Belgium Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Belgium Life Insurance Market Report Overview

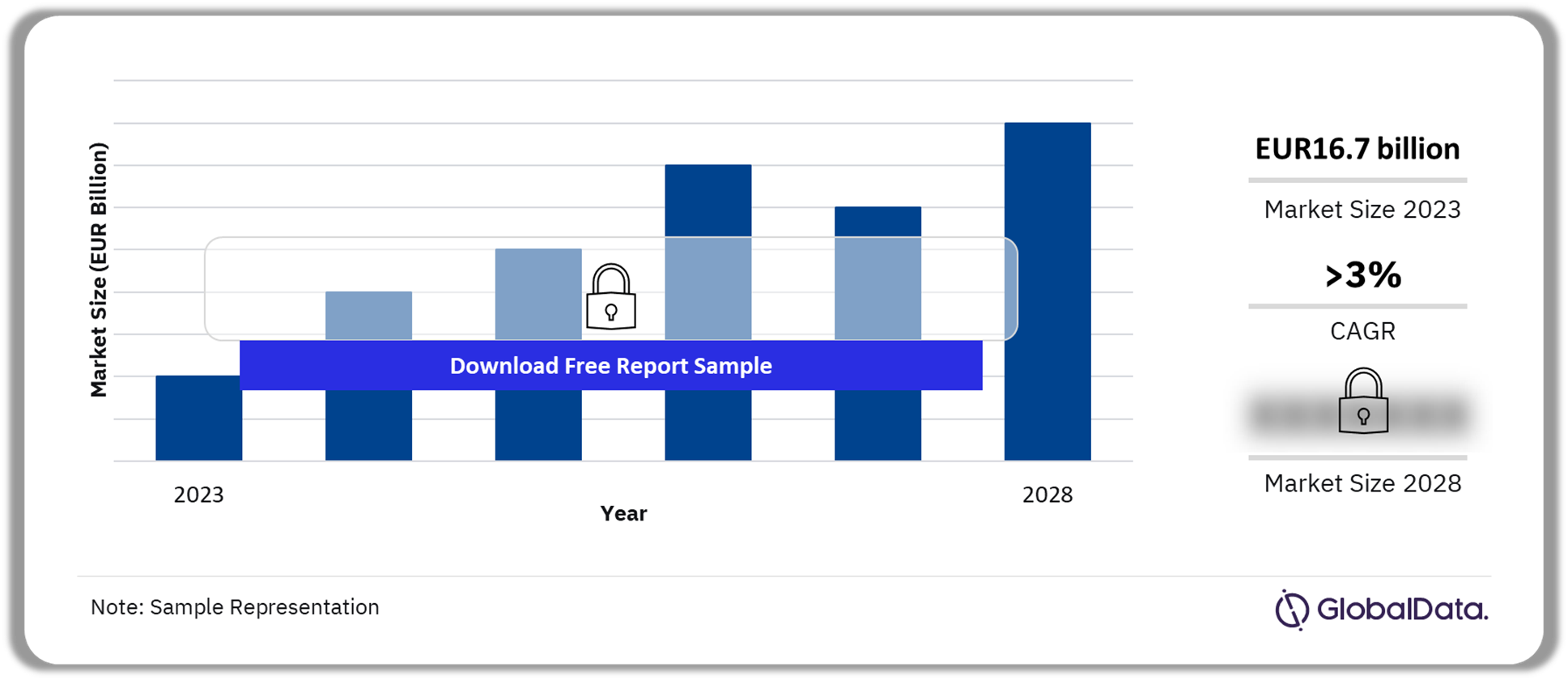

The gross written premium of the Belgium Life insurance market was EUR16.7 billion ($17 billion) in 2023 and is expected to attain a CAGR of more than 3% during 2024-2028. The Belgium Life insurance market research report provides in-depth market analysis, including insights into the lines of business in the country’s Life insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including gross written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Belgium Life Insurance Market Outlook, 2023-2028 (EUR Billion)

Buy the Full Report to Gain More Information about the Belgium Life Insurance Market Forecast

The Belgium Life insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Belgium economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | EUR16.7 billion ($17 billion) |

| CAGR (2023-2027) | >3% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Lines of Business | · Endowment

· Other Life |

| Key Distribution Channels | · Direct Marketing

· Insurance Brokers · Bancassurance |

| Leading Companies | · AG Insurance

· KBC Insurance · Ethias · Belfius Insurance · AXA Belgium |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Belgium Life Insurance Market Trends

ESG, Insurtechn and Inclusive Insurance are a few of the recurring trends in the Belgium Life insurance market.

- In Belgium, the number of years that must pass to consider a medical condition as “forgotten” varies according to the specific cancer pathology. Different cancers have varying numbers of years associated with being considered forgotten and these number of years are updated regularly as per the scientific data available on the medical progress of the different cancers.

- The right to be forgotten medically and not be asked to provide a medical history for purchasing life or health insurance and taking bank loans is explicitly recognized in eight of the EU member states, with Belgium being one of them. For example, banks and insurance companies cannot ask a prospective customer who has survived cancer to produce medical records if a certain period has elapsed since the cancer patient’s treatment.

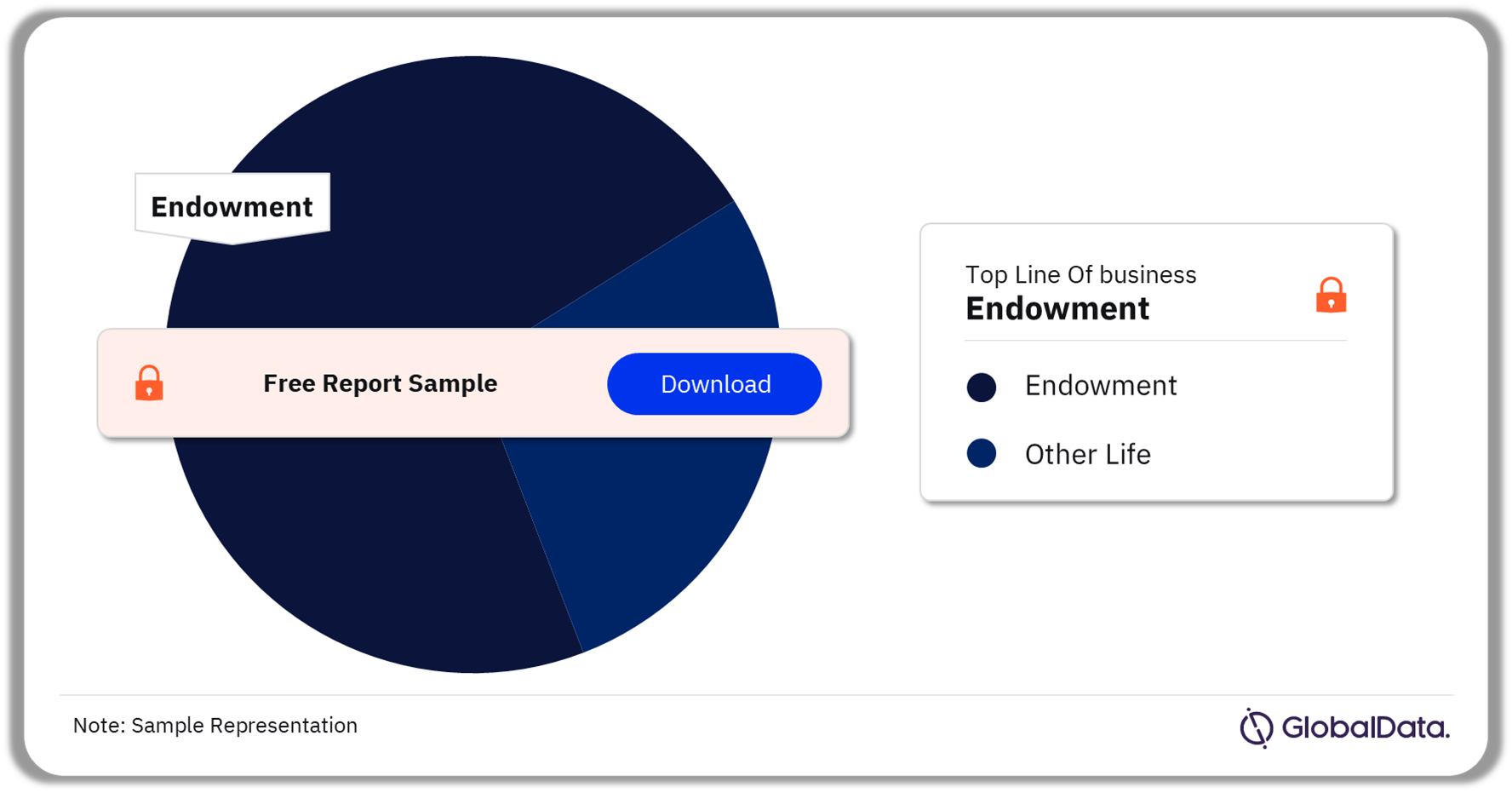

Belgium Life Insurance Market Segmentation by Lines of Business

Endowmentwas the leading Life insurance line of business in 2023

The key lines of business in the Belgium Life insurance industry are Endowment and other life insurance. Endowment insurance policies in Belgium consist of individual life and group life investment-type insurance. They are mostly invested until the insured is 65 years of age, to supplement retirement savings.

Belgium Life Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Belgium Life Insurance Market

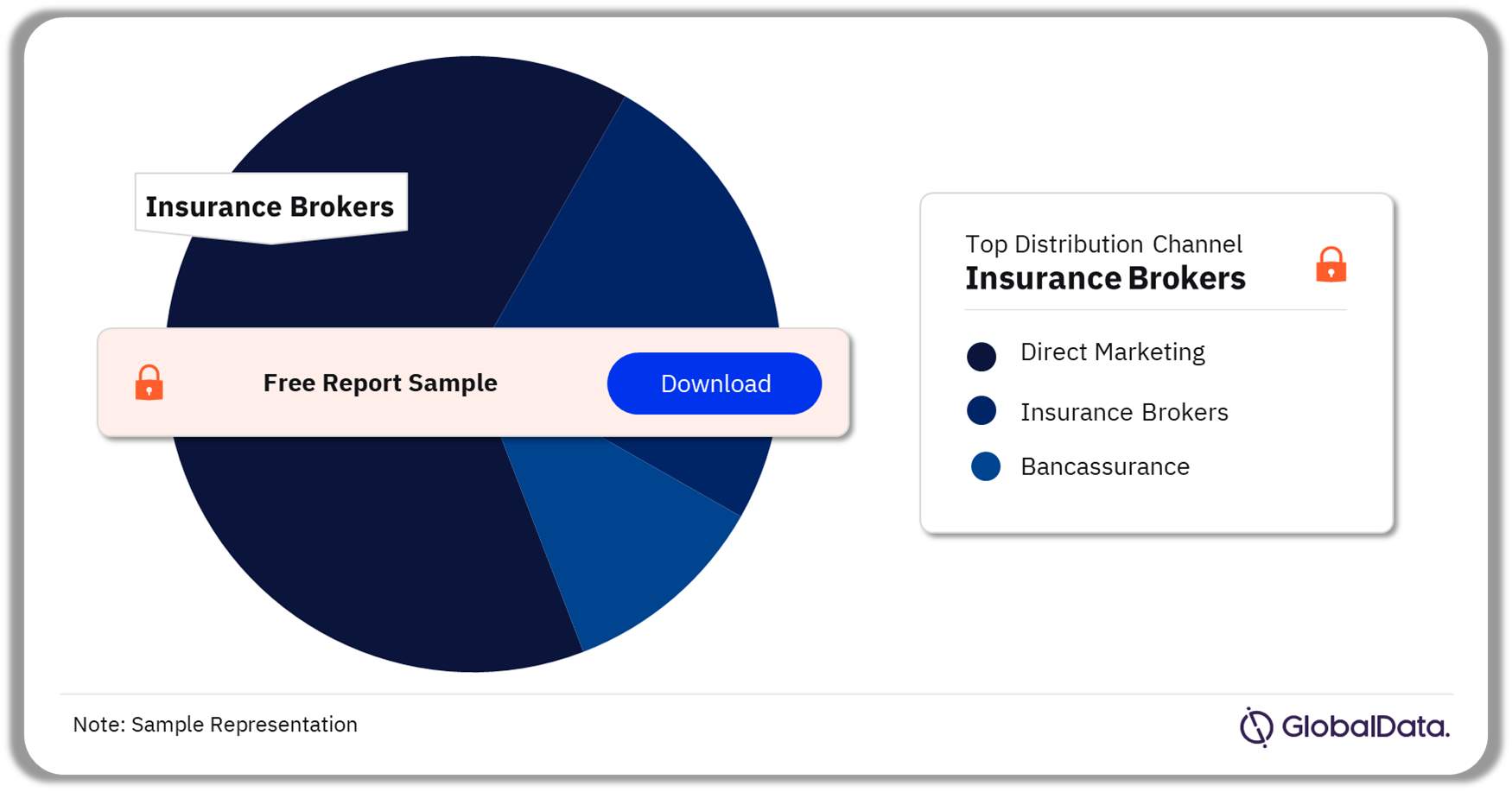

Belgium Life Insurance Market Segmentation by Distribution Channels

Insurance brokers was the leading distribution channel in 2023

A few of the key distribution channels in the Belgium Life insurance industry are direct marketing, insurance brokers and bancassurance. Insurance brokers is the primary distribution channel in Belgium life insurance, except for unit-link insurance contracts.

Belgium Life Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Belgium Life Insurance Market

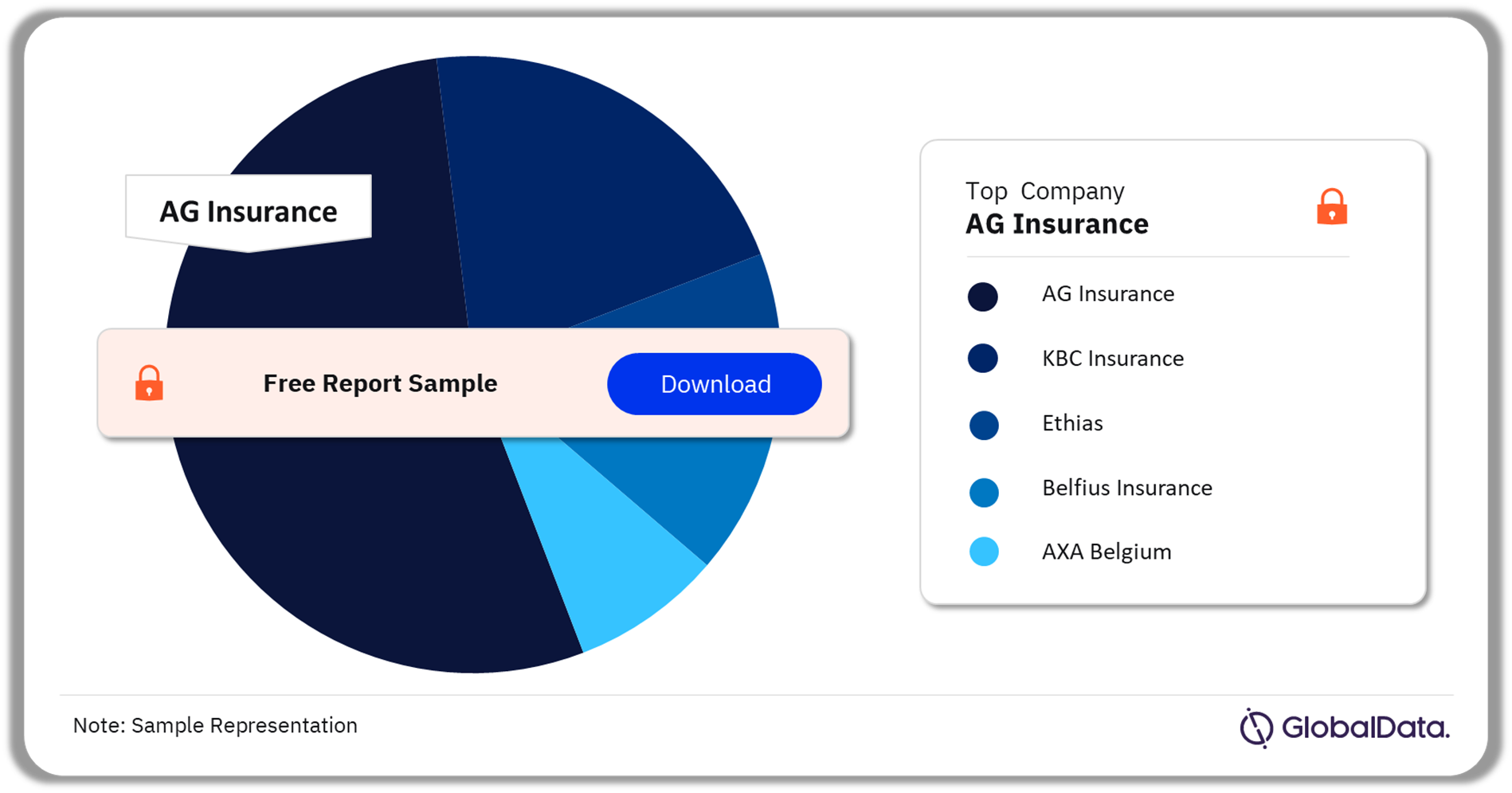

Belgium Life Insurance Market - Competitive Landscape

AG Insurance was the largest Life insurer in 2022

A few of the leading Life insurance companies in Belgium are:

- AG Insurance

- KBC Insurance

- Ethias

- Belfius Insurance

- AXA Belgium

AG Insurance accounted for the highest market share followed by KBC Insurance, in 2022. The company offers digital solutions through its website and apps. MyAG, the customer portal on the company website, enables users to log in securely, access and download contracts/documents, report and track claims, and update contact details.

The AG MuMa Dashboard app provides users with a detailed view of the investment funds related to their life insurance products, including details of fund managers, news about financial markets, and fund performance.

Belgium Life Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Companies in the Belgium Life Insurance Market

Belgium Life Insurance Market - Latest Developments

- On October 2023, Howden Group Holdings, an insurance intermediary company based in the UK that provides insurance broking and underwriting solutions, acquired WDR Insurance Group, an insurance brokerage firm based in Belgium.

- On August 2023, Monument Assurance Belgium, the Belgian subsidiary of Monument Re, acquired a run-off block of retail life policies, annuities, and associated assets from Federale Assurance, a Belgian cooperative insurance company.

Segments Covered in the Report

Belgium Life Insurance Lines of Business Outlook (Value, EUR Billion, 2019-2023)

- Endowment

- Other Life

Belgium Life Insurance Distribution Channels Outlook (Value, EUR Billion, 2019-2023)

- Direct Marketing

- E-Commerce

- Bancassurance

- Other Distribution Channels

Scope

This report provides:

- A comprehensive analysis of the Life insurance segment in Belgium.

- Historical values for the Belgium Life insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top Life insurance companies in Belgium and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Belgium’s Life insurance segment.

- A comprehensive overview of Belgium’s economy, government initiatives, and investment opportunities.

- Belgium’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Belgium’s Life insurance industry’s market structure giving details of lines of business.

- Belgium’s Life reinsurance business market structure giving details of premium ceded along with cession rates.

- Distribution channels deployed by Belgium’s Life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Belgium’s Life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Belgium’s Life insurance segment.

- Assess the competitive dynamics in the Life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

KBC Insurance

Ethias

Belfius Insurance

AXA Belgium

P&V Assurances

NN Insurance Belgium

Allianz Benelux

Table of Contents

Frequently asked questions

-

What was the Belgium Life insurance market gross written premium in 2023?

The gross written premium of the Belgium Life insurance market was EUR16.7 billion ($17 billion) in 2023.

-

What will the Belgium Life insurance market growth rate be during the forecast period?

The Life insurance market in Belgium is expected to achieve a CAGR of more than 3% during 2024-2028.

-

Which line of business held the largest share of the Belgium Life insurance market in 2023?

Endowment held the largest share of the Belgium Life insurance market in 2023.

-

Which distribution channel was the leading distribution channel of the Belgium Life insurance market in 2023?

Insurance brokers was the leading distribution channel for the Portuguese Life insurance market in 2023.

-

Which are the key companies operating in the Belgium Life insurance market?

A few of the leading Life insurance companies in Belgium are AG Insurance, KBC Insurance, Ethias, Belfius Insurance and AXA Belgium.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports