Blockchain Market Trends and Analysis by Region, Application, Vertical and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Blockchain’ report can help:

- Understand the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘Blockchain’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for the period 2020-2030 for market assessment.

- The report offers detailed segmentation by:

- Application – Supply Chain Management, Cross-Border Payments, and Settlements, Lot lineage/provenance, Trade Finance & Post-Trade Settlements, Identity management, Property Ownership Management, Energy Settlements, and Others

- Vertical – BFSI, Transport and Logistics, Cross-sector, Retail, Healthcare, Government, Others

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market trends, drivers, and challenges impacting the blockchain

- The report covers dashboard analytics for M&A deals, venture financing/private equity deals, job activity, social media analytics, and patent activities.

- The competitive landscape includes competitive positioning of key companies and their strengths and limitations in the market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- The report covers competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest blockchain trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Blockchain Products/Solution Providers

- Cryptocurrency Products/Solution Providers

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms/Investment Firms

- Telecom/Networking Companies

Get a Snapshot of the Blockchain Market, Download a Free Report Sample

Blockchain Market Report Overview

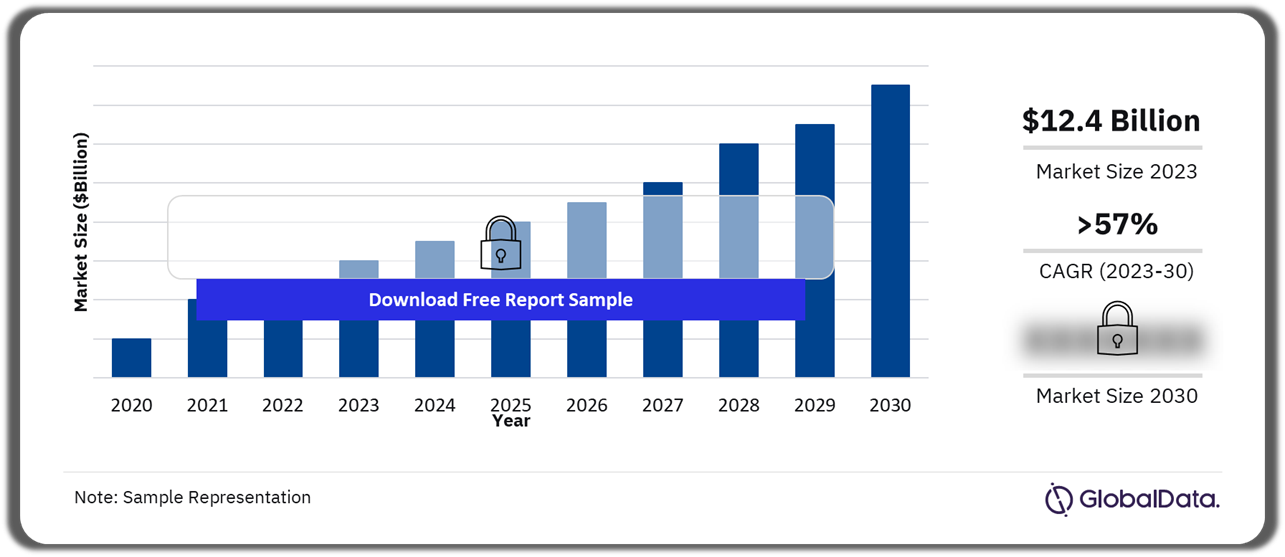

The blockchain market size revenue was valued at $12.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 57% over the forecast period. The market is expected to be driven by the growing use of technology to make illiquid assets such as real estate and fine art more accessible through asset tokenization. Further, growth will be fueled by the increasing adoption of blockchain-as-a-service by small and medium enterprises to integrate the technology into their businesses without requiring extensive in-house infrastructure.

Developments in technologies such as web3 and non-fungible tokens (NFTs) are revolutionizing the market. Web3 signifies the shift from the current centralized internet, known as Web2, to a decentralized model where users have ownership of their data and participate directly in digital economies. Blockchain provides the infrastructure for developing essential components of Web3 and its potential growth is expected to drive the adoption of blockchain technology. Further, blockchain technology underpins NFTs, positioning them as one of the primary blockchain applications alongside cryptocurrencies. As NFTs find applications in gaming, music, and entertainment, and enable voting and governance rights, they will positively impact the market.

Blockchain Market Outlook, 2020-2030 ($Billion)

Buy the Full Report for Additional Insights on the Blockchain Market Forecast

Asset tokenization utilizes the technology to convert physical or digital assets into divisible, decentralized, and tradable digital tokens, allowing investors to purchase portions of an asset rather than the whole. Recognized as a significant market opportunity by prominent financial institutions such as JP Morgan, BlackRock, Goldman Sachs, and BNY Mellon, asset tokenization emerges as a prominent application with extensive implications for financial markets and the broader economy. As the landscape of asset tokenization platforms grows, companies across finance, real estate, and fine arts are delving into inventive uses of this technology, thereby driving the expansion of the market.

Layer 2 solutions, built upon existing blockchains (known as layer 1), are designed to boost transaction speed and capacity. By processing transactions off layer 1, they alleviate network congestion, reduce transaction costs, and accelerate processing while maintaining the security and decentralization inherent in layer 1. Layer 2 solutions are anticipated to unlock new applications as they become more sophisticated and widely adopted. These applications will drive the ongoing evolution of the blockchain ecosystem, enhancing its utility for both public and private use cases, and propelling market growth.

However, the industry faces a talent shortage exacerbated by the growing popularity of NFTs and decentralized finance (DeFi) projects, resulting in inflated salaries for blockchain developers and intense competition among companies offering lucrative packages. This scarcity of qualified individuals hampers project development. Furthermore, regulatory ambiguity impedes widespread blockchain adoption, especially concerning public blockchains, which challenge conventional oversight methods due to their decentralized nature.

| Market Size (2023) | $12.4 billion |

| CAGR (2023 – 2030) | >57.0% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Landscape, Growth Trends |

| Application Segment | Supply Chain Management, Cross-Border Payments, and Settlements, Lot lineage/provenance, Trade Finance & Post-Trade Settlements, Identity management, Property Ownership Management, Energy Settlements, Others |

| Vertical Segment | BFSI, Transport and Logistics, Cross-sector, Retail, Healthcare, Government, Others |

| Geographies | North America, Europe, Asia-Pacific, South & Central America, Middle East & Africa |

| Countries | US, Canada, Mexico, UK, Germany, France, Italy, Spain, Netherlands China, India, Japan, Singapore, Australia, South Korea, Brazil, Argentina, UAE, South Africa, and Saudi Arabia |

| Key Companies | International Business Machines Corp., Accenture Plc, Alibaba Group Holding Ltd., Tencent Holdings Ltd., Oracle Corp., Alphabet Inc., HSBC Holdings Plc, Salesforce Inc., Amazon.com Inc., JPMorgan Chase & Co. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

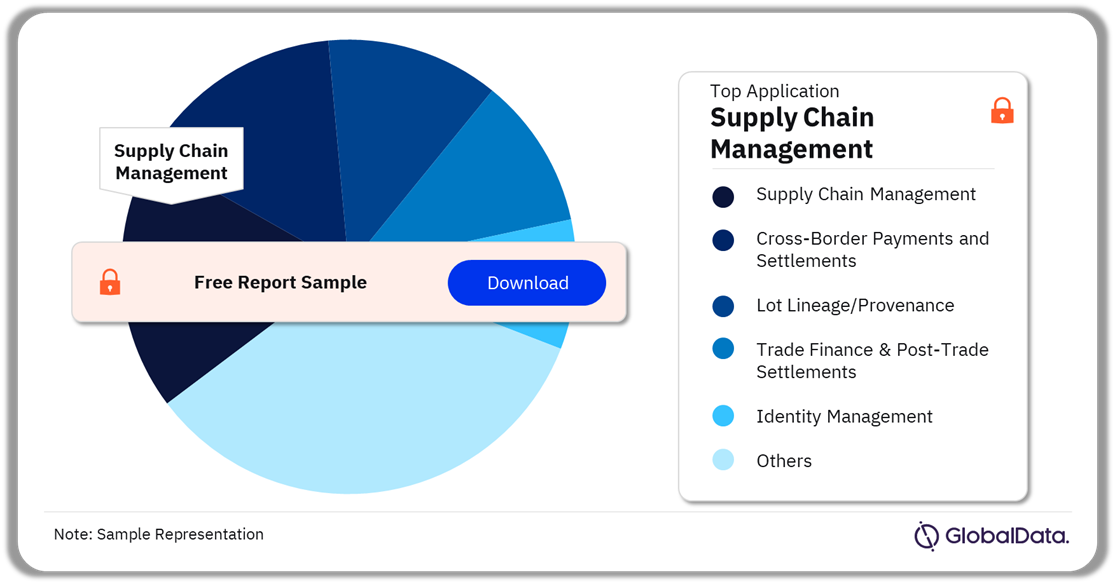

Blockchain Market Segmentation by Application

Supply chain management accounted for the highest share of the market in 2023. The luxury industry has emerged as a leading adopter of blockchain-related supply chain solutions. The technology aligns well with the high-value, low-volume nature of luxury goods, offering a clear solution for assuring product authenticity and enhancing customer experiences, particularly for affluent consumers who value traceability. Additionally, the sector’s overall uniform digital readiness further facilitates this adoption.

Technology is also being used in cross-border payments and settlements to enhance transaction processes to improve speed, security, and efficiency. Blockchain-enabled cross-border payments aim to mitigate traditional banking issues such as delays and high fees, while settlements focus on post-transaction accuracy and record reconciliation. Applications such as tokenization, stablecoins, and CBDCs are increasingly being integrated into cross-border payment systems driving growth of the segment.

Blockchain Market Share by Application, 2023 (%)

Buy the Full Report for More Information on Blockchain Market Applications

Applications in identity management are emerging as efficient alternatives to traditional methods, offering improved data control. They are primarily used for processes such as Know Your Customer (KYC) and employment verification. Investments by companies and governments in identity solutions are expected to drive segmental growth. For instance, Deloitte and Wipro introduced blockchain-based identity solutions in 2023, while the South Korean government has introduced a blockchain-powered digital driver’s license, an employee ID system, and a planned national digital ID set to launch in 2024.

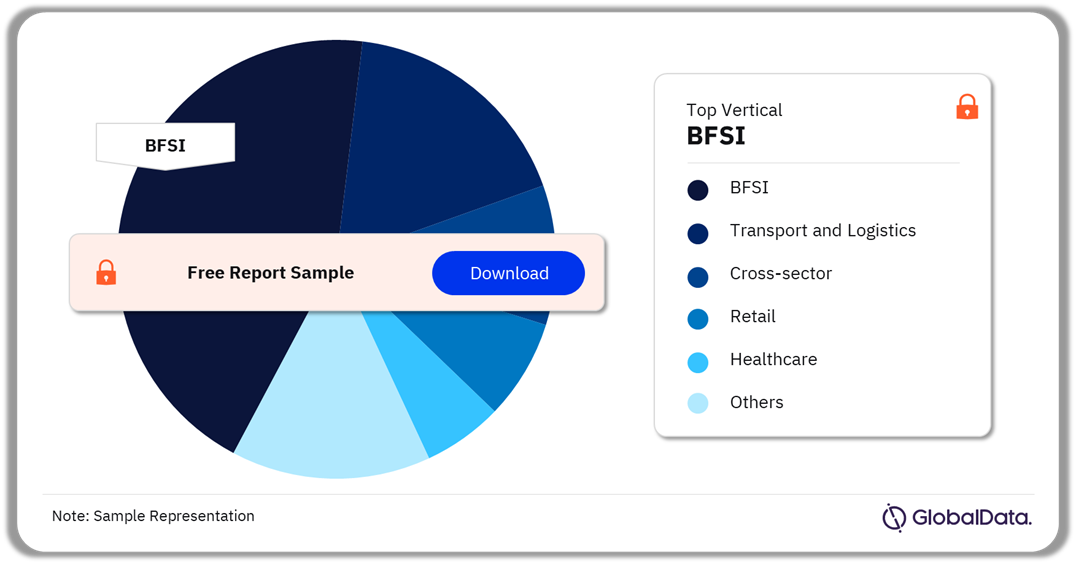

Blockchain Market Segmentation by Vertical

In 2023, most expenditure came from the BFSI vertical, with notable applications in cross-border payments, trade finance, and asset management. The industry’s substantial investment capacity, combined with a growing interest in areas such as asset tokenization, which has the potential to drive significant value, has strengthened its dominance.

Apart from BFSI, notable adoption is observed in supply chain-oriented industries such as retail transport, and logistics, primarily for transaction processing and asset tracking purposes. However, adoption has been slower due to intricate integration requirements, involvement of diverse stakeholders, regulatory hurdles, and reliance on complementary technologies such as the Internet of Things (IoT), including radio-frequency identification (RFID) tags and other tracking devices.

Blockchain Market Share by Vertical, 2023 (%)

Buy the Full Report for More Information on Blockchain Market Verticals

Applications in most other sectors, including healthcare and the public sector, are still in the nascent phase. The energy sector exhibits promise, with initiatives such as Shell, Accenture, and American Express’s project for sustainable air fuel and Volkswagen’s project for renewable energy-powered electric vehicle charging. The healthcare and public-sector segments are expected to witness blockchain adoption in the coming years, though this growth may be slowed down by outdated legacy systems, strict regulations, privacy worries, and a history of limited collaboration among competitors.

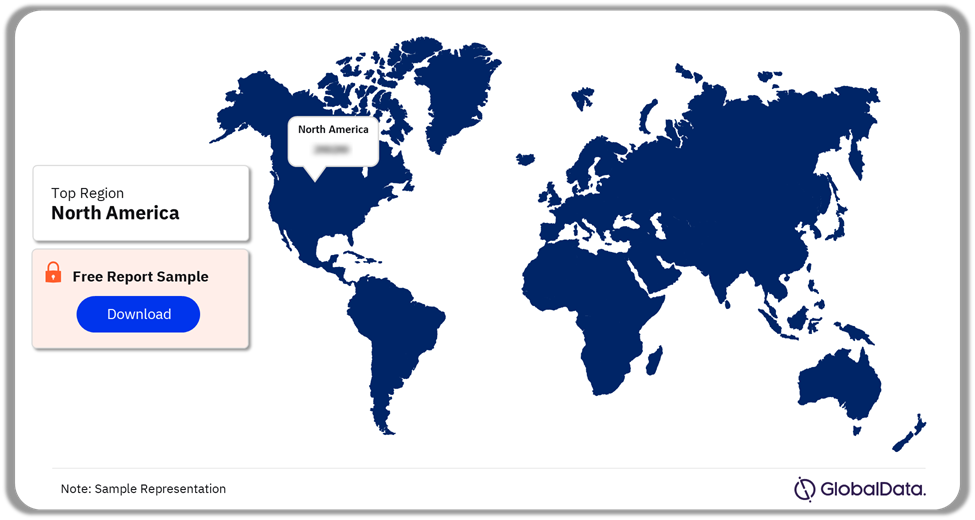

Blockchain Market Analysis by Region

North America remains at the forefront of technological advancement, capturing over 40% of overall revenues in 2023. The US leads in blockchain-related venture funding, capitalizing on early adoption and the presence of prominent blockchain-native firms and major tech companies, providing it a competitive advantage. Companies in the country are at the forefront of blockchain applications. For instance, Franklin Templeton oversees the largest tokenized US government money market fund globally through asset tokenization while Walmart employs blockchain in its retail supply chain to bolster sustainability and traceability.

In 2023, Europe emerged as the second-largest market, benefitting from the technology’s alignment with the region’s citizen-centric, sustainable, and transparent policies. Notably, in 2023, Belgium announced its focus on promoting the development of a blockchain infrastructure for storing and managing official documents during its EU presidency. The EU has taken a unified approach to the technology, evidenced by the introduction of the Markets in Crypto-Assets (MiCA) regulation, which establishes a customized framework for digital assets. This regulatory clarity is attracting blockchain ventures and is anticipated to drive stronger adoption in Europe compared to the US.

Blockchain Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Blockchain Market

The Asia-Pacific region is poised to experience the highest growth during the forecast period. Factors driving this growth include a favorable regulatory environment, robust government initiatives, and an expanding middle class with a growing demand for improved financial services. The significant investment by the Chinese government in the technology, exemplified by initiatives such as the Blockchain-based Service Network, is expected to propel the region’s market forward. Countries within the region are leading the way in applications, particularly in identity management.

The market in South & Central America is experiencing momentum due to the increasing presence of small and medium enterprises, which are increasingly embracing digitization to bolster their IT infrastructure. This strategic shift is geared towards fostering business expansion and meeting customer needs effectively. Moreover, the expanding information and communications technology (ICT) sector and the heightened uptake of cutting-edge technologies are further driving the growth of the market in the region.

Blockchain Market – Competitive Landscape

The competition within the landscape of blockchain technology companies is intense, with established firms such as International Business Machines Corp., Accenture Plc, and Alibaba Group Holding Ltd., alongside emerging startups such as Ripple and R3. These companies vie to develop the most secure, efficient, and cost-effective solutions for their clients, focusing on key areas, including usability, security, privacy, and scalability. Heavy investments in research and development are made to maintain a competitive edge, and as technology advances, competition is expected to intensify further. Despite the industry’s fragmentation, the rise of startups and new ventures is heightening the competitive environment.

To bolster their offerings, many companies are forging partnerships. For example, in January 2024, Alibaba Group announced a collaboration between Alibaba Cloud and Mysten Labs, a pivotal developer behind the Sui blockchain, aiming to enhance the Sui blockchain ecosystem. Similarly, in November 2023, Tencent Cloud collaborated with 17 other internet infrastructure firms to join forces with Infura, a web3 API provider developed by ConsenSys. Together, they launched Infura’s Decentralized Infrastructure Network (DIN), which offers decentralized remote procedure call (RPC)-as-a-service. This initiative aims to improve accessibility, reliability, and efficiency within Web3.

Market competitors are also concentrating on refining their product portfolios to meet evolving user needs and maintain competitiveness. To achieve this, companies are collaborating with universities globally to support technical advancements, academic research, and innovation in cryptocurrency and blockchain technology. For instance, in May 2024, BlockyPro, a digital asset trading platform, unveiled the formation of a blockchain financial technology alliance in partnership with several renowned universities in the US. This alliance is designed to advance research and application in financial technology while reinforcing its strategy and platform security. Bringing together experts and scholars from esteemed institutions, including MIT, Stanford University, and Harvard University, the alliance aims to collaboratively explore and innovate next generation blockchain technology.

Leading Companies in the Blockchain Market

- International Business Machines Corp.

- Accenture Plc

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Oracle Corp.

- Alphabet Inc.

- HSBC Holdings Plc

- Salesforce Inc.

- Amazon.com Inc.

- JPMorgan Chase & Co.

Buy the Full Report to Know More About Leading Blockchain Companies

Blockchain Market Segments

GlobalData Plc has segmented the blockchain market report by application, vertical, and region:

Blockchain Market Application Outlook (Revenue, $Million, 2020-2030)

- Supply Chain Management

- Cross-Border Payments and Settlements

- Lot Lineage/Provenance

- Trade Finance & Post-Trade Settlements

- Identity Management

- Property Ownership Management

- Energy Settlements

- Others

Blockchain Market Vertical Outlook (Revenue, $Million, 2020-2030)

- BFSI

- Transport and Logistics

- Cross-sector

- Retail

- Healthcare

- Government

- Others

Blockchain Market Regional Outlook (Revenue, $Million, 2020-2030)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Netherlands

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- Singapore

- South Korea

- Rest of Asia-Pacific

- South & Central America

- Brazil

- Argentina

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- South Africa

- Saudi Arabia

- Rest of the Middle East & Africa

Scope

This report provides overview and service addressable market for blockchain market.

It identifies the key trends impacting growth of the blockchain market over the next 12 to 24 months.

It includes global market forecasts for the blockchain market and analysis of M&A deals, VF/PE deals, patents, social media, and job market trends.

It contains details of M&A deals in the blockchain space and a timeline highlighting milestones in the development of blockchain market.

The detailed value chain consists of four layers: Infrastructure Layer, Software Layer, Application Layer, and Services Layer

Key Highlights

The blockchain market size revenue was valued at $12.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 57.0 % over the forecast period. The increasing use of the technology in the financial sector for applications such as asset tokenization and decentralized finance and developments in layer 2 solutions that improve the scalability of blockchain networks are expected to drive future growth of the market.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global blockchain market by application, vertical, region and key drivers in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the blockchain market.

- The report also covers key insights on buying criteria, vendor/buyer ecommendations along with competitive insights on key market players.

- With more than 100 charts and tables, the report is designed for an executive-level audience, enhancing presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in blockchain market.

- The broad perspective of the report coupled with comprehensive, actionable detail will help telecom companies, infrastructure security providers, blockchain providers, cryptocurrency service providers, and other intermediaries succeed in growing the blockchain market globally.

Key Players

International Business Machines Corp.Accenture Plc

Alibaba Group Holding Ltd.

Tencent Holdings Ltd.

Oracle Corp.

Alphabet Inc.

HSBC Holdings Plc

Salesforce Inc.

Amazon.com Inc.

JPMorgan Chase & Co.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the blockchain market size in 2023?

The blockchain market size was valued at $12.4 billion in 2023.

-

What is the blockchain market growth rate?

The blockchain market is expected to grow at a CAGR of more than 57.0% during the forecast period.

-

What are the key blockchain market drivers?

The increasing use of the technology in the financial sector for applications such as asset tokenization and decentralized finance and developments in layer 2 solutions that improve the scalability of blockchain networks are expected to drive future growth in the market.

-

Which was the leading application segment in the blockchain market in 2023?

The supply chain management segment accounted for the largest blockchain market share by application in 2023.

-

Which was the leading vertical segment in the blockchain market in 2023?

The BFSI segment accounted for the largest blockchain market share by vertical in 2023.

-

Which was the leading regional market in the blockchain market in 2023?

North America accounted for the largest blockchain regional market share in 2023.

-

Which are the leading blockchain companies globally?

The leading blockchain companies are International Business Machines Corp., Accenture Plc, Alibaba Group Holding Ltd., Tencent Holdings Ltd., Oracle Corp., Alphabet Inc., HSBC Holdings Plc, Salesforce Inc., Amazon.com Inc., and JPMorgan Chase & Co.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports