Augmented Reality (AR) – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Accessing in-depth insights from the ‘Augmented Reality (AR)’ thematic intelligence report will help you:

- Get an overview of the augmented reality theme and understand its progress over the forecast period.

- Gain an insight into the industry, including forecasts for augmented reality revenues to 2030. These forecasts are split by end-user and platform. There is also market share information for the AR smart glasses and AR headsets markets.

- Identify the key trends impacting the growth of the theme over the next 12 to 24 months, namely technology trends, macroeconomic trends, regulatory trends, and media trends.

- Assess the M&A deals associated with the augmented reality theme.

- Learn about the milestones in the development of augmented reality to better comprehend the growth of the market.

- Analyze the core segments of the value chain including semiconductors, components, devices, platforms, and applications and content.

- Benchmark the leading and challenging vendors across all five value chain segments.

How is the ‘Augmented Reality (AR)’ report unique from other reports in the market?

- Learn about AR, including market forecasts for 2030 and profiles of the leading companies to understand the market better.

- Gain a foothold on this potentially lucrative AR ecosystems market and learn about developing technologies such as content development AR which is beginning to move into the mainstream.

- Learn about how leading tech companies are rushing to build sustainable AR ecosystems.

- Learn about the impact of AR on gaming and consumer electronics from the report’s sector scorecard that ranks companies based on their strengths.

We recommend this valuable source of information to anyone involved in:

- IT Hardware manufacturer/Software Developer

- Semiconductor and Component Manufacturers

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Augmented Reality (AR) Thematic Report

Download a Free Report Sample

Augmented Reality (AR) Thematic Report Overview

The application of AR technology in social media, gaming, and e-commerce is on the rise. Many companies such as Pokémon Go, Snapchat Lenses, and TikTok Effects have invested in AR technology. The adoption of AR by enterprises is also advancing in sectors such as retail, healthcare, and manufacturing to enhance user experience, training, and remote collaboration.

The Augmented Reality (AR) thematic intelligence report assesses how AR is disrupting multiple industries with real-life use cases. It provides an overview of the current landscape, as well as key players while also highlighting opportunities for the use of AR in the future. The report provides an industry-specific analysis based on GlobalData databases and surveys, along with an overview of the latest trends shaping the market.

| Report Pages | 99 |

| Regions Covered | Global |

| Key Trends | · Technology Trends

· Macroeconomic Trends · Media Trends · Regulatory Trends |

| Value Chain | · Semiconductors

· Components · Devices · Platforms · Applications and Content |

| Leading Adopters | · Apple

· Qualcomm · Meta |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Augmented Reality (AR) – Trends

The main trends shaping the augmented reality theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, media trends, and regulatory trends.

Technology trends: The major technology trends shaping the augmented reality theme in the coming years are the rising investment in the consumer metaverse by tech giants such as Meta and Epic Games, focus on Mobile AR and webAR, and rising deployment of Cloud services among others.

Macroeconomic trends: The major macroeconomic trends impacting the augmented reality theme are the abandonment of AR projects in 2023 by big tech, the dearth of AR content limiting its adoption, and the development of XR by governments among others.

Regulatory trends: Data privacy regulations, the risk to intellectual property (IP) due to AR, and privacy threats owing to the large-scale collection of audio and visual data are the major regulatory trends shaping the augmented reality theme in the coming months.

Media trends: The major media trends impacting the augmented reality theme are the application of AR in social media platforms, AR advertising for more inventive, eye-catching, and interactive ads, and the rise of AR gaming among others.

