Aging Population and Medical Devices – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Aging Population and Medical Devices Report Overview

The aging population is a captive market for the medical devices industry due to the rising demand for home care solutions for the elderly. Advancements in medical device technology have resulted in a significant increase in the number of conditions that can be managed in a home care setting. To capitalize on this strong demand and growth, manufacturers are increasingly producing consumer-targeted equipment. The COVID-19 pandemic placed additional stress on healthcare delivery systems worldwide, exposing the structural ageism that led to high rates of morbidity and mortality among older populations. These circumstances prompted global organizations to call for medical, scientific, social, and financial preparedness for the aging population as a global imperative.

This report is a thematic brief, which identifies those companies most likely to succeed in a world filled with disruptive threats. Inside, we predict how each theme will evolve and identify the leading and disrupting companies. The report covers the aging population theme.

| Key Trends | · Technology Trends

· Macroeconomic Trends · Regulatory Trends |

| Key Value Chain Components | · Patients Seeking Medical Care

· Elderly Care Devices · Providers |

| Key Public Companies | · Alphabet

· Abbott Laboratories · Apple · Becton Dickinson · Dexcom · GE Healthcare |

| Key Private Companies | · Biotronik

· Medline Industries |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Insights on the Aging Population and Medical Devices Theme, Download a Free Sample Report

Aging Population and Medical Devices – Key Trends

The main trends shaping the wearables theme over the next 12 to 24 months are classified into three categories including technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: The growing use of AI, the rising popularity of virtual care and telemedicine, remote patient monitoring (RPM), wearable devices, intelligent drug dispensing, and medical robotics are the key technology trends gaining traction in the market.

Macroeconomic Trends: Increasing healthcare costs, high inflation, surging prevalence of chronic diseases, and the growing importance of value-based care programs are key macroeconomic trends anticipated to boost the aging population and medical devices theme during the next few years.

Regulatory Trends: Authorization of medical devices for home use, RPM reimbursement, and data privacy are some of the leading regulatory trends likely to impact this theme. The FDA changed some of its enforcement policies so that home care devices such as physiological monitors, oximeters, spirometers, apnea monitors, electrocardiographs (ECGs), and others, which were previously cleared or approved for marketing to hospitals, could be marketed for home use without additional submissions.

Buy the Full Report for Key Aging population and medical devices Theme, Download a Free Report Sample

Aging Population and Medical Devices – Industry Analysis

Many countries are dealing with an aging population in some form. Public health policies and improvements in health care services have led to increases in life expectancy and declines in infant mortality and premature death. Addressing the unmet care and support needs of an aging population, and designing services, devices, and solutions centered around the needs of the older population, are therefore becoming urgent public health priorities for many countries. Global expenditure on healthcare has continued to grow over the last two decades. According to the Organization for Economic Co-Operation and Development (OECD), healthcare costs have been steadily increasing, and are expected to continue growing at the historical compound annual growth rate (CAGR) of 3.9% during the forecast years.

Aging Population and Medical Devices Industry Analysis

The aging population and medical devices industry analysis also covers –

- Market Size and Growth Forecasts

- Case Study: Intelligent Drug Dispensing

- Timeline

- Signals

- M&A Trends

Buy the Full Report for Aging population and Medical Devices Industry Analysis, Download a Free Sample Report

Aging Population – Value Chain Analysis

The key components in the aging population value chain are the patients seeking healthcare services, devices that facilitate or improve aging in place, and the providers of these devices and services.

Patients Seeking Medical Care: Being a regular consumer of medical services is a significant part of daily life for many older adults around the globe. As average lifespans increase, so too are older people living with more chronic and acute health problems and relying on care through the health system to maintain functioning and prolong their lives. Medical device technologies are becoming a great resource to facilitate or improve aging in place and promote health-related quality of life. The aging population is therefore increasingly seeking these devices for remote assistance, social communication, and medical care, highlighting the importance of incorporating their needs and preferences when developing effective technological solutions.

Aging Population Value Chain Analysis

Buy the Full Report for Aging Population Value Chain Analysis, Download a Free Sample Report

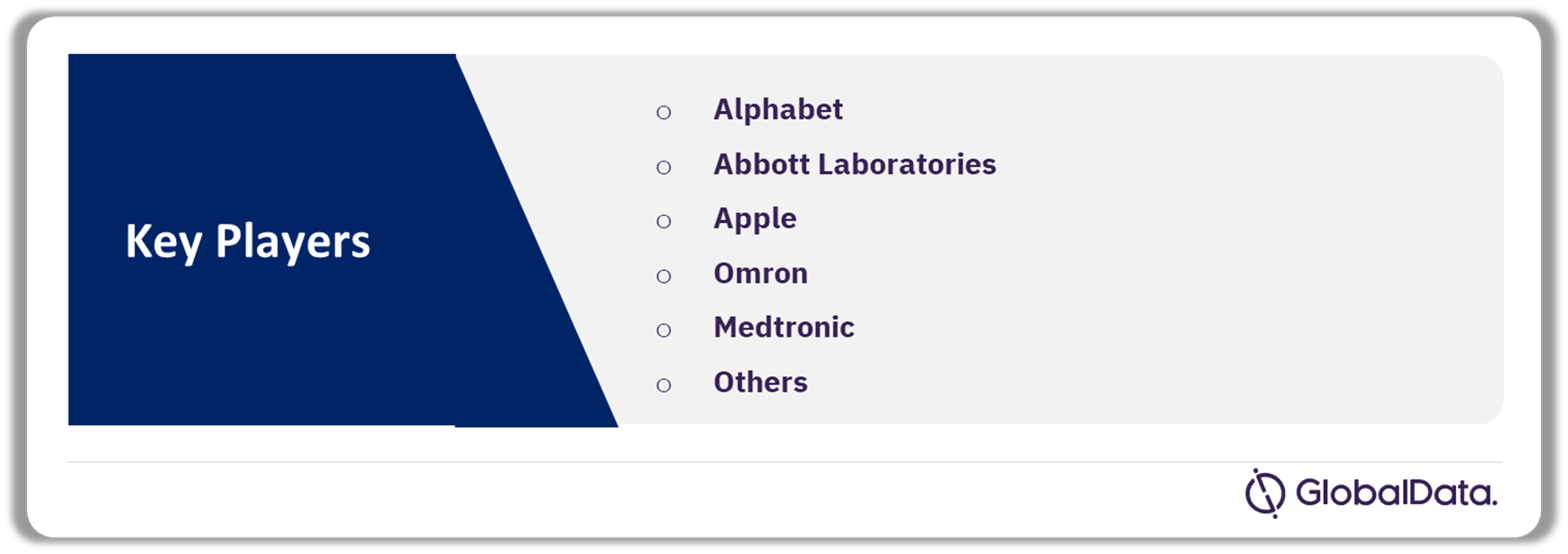

Aging Population and Medical Devices – Competitive Landscape

The key companies making their mark within the aging population theme are –

Public Companies: Alphabet, Abbott Laboratories, Apple, Becton Dickinson, Boston Scientific, Cochlear, Demant, Dexcom, GE Healthcare, Invacare, Medtronic, Omron, Philips, ResMed, Sonova, and Teladoc are some of the leading public companies in the aging population theme.

Private Companies: Biotronik and Medline Industries are the key private companies in this theme.

Aging Population and Medical Devices Public Companies

Buy the Full Report for Public Company Analysis in the Aging population and medical devices Theme, Download the Free Sample Report

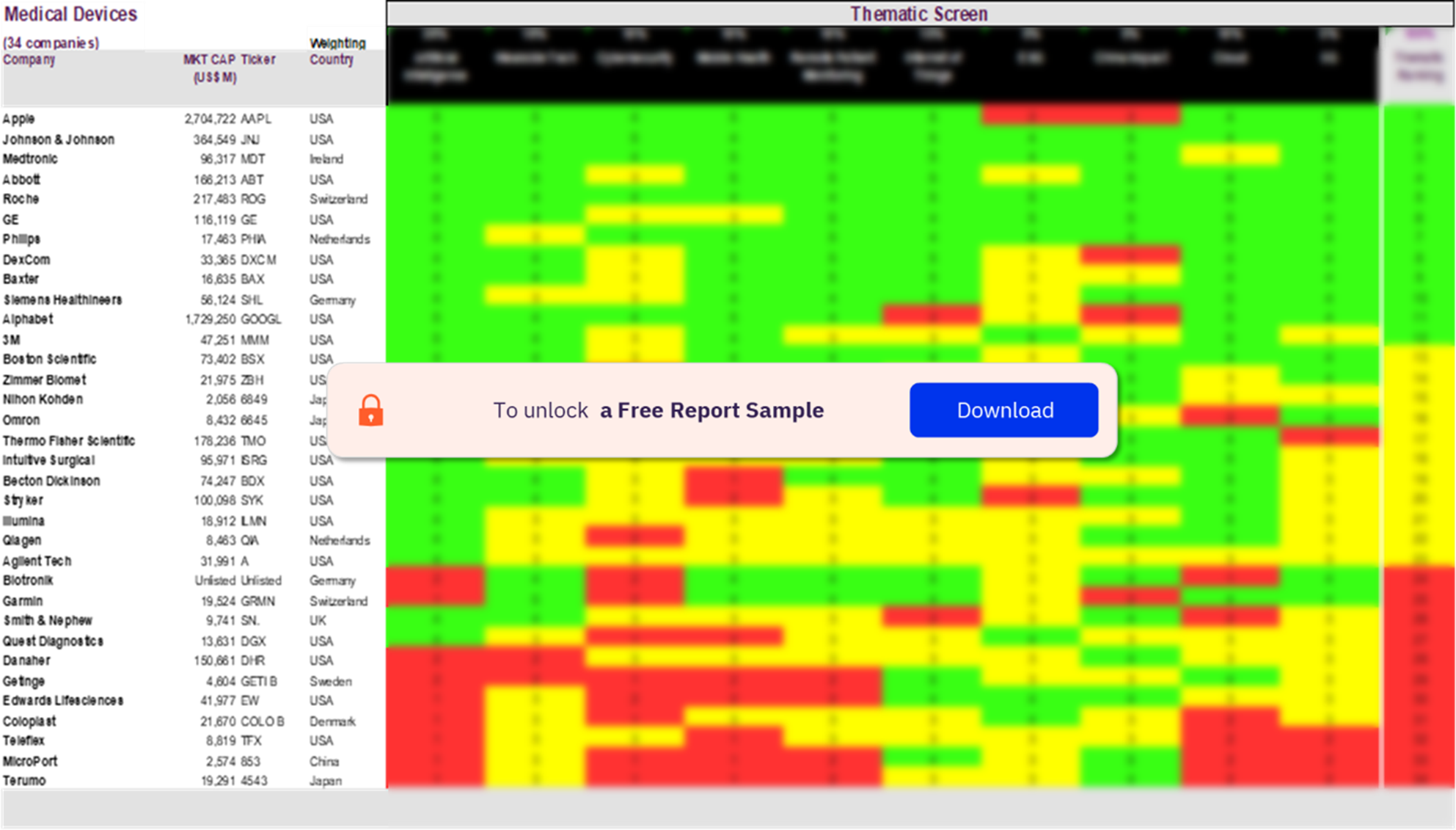

Medical Devices Scorecard

The scorecard approach predicts tomorrow’s leading companies within each sector through three screens including a thematic screen, a valuation screen, and a risk screen.

Medical Devices Scorecard Analysis

Buy the Full Report for Scorecard Analysis in the Aging population and Medical Devices Theme, Download the Free Sample Report

Scope

This report is a thematic brief, which identifies those companies most likely to succeed in a world filled with disruptive threats. Inside, we predict how each theme will evolve and identify the leading and disrupting companies.

The report covers the aging population theme.

Reasons to Buy

- GlobalData’s thematic research ecosystem is a single, integrated global research platform that provides an easy-to-use framework for tracking all themes across all companies in all sectors. It has a proven track record of identifying important themes early, enabling companies to make the right investments ahead of the competition and secure that all-important competitive advantage.

- Develop and design your corporate strategies through an in-house expert analysis of wearable tech by understanding the primary ways in which this theme is impacting the healthcare industry.

- Stay up to date on the industry’s major players and where they sit in the value chain.

- Identify emerging industry trends to gain a competitive advantage.

Medtronic

GE Healthcare

Boston Scientific

ResMed

AdaptHealth

Contec Medical Systems

Innovo Medical

Apple

Dexcom

Omron

Abbott

UnaliWear

Insulet

Cochlear

Demant

Sonova

Invacare

Medline Industries

Envoy Medical

MED-EL Elektromedizinishce

Table of Contents

Frequently asked questions

-

What are the key trends shaping the aging population and medical devices theme?

The key trends shaping the aging population and medical devices theme are technology trends, regulatory trends, and macroeconomic trends.

-

What are the value chain components of the aging population and medical devices theme?

The key components in the aging population value chain are patients seeking medical care, elderly care devices, and providers.

-

Which are the leading public companies in the aging population and medical devices theme?

Alphabet, Abbott Laboratories, Apple, Becton Dickinson, Boston Scientific, Cochlear, Demant, Dexcom, GE Healthcare, Invacare, Medtronic, Omron, Philips, ResMed, Sonova, and Teladoc are some of the leading public companies in the aging population theme.

-

Which are the leading private companies in the aging population and medical devices theme?

Biotronik and Medline Industries are the key private companies in this theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Medical Devices reports