Augmented Reality (AR) in Automotive – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Augmented Reality (AR) in Automotive Thematic Report Overview

Augmented Reality (AR) can enable the safer operation of vehicles through easily understandable head-up displays (HUDs). AR can also ensure faster training of automotive staff, create more immersive entertainment experiences, and help with vehicle manufacturing.

Moreover, the arrival of autonomous vehicles (AVs) will allow content to be overlaid on the outside world or allow car windows to be repurposed to display a different world entirely. AR can also increase maintenance, software, and hardware upgrade efficiency outside the vehicle, creating new avenues for sales. It can enhance consumer engagement and increase brand loyalty by allowing customers to view virtual vehicles in real life and also take a virtual test drive.

The ‘Augmented Reality in Automotive’ thematic intelligence report offers an in-depth insight into the augmented reality theme and the impact it has on the automotive sector. It provides a comprehensive analysis of the industry, including real-life case studies that highlight the use of AR technologies within the automotive sector. The report also provides insights into the AR value chain, key players, and the competitive landscape of the technology companies within the AR theme.

| Key Value Chain Components | • Semiconductors

• Components • Devices • Platforms • Applications & Content |

| Leading Augmented Reality Adopters in Automotive | • BMW

• Ford • GM • Hyundai • Mercedes-Benz Group |

| Leading Augmented Reality Vendors | • Alibaba

• Alphabet • Amazon • Apple • ByteDance |

| Specialist Augmented Reality Vendors in Automotive | • Blippar

• DigiLens • Envisics • Holoride • Stradvision |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Augmented Reality Value Chain Analysis

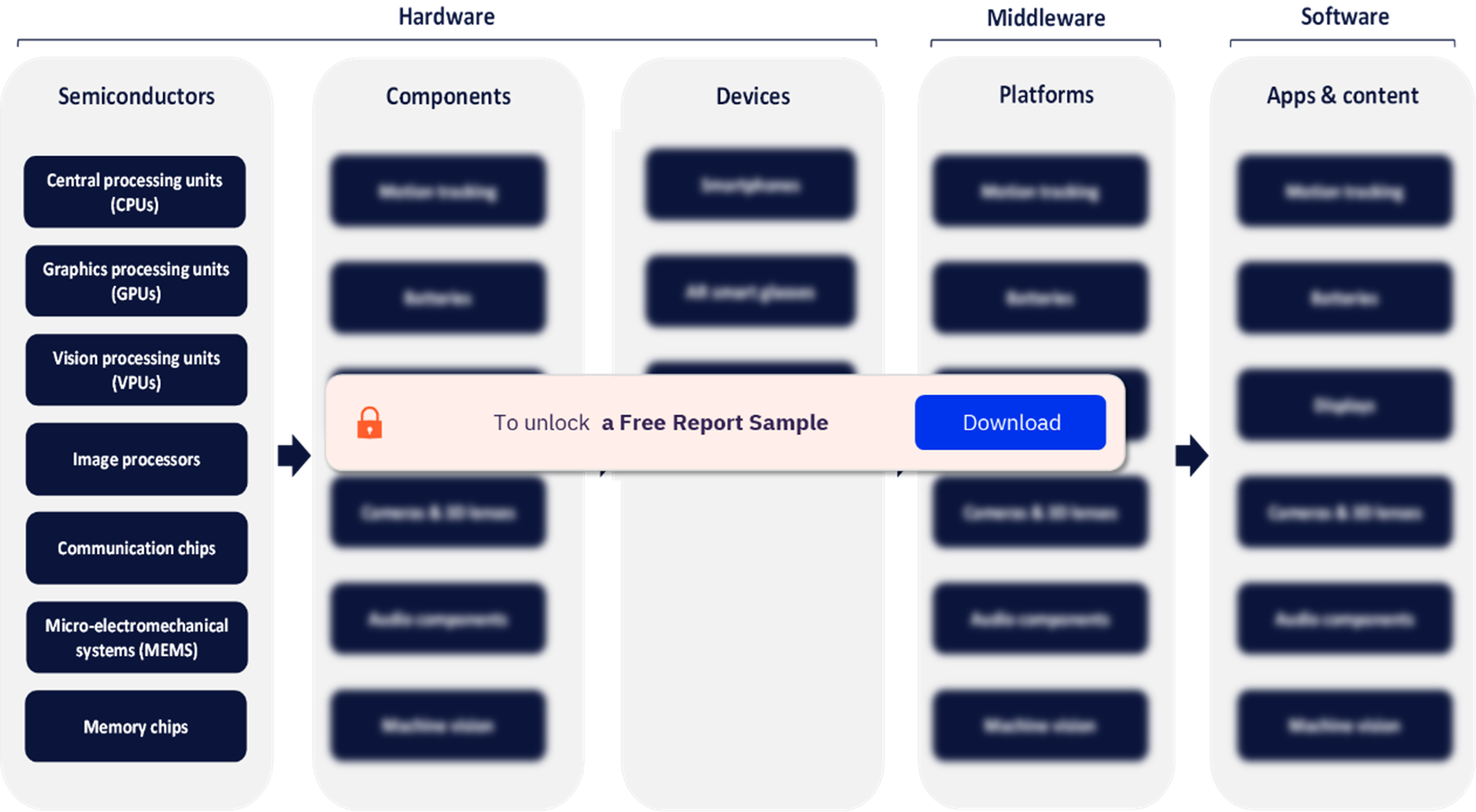

The augmented reality value chain is split into five segments including semiconductors, components, devices, platforms, and applications and content.

Semiconductors: Semiconductors are one of the key battlegrounds in AR today. Although no new AR-specific silicon has arrived on the market following the launch of the XR2 5G, chipmakers are striving to improve their existing capabilities to suit the evolving requirements of AR, mostly around screen resolution, frame rates, processing speed, and connectivity.

Augmented Reality Value Chain

Buy the Full Report for Augmented Reality Value Chain Insights, Download a Free Sample Report

Augmented Reality in Automotive– Competitive Landscape

This thematic report highlights the companies that will make their mark in the upcoming days.

Leading augmented reality adopters in automotive: BMW, Ford, GM, Hyundai, and Mercedes-Benz Group among others are the leading augmented reality adopters in the automotive sector.

Leading augmented reality vendors: Alibaba, Alphabet, Amazon, ByteDance, Magic Leap, Meta, and Microsoft among others are the leading augmented reality vendors gaining traction.

Specialist augmented reality vendors in automotive: Blippar, DigiLens, Envisics, Holoride, and Stradvision are the specialist augmented reality vendors in the automotive sector.

Leading Companies within the AR Theme in the Automotive Sector

Buy the Full Report for More Insights into the Leading Companies Making their Mark Within the AR Theme, Download a Free Sample

Future Mobility Sector Scorecard

The future mobility sector scorecard comprises the thematic screen, valuation screen, and risk screen. The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

Future Mobility Sector Scorecard Analysis

Buy the Full Report for More Insights on the Scorecard Analysis of Augmented Reality in the Automotive Sector, Download a Free Sample

Scope

- This report is a thematic analysis of the augmented reality in the automotive sector: It covers OEMs and specialist vendors in automotive. It also covers augmented reality as a whole, providing value chains and forecasts, as well as company details.

- Whilst most investment research is underpinned by backwards looking company valuation models, GlobalData’s thematic methodology identifies which companies are best placed to succeed in a future filled with multiple disruptive threats

Reasons to Buy

- Our thematic investment research product, supported by our thematic engine, is aimed at senior (C-Suite) executives in the corporate world as well as institutional investors.

- Corporations: helps CEOs in all industries understand the disruptive threats to their competitive landscape.

- Investors: helps fund managers focus their time on the most interesting investment opportunities in global TMT.

- Our unique differentiator, compared to all our rival thematic research houses, is that our thematic engine has a proven track record of predicting winners and losers.

Tesla

GM

SAIC

Volkswagen

Geely

Hyundai

Kia

Toyota

BMW

Baidu

Mercedes-Benz

NVIDIA WayRay Visteon Varjo Stradvision Holoride Envisics Digilens Blippar Volkswagen Stellantis Renault GM Ford

Table of Contents

Frequently asked questions

-

What are the key value chain components in the augmented reality theme?

The augmented reality value chain is split into five segments including semiconductors, components, devices, platforms, and applications and content.

-

Which are the leading augmented reality adopters in the automotive sector?

BMW, Ford, GM, Hyundai, and Mercedes-Benz Group among others are the leading augmented reality adopters in the Automotive sector.

-

Which are the leading augmented reality vendors?

Alibaba, Alphabet, Amazon, ByteDance, Magic Leap, Meta, and Microsoft among others are the leading augmented reality vendors gaining traction.

-

Which are the specialist augmented reality vendors in the automotive industry?

Blippar, DigiLens, Envisics, Holoride, and Stradvision are the specialist augmented reality vendors in the Automotive sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.