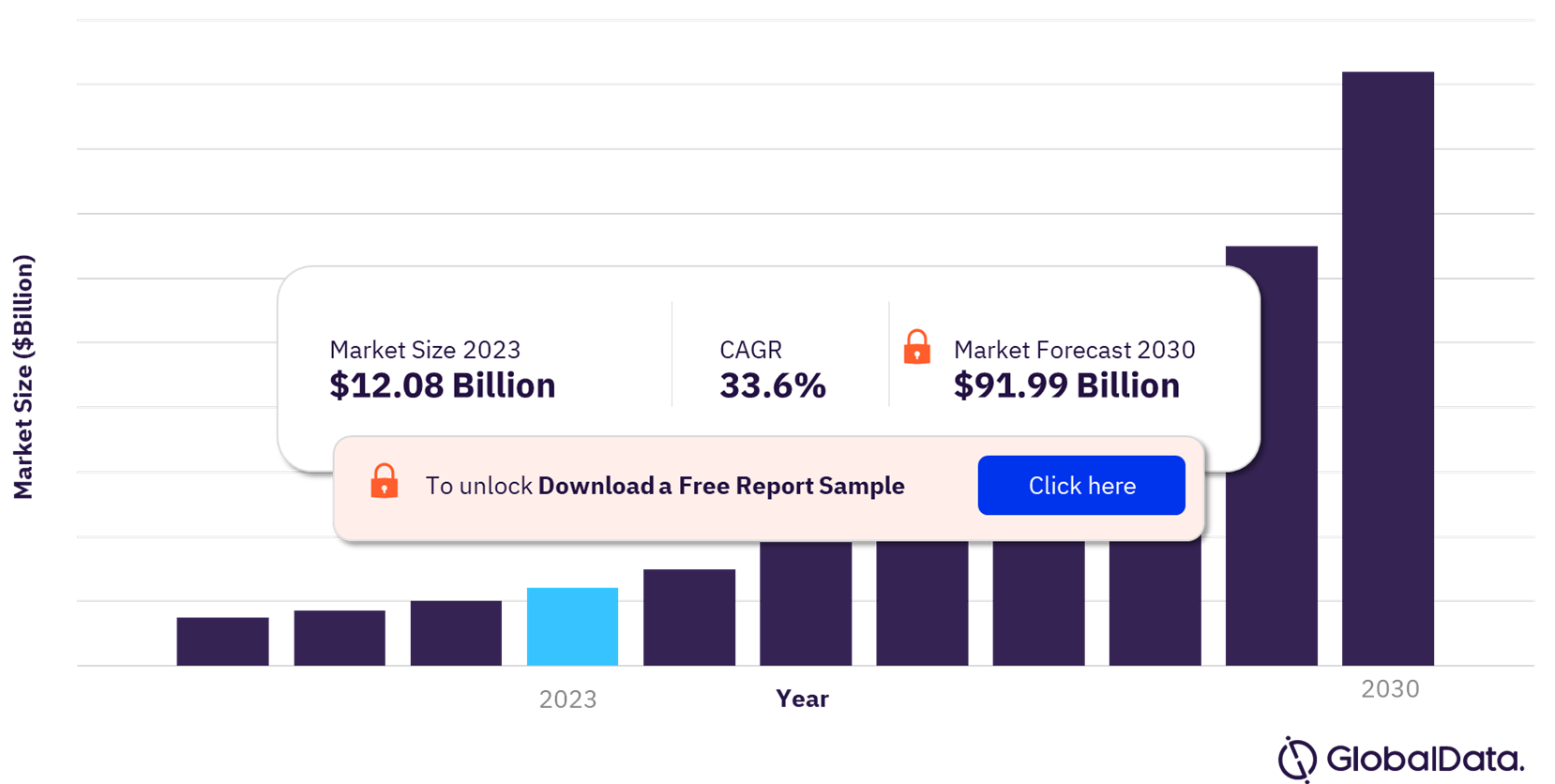

The 5G Infrastructure market will be valued at $12.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 33.6% over the forecast period. The 5G infrastructure comprises the Radio Access Network (RAN), core network, and backhaul and transport, with the latter incorporating fiber optics or microwave antennas. The rising demand for high-speed connectivity with low latency for various mission-critical applications like drone connectivity, vehicle-to-everything (V2X), and implementation of smart cities are anticipated to drive the growth of the 5G infrastructure industry.

The COVID-19 outbreak interrupted the implementation of the 5G infrastructure in many countries owing to the disturbances in testing and trials required for confirming the processing performance and stability of 5G standalone networks. The pandemic also stemmed the postponement of the 5G spectrum auction plans by the telecom regulators, thereby adversely impacting the market growth.

5G Infrastructure Market Outlook, 2020-2030 ($ billion)

View Sample Report for Additional Insights on 5G Infrastructure Market Forecast, Download a Free Report Sample

The proliferation of IoT devices and the increasing adoption of remote healthcare services has necessitated the need for reliable and fast connectivity. This growth is expected to be encouraged by the significant spending on healthcare facilities by some of the largest economies, including the US and China. The National Health Expenditure Accounts (NHEA) in the US predict healthcare expenditure to exceed $16.0 trillion by 2030, accounting for nearly 32% of the GDP. Likewise, the Chinese government has announced plans to increase healthcare spending to 6% of its GDP by 2025, up from the current level of around 5.5%. This is in line with the government’s overall goal of achieving universal healthcare coverage by 2030.

The 5G infrastructure market is expected to be further fueled by significant investments by governments and telecom companies in the development and deployment of 5G networks. For instance, the Federal Communications Commission (FCC), US, conducted an auction of 5G spectrum in 2020, which raised over $4.5 billion in revenue. Telecom companies will use this spectrum to deploy 5G networks across the country. Similarly, the Japanese government has set a goal to launch 5G services nationwide by 2023. However, challenges such as high deployment costs, limited spectrum availability, and regulatory constraints may hinder market growth.

5G Infrastructure Market Segmentation by Component

The 5G infrastructure market by component is bifurcated into hardware and services. The hardware segment captured the largest revenue share in 2022. The Radio Access Network (RAN) is responsible for delivering wireless connectivity to mobile devices, while the core network manages network traffic and provides connectivity between different RANs. Backhaul and transport networks connect RANs and core networks, and they play a critical role in ensuring seamless connectivity and data transfer. The hardware segment growth is owed to the increasing investments in RAN technologies such as virtualized RAN (vRAN) and Open RAN. These technologies assist in reducing costs and increasing flexibility in RAN deployments, therefore driving adoption among telecom operators.

Nevertheless, the services segment is anticipated to observe the highest growth with a CAGR of over 35.0% from 2023 to 2030. This growth is attributed to the increased adoption of consulting services that help businesses to optimize the performance of their 5G networks. This includes conducting network assessments, identifying, and resolving network performance issues, and providing ongoing support to ensure optimal network performance. Such services can also help businesses optimize the cost and identify and mitigate risks associated with 5G infrastructure deployment and operation.

For More Component Insights in the 5G Infrastructure Market, Download a Free Report Sample

5G Infrastructure Market Segmentation by Frequency Range

The 5G Infrastructure by frequency range segment is categorized as low-frequency bands (FR1) and high-frequency bands (FR2). The FR1 segment with a frequency range of 450 MHZ – 6 GHZ registered the largest market share in 2022 and is expected to continue its dominance in the market by 2030. The high demand for FR1 across the globe is directly impacted by the support this band offers to several applications in 5G, including Enhanced Mobile Broadband (eMBB), Internet of Things (IoT), Fixed Wireless Access (FWA), and critical communications. Communication service providers have significantly invested in acquiring FR1 frequencies and thus delivering high bandwidth services to businesses, consumers, and industries. For instance, in 2020, Vodafone acquired a 5G spectrum in the 3.6 GHz band in several European countries, including Germany, Italy, and Spain.

The higher frequency bands (FR2) of range 24.250 GHZ – 52.60 GHZ aim at providing short-range very high data rate capability for the 5G radio. FR2, also called millimeter wave (mmWave), has several potential applications in 5G, including virtual and augmented reality, smart cities, industrial automation, and telemedicine, among others. This segment is expected to witness substantial growth as few federal governments across developed economies have released mmWave spectrum bands to provide enhanced data services. Countries, including Japan, Russia, Italy, and South Korea, have released mmWave frequencies for improved data services.

For More Frequency Range Insights in the 5G Infrastructure Market, Download a Free Report Sample

5G Infrastructure Market Segmentation by Deployment Architecture

The non-standalone (NSA) network architecture dominated the global 5G infrastructure industry owing to the rapid adoption of NSA bringing many advantages, including faster deployment, cost-efficiency, better coverage, and increased capacity. The NSA network is normally deployed in combination with the prevailing LTE infrastructure. However, in order to fully utilize the benefits of 5G, service providers will eventually need to transition to standalone (SA) architecture.

The SA segment is expected to witness the fastest growth in the 5G infrastructure market over the forecast period. SA architecture provides full 5G capabilities, including advanced functionalities like network slicing and ultra-reliable low latency communication (URLLC). Verizon began deploying its 5G network using non-standalone architecture in 2019, but in 2020, it began transitioning to standalone architecture in order to fully utilize 5G capabilities. The SA architecture allows for more flexibility in network design and deployment and offers better security compared to NSA architecture.

For More Deployment Architecture Insights in the 5G Infrastructure Market, Download a Free Report Sample

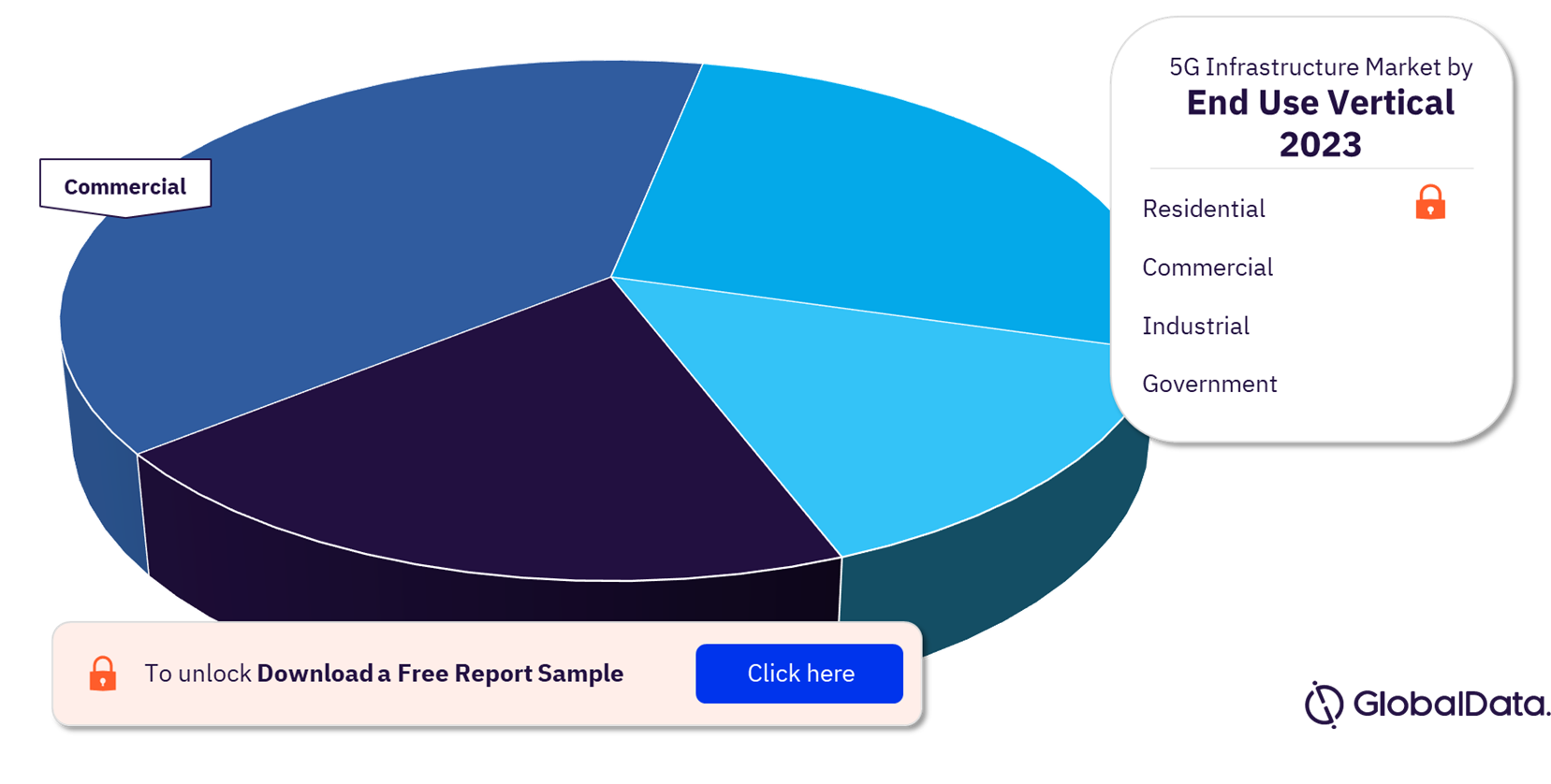

5G Infrastructure Market Segmentation by End-Use Verticals

The commercial segment captured the largest revenue share of the 5G infrastructure market in 2023. This is attributable to the rising demand for transferring large amounts of data at much faster speeds for use cases, including seamless connectivity during cloud computing, uninterrupted virtual meetings, and creating a smart workplace by providing enhanced connectivity to IoT devices. Moreover, the technology can enable real-time tracking and monitoring of goods in transit, improve supply chain visibility and reduce delays and losses.

5G Infrastructure Market Share, by End-Use Vertical, 2023 (%)

5G Infrastructure Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The growing need to provide uniform connectivity to cloud-based AR/VR gaming and smart home applications, among others, has surged the deployment of 5G infrastructure for residential applications. The rising culture of working from home, where remote workers demand reliable connectivity, easier collaboration with colleagues, access to cloud-based applications, and seamless participation in virtual meetings, is expected to propel the growth of the residential segment during the forecast period.

The deployment of 5G infrastructure is increasing rapidly across the industrial sector owing to the rising need for leveraging the 5G capabilities for remote operations involving heavy machinery, robotics and automation, predictive maintenance, industrial IoT, supply chain optimization, and quality control. Furthermore, the increasing focus on smart cities development, public safety and emergency services, efficient monitoring and management of power grids, and real-time monitoring and analysis of border security systems, among other applications, are driving the demand for 5G infrastructure in the government sector.

5G Infrastructure Market Analysis by Region

The Asia Pacific region captured the largest market share of over 45.0% in 2023. This is attributable to the determined installations of 5G New Radio infrastructure by key communication service providers, such as KT Corporation, China Mobile Limited, China Telecom, NTT Docomo Inc, and SK Telecom, among others, in the region. In addition, India witnessed the first-ever 5G spectrum auction with 40 rounds of bidding across seven days ending in August 2022. Reliance Jio, Bharti Airtel, Vodafone Idea (Vi), and Adani Data Networks bid for spectrum worth approximately $ 1902 trillion. Such advancements in the region are driving the 5G infrastructure regional growth.

Asia-Pacific 5G Infrastructure Market Share by Country, 2023 (%)

View Sample Report for Additional 5G Infrastructure Market Insights, Download a Free Report Sample

The US market is anticipated to expand at a substantial CAGR from 2023 to 2030 owing to the presence of several major communications service providers, such as T-Mobile, AT&T Inc., Verizon Communications, and Sprint Corporation, in the country. In July 2021, Verizon Communications partnered with Ericsson, a networking and telecommunications company based in Sweden, to deploy a cloud-native, container-based 5G core network in the Verizon network. The partnership aims to accelerate the deployment of Verizon’s 5G Standalone (SA) network, designed to provide faster speeds, lower latency, and improved network reliability. These partnerships are expected to fuel the demand for 5G infrastructure in the region. Likewise, regions of Central and South America and the Middle East and Africa, are anticipated to register significant CAGR over the forecast period.

5G Infrastructure Market – Competitive Landscape

The 5G Infrastructure market is still in its early stages and is expected to grow rapidly over the forecast period. The industry is dominated by a few companies such as Huawei Technologies, Ericsson AB, Nokia Corporation, Samsung Electronics, and ZTE Corporation. Nevertheless, the 5G infrastructure market is highly competitive and dynamic, with new companies entering the market and existing companies expanding their offerings. For instance, Mavenir, a US-based company, has been expanding its offerings to include 5G infrastructure solutions, such as its virtualized 5G RAN platform, which is designed to help communication service providers deploy and manage 5G networks more efficiently and cost-effectively.

Leading Players in the 5G Infrastructure Market

- Huawei Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corp

- Samsung Electronics Co Ltd

- NEC Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- CommScope Inc.

- Comba Telecom Systems Holdings Ltd

To Know More About Leading 5G Infrastructure Market Players, Download a Free Report Sample

5G Infrastructure Market Research Overview

| Market Size in 2023 | $12.08 billion |

| Market Size in 2030 | $91.99 billion |

| CAGR (2023-2030) | 33.6% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Component Segment | Hardware, Services |

| Frequency Range | Low Frequency Bands (FR1), High Frequency Bands (FR2) |

| Deployment Architecture | Non-Stand Alone (NSA), Stand-Alone (SA) |

| End-Use Vertical | Residential, Commercial, Industrial, Government |

| Regional Segment | North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

| Country Segment | Australia, China, India, Japan, South Korea, US, Canada, Brazil, UK, Germany, Italy, Spain, Saudi Arabia, UAE |

| Key Companies | Huawei Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Nokia Corporation, ZTE Corp, Samsung Electronics Co Ltd, NEC Corporation, Cisco Systems, Inc., Fujitsu Limited, CommScope Inc., Comba Telecom Systems Holdings Ltd |

5G Infrastructure Market Segments and Scope

GlobalData Plc has segmented the 5G Infrastructure market report by component, frequency range, deployment architecture, end-use vertical, and region:

Global 5G Infrastructure Component Outlook (Revenue, $ Million 2020-2030)

- Hardware

- Software

Global 5G Infrastructure Frequency Range Outlook (Revenue, $ Million 2020-2030)

- Low-Frequency Bands (FR1)

- High-Frequency Bands (FR2)

Global 5G Infrastructure Deployment Architecture Outlook (Revenue, $ Million 2020-2030)

- Non-Stand Alone (NSA)

- Stand-Alone (SA)

Global 5G Infrastructure End-Use Vertical Outlook (Revenue, $ Million 2020-2030)

- Residential

- Commercial

- Industrial

- Government

Global 5G Infrastructure Regional Outlook (Revenue, $ Million 2020-2030)

- North America

- The US

- Canada

- Europe

- Germany

- The UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Australia

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- Saudi Arabia

- The UAE

- Rest of Middle East & Africa

Scope

This report provides overview and service addressable market for 5G infrastructure market.

It identifies the key trends impacting growth of the market over the next 12 to 24 months.

It includes global market forecasts for the 5G infrastructure market and analysis of patents, jobs, social media activities, and venture funding trends.

It contains details of M&A deals in the 5G infrastructure space, and a timeline highlighting milestones in the development of 5G infrastructure market.

The detailed value chain consists of six layers: Procurement of raw materials and components layer, design and development layer, manufacturing and assembly layer, deployment and installation layer, testing and optimization layer, and maintenance, repair and upgrade layer.

Key Highlights

The global 5G Infrastructure market will be valued at $ 12.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 33.6% over the forecast period. The rising demand for high-speed connectivity with low latency for various mission-critical applications like drone connectivity, vehicle-to-everything (V2X), and implementation of smart cities is anticipated to drive the growth of the 5G infrastructure industry over the forecast period.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the quality management software market by solution, deployment, enterprise size band, industry vertical, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the quality management software market.

• The report highlights the solution segments (audit management, calibration management, change management, complaint management, corrective and preventive actions, document management, employee training management, risk management, supplier quality management, others), deployment segments (on-demand and on-premises), enterprise size band (Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), Very Large (5000+)), and industry verticals (consumer goods, healthcare and pharmaceuticals, IT & communication, manufacturing, retail banking and insurance, retail, transportation & logistics, others)

• The report is designed for an executive-level audience, boasting presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in the quality management software market.

• The broad perspective of the report, coupled with comprehensive, actionable detail, will help software providers and other market players succeed in growing the quality management software market globally.

Key Players

Huawei Technologies Co LtdTelefonaktiebolaget LM Ericsson

Nokia Corporation

ZTE Corp

Samsung Electronics Co Ltd

NEC Corporation

Cisco Systems, Inc.

Fujitsu Limited

CommScope Inc.

Comba Telecom Systems Holdings Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What is the 5G infrastructure market size in 2023?

The 5G infrastructure market size will be valued at $12.08 billion in 2023.

-

What is the 5G infrastructure market growth rate?

The 5G infrastructure market is expected to grow at a CAGR of 33.6% over the forecast period (2023-2030).

-

What are the key 5G Infrastructure market drivers?

The increased demand for high-speed internet, growing adoption of the Internet of Things (IoT), and increased investment in smart city infrastructure are some of the major factors driving the 5G infrastructure market growth.

-

What are the key 5G Infrastructure market segments?

Component: Hardware, Software

Deployment Architecture: Non-Stand Alone (NSA), Stand-Alone (SA)

Frequency Range: Low-Frequency Bands (FR1), High-Frequency Bands (FR2)

End-use vertical: Commercial, Residential, Industrial, Government

-

Which are the leading 5G Infrastructure companies?

The leading 5G Infrastructure companies are Huawei Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Nokia Corporation, ZTE Corp, Samsung Electronics Co Ltd, NEC Corporation, Cisco Systems, Inc., Fujitsu Limited, CommScope Inc., Comba Telecom Systems Holdings Ltd.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more 5G reports