Augmented Reality (AR) – Industry Analysis

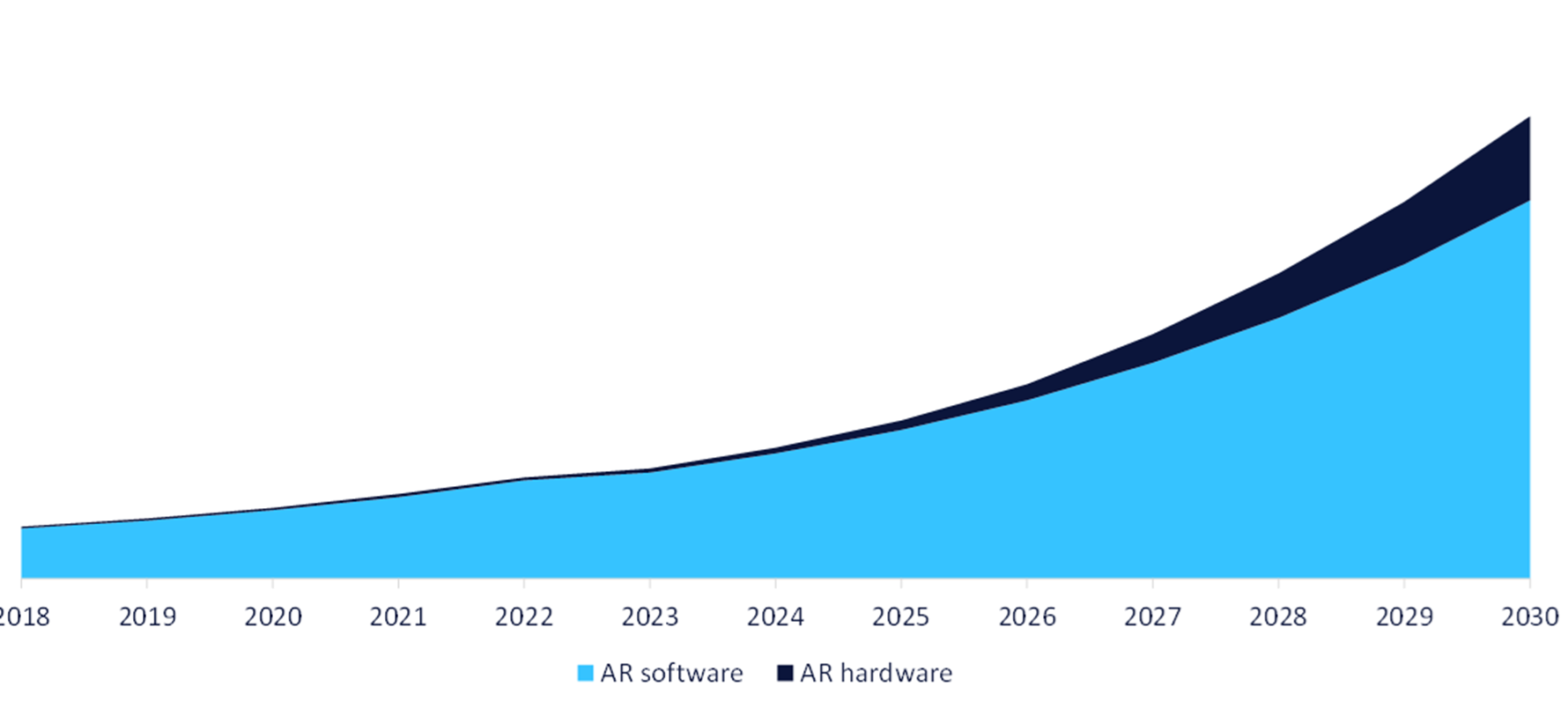

AR is a major investment theme for many tech companies. The global AR market was valued at nearly $22 billion in 2022 and it is expected to grow at a CAGR of more than 20% over 2022-2030. AR software is the dominant segment in terms of revenue in the market. Steady investments by enterprises into task-specific solutions such as remote collaboration, training, maintenance, and customer support will drive the growth of the enterprise AR software market.

The Augmented Reality (AR) industry analysis also covers:

- Use cases

- Timeline

- M&A trends

Global AR Revenue, 2018 – 2030 ($ Billion)

Buy the Full Report for More Industry Insights into the Augmented Reality (AR) Market Forecast

Augmented Reality (AR) - Value Chain Analysis

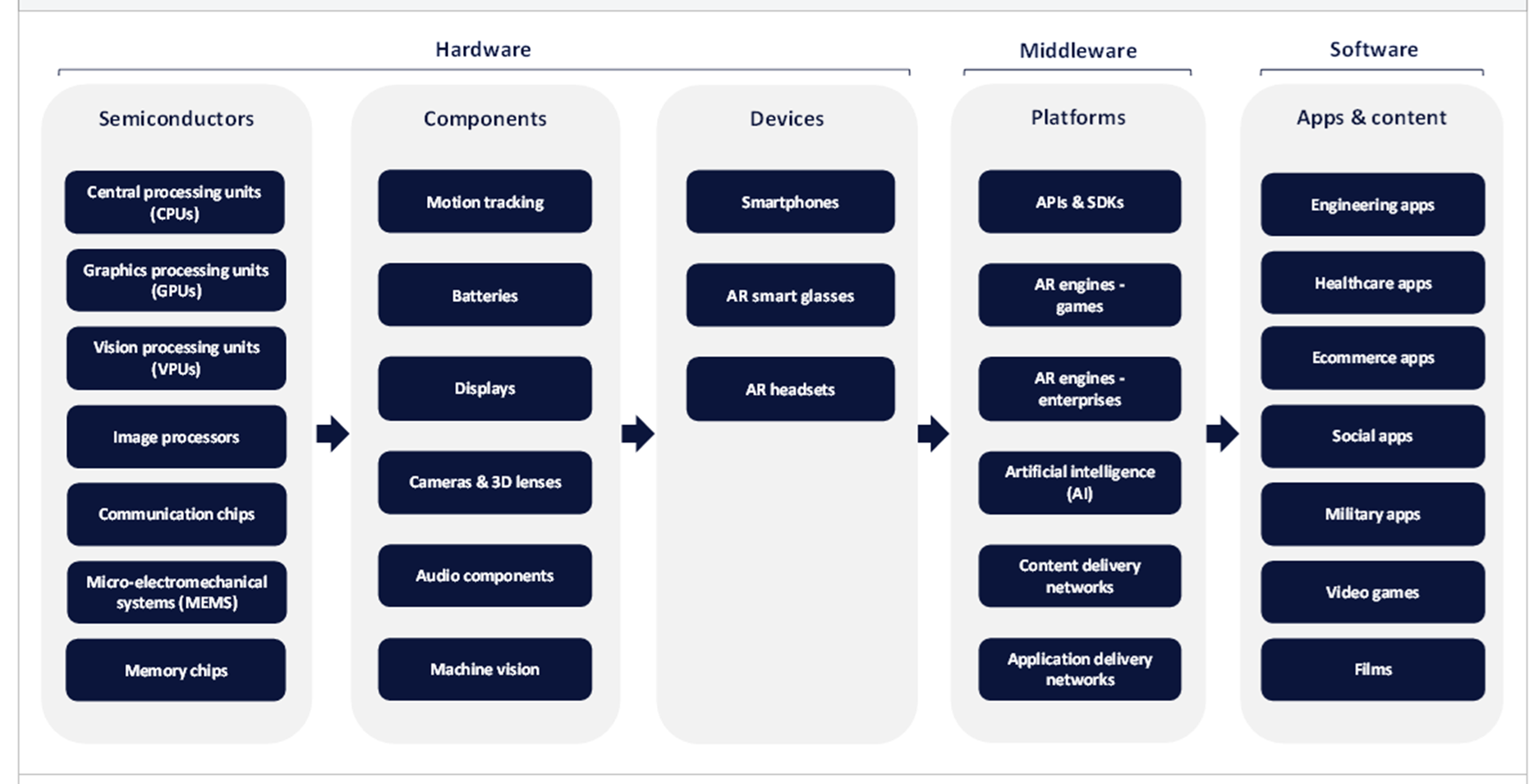

The AR value chain is split into semiconductors, components, devices, platforms, and applications and content.

Semiconductors: Semiconductors are one of the key battlegrounds in AR today. Until 2018, AR device makers primarily relied on powerful smartphone and PC chips, however, the launch of Qualcomm’s XR1 AR and VR-specific chipset revolutionized the market. Subsequently, in 2019, Qualcomm launched the XR2 5G platform, describing it as the “world’s first 5G-supported extended reality (XR) platform.” In addition, Qualcomm is the leading player in the AR central processing unit (CPU) space.

AR Value Chain Analysis

Buy the Full Report for More Value Chain Insights into the Augmented Reality (AR) Theme

Leading AR Adopters

A few of the leading companies making their mark within the augmented reality theme are:

- Apple

- Qualcomm

- Meta

Buy the Full Report to Know More About the Leading AR Companies

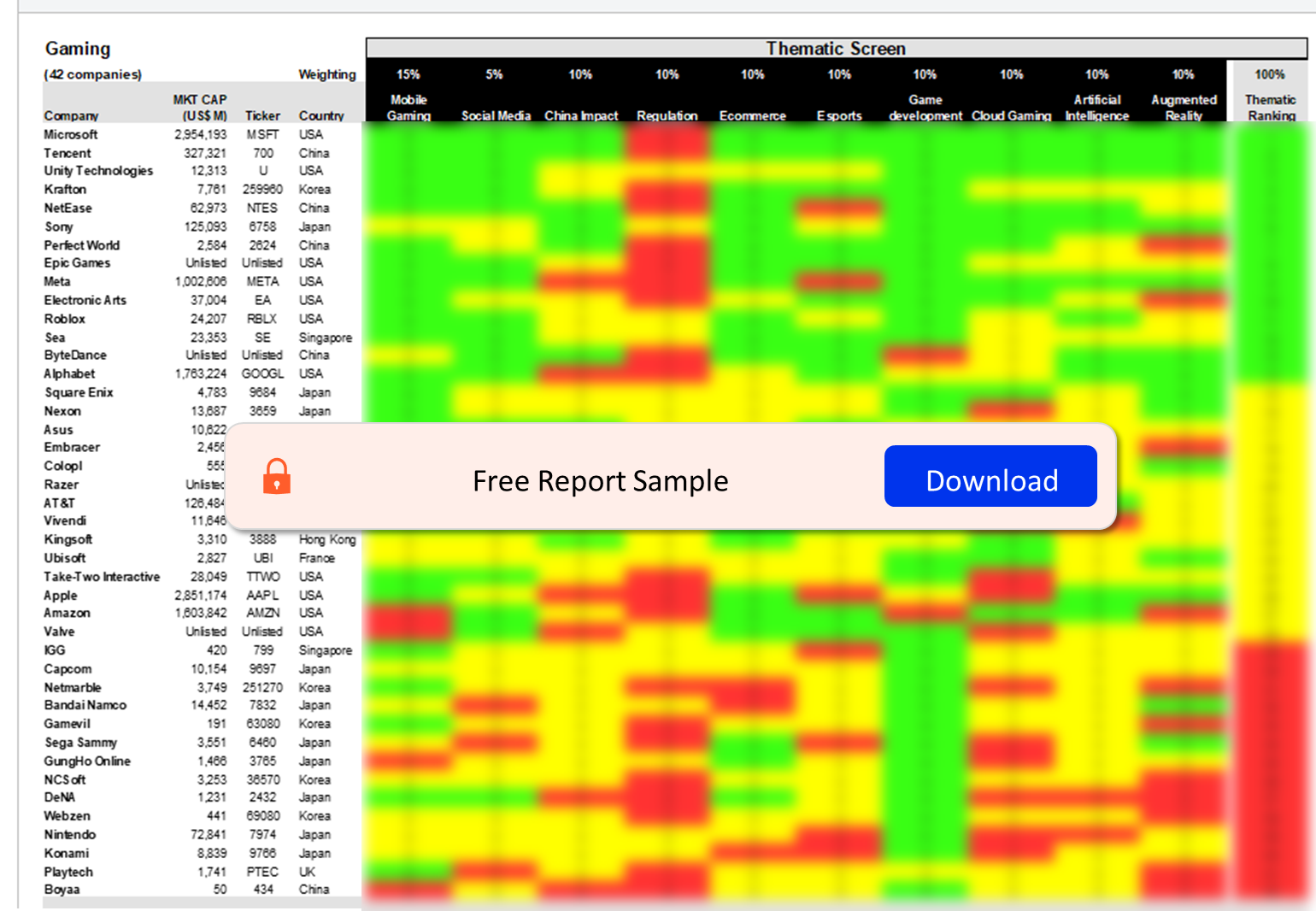

Gaming Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens – a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Gaming sector scorecard – Thematic Screen

Buy the Full Report to Know More about the Sector Scorecards

The sector scorecards also include:

- Consumer electronics sector scorecard

Key Highlights

According to GlobalData forecasts, the AR market will be worth $100 billion by 2030, up from $22 billion in 2022. AR software will generate most of this revenue, with limited spending on AR headsets and AR smart glasses.

AR is evolving into a utility in specific consumer and enterprise applications. On the consumer front, AR is primarily used in social media, gaming, and ecommerce. While Pokémon Go and Snapchat Lenses have helped popularize AR as a tool for entertainment, ecommerce is using it as a utility.

The adoption of AR by enterprises is also advancing in sectors such as retail, healthcare, and manufacturing, mainly for user experience, training, and remote collaboration. Businesses will continue to adopt AR in the coming years, but the high cost of headsets and smart glasses will hinder widespread adoption in the short term. In terms of end users, the enterprise AR segment is dominant and will maintain its lead over the forecast period.

AAC Technologies

Accuvein

Adlens

Adobe

Akamai

Alibaba

Alphabet (Google)

Amazon

Ambarella

AMD

Analog Devices

Apple

Apprentice

AR.js

Argon

Arm

Arspectra

Aryzon

Asus

Atheer

Augmedics

Augment

Autodesk

Auxbrain

Avegant

BAE Systems

BaishanCloud

Bandai Namco

Blu Wireless

BOE Technology

Boeing

Bosch

Brain Lab

Broadcom

BYD

ByteDance

Cadence

CAE Healthcare

Carl Zeiss

CBAK Energy Technology

ChinaCache

Chukong Technologies

Cirrus Logic

Cisco

Cloudflare

Cognex

Comcast

Dassault Systèmes

De Beers

Desay Battery

DigiLens

Dispelix

Dolby Labs

Dynapack

East City Films

eBay

Elbit Systems

Elyland

EON Reality

Epic Games

Everysight

Eyelights

F5

Fastly

Fresnel Technologies

Genius Electronic Optical

Goertek

Gravity Jack

Groove Jones

Himax

Huawei

IBM

Ikea

Illumix

ImagineAR

INDE

Infineon

Intel

Intellectsoft

Iristick

Jarvish

JBKnowledge

JD.com

jsDelivr

Kinicho

Kioxia

Kopin

Largan Precision

Leica

Lenovo

Lens Technology

LetinAR

LG Display

Lockheed Martin

L'Oréal

Lumus

Mad Gaze

Magic Leap

Mantis Vision

Maxst

MediaTek

Medivis

Medtronic

Meta

Micron

Microoled

Microsoft

Mimi (3D Sound Labs)

Mojo Vision

Murata

Nanya Tech

NetEase

Netflix

Nexon

Niantic

Niantic (8th Wall)

Nintendo

Nokia

Northrop Grumman

Nvidia

NXP Semiconductors

Occipital

Olympus

OmniVision

OnSemi

Oppo

Oracle

Orca Health

Panasonic

PMD

Proximie

PTC

Qorvo

Qualcomm

Realmax

RealWear

Re'flekt

Renesas

Resolution Games

Rokid

Samsung Electronics

Saphlux

Schneider Electric (Aveva)

ScopeAR

SeeYA Technology

Seiko Epson

Sennheiser

Sensata

Sephora

Shopify

Siemens

Sighthound

Sixense

SK Hynix

Skyworks

Snap

Sony

Square Enix

StackPath

STMicroelectronics

Synopsys

Target

TCL (Leiniao)

TDK

TeamViewer

Tencent

Texas Instruments

The Home Depot

ThirdEye

Tilt Five

Toshiba

TSMC

Ubisoft

Ultraleap

Unisoc Technologies

Unity Technologies

Universal Display

USound

Varjo

Verizon

ViacomCBS

ViewAR

Vipaar

Visionstar (EasyAR)

Visometry

VividQ

Vivo

Vuzix

Walmart

Walt Disney

Warner Bros. Discovery

WayRay

Western Digital

Xiaomi

Xloong

Xreal

Yangtze Memory

Young Optics

Zapworks

Zoom

Table of Contents

Frequently asked questions

-

What was the size of the global AR market in 2022?

The global AR market was valued at nearly $22 billion in 2022.

-

What are the key trends shaping the augmented reality theme?

The main trends shaping the augmented reality theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, media trends, and regulatory trends.

-

What are the main layers of the AR value chain?

The AR value chain is split into semiconductors, components, devices, platforms, and applications and content.

-

Which are the leading companies in AR theme?

A few of the leading AR companies making their mark within the augmented reality theme are Apple, Qualcomm, and Meta.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.