Asia-Pacific (APAC) Mobile Broadband Market Trends and Opportunities, 2023 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

APAC Mobile Broadband Market Overview

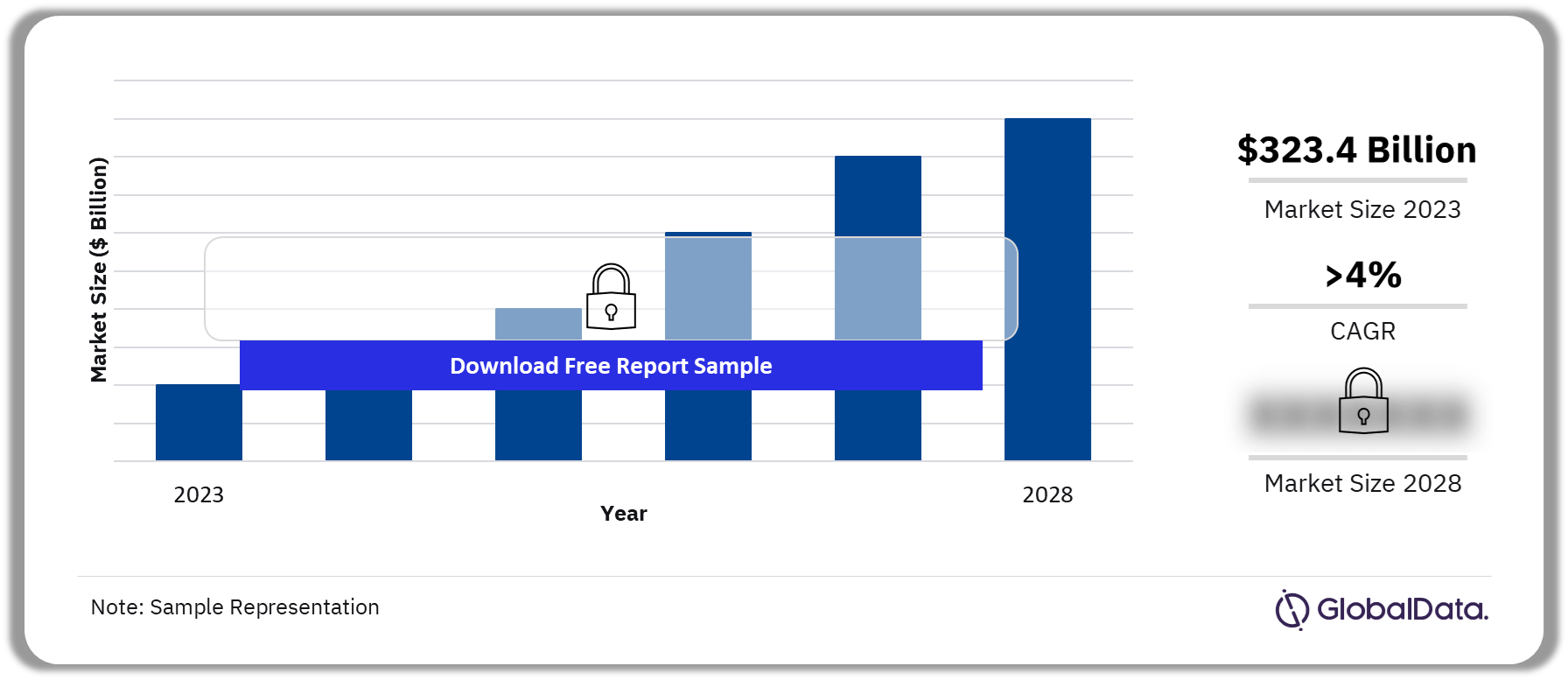

The mobile service revenue in Asia-Pacific (APAC) was $323.4 billion in 2023. The market will register a CAGR of more than 4% during 2023-2028. The ongoing expansion of 5G networks and the planned launch of 5G services in new countries over the next few years will create opportunities for operators to increase their ARPU levels. Moreover, the continued expansion of LTE/4G networks will bring high-speed wireless internet access to rural areas and markets that are relatively underserved by 5G networks, thus driving higher data consumption.

APAC Mobile Broadband Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report for the APAC Mobile Broadband Market Forecast

Buy the Full Report for the APAC Mobile Broadband Market Forecast

Asia-Pacific (APAC) Mobile Broadband Market Insider Report provides an executive-level overview including quantitative and qualitative insights into the mobile market. The report analyzes key trends and growth drivers shaping the regional market. It also provides a comprehensive overview of the competitive landscape.

| Market Size (2023) | $323.4 billion |

| CAGR (2023-2028) | >4% |

| Key Device Type | · Handsets

· Connected Data · M2M/IoT |

| Leading Companies | · Rakuten

· TPG Telecom · Globe Telecom · Bharti Telecom · Telenor Group |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

APAC Mobile Broadband Subscription Trends

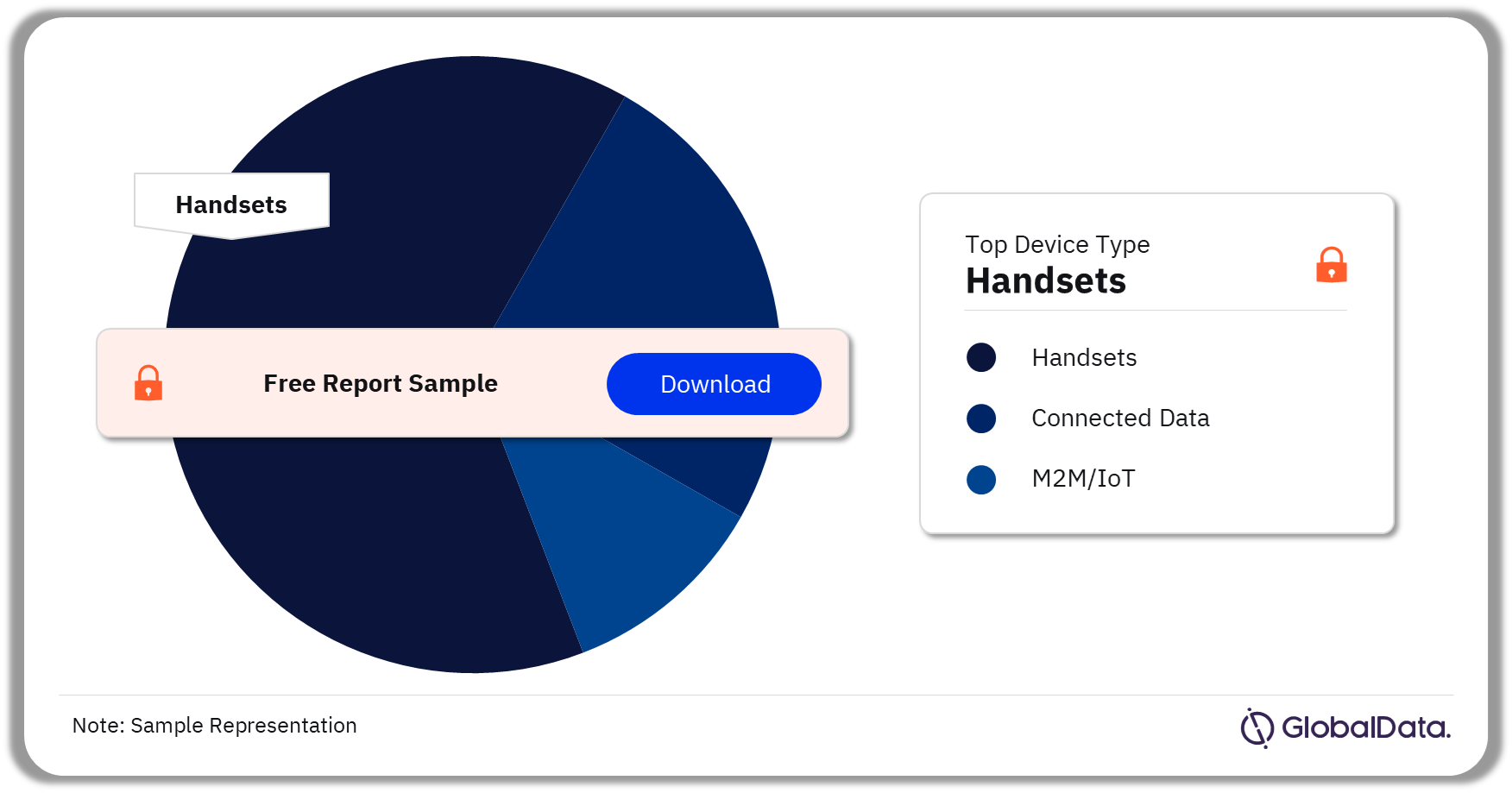

Mobile Device Trends in APAC: The key device types in the APAC mobile broadband market are handsets, connected data, and M2M/IoT. In 2023, handsets accounted for the highest share of the total mobile service revenue. The segment is further classified into smartphones and feature phones. Smartphones occupied the dominant share of the mobile handset market in 2023. The growing adoption of smartphones, the adoption of 4G/5G services, and expanding mobile network coverage across APAC are driving the market growth.

APAC Mobile Broadband Subscription Trends Analysis by Device Type, 2023 (%)

Buy the Full Report for More Subscription Trends Insights into the APAC Mobile Broadband Market

APAC Mobile Broadband Revenue Trends

Mobile Average Revenue Per User (ARPU) Trends in Asia-Pacific: The continued rise in mobile data ARPU levels will drive the aggregate mobile services ARPU in APAC by 2028. The increase in the adoption of higher ARPU 4G and 5G service plans offered by operators will drive market growth. Furthermore, as of 2023, Japan is the most expensive country in the APAC region in terms of mobile data tariffs as compared to other countries.

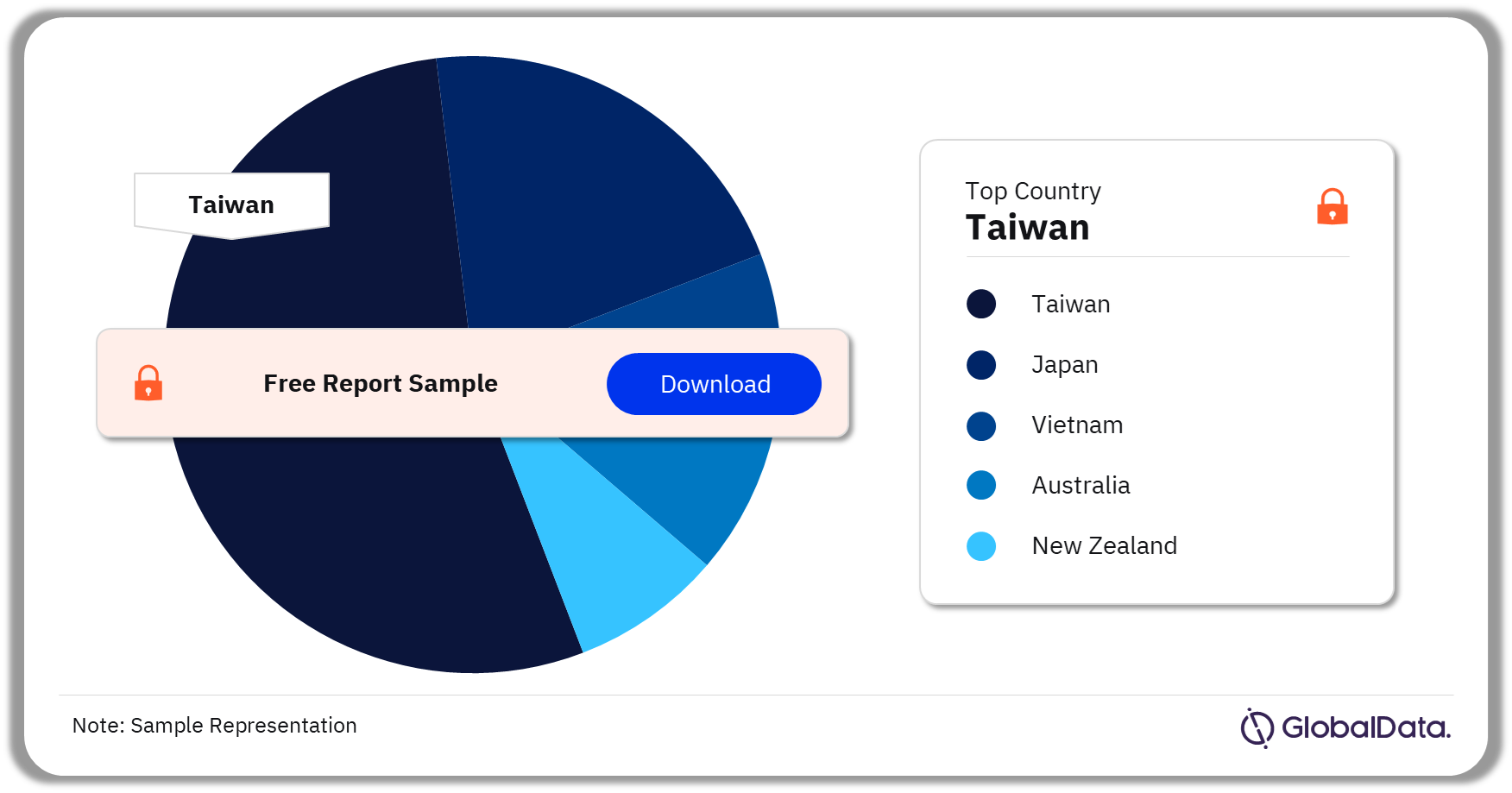

Mobile Revenue Trends in APAC: Growth in subscriptions of all the device categories over the forecast period will drive mobile service revenue growth in APAC. The key countries in the APAC mobile broadband market are Taiwan, Japan, Vietnam, Australia, and New Zealand.

APAC Mobile Broadband Revenue Trends Analysis by Country, 2023 (%)

Buy the Full Report for More Revenue Trends Insights into the APAC Mobile Broadband Market

APAC Mobile Broadband Market – Competitive Landscape

A few of the key companies in the APAC mobile broadband market are:

- Rakuten

- TPG Telecom

- Globe Telecom

- Bharti Telecom

- Telenor Group

Few telcos in the APAC region have been offloading their tower businesses to reduce capex, enhance their balance sheets, and release more cash for core business development through investments into new revenue streams.

APAC Mobile Broadband Market Players

Buy the Full Report for More Company Insights into the APAC Mobile Broadband Market

Segments Covered in this Report

APAC Mobile Broadband Device Type Outlook (Market Share, %, 2023)

- Handsets

- Connected Data

- M2M/IoT

Reasons to Buy

- This Insider Report provides a comprehensive examination through a forward-looking analysis of Asia-Pacific’s mobile broadband market trends in a concise analytical format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in Asia-Pacific’s mobile broadband markets.

- The report is designed for an executive-level audience, with charts and tables boasting presentation quality.

- The broad perspective of the report coupled with comprehensive actionable insights will help operators, equipment vendors, and other telecom industry players better position to seize the growth opportunities in Asia-Pacific’s evolving mobile broadband market.

Axiata

Bharti Airtel

BSNL

CAT Telecom

CBN

Celcom

China Unicom

CTExcel

Digi

Dito Telecommunity

Indosat Ooredoo

MNTL

Onic

Optus

Rakuten

Reliance Jio

Singtel

Telenor

Telstra

TOT

TPG Telecom

Table of Contents

Figures

Frequently asked questions

-

What is the APAC mobile broadband market size in 2023?

The total mobile service revenue in Asia-Pacific (APAC) is estimated at $323.4 billion in 2023.

-

What will be the CAGR in the APAC mobile broadband market during 2023-2028?

The mobile services revenue in APAC is likely to grow at a CAGR of more than 4% during 2023-2028.

-

Which is the leading device type in the APAC mobile broadband market?

In 2023, handsets are the dominant device category, accounting for over 90% of the total mobile service revenue during 2023.

-

Which is the country expected to garner the APAC mobile broadband market growth?

Taiwan’s mobile service revenue will witness the fastest growth in the APAC region.

-

Which is the largest service type in the APAC mobile broadband market?

In 2023 data service type dominated the APAC mobile broadband market share.

-

Which are the leading APAC mobile broadband market players?

Rakuten, Dito Telecommunity, TPG Telecom, Vodafone Hutchison Australia, China Unicom, Axiata, Telenor Group, BSNL, MTNL, China Mobile Communications, Globe Telecom, and Bharti Telecom are some of the leading APAC mobile broadband market players.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Mobile Broadband reports