Artificial Intelligence (AI) in Insurance – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Incumbent insurers are increasingly under threat from disruptive insurtech startups. These companies are drawing on technologies such as artificial intelligence (AI), cloud computing, and the internet of things (IoT) to offer a more personalized insurance experience. Additionally, technologies such as machine learning (ML), computer vision (CV), and conversational platforms can enhance customer service, claims processing, and underwriting. The emergence of several specialist tech vendors has meant these tools are now more accessible to the ordinary insurer.

The AI in insurance thematic research report highlights the impact of AI in the insurance industry and discusses insurance challenges, case studies, AI timelines, and value chains.

AI in Insurance – Industry Analysis

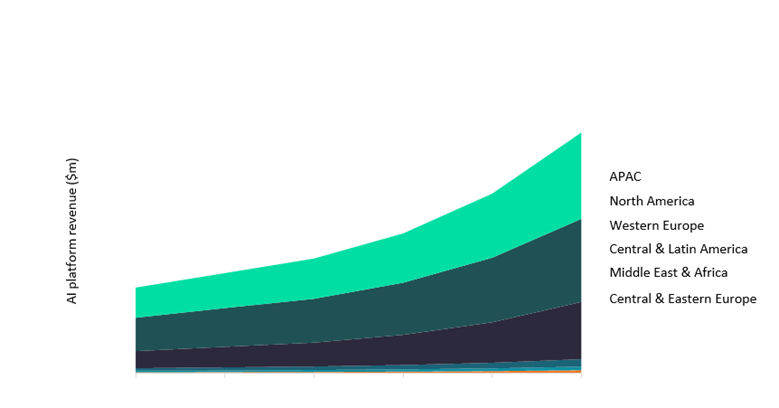

The AI platform revenue in the insurance industry was worth $1.2 billion in 2019 and is expected to achieve a CAGR of more than 22% during 2019-2024. High APAC spending on AI platforms in the insurance sector will be driven by the Chinese tech giant’s role in the country’s domestic insurance market. Alibaba, Tencent, and Baidu will play an influential role in the marketing and distribution of insurance via their numerous partnerships with Chinese insurers.

The AI in the insurance industry analysis also covers:

- Mergers and acquisitions

- AI Timeline

AI Platform Revenue in the Insurance Industry by Region, 2019-2024

To gain more information about AI platform revenue in the insurance industry, download a free report sample

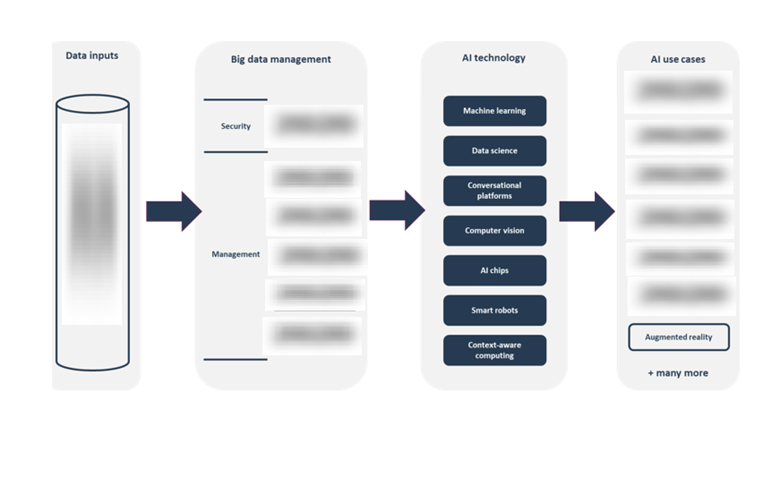

AI in Insurance - Value Chain Analysis

GlobalData’s AI value chain consists of four segments: data inputs, big data management, AI technology, and AI use cases. It provides an overview of seven main AI technologies such as machine learning (ML), data science, conversational platforms, computer vision, AI chips, smart robots, and context-aware computing.

Machine Learning: Many companies use ML as part of predictive data models or software platforms that analyze behavioral data. Businesses have also taken ML and applied it to specific industry use cases, such as detecting bank fraud, assessing a person’s creditworthiness, preventing cyberattacks, and delivering personalized ads to consumers.

AI Value Chain Analysis

For more insights on the AI value chains, download a free report sample

Leading AI Adopters in the Insurance Industry

Some of the leading insurance companies that are currently deploying AI are Allianz, Aon, AXA, Brit, Chubb, Direct Line Group, and Lemonade.

Leading AI Vendors

Some of the leading vendors associated with the AI theme are Alibaba, Alphabet, Amazon, Apple, Darktrace, Graphcore, Megvii, and Mobvoi.

Specialist AI Vendors in the Insurance Industry

Some of the specialist AI vendors in the insurance industry are Afiniti, Cape Analytics, CCC Information Services, Clara Analytics, Cytora, and Flyreel.

To know more about leading companies associated with the AI in insurance theme, download a free report sample

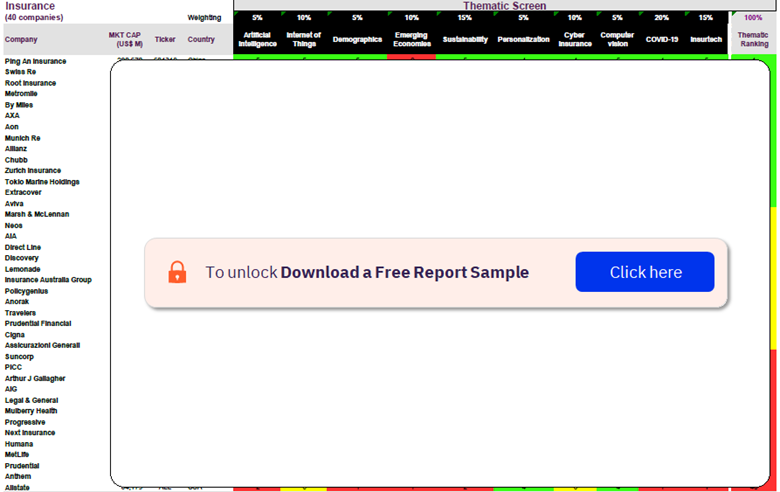

Insurance Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The insurance sector scorecard has two screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

Insurance Sector Scorecard – Thematic Screen

To know more about the insurance sector scorecards, download a free report sample

AI in Insurance Market Overview

| Report Pages | 46 |

| Regions Covered | Global |

| Market Size (2019) | $1.2 billion |

| CAGR (2019-2024) | >22% |

| Value Chains | Data Inputs, Big Data Management, AI Technology, and AI Use Cases |

| Leading AI Adopters | Allianz, Aon, AXA, Brit, Chubb, Direct Line Group, and Lemonade |

| Leading AI Vendors | Alibaba, Alphabet, Amazon, Apple, Darktrace, Graphcore, Megvii, and Mobvoi |

| Specialist AI Vendors | Afiniti, Cape Analytics, CCC Information Services, Clara Analytics, Cytora, and Flyreel |

Scope

- Growth forecast of the AI platform market in the insurance sector, including a regional breakdown of sector spending on AI technologies.

- Recommendations on which of the seven key AI technologies should be deployed across the insurance value chain (product development, marketing and distribution, underwriting and risk profiling, claims management, and customer service), and where they will offer the most value.

- Several examples of sector-specific AI use cases, in addition to qualitative analysis of the benefits these AI solutions can offer insurance companies.

- Identification of the leading insurance companies adopting AI segmented by business line (motor, property, and life insurance), alongside in-depth coverage of the various specialist tech vendors with insurance-specific AI platforms.

- GlobalData’s Insurance thematic scorecard ranks companies in the sector based on investment in ten key themes disrupting the industry, including AI. This is informed by GlobalData’s comprehensive tracking of AI-related deals, job openings, patents ownership, company news, and financial and marketing statements.

Reasons to Buy

Insurance companies:

- Identify leading AI vendors in insurance and pinpoint potential partners based on our comprehensive analysis of where in the value chain, and in which insurance sectors, vendors can best support.

- Benchmark your AI strategy against competitors in the sector through access to several examples of successful AI investment case studies and insurer-vendor partnerships. This includes Aon’s partnership with leading vendor Zesty.ai and Zurich’s collaboration with Greater Than.

- Improve existing investment in AI technology by learning where in the insurance value chain AI can be used, and the benefits of those use cases. Discussion of specific insurance business lines helps clarify which AI technologies will be most useful to different insurers, and where to prioritize resources.

Vendors:

- Develop marketing messages and value propositions for your AI solutions targeted at potential insurance partners by learning about some of the key insurance sector sentiments towards AI technology and its business benefits.

- Quantify the sales opportunity for AI platforms in your regional market by accessing GlobalData’s market growth forecast segmented by geographic region.

IBM

Amazon

Baidu

Apple

Nvidia

Intel

AMD

Qualcomm

iRobot

ABB

Robotiq

Teradyne

Festo

Samsung

Sony

Axa

Allianz

Zurich

Ping An

Root Insurance

Lemonade

Tokio Marine

Swiss Re

China Life

Tencent

Alibaba

Munich Re

Metromile

Progressive

Travelers

Aon

Brit

Sentiance

Lapetus

Tractable

Cape Analytics

H20.ai

Cytora

Afiniti

WorkFusion

Sapiens

CCC Information Services

Direct Line

Nauto

Greater Than

Clara Analytics

Shift Technology

Spraoi

Sprout.ai

Zesty.ai

Synthesized.io

Chubb

Flyreel

Anorak

Trov

Bdeo

Euler Hermes

Bold Penguin

Next Insurance

Rakuten

Table of Contents

Frequently asked questions

-

What was the AI platform revenue in the insurance industry in 2019?

The AI platform revenue in the insurance industry was worth $1.2 billion in 2019.

-

What is AI in the insurance industry growth rate?

AI in the insurance industry is expected to achieve a CAGR of more than 22% during 2019-2024.

-

What are the components of the AI value chain?

GlobalData’s AI value chain consists of four segments: data inputs, big data management, AI technology, and AI use cases.

-

Which are the leading AI adopters in the insurance industry?

Some of the leading AI adopters in the insurance industry are Allianz, Aon, AXA, Brit, Chubb, Direct Line Group, and Lemonade.

-

Which leading vendors are associated with the AI theme?

Some of the leading vendors associated with the AI theme are Alibaba, Alphabet, Amazon, Apple, Darktrace, Graphcore, Megvii, and Mobvoi.

-

Who are the specialist AI vendors in the insurance industry?

Some of the specialist AI vendors in the insurance industry are Afiniti, Cape Analytics, CCC Information Services, Clara Analytics, Cytora, and Flyreel.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports