Brazil Cards and Payments – Opportunities and Risks to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Brazil Cards and Payments Market Overview

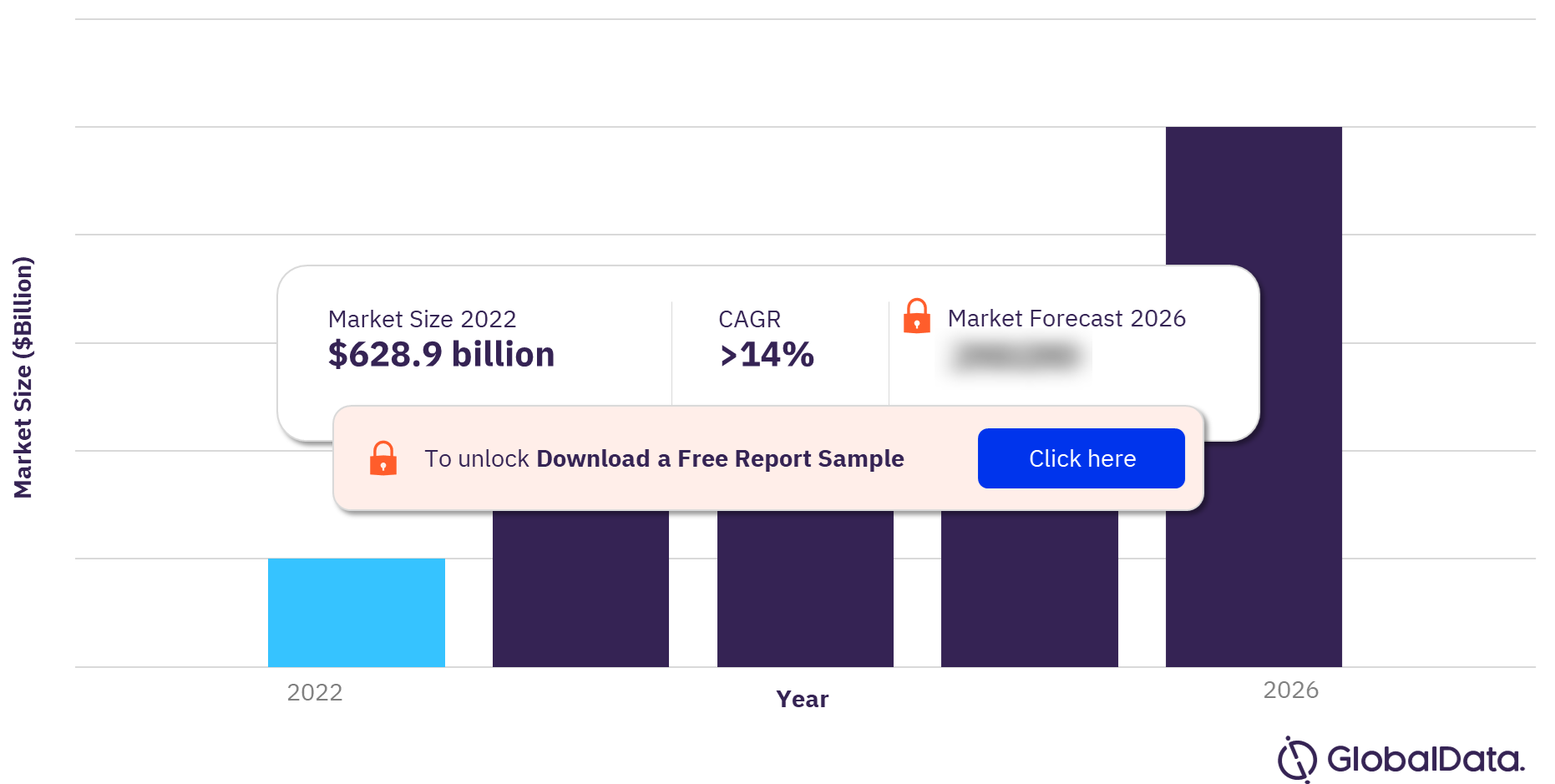

The Brazil cards and payments market size was valued at $628.9 billion in 2022 and is expected to achieve a CAGR of more than 14% during 2022-2026. The government has taken several steps to boost financial inclusion and promote electronic payments in Brazil, including expanding banking infrastructure in rural regions, appointing banking correspondents, and introducing regulation allowing consumers to open bank accounts through digital channels.

Brazil Cards and Payments Market Outlook, 2022-2026 ($ Billion)

To gain more information on the Brazil cards and payments market forecast, download a free report sample

The Brazil cards and payments market research report provides detailed analysis of market trends in the Brazil’ cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, cards, credit transfers, direct debits, and cheques during the review-period.

| Market Size (2022) | $628.9 billion |

| CAGR | >14% |

| Forecast Period | 2022-2026 |

| Historical Period | 2018-2021 |

| Key Payment Instruments | Cash, Cards, Credit Transfers, Direct Debits, and Cheques |

| Key Segments | Card-Based Payments, Merchant Acquiring, Ecommerce Payments, In-Store Payments, Buy Now Pay Later, Mobile Payments, P2p Payments, Bill Payments, and Alternative Payments. |

| Leading Players | Caixa Economica Federal, Banco Bradesco, Santander, Banco do Brasil, Itau Unibanco, Hipercard, Elo, Mastercard, and Visa, among others |

Brazil Cards and Payments Market Dynamics

Buy now pay later (BNPL) services are gaining prominence in Brazil. Credit offered by banks is a popular option. Several banks provide installment payment facilities with their credit cards. To benefit from the growing market, new ecommerce platforms are launching in the country. In December 2022, Espaço Smart, a retailer of construction-related products, launched its ecommerce store in the country.

The proliferation of digital-only banks has helped drive competition in the banking space, thus boosting credit card holding. In November 2021, N26 launched its banking services in Brazil. In September 2022, the bank launched the Mastercard-branded Transparent credit card in virtual and physical variants.

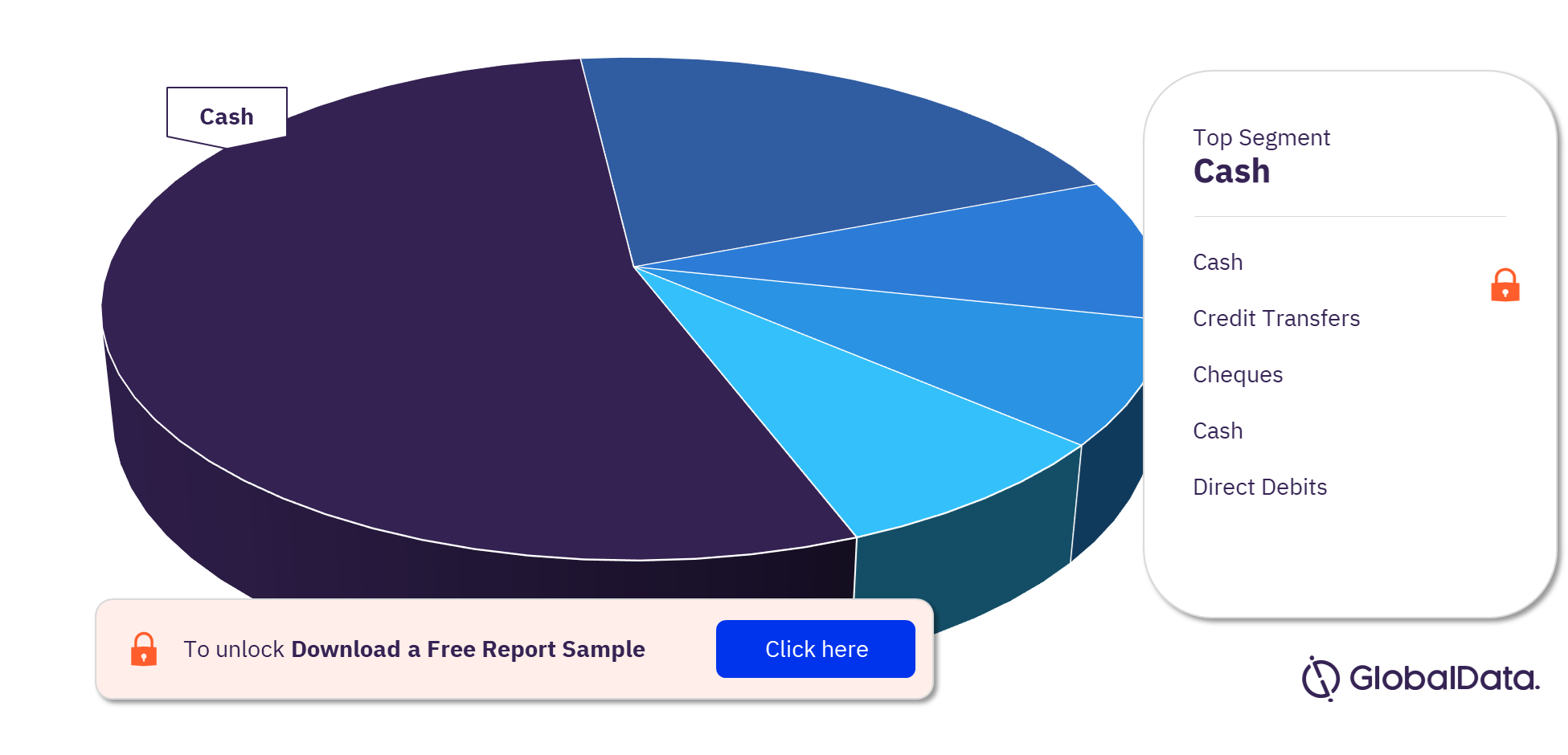

Brazil Cards and Payments Market Segmentation by Payment Instruments

The key payment instruments in the Brazil cards and payments market are cards, credit transfers, cheques, cash, and direct debits. In 2022, cash is the dominant payment instrument in terms of transaction volume. Brazil is a cash-based economy, with cash typically used for day-to-day, low-value transactions.

Brazil Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Brazil cards and payments market, download a free report sample

Brazil Cards and Payments Market Segments

The key segments in the Brazil cards and payments market are card-based payments, merchant acquiring, ecommerce payments, in-store payments, buy now pay later, mobile payments, p2p payments, bill payments, and alternative payments.

Cash payments are set to decline in Brazil, in line with the rising consumer preference for electronic payments. Card payments are gaining prominence in Brazil, with the average individual holding more than four cards. The growth of card-based payments has been supported by the increase in banking penetration in 2022.

Brazil Cards and Payments Market - Competitive Landscape

Some of the leading players in the Brazil cards and payments market are Caixa Economica Federal, Banco Bradesco, Santander, Banco do Brasil, Itau Unibanco, Hipercard, Elo, Mastercard, and Visa, among others.

Segments Covered in the Report

Brazil Cards and Payments Instruments Outlook (Value, $ Billion, 2018-2026)

- Cards

- Credit Transfers

- Cheques

- Cash

- Direct Debits

Brazil Cards and Payments Market Segments Outlook (Value, $ Billion, 2018-2026)

- Card-Based Payments

- Merchant Acquiring

- Ecommerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

The report provides top-level market analysis, information and insights into the Brazilian cards and payments industry, including –

- Current and forecast values for each market in the Brazilian cards and payments industry, including debit, credit, and charge cards

- Detailed insights into payment instruments including cash, cards, credit transfers, direct debits, and cheques. It also, includes an overview of the country’s key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the Brazilian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Brazilian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Brazilian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Brazilian cards and payments industry.

- Assess the competitive dynamics in the Brazilian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Brazil.

- Gain insights into key regulations governing the Brazilian cards and payments industry.

Banco Bradesco

Santander

Banco do Brasil

Itau Unibanco

Hipercard

Elo

Mastercard

Visa

American Express

Diners Club.

Table of Contents

Frequently asked questions

-

What was the Brazil cards and payments market size in 2022?

The cards and payments market size in Brazil was valued at $628.9 billion in 2022.

-

What is the Brazil cards and payments market growth rate?

The cards and payments market in Brazil is expected to achieve a CAGR of more than 14% during 2022-2026.

-

What is the leading payment instrument in the Brazil cards and payments market in 2022?

Cash is the leading payment instrument in terms of volume transactions in the Brazil cards and payments market in 2022.

-

Who are the leading players in the Brazil cards and payments market?

Some of the leading players in the Brazil cards and payments market are Caixa Economica Federal, Banco Bradesco, Santander, Banco do Brasil, Itau Unibanco, Hipercard, Elo, Mastercard, and Visa, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports